Good morning.

It’s a great day to listen to me read “The Big Print” by nostr:npub1d3f4m9dgvkdjxn26pqzsxn6lpfn78sxwllxyt8mp76q0a9zyyjlswhr4xv

nostr:note1zjv2ew72f097464qc56jxwxq5r7s3spfzseuuykl6am3y4hkjv0spyf7w7

Strange, I searched it in my audible app and it didn't show up.

But when I searched it on Amazon, there it was saying it is available on audible...

Alright, Nostr fam, what's a "Zap"?

Are we just slapping the word on any digital tip jar, or are we sticking to a core value? Because frankly, if I wanted vague financial gestures, I'd use Venmo.

Words are important. And our users need definitions.

Here are some options:

- 1: The "Participation Trophy" definition:

Oh, you sent value, any value as a reaction to a post? That's a Zap! Doesn't matter if it's sats, seashells, or your grandma's IOU. You can "Zap" anything, through any means: on-chain, lightning, cashu, whatever. It only has to transfer value.

Pros: Everyone gets a gold star! (Even if they don't deserve it.)

Cons: Turns "Zap" into meaningless digital confetti. (Isn't confetti fun?)

- 2: The "Bitcoin Or Bust" definition:

It's gotta be Bitcoin! It can use any chain, any L2, lightning, cashu and even BTC bank accounts, either custodial or self-custody. The method is irrelevant as long as it is valued in BTC.

Pros: Bitcoin-centric

Cons: Custodial shenanigans.

- 3: The "Any Lightning" definition:

If it didn't come through the Lightning Network, it's not a Zap. Period. However, Taproot assets count as lightning. So, It can be any token.

Pros: No other L2 shenanigans

Cons: Cashu is out. Might hurt nostr:nprofile1qqs9pk20ctv9srrg9vr354p03v0rrgsqkpggh2u45va77zz4mu5p6ccpzemhxue69uhk2er9dchxummnw3ezumrpdejz7qgkwaehxw309a5xjum59ehx7um5wghxcctwvshszrnhwden5te0dehhxtnvdakz7qrxnfk's feelings

- 4: The "Lightning and BTC" definition:

"Bitcoin, Lightning, no exceptions. If you're not doing it this way, you're doing it wrong."

Pros: Clarity. Precision. Dictatorship.

Cons: Still hurting nostr:nprofile1qqs9pk20ctv9srrg9vr354p03v0rrgsqkpggh2u45va77zz4mu5p6ccpzemhxue69uhk2er9dchxummnw3ezumrpdejz7qgkwaehxw309a5xjum59ehx7um5wghxcctwvshszrnhwden5te0dehhxtnvdakz7qrxnfk

--

So, which is it? Are we watering down "Zap" until it's just another internet high-five, or are we maintaining some semblance of integrity?

How would you define the boundaries of what a zap is and isn't? Should a cashu zap count as a zap? Or should we name it something else?

You get zapped by lightning, get it?

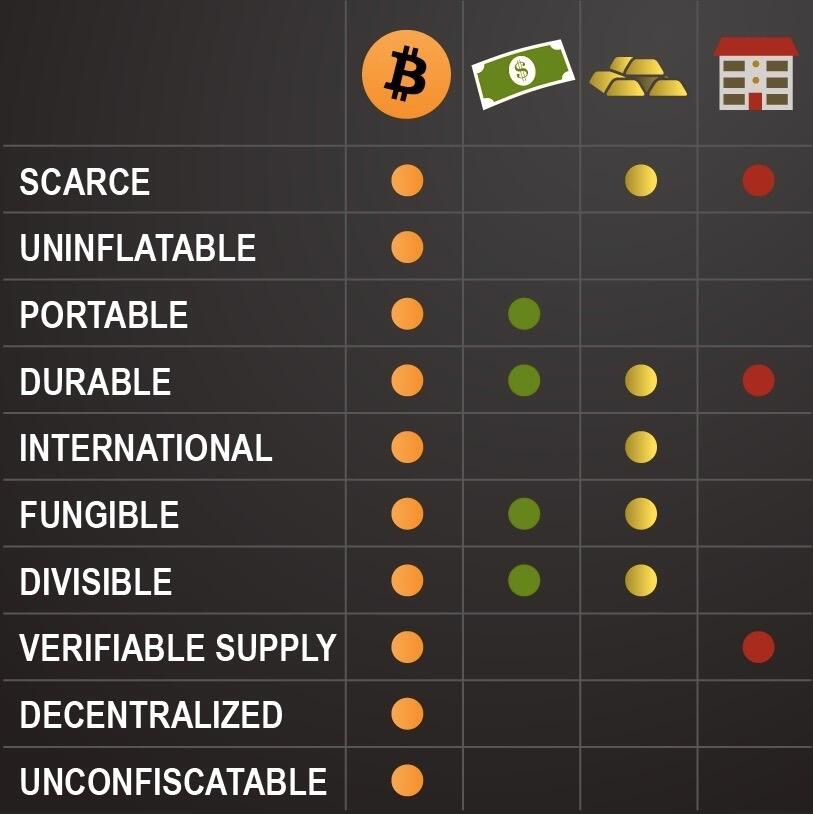

Nano has all of these qualities and it has less inflation than bitcoin.

Why isn't Nanos price higher than bitcoin?

Betamax machines are deflationary. There are very few and the number gets smaller over the years.

Yet, they have very little value.

Something can be deflationary and not go up in price.

it doesn't matter how disinflationary something is if there is no demand for it.

Although I agree that a deflationary thing is much more sensitive to demand!

If the hashrate doesn't rise, then the difficulty doesn't rise. Bitcoin is not programmed to get more expensive. It gets more expensive in reaction to more demand.

oh sorry, I meant I blocked Elon, not O'Dell

I blocked him lol

It has cleared many times. Why hasn't bitcoin failed many times?

Did you know that 50 degrees F has an equivalent in other measuring systems?

Did you also know that Celsius is meant to measure water temp and Fahrenheit is meant for gas temperatures?

The Theory of Gravity was accepted because of the large amount of data it explains.

How can there be more than one truth? Water freezes at sea level at 0 Celsius, but also at 20 celsius?

those darned republicans, committing all the voter fraid!

yes, if Blackrock adds 1 million nodes that follow bitcoin's rules, so what?

2 drinks is just fine. No headache or hangover. 2 drinks is the perfect sleeping pill.

I used to drink until I blacked out every day. Then I decided that I was tired of feeling like shit everyday and being poor. So I quit.

Now I will maybe have 2 drinks on a Friday evening. But I haven't had a drink in 3 weeks, and wow, I'm still here.

If your payoff is being shitfaced, you are just destroying your health and finances and relationships.