UAE Ambassador Says Arab World Has 'No Alternative' To Trump's Gaza Plan

UAE Ambassador Says Arab World Has 'No Alternative' To Trump's Gaza Plan

In an extraordinarily surprising development, the United Arab Emirates (UAE has signaled the possibility of removing all Palestinians from Gaza, in accordance with Trump's controversial Gaza plan.

UAE Ambassador to the US Yousef Al Otaiba in a fresh interview called the plan "difficult but inevitable" and said he's sees "no alternative" but Trump's plan to expel Gaza's population and undertake massive economic redevelopment of the Strip. He had been asked by a reporter whether the UAE is working on a separate plan, to which he responded no, there's no other plan.

The UAE ambassador to the US said on Wednesday that he saw “no alternative” to Trump’s plan to expel Gaza’s population and redevelop the strip.

Though the prospect of ethnic cleansing caused global outrage, the UAE called it “difficult” but pointed to a lack of other options. https://t.co/Zsbg4yjJcZ

— Middle East Eye (@MiddleEastEye) https://twitter.com/MiddleEastEye/status/1889994529731907585?ref_src=twsrc%5Etfw

It was in September 2020 that the UAE announced the Trump-sponsored Abraham Accords for normalization with Israel. UAE has long been a close regional US-ally, but the ambassador's words are still deeply surprising and might actually contradict the UAE's official stance.

For example, regional media just yesterday https://timesofindia.indiatimes.com/videos/international/israel-ally-uae-rejects-trump-gaza-plan-renews-pitch-for-two-state-solution/videoshow/118202695.cms

:

The UAE, a key ally of both Israel and the United States in the Muslim world, has taken a firm stance against U.S. President Donald Trump’s reported plan for Gaza. In a phone call with U.S. Secretary of State Marco Rubio, UAE President Sheikh Mohammed bin Zayed Al Nahyan strongly rejected any attempt to displace Palestinians or deny them their “inalienable rights.”

The country's leadership has just this week called for a two-state solution. And per https://www.reuters.com/world/middle-east/uae-president-tells-us-two-state-solution-is-key-peace-region-state-news-agency-2025-02-12/

It said the UAE, one of the few Arab countries that normalised relations with Israel, categorically rejected any attempt to displace the Palestinians and deny them "inalienable rights".

It could be that in breaking from the official government position, Amb Otaiba is trying to curry favor in Washington, or else he could be signaling to the White House that the UAE is ready to jump on board the US plan if other regional governments to as well.

But Arab nations have been pretty lockstep on the issue, and Jordan and Egypt in particular are not budging in terms of their vehement rejection of the Trump plan.

?itok=HR0QsfAE

?itok=HR0QsfAE

The White House itself appears to have moved the goal posts of late: "Right before walking away from the podium at the White House press briefing on Wednesday, press secretary Karoline Leavitt said she had one more note to add: US President Donald Trump, she said, has tasked Arab nations to present him with a plan for the Gaza Strip,"https://www.middleeasteye.net/news/trump-appears-shift-gaza-he-tasked-arabs-draw-plan

reports.

* * *

What happens next with the fragile Hamas-Israel truce deal?

Below are some reaction statements from retired top US Generals, offering their thoughts, via Peter Tchir's Academy Securities:

“It took a year of negotiations to reach the current deal. Trump pressurized the negotiations to get to where we are now. The ceasefire will be difficult to continue with all that is in play on both sides. Hamas saying they will delay the release of more hostages until further notice brought Trump back into the middle of the problem. He re-pressurized the ceasefire again by saying that ‘all hell will break out’ if Hamas does not return the hostages on Saturday at noon. Complicating the ceasefire is the fact that neither side wants to end the war. Israel still wants to destroy Hamas, while Hamas wants the IDF out of Gaza so they can reassert governance and rebuild their military arm. Trump is trying to move the conversation to solving the larger ‘Gaza-next’ problem.”

– General Robert Walsh

“There are a number of options as of Saturday noon, but what seems most likely is a resumption of combat operations in Gaza with the objective of forcibly rescuing the remaining hostages. Obviously, if this was a considered and evaluated course of action, it would have been executed earlier in the war. However, Trump may also encourage Israel to attack any number of high value targets in Iran, including nuclear research facilities, and military targets to include Iranian naval vessels. Albeit weakened, Tehran can influence the actions of Hamas and their decision with respect to the Israeli hostage release.”

– General Spider Marks

“I suspect that this returns to violence soon. Six weeks was a stretch at best. Trump’s green light to Bibi without a regional or local strategy and end state is dangerous, but it is Trump’s preferred style. Certainly, Iran is one messaging target but the message to the GCC is not in line with what the Arab street can accept regarding the Palestinians. I don't see them accepting the Gaza solution proposed. The messaging about the U.S. assuming control of Gaza is not feasible and probably not acceptable. This is pressurizing both sides in the region.”

– General Frank Kearney

“Agree with all. I would add that the parties are as stubborn as ever, but the ordinary people impacted are completely fed up (both Israelis and Palestinians). Saudi Arabia has put a line in the sand that the Palestinians will not become regional refugees. Hamas' line in the sand is they want to be seen as the liberators and continued power broker on the ground. Maybe Trump’s position brings about some new thinking about how to build something enduring. It could take advantage of popular needs/demands in Gaza, and push out Hamas as the decision maker.”

– General Michael Groen

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/13/2025 - 13:10

Musk Could Pull OpenAI Bid If Altman "Preserves Charity's Mission"

Musk Could Pull OpenAI Bid If Altman "Preserves Charity's Mission"

At the start of the week, Elon Musk led a group of investors in a $97.4 billion bid to https://www.zerohedge.com/political/musk-led-group-leads-974-billion-bid-control-openai

, the creator of ChatGPT. However, Musk's attorney now says the billionaire will withdraw the offer if OpenAI halts its transition from a nonprofit to a for-profit entity.

"If OpenAI, Inc.'s Board is prepared to preserve the charity's mission and stipulate to take them for sale' sign off its assets by halting its conversion, Musk will withdraw the bid," Musk's lawyers wrote in a court filing on Wednesday. https://www.wsj.com/tech/musk-to-withdraw-bid-if-openai-remains-a-nonprofit-3bfebe67?st=M8nVxw&reflink=article_copyURL_share

first reported this.

If not, "the charity must be compensated by what an arms-length buyer will pay for its assets," the filing said, adding that Musk's very "serious offer" was to further the charity's mission.

Following the unsolicited offer by Musk's investor group, OpenAI CEO Sam Altman wrote on X: "No thank you, but we will buy Twitter for $9.74 billion if you want."

Musk responded by calling Altman a "Swindler."

Swindler

— Elon Musk (@elonmusk) https://twitter.com/elonmusk/status/1889062013109703009?ref_src=twsrc%5Etfw

Musk and Altman have been fighting in court over the direction of OpenAI. Both founded the charitable organization in 2015, and since then, Musk has been furious about Altman's approach to potentially converting it into a for-profit company.

"It's time for OpenAI to return to the open-source, safety-focused force for good it once was," Musk said in a statement provided by his lawyers earlier this week, adding, "We will make sure that happens."

The three-page filing, submitted to a San Francisco court Wednesday, has Musk blasting Altman and OpenAI, accusing the company of "repeated self-dealing, putting profits over safety, transferring its technology and keeping it closed source, concentrating AI's power in the hands of Microsoft."

Musk's bid for OpenAI is backed by xAI, his own artificial intelligence company, which could merge with OpenAI following a deal. Other investors in the potential deal include Valor Equity Partners, Baron Capital, Atreides Management, Vy Capital, and 8VC, a venture firm led by Palantir co-founder Joe Lonsdale. And who else? Ari Emanuel is the CEO of the Hollywood company Endeavor.

It's not over...

And there it is 💀 https://t.co/fUgFIiVm1W

— Autism Capital 🧩 (@AutismCapital) https://twitter.com/AutismCapital/status/1889062600304198086?ref_src=twsrc%5Etfw

Altman told the press by mid-week, "Our company is not for sale, nor is the mission. We are happy to buy Twitter."

SCAM ALTMAN: "Our company is not for sale, neither is the mission. We are happy to buy Twitter." https://t.co/dTTNb2P6kh

— DogeDesigner (@cb_doge) https://twitter.com/cb_doge/status/1889774451748684255?ref_src=twsrc%5Etfw

Musk and his lawyers are prepared to match or exceed any bids higher than their own.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/13/2025 - 07:20

https://www.zerohedge.com/technology/musk-could-pull-openai-bid-if-altman-preserves-charitys-mission

Citi Warns Arabica Coffee Rally May Have Peaked As Demand Destruction Looms

Citi Warns Arabica Coffee Rally May Have Peaked As Demand Destruction Looms

Arabica coffee futures have recorded a parabolic rally this year due to tightening supplies from top grower Brazil. However, demand may diminish at these record-high prices, potentially capping further price gains.

Citi analyst Arkady Gevorkyan told clients that arabica coffee's three-month price target and 2025 average price target are around $3.30 per pound. He stated that high-end arabica beans - favored by Starbucks and other top brands - "have likely peaked as demand starts to curtail and supplies replenish."

Early Wednesday morning, arabica coffee futures in New York peaked around $4.27 a pound after hitting a record $4.295 on Tuesday. Gevorkyan also expects 2025-26 Brazilian arabica supply at 62.6 million bags, down 5 million from the current market year.

?itok=mcpNQOhk

?itok=mcpNQOhk

However, late last week, Andrea Illy, chairman of Italian roaster Illycaffè SpA, joined Bloomberg TV for an interview in which he warned that Arabica coffee futures could surge another 20–25% in the coming months.

Illy explained that soaring prices would likely lead to demand destruction as consumers are forced to reduce coffee consumption. He added that the rally in arabica futures—currently on its longest upward streak on record—is primarily driven by supply concerns in Brazil and fears that adverse weather conditions could impact the country's next Arabica harvest.

Besides bean stocks at exchange-monitored warehouses, Illy warned it's unclear how much supply is available in some of these top-producing countries. He described the situation: "We are navigating this market blind."

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/13/2025 - 06:55

VDH: How To Commit Democratic Party Suicide

VDH: How To Commit Democratic Party Suicide

https://victorhanson.com/how-to-commit-democratic-party-suicide/

The Democratic Party is polling about 31 percent approval, a near-historic low.

?itok=dQtn5HLk

?itok=dQtn5HLk

Despite enjoying a huge lead in fundraising, legacy media favoritism, and incumbency, in the 2024 election, Democrats lost the White House to Donald Trump. Ever since, they have offered nothing new, no novel agenda, no innovative policies—nothing other than screaming that they are loudly against everything and anything that the president is for.

In the past, what did they accomplish by following their prior two impeachments with attempts to de-ballot Trump? Who thought sending an FBI swat team to raid Trump’s home or waging five lawfare civil and criminal suits and issuing 91 felony indictments against him would win over the public?

Was conducting a media barrage of Hitler-Trump invectives, or lowering the bar of demonization that likely led to two assassination attempts of Trump a good way to win an election?

Apparently not, given the Democrats have now lost the presidency, the House, and the Senate. The Supreme Court is conservative. They have no power to subpoena anyone; they cannot block any nomination. Much of their old administrative state control is eroding. All the main issues—the economy, energy, border security, illegal immigration, crime, DEI/woke, and foreign policy—poll against the Democrats. The more they shouted that biological men must be able to compete as transgendered females in women’s sports, the more that 80% of the public disagreed, women were turned off, and the absurd idea was exploded by Trump.

The power of the administrative state, the legacy network news, print media, and Silicon Valley’s social media and search engines, the billions that poured into the Biden and Harris campaign all went for naught.

The efforts of moderators to warp debates, of network news to edit out unfavorable Harris or Biden comments, of leftists to cancel, deplatform, ostracize, censor, and shadow ban their enemies have failed. More likely to succeed now are numerous lawsuits against leftwing media for chronic defamation and censorship.

Given that collective meltdown, what would a sane Democratic Party do?

If they were stable, then they might renounce political suicide and perhaps return to something akin to the Clinton efforts of 1992 and 1996. Then the once self-destructive Democrats finally gave up on disastrous out-of-touch McGovernism, Carterism, an Dukakism. Instead, they began to embrace legal-only immigration, secure borders, balanced budgets, support for law enforcement, and meritocracy.

The result?

After twelve years in the wilderness (1980-1992), the Democrats regained power for the next 16 of 24 years—only in the second term of Barack Obama to go full radical Jacobin and soon lose it.

The current self-destructive obsessions with DEI/woke racialism, bi-coastal talk-down elitism, boutique transgenderism, and nonstop America Lastism all came to fruition during the Biden years. A shameless conspiracy to use an enfeebled John Biden as a prop to masque an otherwise unpalatable radical, neo-socialist agenda ensured the MAGA counterrevolution.

But instead of postmortem autopsy and introspection, since Election Day, the Democrats have doubled down on their veritable collective self-destruction.

On immigration, after wiping out the border and allowing in 12 million illegal aliens, including more than 500,000 suspected felons, they seem deliberately to be alienating public opinion even further.

So, thousands of leftists swarm and block the freeways of Los Angeles to protest the deportations of criminals. And how exactly?

By enraging middle-class commuters, while burning the flag of the country that they demand must allow them to stay, while chauvinistically waving the flag of the country to which under no circumstances they wish to return?

New Jersey Democratic governor Patrick Murphy idiotically virtue-signaled that he would defy the law, as he bragged that he was harboring an illegal alien living above his garage.

Then, when apprised that such performance-art showboating was a felony, in theory entailing a long prison sentence, the now buffoonish governor changed his narrative that the occupant of his garage was not really illegally living above his garage.

Democratic governors and mayors vie, bragging that they will be foremost in breaking the law by impeding the efforts of the federal immigration services to find and deport illegal aliens—for now, half a million criminals. Other activists are tipping off criminal illegal-alien gang leaders to avoid US government efforts to apprehend such dangerous criminals.

Is that the way to win back the working classes? By ensuring that the felons of M-13, Norteños, Sureños, and Tren de Aragua can flee and put in danger fellow American police officers?

Elon Musk has been appointed by Donald Trump to create a new government agency, DOGE (Department of Government Efficiency), to find waste, fraud, and abuse in the government spending of taxpayers money.

He and his young team of tech standouts have exposed shocking waste and fraud, but mostly insanity, in the USAID’s $50 billion of foreign aid grants.

Why are Americans paying for overseas drag shows or gay and trans advocacy in culturally imperialist fashion in traditional and conservative societies abroad? Why are we paying eight percent of the budget of the hardcore left-wing BBC? Is that a way back to the White House?

Do Politico, the New York Times, or the Wuhan gain-in-function virology lab and birthplace of COVID-19 really need millions of dollars of taxpayer dollars?

Do Democrats really think the middle class will hate Elon Musk for exposing that their government may well have handed the communist Chinese the necessary cash to birth a manufactured killer virus that took one million American lives?

Is that a winning strategy—to scream in Congress that Musk is a Nazi, a dictator for showing that Biden’s USAID under leftist Samantha Power was a clearing house to enrich and empower well-off leftist organizations that only weakened their own country abroad?

Do we really wish to spend $20 million to bequeath a woke Sesame Street to Middle East television?

Is it smart to gin up hatred of Elon Musk, who revolutionized space travel, the auto industry, and social media?

Is the Democrats’ message something like “We hate Elon Musk and will stop his free internet service to Americans ruined by fires and hurricanes and abandoned by their government?”

Or do Democrats despise Musk for providing free internet to Ukrainians battling for their lives against Russians?

Or is the key strategy to loathe Musk for crafting a risky rescue mission to save the lives of American astronauts virtually abandoned by the incompetent Biden government space program?

For Democratic officials to scream that Musk has no right to ferret out fraud is historically ignorant. He was selected by the president with the same powers that such appointees enjoy that are by statute not required to be approved by the Senate. The DOGE head is as legitimate as the National Security Advisor, who likewise needs no confirmation but also serves at the wishes of an elected president and likewise can do nothing without his approval.

Is Musk’s position in the Trump administration new?

Hardly.

Musk certainly has more legitimate legal authority via his DOGE position than that of FDR’s in-house informal advisors—such as Harry Hopkins—who from within the White House directed much of World War II foreign policy with the Soviets.

Financier Bernard Baruch held no major position for years under Woodrow Wilson and FDR and yet rebooted America’s wartime economy in two wars.

DOGE head Musk is more akin to FDR’s appointed war production board—similar to the likes of the unelected and unconfirmed Henery Ford, Henery Kaiser, and William Knudson, with the caveat that the latter three exercised far more power than does Musk.

During the confirmation hearings on Trump’s cabinet and agency nominations, Democratic senators did not question nominees like Pete Hegseth, Pam Bondi, and Kash Patel so much as scream, interrupt, and insult them on live television.

Rather than ask the nominees questions about their policies and agendas, almost all the interrogatives were ad hominem.

All this came from a party that oversaw the greatest weaponization of our government in modern history while leaving us with two theater wars abroad, a scary and dangerous DEI/woke destruction of meritocracy, hyperinflation, $7 trillion more in debt, 12 million illegal aliens, the erasure of the border, and a vast shortfall in military recruitment.

During the recent Democrat Party convention elections, the voting turned into a virtual DEI tutorial on why the public is repulsed by Democrats.

The Party’s carnival-like elections were overseen by race/gender/orientation censors. In incomprehensible, jargon-filled lectures, they droned on about the correct quotas—trans, non-binary, female, black, Hispanic, Native American—that would override simple democratic voting.

When one looks for sanity among the Democrat Senate and House leaders, there is only madness to be found. Sen. Corey “Spartacus” Booker is back again, now screaming and playacting as if he were Winston Churchill willing to fight Trump-Hitler on the beaches, hills, fields, etc.

Rep. Al Green was wheeled out on spec to bellow and bluster that he was introducing articles of impeachment—is it for the fourth, fifth, or sixth time against Trump?

House Minority Leader Hakim Jefferies boasts he will fight Trump “in the streets”—alongside whom? The despised Antifa? The utterly corrupt and discredited BLM?

I doubt Rep. Jefferies himself will replay the 2020 summer of destruction. More likely he will parrot Kamala Harris’s 2020 bragging of the then ongoing four months of violent protests: “They’re not gonna stop before Election Day in November, and they’re not gonna stop after Election Day, and they should not.”

Maxine Waters is back, trying to trump her earlier threats to birddog and harass Trump supporters in her usual racialist fashion.

AOC—the supposed future of the Jacobins—drones that Musk is “one of the most unintelligent billionaires” she has met. This putdown comes from the nincompoop who claimed Trump’s low unemployment rate was due only to people holding two jobs.

Does AOC think catching a rocket with a mechanical arm is proof of dumbness, and the rants of Mazie Hirono and Elizabeth Warren display wisdom?

What the Democrats don’t realize is that they staged a French-style cultural, political, and economic revolution and tried to destroy their enemies by weaponizing government and the media—and they have now lost.

This current counter-revolution is a return to centrist normalcy and just beginning. It is deemed wild only by feral Democrats, whose high crimes and misdemeanors, and various conspiracy theories over the years of their madcap rule are now being revealed every day.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 23:50

https://www.zerohedge.com/political/vdh-how-commit-democratic-party-suicide

America's War On Coal Power-Plants Is Over

America's War On Coal Power-Plants Is Over

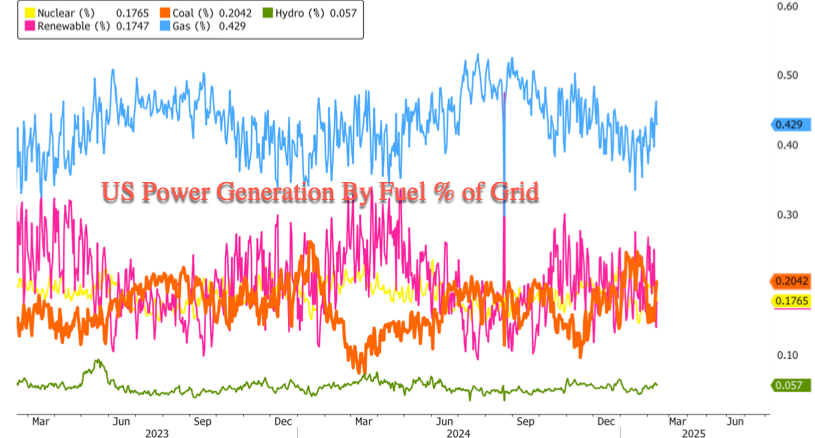

Al Gore's worst nightmare, US Energy Secretary Chris Wright told Bloomberg TV hosts on Tuesday that coal-fired power plants will remain the backbone of President Trump's reindustrialization of America. Wright emphasized that coal plants will be restarted to ensure affordable and reliable electricity for decades.

"What's been the big issues for this president that he ran on, you know, the economic well-being of Americans and the National Security of our country. And our citizens, so we've had 20-plus years of sort of deindustrializing the United States and letting our heavy industry flow overseas. This president is passionate about increasing National Security, and that means we have to have the ability to build heavy steel-intensive and aluminum-intensive material systems in our country again. So this is an attempt, I believe, by our president to incentivize the reindustrialization of America," Wright told Bloomberg hosts.

When asked about energy security and coal's role, Wright responded: "Coal has been essential to the United States' energy system for over 100 years. It's been the largest source of global electricity for nearly 100 years, and it will be for decades to come, so we need to be realistic about that - now with coal, are we going to see a renaissance in surging coal production in the US - not likely - but we're on a path to continually shrink the electricity we generate from coal - that's made electricity more expensive and our grid less stable. So I think the best we can hope for in the short term is to stop the closure of coal power plants no one has won by that action."

He continued: "The goal is just affordable, reliable, secure energy from wherever that comes from obviously, there's going to be roles in the long run for solar energy. There are places where it makes tons of sense where the natural resources are there and the infrastructure is benefited by adding more solar to the grid, but I will say one thing for sure: we're not going to go down the road of Germany - you know they spent a half a trillion dollars - they more than doubled their price of electricity - they actually shrunk the total amount of electricity the country produces by about 20% - and their industry is fleeing the country - that's the path the United States was starting to go down, but that's the wrong path."

The coal discussion starts around the four-minute mark...

The latest data from Bloomberg shows coal accounts for about 20.5% of power generation today.

?itok=Ae8M07vw

?itok=Ae8M07vw

"It's not immediately clear what actions the US could take to help prevent coal-fired power plants from closing," https://www.bloomberg.com/news/articles/2025-02-11/us-should-stop-closure-of-coal-fired-power-plants-wright-says

noted.

Michelle Bloodworth, president of America's Power, a trade group representing Core Natural Resources and Peabody Energy, explained that many coal plants have been shuttered over the years because "bad policies have made them uneconomic." He noted, "Fortunately, President Trump is seeking to change this."

The entire global warming https://www.zerohedge.com/political/dc-swamp-uniparty-unmasked-these-seven-ngos

must be having a meltdown over Wright's remarks. With USAID funding slashed, one has to wonder—how will they bankroll Greta Thunberg's marches now?

Trump's nominee for Energy Secretary Chris Wright dispels the climate propaganda. He is Al Gore's worst nightmare.https://t.co/DfMP1qhh5v

— Citizen Free Press (@CitizenFreePres) https://twitter.com/CitizenFreePres/status/1858153883366822091?ref_src=twsrc%5Etfw

Earlier Wednesday, PJM Interconnection—which coordinates the movement of wholesale electricity and ensures power supplies for 65 million people across all or parts of 13 Eastern and Midwestern US states, as well as Washington, DC, outlined how it will fast-track NatGas power generators to ensure grid stability as "https://www.zerohedge.com/markets/next-ai-trade

and Powering Up America theme progresses ahead.

Nation's Largest Grid To Fast-Track NatGas Power Plants To Fuel Next AI Trade https://t.co/FbdbP9xN6e

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1889689732491153789?ref_src=twsrc%5Etfw

Our latest commentary on the coal industry:

https://www.zerohedge.com/energy/coordinated-strategy-bring-american-energy-dominance-back-again

https://www.zerohedge.com/commodities/will-trumps-coal-comments-davos-greenies-revive-us-miners

https://www.zerohedge.com/energy/americas-electric-grid-risk-and-we-need-coal-save-it

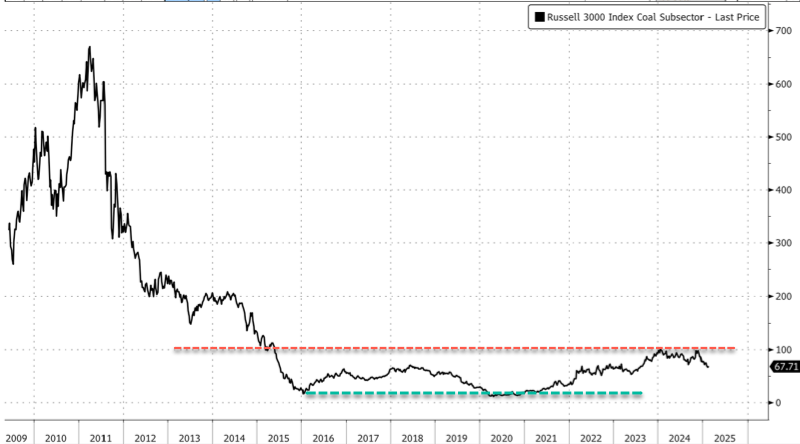

Peabody Energy, the top US coal miner, has yet to catch a bid, blowing through three years of support.

?itok=toLA0QCp

?itok=toLA0QCp

After a decade and a half of the 'green cult' forcing the nation to buy Chinese green tech and wind down all fossil fuel power generation, the Russell 3000 Coal Subsector Index trades near decade lows. The question is whether Trump's pro-grid stability policies reverse these toxic trends.

?itok=XZl4zBiQ

?itok=XZl4zBiQ

The nation needs grid stability before https://www.zerohedge.com/markets/uranium-stocks-soar-beginning-next-esg-craze

. The only way for that to occur is through coal and NatGas power generators amid rising power demand from AI data centers, electric vehicles, onshoring, and other electrification trends.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 23:00

https://www.zerohedge.com/commodities/al-gores-worst-nightmare-says-war-coal-power-plants-will-stop

Disney Announces Reduction Of DEI Programs Due To Trump Executive Actions

Disney Announces Reduction Of DEI Programs Due To Trump Executive Actions

On Tuesday, it was reported that the Walt Disney Company is preparing to significantly reduce the scale of its diversity, equity, and inclusion (DEI) programs and initiatives in response to President Donald Trump’s efforts to crack down on such practices.

?itok=vMbpUZZZ

?itok=vMbpUZZZ

As reported by the https://dailycaller.com/2025/02/11/disney-diversity-equity-inclusion-dei-bob-iger-donald-trump-era/

, Disney’s Chief Human Resources Officer Sonia Coleman made the announcement in an internal memo, which was later reported on by Axios.

Among other changes, the company will replace its “Diversity and Inclusion” performance factor with a “Talent Strategy” metric that focuses less on identity and more on business success.

Disney will also abandon its “Reimagine Tomorrow” campaign, which had touted efforts to increase “diverse representation” in media produced by Disney.

The program aimed to see at least 50% of Disney’s characters would consist of “underrepresented groups.”

The company will also revisit disclaimer messages and content advisories that have been added onto older films.

Films such as “Peter Pan” and “Dumbo” would see such warnings appear on-screen before the start of the movie, often referring to “negative depictions and/or mistreatment of peoples or cultures.”

Now, such messages will be moved to the summary section below the media player, and will not play in the movie itself.

Back in 2023, CEO Bob Iger addressed possible changes to the company’s DEI policies, telling shareholders during an annual meeting that “our primary mission needs to be to entertain, and then through our entertainment to continue to have a positive impact on the world.”

“I’m very serious about that,” Iger emphasized. “It should not be agenda-driven, it should be entertainment-driven.”

President Trump has called for the elimination of DEI practices, pointing out that they often ignore merit in favor of arbitrary factors such as racial, gender, and sexual identity. Other companies that have reduced or eliminated DEI efforts in recent weeks include Google, Facebook, John Deere, and American Airlines.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 20:05

Fired Inspectors General Sue Trump To Get Jobs Back

Fired Inspectors General Sue Trump To Get Jobs Back

A group of eight federal inspectors general has sued the Trump administration after they were ousted from their jobs last month.

?itok=9naLSOq4

?itok=9naLSOq4

The IGs claim that their firings - which came in the form of a two-sentence email, were illegal because they violated a federal law requiring the White House to inform Congress with 30 days' notice, and provide "substantive rationale" for the firings, according to their 32-page complaint filed on Wednesday in the US District Court for the District of Columbia - where we're guessing they'll find a sympathetic judge.

The plaintiffs are eight of the 17 Senate-confirmed inspectors general who were fired just four days into President Donald Trump's second term in what the White House cited as "changing priorities." They are seeking their jobs back at the departments of Defense, Veterans Affairs, Health and Human Services, Education, Agriculture, Labor and State, and the Small Business Administration.

"IGs must be watchdogs, not lapdogs," reads the complaint, which names the Trump-appointed leaders or interim acting heads of each agency as defendants, according to the https://www.washingtonpost.com/politics/2025/02/12/trump-fired-inspectors-general-lawsuit/

.

"Plaintiffs’ purported removals have sent shockwaves and a massive chilling effect through the IG community," the complaint continues, adding that they "have been sent a message that non-partisanship and truth-telling will not be tolerated. That message will have the effect of intimidating the [inspector general] workforce and thus chill their critical work for the American people."

The fired IGs who joined the lawsuit are; Rob Storch (Defense), Michael Missal (VA), Christi Grimm (HHS), Sandra Bruce (Education), Phyllis Fong (Agriculture), Larry Turner (Labor), Cardell Richardson (State) and Hannibal “Mike” Ware (SBA).

Only two cabinet-level watchdogs were spared their jobs - those at Homeland Security and the DOJ, after the Tuesday firing of another IG; USAID's IG Paul Martin, a Biden appointee. Martin was fired after his office issued a blistering report slamming the Trump administration for 'hobbling' USAID's mission (to enrich corrupt politicians and influence the news?), and shrinking its staff.

The Wednesday complaint also claims that Trump has yet to communicate his intention to remove the watchdogs to Congress, in writing or otherwise, using any "substantive rationale for the removal of any IG — let alone the required detailed and case-specific reasons."

"His only public explanation came during a press gaggle on January 25 … when he stated, ‘I don’t know them … but some people thought that some were unfair, some were not doing their job,’ and falsely asserted that ‘it’s a very standard thing to do."

"The President did not identify the ‘people’ who supposedly ‘thought’ these things, which IGs any such thoughts pertained to, or how the unidentified IGs supposedly “were not doing their job," the complaint continues.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 16:40

https://www.zerohedge.com/political/fired-inspectors-general-sue-trump-get-jobs-back

Poor 10Y Auction Tails Despite Surging Yields

Poor 10Y Auction Tails Despite Surging Yields

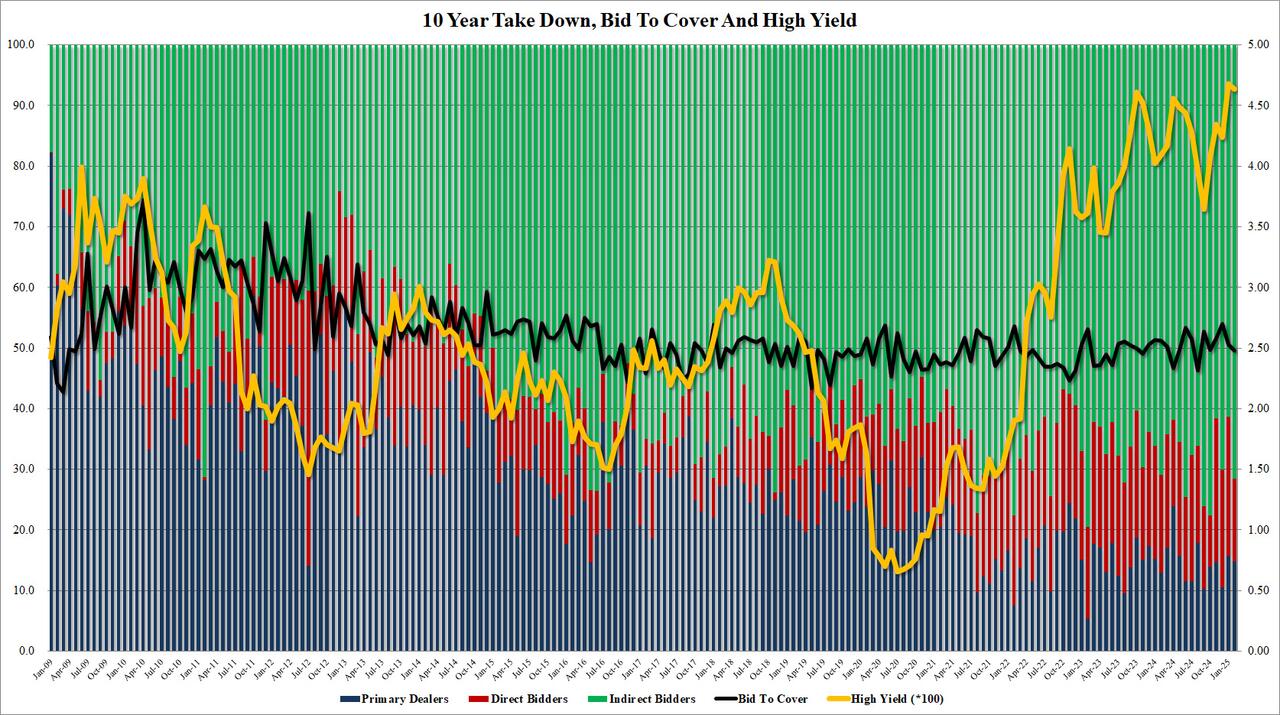

After yesterday's stellar 3Y auction, many were expecting today's sale of benchmark 10Y paper to also be very solid too, especially after the massive post-CPI concession which sent the 10Y surging by over 10bps. It did not quite work out that way, and when the Treasury sold $39BN in 10Y paper at 1:00pm ET, the auction tailed by 0.9bps, the biggest tail since August, in a sale that left a lot to be desired.

?itok=o2XDBqtL

?itok=o2XDBqtL

The bid to cover dropped to 2.48 from 2.53, this was the lowest bid to cover since August.

The internals were better with Indirects rising tom 71.6% from 61.4%, the highest since October 24. And with Directs awarded 14.8%, Dealers were left holding just 13.6%, the lowest since last October.

?itok=eUOM5eDY

?itok=eUOM5eDY

Overall, this was a disappointing, if hardly terrible auction, and considering the massive surge in yields, it probably should have had better participation, although the market was hit by way too many other news to care about this particular sale and predictably, the 10Y barely moved in the secondary market after the news of the auction broke.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 13:29

https://www.zerohedge.com/markets/poor-10y-auction-tails-despite-surging-yields

Hegseth Drops Bombshell Of Realism On Europe, Rules Out NATO Membership For Ukraine

Hegseth Drops Bombshell Of Realism On Europe, Rules Out NATO Membership For Ukraine

Trump's Defense Secretary Pete Hegseth has definitively poured cold water on Ukraine's hopes of gaining Washington backing to join NATO, at a moment he's visiting the alliance's headquarters.

Hegseth issued firm words on this crucial question directly to the faces of top Ukrainian officials in opening remarks before the Ukraine Defense Contact Group - the alliance of 50+ countries and the European Union who support Ukraine's military - which is meeting in Brussels this week.

The US defense chief not only ruled out NATO membership, but laid out that it is "unrealistic" to expect Ukraine’s borders to revert to pre-2014, in reference to Russian rule over Crimea.

Defense Secretary Pete Hegseth:

"The United States does not believe that NATO membership for Ukraine is a realistic outcome for a negotiated settlement." https://t.co/ui9E38wV1M

— The American Conservative (@amconmag) https://twitter.com/amconmag/status/1889675004121346536?ref_src=twsrc%5Etfw

"We want, like you, a sovereign and prosperous Ukraine. But we must start by recognizing that returning to Ukraine’s pre-2014 borders is an unrealistic objective." Hegseth said.

And that's when he finally spoke some realism on the tragic conflict which is about to reach the 3-year mark, something which has been sorely missing from Washington commentary:

"Chasing this illusionary goal will only prolong the war and cause more suffering," he stressed.

On the question of Zelensky's stated goal of gaining NATO admission, which many independent analysts have long warned would surely trigger Article 5 and hurl Russia and the West toward direct nuclear-armed confrontation, Hegseth said the following:

"The United States does not believe that NATO membership for Ukraine is a realistic outcome of a negotiated settlement."

He also vowed that no American troops would be sent to Ukraine as part of any future security agreement.

"Instead, any security guarantee must be backed by capable European and non-European troops. If these troops are deployed as peacekeepers to Ukraine at any point, they should be deployed as part of a non-NATO mission and not covered under Article 5. There also must be robust international oversight of the line of contact," the new Pentagon chief said.

How about we just get rid of it https://t.co/FWqvabQYlz

— Dave DeCamp (@DecampDave) https://twitter.com/DecampDave/status/1889686669013418243?ref_src=twsrc%5Etfw

He stressed that any potential security guarantees that result from negotiated settlement "should not be provided through NATO membership."

"To be clear," he continued, "as part of any security guarantee, there will not be US troops deployed to Ukraine."

And as expected, he reiterated President Trump longtime calls for allies to increase their defense spending to 5% of their GDP, as opposed to the current goal of 2% (which many are still not achieving).

"Members of this contact group must meet the moment … 2% is not enough," Hegseth said. "President Trump has called for 5%, and I agree. Increasing your commitment to your own security is a down payment for the future, a down payment, as you said, Mr. Secretary, of peace through strength."

He also revealed part of Trump's strategy for leverage against Moscow to get them to the peace table. "Lower energy prices coupled with more effective enforcement of energy sanctions will help bring Russia to the table," he claimed, despite Moscow having shown its ability to weather the sanctions storm and even prosper.

?itok=E47Zvx0V

?itok=E47Zvx0V

Later this week Treasury Secretary Scott Bessent will travel to Ukraine to meet Zelensky to talk about ways to end the conflict, but also as part of Trump efforts to secure access to the war-ravaged country's rare earth minerals. Given Hegseth's words, which could mark the final death knell for Ukraine's already long diminished hopes of achieving success, it looks like Washington under Trump is now quite serious about seeking a swift ending to the war and all its death and destruction.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 13:25

Growth And Value Are Not Mutually Exclusive

Growth And Value Are Not Mutually Exclusive

https://realinvestmentadvice.com/resources/blog/growth-and-value-are-not-mutually-exclusive/

Might Nvidia and Tesla, with price-to-earnings ratios (P/E) nearly double and quadruple that of the S&P 500, respectively, be value stocks? Conversely, is it possible that Ford is not a value stock despite a P/E of 10, a price-to-sales ratio (P/S) of .20, and a 7.5% dividend yield? Based solely on that information, answering the question is impossible. Regardless, we bet most investors classify Nvidia and Tesla as growth stocks and Ford as a value stock.

This article introduces GARP- Growth at a Reasonable Price. As we will detail, by introducing earnings growth expectations into traditional valuation equations, some value stocks may not be quite the gems investors think. Likewise, some growth stocks may be value stocks.

?itok=QUmYsKR4

?itok=QUmYsKR4

Defining Value And Growth

Investopedia defines a value stock as follows:

A value stock refers to shares of a company that appears to trade at a lower price relative to its fundamentals, such as dividends, earnings, or sales.

By and large, most investors would agree with their definition. Investors often use the word “cheap” when describing value stocks.

Investopedia defines a growth stock as follows:

A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market.

Here, too, most investors would approve of Investopedia’s definition. Some may add that growth stocks often boast high valuations.

Value and growth are frequently used terms by investors. Rarely, however, do we hear investors use both descriptors on the same stock. Instead, most investors segregate stocks into one classification or the other. Doing so may cloud their analysis, thus limiting the potential stocks that can meet their objectives and others that may fall short of their expectations.

The PEG Ratio

Listed below are some popular equity valuation metrics:

Price to Earnings (P/E)

Price to Forward Earnings (P/FE)

Price to Sales (P/S)

Price to Book Value (P/BV)

Price to Free Cash Flow (P/FCF)

The listed per-share ratios are great tools to calibrate how much of a particular fundamental, like earnings or sales, an investor can buy given the share price. While they are essential valuation measures, they lack one of the most critical indicators of future stock performance. They are all based on historical financial data. The one exception is price-to-forward earnings (P/FE). While P/FE is forward-looking, most investors only use one-year earnings growth forecasts to calculate the ratio.

A company’s track record is critical information, but investors should buy or sell stocks based on their future. Thus, expected growth, not just historical growth, should be at the top of investors’ minds.

To assist in stock valuation with expected growth in mind, ratios like the PEG (price/earnings to growth) ratio are beneficial. The PEG ratio divides the standard P/E ratio by the expected growth rate.

Most often, three to five-year expected growth rates are used in the PEG ratio. However, investors can reformulate forward-looking valuations based on any years of growth estimates they choose.

Decomposing PEG

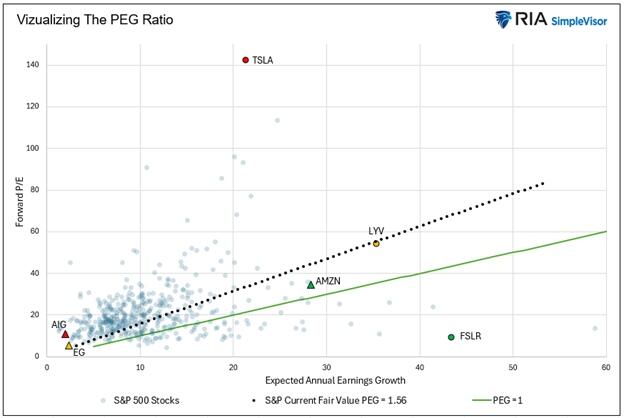

We created the scatter plot below to better understand the PEG ratio. It plots 458 of the S&P 500 stocks. We excluded those with negative or absurdly high forward P/E ratios. The data, courtesy of Zacks, uses its proprietary 3–—to 5-year annualized earnings growth estimates.

Each blue dot represents the intersection of a stock’s one-year forward P/E and its expected annual earnings growth. The black dotted line represents fair value relative to the S&P 500 index. The current forward P/E for the S&P 500 is 24.26, and its expected earnings growth is 15.55%. Thus, its PEG ratio is 1.56 (24.26/15.55). The black dotted line connects all points with an identical PEG ratio. The green line connects all PEG ratios that are equal to 1.0. Traditionally, anything below 1.0 is considered value.

?itok=bME2KlrD

?itok=bME2KlrD

Currently, 29.5% of stocks are cheaper than the S&P 500, i.e., below the black dotted line. Only 12.25% have PEG ratios below 1 (beneath the green line).

Value And Growth May Not Be What We Think

To draw more insights from the graph, we highlight six stocks. They show how the PEG ratio can complement other valuation methods.

AIG (red triangle) has a forward P/E 11, which is well below the S&P 500 and is what many investors would classify as value. However, its expected earnings growth rate is a mere 2%. Thus, its PEG ratio of 5.50 makes it very expensive.

TSLA (red circle) has a forward P/E of 142, representing the highest valuation of those stocks plotted. Despite such a high valuation, its expected growth rate is only 21%, not much more than the index’s 15.5%. Either investors think that earnings growth will be over four times Zack’s expectations, or Tesla is grossly overvalued. Suppose Tesla matches Elon Musk’s prediction that it will have a market cap greater than the five current largest companies combined. In that case, its annual growth rate may ultimately be multiples of Zack’s forecast; thus, currently, it may be a value stock.

AMZN (green triangle) has a higher-than-market forward P/E of 28. However, its growth expectations of 35% are almost double the expected growth rate of the S&P 500 (18%). Therefore, AMZN is a value stock despite its higher-than-market valuation and its exceptional expected growth rate.

FSLR (green circle) has a very low forward P/E of 9 and an expected annualized growth rate of 43%. Based on this data, FSLR is a deep-value growth stock. Also, note that its PEG of .20 is well below the traditional 1% value indicator.

EG (orange triangle) has a low forward P/E of 5. Such is likely due to its low expected growth rate of 2%. Despite its low valuation and growth rate, EG is fair value to the S&P 500 index with a PEG of 1.56. Based solely on this data, an investor should be indifferent to owning EG and the S&P 500.

LYV (orange circle) has a high forward P/E of 54 and a high expected growth rate. Like EG, it has a PEG in line with the market of 1.56.

Summary

The first paragraph asked whether TSLA, NVDA, and F were value stocks.

We have already shared our analysis of TSLA.

Interestingly, based solely on this data, NVDA is a value stock with a PEG ratio below the S&P 500 and 1.0.

Despite its very low valuations and high dividend yield, Ford has a PEG ratio of 1.86, moderately above the S&P 500 and well above 1.0. Based solely on this analysis, Ford is not a value stock.

Value is in the eye of the beholder and may not be apparent as some may think!

The data we use in this analysis is courtesy of Zack’s. Ideally, using an average of multiple earnings growth projections and your projections provides the most thorough analysis.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 13:05

https://www.zerohedge.com/markets/growth-and-value-are-not-mutually-exclusive

Nation's Largest Grid To Fast-Track NatGas Power Plants To Fuel Next AI Trade

Nation's Largest Grid To Fast-Track NatGas Power Plants To Fuel Next AI Trade

Common sense has returned, and the adults are back in the White House. This time, they are not wearing toxic "climate-crisis blinders" that de-growth the economy, spark inflation, and push power grids into near points of failure with unreliable green energy. As https://www.zerohedge.com/markets/next-ai-trade

unleashes massive power demand from data centers, electric vehicles, and other electrification trends through the decade's end and into 2030, electricity will have to become reliable and cheaper.

To achieve this, PJM Interconnection—which coordinates the movement of wholesale electricity and ensures power supplies for 65 million people across all or parts of 13 Eastern and Midwestern US states, as well as Washington, DC—will analyze 50 new projects aimed at improving grid stability in April, the Federal Energy Regulatory Commission stated in an order on Tuesday. https://www.bloomberg.com/news/articles/2025-02-12/biggest-us-grid-gets-ok-to-fast-track-power-plants-amid-ai-boom

was the first to report this.

?itok=ShVkC79C

?itok=ShVkC79C

Forget solar and wind—PJM will prioritize massive natural gas generators in upcoming projects to ensure grid stability and lower power costs, which is one of the mandates the American people gave the president. These proposed projects will join 55 gigawatts of legacy projects, including batteries and renewables, all set for review this spring.

The urgent move comes less than one month after PJM issued a Level 1 emergency and "https://www.zerohedge.com/weather/pjm-grid-declares-max-generation-alert-polar-vortex-unleashes-mini-ice-age

" across the grid, as the polar vortex caused heating demand to surge.

FERC said last year that PJM warned of "resource adequacy concerns" on the grid after a surge in new data center construction and other electrification trends, including electric vehicles and on-shoring.

"PJM is in grave danger of not having enough generation to meet demand," Commissioners David Rosner and Willie Phillips wrote in a statement.

Remember what Goldman noted about the Mid-Atlantic power crisis...

Goldman Says Mid-Atlantic Power Prices "Finally Caught Up To AI Data Center Load Growth Story" https://t.co/6BInBek7Zz

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1819892289558212942?ref_src=twsrc%5Etfw

So, how did we arrive at the point where grids have become unstable and power costs are soaring?

Well, radical leftists—under the guise of tackling the climate crisis—pushed de-growth policies, promoting a single solution: buying green technology from China (seems sus). The result has fueled inflation and raised serious concerns about grid stability.

One can't help but ask whether these policies deliberately sabotaged the US economy while https://www.zerohedge.com/energy/global-coal-consumption-still-soaring

online. America First lawmakers should inquire on Capitol Hill whether America was being weakened from within.

NatGas generators are crucial to restoring stability and lowering power costs to shore up the grid.

When it comes to achieving real grid decarbonization while maintaining stability, we highlighted the nuclear theme back in December 2020 with our note: https://www.zerohedge.com/markets/uranium-stocks-soar-beginning-next-esg-craze

.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 09:55

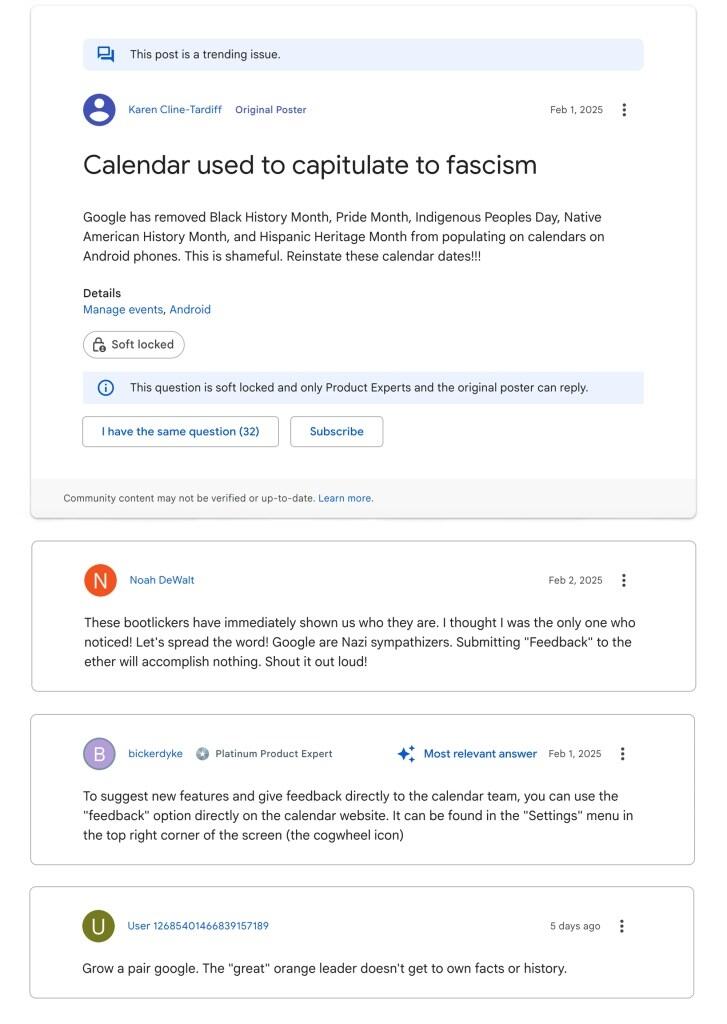

Culture Shift: Google Calendar Removes Pride, Black History Month, Other DEI Dates

Culture Shift: Google Calendar Removes Pride, Black History Month, Other DEI Dates

Google Calendar has erased so called ‘cultural’ dates including Pride, Black History Month, Indigenous People Month, and Hispanic Heritage, and will only display official public holidays and national observances going forward.

?itok=wxB1B1YT

?itok=wxB1B1YT

Over 500 million people who use Google Calendar will no longer see the DEI dates popping up with a spokesman for the company explaining that “maintaining hundreds of moments manually and consistently globally wasn’t scalable or sustainable.”

Google Calendar will no longer force pride month onto your calendar going forward. 🔥 https://t.co/CM0ndmSy3a

— Robby Starbuck (@robbystarbuck) https://twitter.com/robbystarbuck/status/1889125167978127589?ref_src=twsrc%5Etfw

In other words, there are too many made up woke ‘holiday’ dates to keep up with.

They’re saying this wasn’t sustainable?

No kidding… https://t.co/74hdZIwBaX

— Steve McGuire (@sfmcguire79) https://twitter.com/sfmcguire79/status/1889126700673323246?ref_src=twsrc%5Etfw

Some have interpreted the move as an effort to fall into line with the Trump administration’s purging of DEI nonsense from government agencies.

Common sense is making a comeback who’d thought that would happen

— The Goon (@Supergoon231) https://twitter.com/Supergoon231/status/1889287243736506410?ref_src=twsrc%5Etfw

Google founder Sergey Brin met with Trump at Mar-a-Lago in December, as did Alphabet CEO Sundar Pichai.

Sounds like Google got the message. So they can make good decisions, that's good to know. https://twitter.com/hashtag/zelena?src=hash&ref_src=twsrc%5Etfw

— Mister Sugar (@ScottWi92107364) https://twitter.com/ScottWi92107364/status/1889286858242171086?ref_src=twsrc%5Etfw

All this garbage will be gone within the next 4 years.

— Stewie Griffin (@StewGriffin52) https://twitter.com/StewGriffin52/status/1889289584904990990?ref_src=twsrc%5Etfw

Deranged leftist Google Calendar users have flooded support pages with complaints, accusing the company of “capitulating to fascism,” and being “Nazi sympathisers.”

?itok=FEDjqphv

?itok=FEDjqphv

If it wasn't clear before, FUCK Google. Fuck Donald. Fuck fascism. You can remove us off your calendar but you can't remove us off this planet.

🏳️🌈🏳️⚧️🇵🇸✊🏿✊🏾✊🏽✊🏼✊🏻

— Potatoo (@potatoo4905) https://twitter.com/potatoo4905/status/1889287654564368817?ref_src=twsrc%5Etfw

* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via https://pauljosephwatson.locals.com/support

.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 09:35

Massive Overnight Russian Strike On Kiev Used Ballistic Missiles, Over 120 Drones

Massive Overnight Russian Strike On Kiev Used Ballistic Missiles, Over 120 Drones

Russia has confirmed its forces launched major overnight missile strikes on Ukrainian military plants as well as energy infrastructure. Kiev suffered significant damage, resulting in casualties and several fires in the city.

A Wednesday statement by the defense ministry said that Russian forces had carried out a "group missile strike on workshops of Ukrainian military-industrial complex enterprises producing unmanned aerial vehicles and FPV drones."

?itok=uESX-vcO

?itok=uESX-vcO

"The goals of the strikes have been accomplished, all designated facilities have been hit," it said. The oblasts of Kyiv, Sumy, Poltava, and Chernigov were struck in the widespread assault.

Importantly the attack involved Iskander-M ballistic missiles and over 120 drones, which Ukrainian forces https://www.bbc.com/news/articles/ce85x4792w6o

to have shot down seven Iskanders and 71 UAVs, according to Russian media sources.

The Ukrainian capital appears to have been one of the hardest hit cities in the wave of strikes, which has been a rarity over the last year. One person was killed there, and four injured, including a nine-year-old girl, Kiev's mayor said.

This night, russia fired ballistic missiles and drones at Ukraine.

Unfortunately, one person was killed in Kyiv as a result of the attack. My condolences to the family. There are wounded, including a child.

Buildings, offices and civilian infrastructure have been damaged. All… https://t.co/wIBiuJ4EQj

— Denys Shmyhal (@Denys_Shmyhal) https://twitter.com/Denys_Shmyhal/status/1889580734064570834?ref_src=twsrc%5Etfw

Ukraine's Deputy Energy Minister on Wednesday said that the recent Russian strikes on gas infrastructure is creating "certain pressure" and that Ukraine will need help from partners to import additional volume of gas.

According to description of the missile attack in Ukrainian https://www.kyivpost.com/post/46962

:

Kyiv’s air defense systems intercepted six Russian Iskander-M ballistic missiles over the capital, according to Timur Tkachenko, head of the Kyiv City Military Administration (KMVA), citing the Air Force.

“This is a dangerous weapon that is not easy to neutralize, and even falling debris can cause serious destruction,” Tkachenko wrote on https://t.me/VA_Kyiv/10724

The attack damaged residential buildings, an office complex, and non-residential infrastructure in the Holosiivskyi, Svyatoshynskyi, Obolonskyi, Dniprovskyi, and Pecherskyi districts. As of 10:00 a.m., all fires in Kyiv had been extinguished or localized.

?itok=ixsVHESf

?itok=ixsVHESf

And Russia's RT detailed, "Russian Telegram channels cited eyewitnesses reporting a 16 explosions across the city. Kiev Mayor Vitaly Klitschko reported fires in several districts, including one in the industrial zone in the northern part of the capital."

President Zelensky reacted by saying that Vladimir Putin is "not preparing for peace" as "he continues to kill Ukrainians and destroy cities."

"This night, Russia launched ballistic missiles and drones against Ukraine, damaging apartment buildings, office complexes, and civilian infrastructure."

"Right now, we need unity and support from all our partners in the fight for a just end to this war," he wrote on Telegram.

Just the day prior Zelensky offered a land swap deal to Putin, saying Ukraine will give up Kursk territory to end the war. The Tuesday comments described that if President Trump gets the warring sides to the negotiating table, "We will swap one territory for another."

Moscow confirms massive strike on Ukrainian military plants. The attack targeted drone assembly enterprises, the Russian Defense Ministry has said. Russia has launched a major missile strike on Ukrainian military drone production plants, the Defense Ministry in Moscow has said.… https://t.co/Th4UupvnKd

— DJ Danza (@DJDanzadotcom) https://twitter.com/DJDanzadotcom/status/1889675134484516905?ref_src=twsrc%5Etfw

The Ukrainian leader when asked in https://www.theguardian.com/world/2025/feb/11/zelenskyy-europe-cannot-guarantee-ukraines-security-without-america

interview precisely which territories Kiev would demand back, he responded: "I don’t know, we will see. But all our territories are important, there is no priority." Obviously he has the four annexed eastern territories in mind.

But Wednesday's ballistic missile and drone attack on Kiev has clearly slammed the door on Zelensky's offer, which the Kremlin was never going to seriously entertain regardless. Ukraine has also continued to fire Western-supplied missiles on Russian territory, for which Moscow has warned it will start hitting command 'decision-making centers' in response.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 09:15

Stocks Slump With Rate-Cut Hopes As CPI Soars In January

Stocks Slump With Rate-Cut Hopes As CPI Soars In January

As we highlighted in our https://www.zerohedge.com/markets/cpi-preview-time-hot-inflation-surprise

, the CPI matters a lot, again!

After https://x.com/zerohedge/status/1879521649260892598

, with Core CPI missing expectations both sequentially and YoY, analysts expect core to accelerate sequentially, but bear in mind we have the annual revisions malarkey to wade through first, so who knows what the 'expectation' will be comparable to.

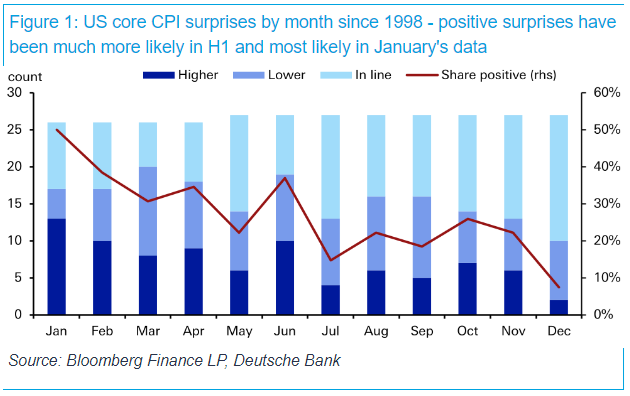

Seasonality screams big beat today, as Deutsche Bank's Jim Reid points out, surprises to CPI over the last 25-plus years have been more likely to be biased to the upside in H1 than in H2. January’s release (which we will see today) has seen the largest number of beats (50%) and the lowest number of downside misses (15%).

?itok=XcU7Sbqq

?itok=XcU7Sbqq

And sure enough, both headline and core CPI rose more than expected in January. Headline CPI jumped 0.5% MoM (+0.3% exp) dragging the price series up 3.0% YoY (+2.9% exp). That is the seventh straight month of accelerating MoM CPI prints...

?itok=LiX0ZVm9

?itok=LiX0ZVm9

Source: Bloomberg

Core CPI - more watched - jumped 0.4% MoM (more than the 0.3% rise expected) and that dragged core consumer prices up 3.3% YoY (3.2% exp)...

?itok=bGc8BtlE

?itok=bGc8BtlE

Source: Bloomberg

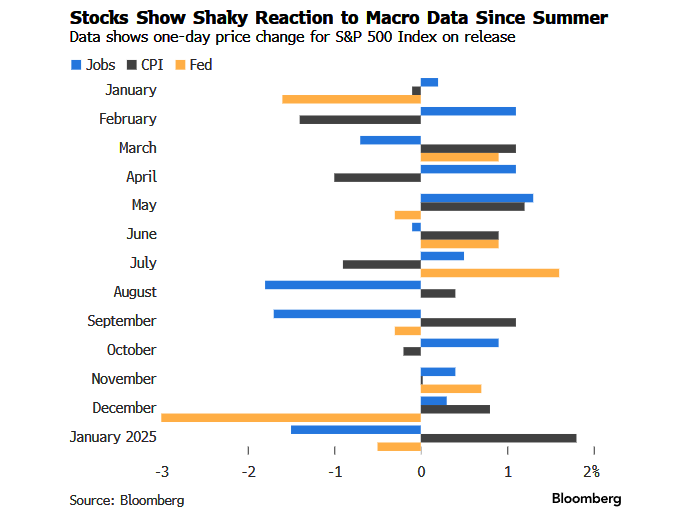

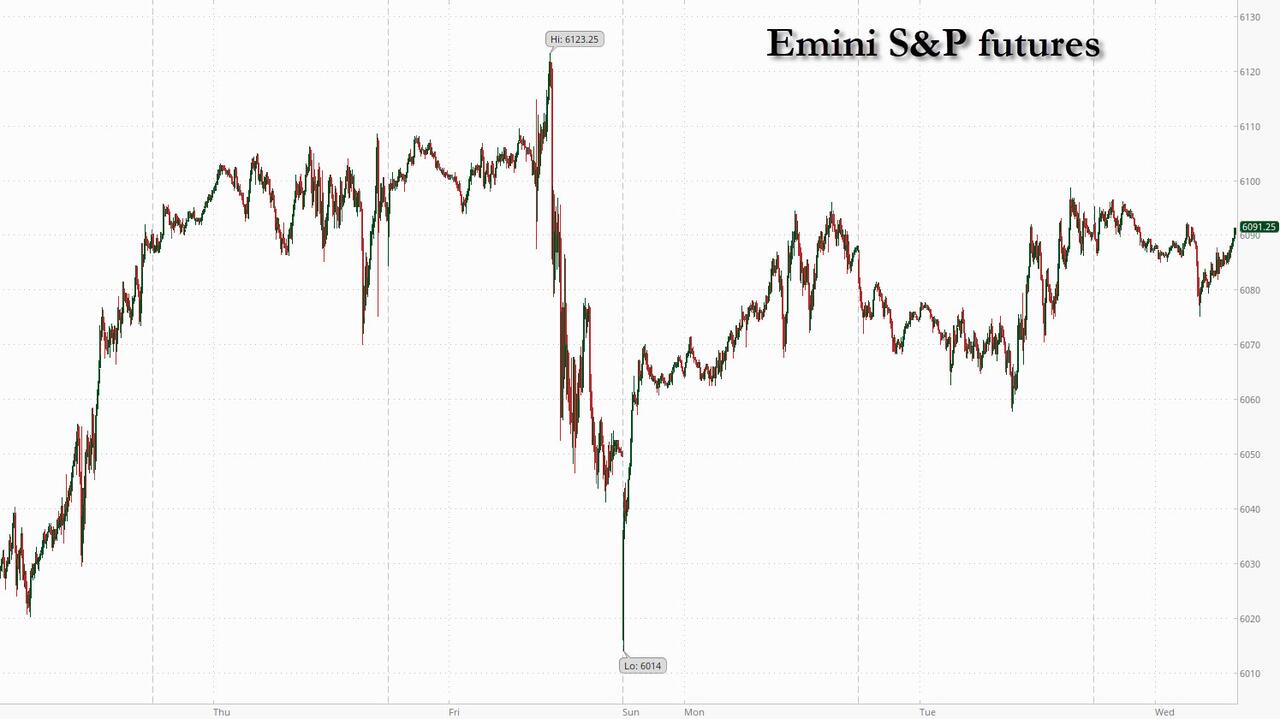

Finally, what will stocks do with this new information?

?itok=KNjS6v_7

?itok=KNjS6v_7

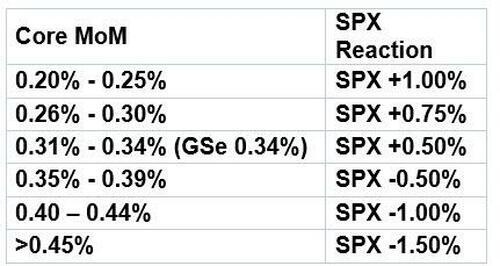

It's certainly been a wild ride on Payrolls and CPI days, but as Goldman's Lee Coppersmith notes, a hit CPI liked this suggests considerable downside for the S&P today...

?itok=Kgg3kJ16

?itok=Kgg3kJ16

And in the pre-market, futures are heading that way...

?itok=WLts3X1J

?itok=WLts3X1J

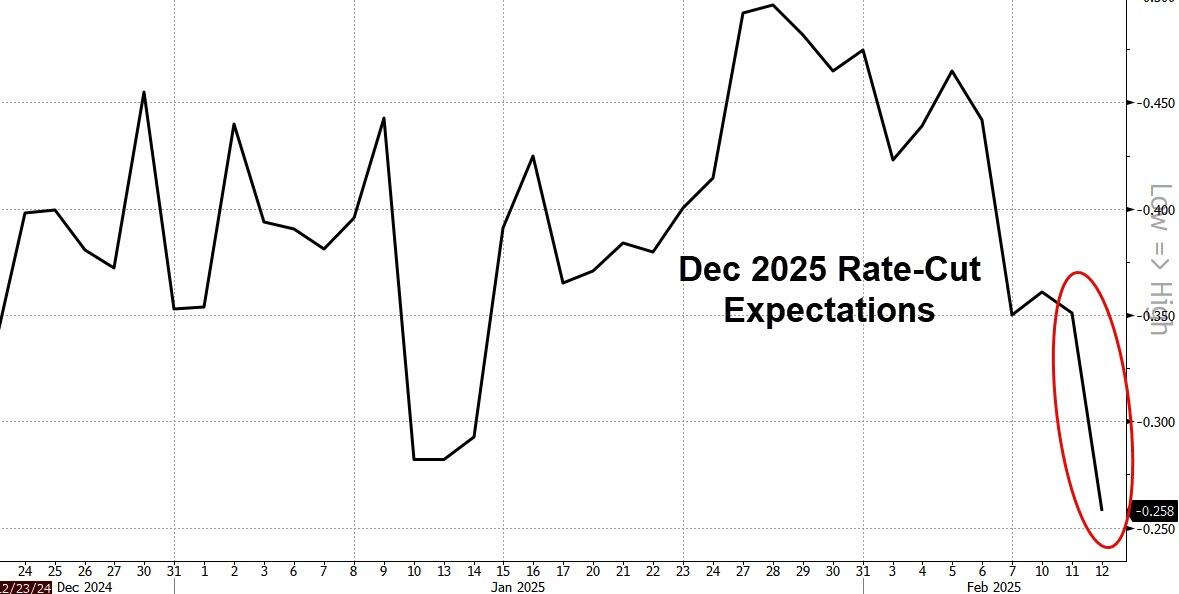

Perhaps more notably, the market is now pricing in just one rate cut this year (pushing expectations from Sept to Dec)...

?itok=K1c62ta6

?itok=K1c62ta6

...but is it different this time under Trump?

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 08:40

https://www.zerohedge.com/economics/stocks-slump-rate-cut-hopes-cpi-soars-january

Futures, Rates Flat Ahead Of High-Stakes CPI Report

Futures, Rates Flat Ahead Of High-Stakes CPI Report

US equity futures are flat, with yields and the dollar modestly higher ahead of this morning's US CPI reports (https://www.zerohedge.com/markets/cpi-preview-time-hot-inflation-surprise

), with the market very much on edge: according to JPM, option markets anticipate a 1.2% swing in the S&P today, the biggest in over a year. Powell’s testimony at the House, CSCO earnings and any update from Trump on his reciprocal tariffs plan

?itok=eIkeYG1t

?itok=eIkeYG1t

In premarket trading, Super Micro Computer (SMCI) jumps 10% after giving an aggressive long-term revenue outlook and saying it “believes” it will meet a Nasdaq Inc. deadline to file audited financial results. Tesla is leading gains for the Magnificent Seven (GOOGL -0.1%, AMZN -0.2%, AAPL +0.06%, MSFT -0.1%, META +0.2%, NVDA +0.3% and TSLA +2.2%). Here are some other notable premarket movers:

Confluent (CFLT) gains 14% after the application software company reported fourth-quarter results that beat expectations and gave an outlook that is seen as positive.

CVS Health (CVS) jumps 10% after its fourth-quarter profit beat Wall Street expectations, a sign of improving performance for the company whose insurance and drugstore units have been under pressure.

Edwards Lifesciences (EW) gains 4% after the maker of heart valves provided a 1Q profit forecast range with a midpoint that beat estimates.

Freshworks (FRSH) rises 6% after the application software company reported 4Q results above street estimates.

Gilead Sciences (GILD) gains 4% after the biopharmaceutical company’s 2025 guidance beat analysts’ estimates.

Kraft Heinz (KHC) declines 3% after providing 2025 adjusted earnings per share guidance that missed the average analyst estimate.

Lyft (LYFT) falls 13% after giving a disappointing outlook for first-quarter gross bookings, warning that cold weather has hurt demand for ride hails and bike rentals.

OneStream (OS) tumbles 19% after the application software company reported a sequential slowdown in key metrics including annual recurring revenue and billings growth.

Teradata (TDC) falls 13% after the infrastructure software company gave a weaker than expected outlook, dashing analyst hopes for signs of a more pronounced recovery.

Upstart (UPST) soars 26% after the AI lending marketplace reported stronger than expected fourth-quarter results and provided an upbeat outlook.

The stakes for markets are high going into Wednesday’s consumer price index numbers. Economists expect core CPI excluding food and energy to rise 0.3% from the previous month in January, picking up from an increase of 0.2% in December. This corresponds to a year-over-year rate of 3.1%.

“We have to watch 10-year Treasury yields very carefully,” said Kenneth Broux, a strategist at Societe Generale in London. Hotter-than-expected inflation could easily push the yield to 4.60% “and the whole risk-on trade will be back on hold,” he said.

As noted last night, the trading desk at JPMorgan's Market Intelligence team estimates the S&P 500 will fall as much as 2% should the January consumer price index reading show an increase of 0.4% or more from the previous month.

0.40% or higher. This first tail outcome would likely be driven by a spike in Shelter as well as seeing some parts of Core Goods flipping from deflationary to inflationary (HH, Medical, and Alcohol). Expect the bond market to react violently as it shifts its view to Fed Funds not being restrictive and the most likely next action of the Fed to be a hike rather than a cut. The move in bond yields would pull the USD higher, further pressuring stocks. Look for NDX to outperform SPX and RTY to underperform. Odds 5.0%; SPX loses 1.5% - 2%.

Between 0.33% - 0.39%. This outcome is likely driven more by hotter goods than services with a more muted reaction in the bond market but similar reaction on stocks. This print is unlikely to fully eliminate all cut expectations for FY25, but likely pushed implied probabilities to be a coin flip as to whether we get one cut in FY25. As of Friday, 37.5bps worth of cuts are being priced into the bond market. Odds 25.0%; SPX loses 75bps – 1.5%.

Between 0.27% - 0.33%. The base scenario which shows a mild increase MoM but is aligned with the trend seen since September which is an inflection higher in inflation that is trending higher with improved growth/hiring, albeit at a potentially softer rate. Look for bond yields to remain range-bound and for a positive outcome for stocks. The upper range is not quite Goldilocks but given the resilience of the market YTD stocks likely push higher led by RTY. Odds, 40.0%; SPX loses 25bps to gains 1%.

Between 0.21% - 0.27%. This is Goldilocks especially if we combine this with a stronger Retail Sales number. Look for the market to fully price in 2x cuts this year and for Equities to respond favorably led by SMid-caps. Odds 25.0%;

SPX gains 1% – 1.5%.

0.20% or lower. The other tail outcome, potentially achieved by a stepdown in Shelter as Core Goods flips back to being net deflationary. Bond yields bull steepen in this scenario leading to material outperformance by RTY versus SPX. USD likely has a negative reaction aiding EM Equities which likely outperform RTY. Odds 5.0%; SPX gains 1.25% – 1.75%.

“Expect the bond market to react violently as it shifts its view to Fed Funds not being restrictive and the most likely next action of the Fed to be a hike rather than a cut,” the team led by Andrew Tyler wrote in a note. “The move in bond yields would pull the USD higher, further pressuring stocks.”

The CPI figures are due shortly before the second half of a two-day testimony marathon for Fed Chair Jerome Powell, who yesterday told lawmakers the central bank is in no rush to adjust rates again.

“Until we get greater clarity on the medium-term inflation trends, bond yields are likely to remain sticky,” said Daniel Murray, Zurich-based chief executive officer of EFG Asset Management. “It is also clearly impacting equity investor sentiment, in particular in the US, where the combination of more hawkish rate expectations alongside tariff uncertainty has contributed to a rangebound market.”

Europe's Stoxx 600 rises for a third day, setting a new intraday record in the process, boosted by solid earnings. Food and beverage is the strongest sector, boosted by Heineken’s 13% rally - the most since 2008 - after the drinkmaker reported full-year results that were ahead of consensus and announced a €1.5 billion share buyback. ABN Amro Bank jumped more than 8% after its net interest income topped forecasts. Energy stocks provide a drag as they track a fall in oil. Here are Europe's biggest movers:

Deutsche Boerse shares rise as much as 1.9%, briefly hitting a fresh high, after the company reported solid earnings and announced a new surprise €500m share buyback.

Heineken shares soar as much as 13%, the steepest intraday advance since 2008, after the brewer reported FY results that came in ahead of estimates and announced a €1.5 billion share buyback.

ABN Amro shares advance as much as 8.9%, hitting the highest intraday level since September 2019, with net interest income beating estimates.

Barratt Redrow shares advance as much as 9.4%, the most since 2020, after the UK housebuilder said it expects annual adjusted pretax profit to be at the upper end of expectations.

Lufthansa shares rise as much as 4.6% after the German flag carrier was upgraded to outperform at Bernstein, while British Airways owner IAG was cut to market perform.

TeamViewer shares climb as much as 6.2% after the German software firm reported 4Q Ebitda that beat estimates. 2025 guidance met the expectations of JPMorgan and Morgan Stanley analysts.

Ahold Delhaize shares fall as much as 2.9% after the company reported 4Q results. While the results were in line with expectations, analysts flagged the US adjusted operating margin miss.

Aker BP shares decline as much as 2.4%, the largest drop in three weeks, after the Norwegian oil producer provided 2025 production guidance that Pareto says was “a little soft.”

Randstad shares drop as much as 6.2% after the recruitment company delivered a “messy” update containing higher-than-expected one-off costs, according to analysts.

Carl Zeiss Meditec shares drop as much as 7.4%, the most in two months, with analysts noting weaker-than-expected Ebita that overshadowed the German health-care supplier’s revenue beat.

Alior Bank shares fall as much as 3.2% and Budimex as much as 3.1% in early Warsaw trading after MSCI announced deletion of both companies from its main indexes, effective as of Feb. 28 close.

Close Brothers shares fall as much as 4.1% after the financial services company said it expects to set aside up to £165 million in 1H 2025 following a regulatory probe into its auto lending business.

Earlier in the session, Asian stocks rose, led by gains in Chinese and Hong Kong shares on continued optimism about artificial intelligence, offsetting concerns over the Federal Reserve’s interest-rate policy. The MSCI Asia Pacific Index was up as much as 0.4%, with Alibaba and Tencent among the biggest boosts. An index of Chinese tech shares listed in Hong Kong advanced 2.7%, aided by a report that Alibaba is working with Apple on AI features. Investors are increasingly bullish on the outlook for Chinese equities as enthusiasm for DeepSeek and other AI developments spurs a fundamental rethink of the market’s attractiveness. For the broader region, sentiment was more downbeat Wednesday after Jerome Powell indicated the Fed is in no rush to cut interest rates, as economic data remains solid. Elsewhere, Indonesia’s key equity gauge rebounded after falling to a three-year low on Tuesday. Taiwanese shares underperformed the region.

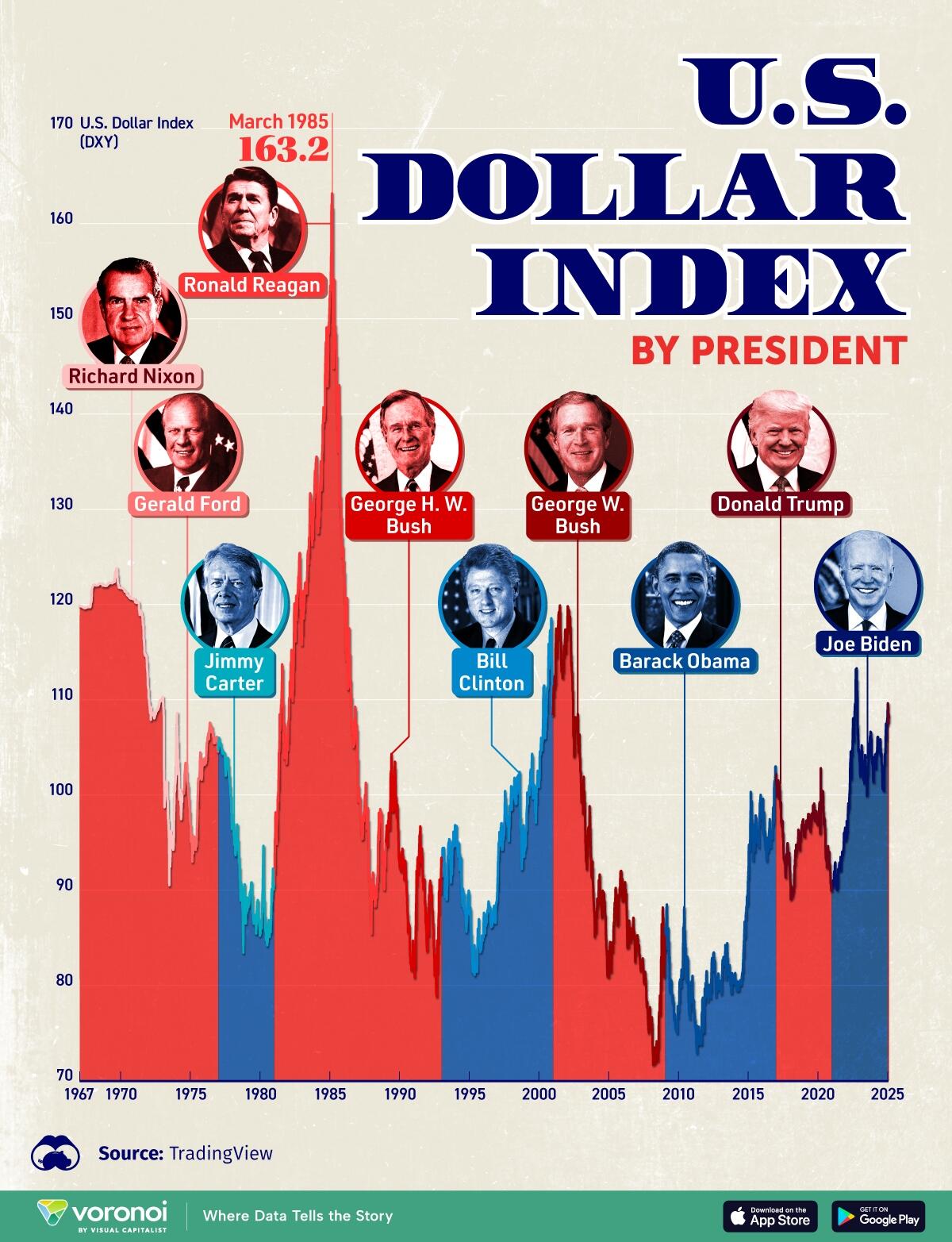

In FX, the Bloomberg Dollar Spot Index is up 0.1%. The Japanese yen is the weakest of the G-10 currencies amid tariff concerns, falling 0.8% against the greenback and pushing USD/JPY to ~153.65. The Japanese government asked Trump on Wednesday to exempt the nation’s companies from his fresh tariffs. The Swiss franc outperforms with a 0.2% gain.

In rates, treasury yields are marginally cheaper across the curve with bunds and gilts lagging slightly as traders await January CPI data at 8:30am New York time and Powell’s testimony to House Financial Services panel at 10am. US 10-year yield is ~1bp higher on the day near 4.55% with bunds and gilts lagging by an additional 1.5bp and 1bp in the sector; curve spreads are narrowly mixed after steepening over past two sessions. Busy event slate also includes $42 billion 10-year note sale at 1pm, following strong demand for Tuesday’s 3-year note auction.

In commodities, Brent crude futures drop 1% to $76.30 a barrel. Spot gold falls $17 to around $2,880/oz.

US economic data calendar includes January CPI report (8:30am) and federal budget balance (2pm). Fed speaker slate includes Powell testimony to the US House Committee on Financial Services (10am), Bostic (12pm) and Waller (5:05pm).

Market Snapshot

S&P 500 futures down 0.2% to 6,080.50

STOXX Europe 600 up 0.2% to 548.02

MXAP up 0.3% to 185.08

MXAPJ up 0.8% to 584.79

Nikkei up 0.4% to 38,963.70

Topix little changed at 2,733.33

Hang Seng Index up 2.6% to 21,857.92

Shanghai Composite up 0.9% to 3,346.39

Sensex down 0.2% to 76,145.08

Australia S&P/ASX 200 up 0.6% to 8,535.26

Kospi up 0.4% to 2,548.39

German 10Y yield little changed at 2.45%

Euro up 0.1% to $1.0373

Brent Futures down 0.9% to $76.32/bbl

Brent Futures down 0.9% to $76.32/bbl

Gold spot down 0.3% to $2,889.78

US Dollar Index little changed at 107.98

Top Overnight News

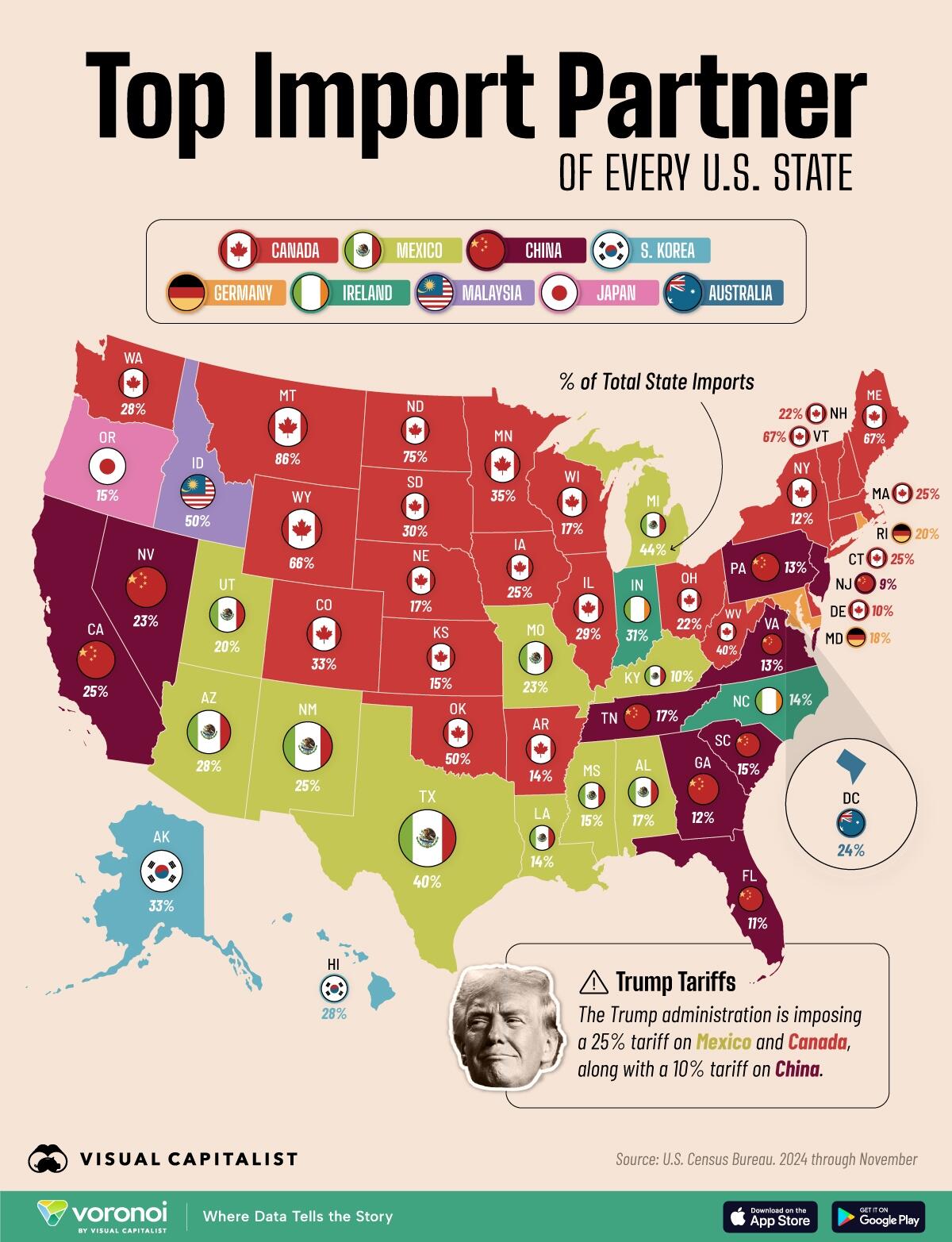

President Trump’s team is working to impose as soon as this week reciprocal tariffs on nations that have slapped levies on U.S. exports, using executive action to bring to life a far-reaching proposal from his first term that never came to fruition. WSJ

US President Trump's advisers reportedly eye bank regulator consolidation and are said to discuss consolidating bank regulators' OCC and FDIC, according to WSJ.

Trump administration officials are discussing plans to curtail and combine the power of banking regulators. After closing and halting the CFPB, the White House is now looking at whether other bank regulators can be consolidated (Fed, OCC, FDIC, Treasury). WSJ

The White House plans to nominate Jonathan McKernan to lead the CFPB full-time and Jonathan Gould to lead the OCC, according to Punchbowl.

US President Trump is lined up to attend a Saudi-backed conference in Miami this month: Reuters

Fed's Williams (Vice Chair) said monetary policy is well positioned to achieve Fed goals and the US economy is in a good place, while inflation expectations are well anchored and the US unemployment rate should stay between 4% to 4.25%. Williams also stated that the US is to grow by around 2% this year and next, while inflation is to hang around 2.5% this year and 2% in the coming years. Furthermore, Williams said it is hard to determine if uncertainty is weighing on the economy, as well as noted that monetary policy is where it should be and monetary policy remains appropriately restrictive.

China's purchases of chipmaking equipment are set to decline this year after three years of growth, as the industry grapples with overcapacity and faces greater constraints from U.S. sanctions, a consultancy said on Wednesday. RTRS

Australia is “killing” the US aluminum market, a Trump adviser said, in a potential blow to its efforts to secure an exemption. Japan asked Trump to exclude its firms from levies. BBG

Eurozone considers imposing a temporary cap on local gas prices amid a record gap compared to the US. European natural gas prices traded at the highest in more than two years this week, in part due to low temperatures and a lack of wind that has stalled renewable energy production. FT

Chancellor Rachel Reeves and the UK government are coming under pressure to either cut spending or raise taxes as growth undershoots expectations. FT

The UK economy may have shrunk in the fourth quarter, with economists expecting GDP fell 0.1% following a stagnant third quarter. The BOE estimates there is a 40% chance that Britain is already in a technical recession. BBG

US crude inventories jumped by 9 million barrels last week, the API is said to have reported. That would be the biggest increase in a year if confirmed by the EIA today. The market will be watching official figures to see if inflows from Canada climbed further. BBG

Tariffs

US Trump aide Navarro is said to be the leading advocate for the reciprocal-tariffs, WSJ sources said; which could also go beyond simply matching other nations’ tariffs to take into account nontariff trade barriers. Potentially leaves Japan, Europe, and China on the hook for higher tariffs.

US President Trump responded "We'll see" when asked if reciprocal tariffs are still coming on Wednesday.

White House said 25% steel tariffs would stack on other levies, according to Canadian press cited by Reuters.

Japanese Industry Minister Muto said they requested the US to exclude Japan from steel and aluminium tariffs, while Finance Minister Kato said they will assess the impact of US tariffs on the Japanese economy and respond appropriately.

The first conversation between European Commission President von der Leyen and US VP JD Vance yesterday was said to be "very constructive" and focused on areas where interests aligned, according to sources cited by the FT.

US President Trump will sign executive orders at 14:30 EST (19:30 GMT), via Punchbowl.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with price action somewhat choppy following the similar performance stateside in the aftermath of Trump's recent tariff announcements and with US CPI data on the horizon. ASX 200 traded higher as strength in the top-weighted financial sector and the industrials atoned for the losses in tech, while participants digested key earnings releases including from Australia's largest bank and most valuable company, CBA. Nikkei 225 advanced on return from yesterday's holiday closure amid recent currency weakness but momentarily pared all of its gains amid rising yields and tariff-related uncertainty. Hang Seng and Shanghai Comp were varied with outperformance in Hong Kong led by strength in tech stocks including Alibaba after reports that Apple partnered with Alibaba to develop AI features for iPhone users in China, while SMIC benefitted after it posted stronger-than-expected revenue and guided revenue growth. Conversely, the mainland was contained with price action choppy amid ongoing trade frictions and the PBoC's liquidity effort.

Top Asian News

BoJ Governor Ueda said they will conduct monetary policy appropriately to achieve the 2% target and will monitor the impact of US tariff and immigration policies. Ueda said the pace of monetary adjustment should depend on economic situations and he is aware that rising inflation, including fresh foods, is having a negative impact on households, while he added there could be risks that rising prices of fresh foods may not be temporary and could affect people's sentiment.

European bourses are generally modestly firmer, despite a mixed handover from the APAC session. European sectors hold a positive bias; Real Estate takes the top spot, propped up by post-earning strength in homebuilder Barratt Redrow (+5.6%). Heineken (+11.4%) jumped at the open after the co. beat on profit and announced a share buyback. Energy is the clear laggard, given the weakness in oil prices today.

Top European News

ECB's Holzmann said lowering rates by 50bps increments this year would "not be a wise move"