Love this. Well played nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle for the work you do marketing Bitcoin and educating people from the heart

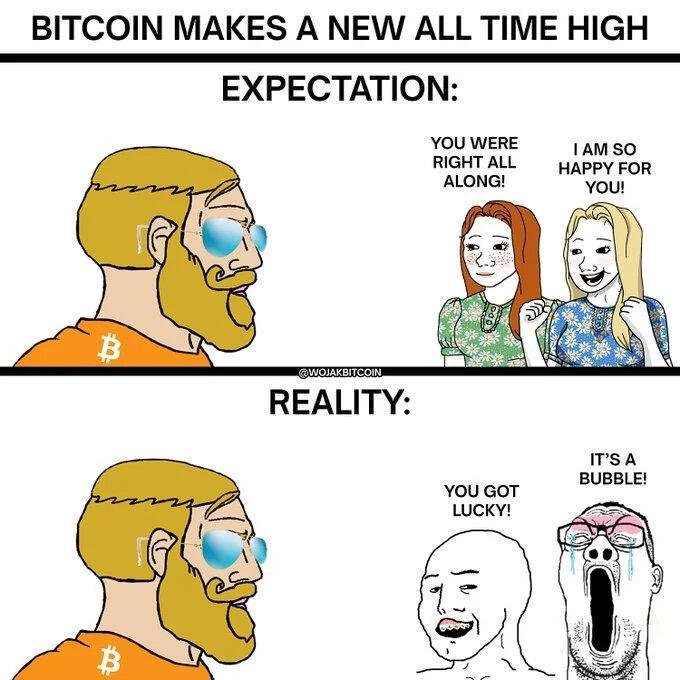

The "you got so lucky" is painful isn't it

Right now getting paid for decisions made years ago

We all need to do more Nostr marketing!

Well done on all the progress. Look forward to having a play around with it

Found out this week that MSTR has borrowed over $4 billion at an average interest rate of 0.8%

THIS IS AN INSANELY CHEAP RATE!

Indeed it's the primary driver of MSTR equity value growth in my mind

And a good insight into why a public market equity like this can generate returns in excess of Bitcoin

Imagine if the retail market was able to borrow at sub 1%...!

I'd love that interest rate

The last 14 days have been the best performing 2 weeks of my investing career

As a private investor I've lost and I've won

When it's your own money on the line it really matters

You live and die by your decisions

But exiting loss making positions to buy Bitcoin is proving a great move

Trust me though: back in 2021/21 I was beating myself up so bad about losing money on some real estate deals

Only with the pain can you get the gain

Had a similar idea a few months back

Essentially a funnel for bringing content from other platforms

"The Bulletin" was a name I liked

Problem is: how do you avoid overload? Getting blasted by stuff you actually don't want to read? Fake news?

Ideating on my new podcast (launch date of mid Jan 2025)

It's amazing how much one can procrastinate about

- name

- topic

- length

- branding

Really just have to get on with booking in some interviews!

Pumped to get going

2025 going to be awesome

Update from the freshly launched Bitcoin options market... BULLISH. Imagine if we double from here in 30 days?

(Note - I would put the chances of this at sub 1%, but hey, very happy to be wrong)

Old school friend of mine did a 4 year man-powered adventure

Epic isn't it!

It's a combination of 2 things

1) the vision in the first place

2) the patience to allow it to become reality

Nice work. Taught me plenty along the way. What a ride!

Nope. 3rd. But this time around I've made major re-allocations from other area's of my portfolio, so there is an outsized impact vs the previous bull markets

Feels so bloody amazing having one's purchasing power surge

I know of a few people that have technical skills they not only trust, but also use, in order to trade in and out of Bitcoin over a multi-year time horizon

But it's certainly not easy

The issue with the approach of simply taking a timeline is what happens if the bull/bear market cycle trend gets broken? Could we never have a bear market again?

Personally I think the fact we have programmed scarcity will mean we see a consistent inflation and deflation

No doubt though, taking some profits when you've made a good gain, in an size that means you don't need to take any more for 4 years, is a great bet

The guru 🙏

Thanks for sharing. It's interesting. There's also good analysis that shows a one off smash buy is often the way to go vs DCA into Bitcoin.

I haven't overly focused on DCA out, but your analysis instinctively is sound, so a lumpsum to then live off makes sense. If one is sophisticated enough to call the top vs the bottom of course

The DCA out I had in mind was sporadic, without a set total amount, so I tend to prefer being long Bitcoin instead.

Seeing an iteration of Instagram demoed by nostr:npub1l2vyh47mk2p0qlsku7hg0vn29faehy9hy34ygaclpn66ukqp3afqutajft here on Nostr really hits home

Indeed, it makes me feel, much like Bitcoin when I really "got it", that Nostr is inevitable

The foundation is there. The ecosystem is yet to be built. So one needs to be patient

Great questions. Of course it's a horses for courses scenario, and very much depends on each persons situation.

Love this kind of discussion.

In 2022 I was at the crunch end of a re-allocation process, selling other assets, in order to accumulate more Bitcoin. Huge decisions. Huge conviction required.

At that time I set a price target of 150k aud (it was trading spot at 30k aud) and a timeline of August 2025. I was thinking to trim the position by 10% on reaching either of the 2.

If possible, I like to stick to strategies, rather than alter en route. Now that we're pretty much at 150k, and a need has come up, I will take some Bitcoin and gift to someone. This is akin to taking profits at the pre-aimed for price.

Otherwise, there are only 2 things I really want 1) a family home and 2) a healthy living expense runway. The question then becomes, as you so rightly point out: 1) take profits and pay tax? or 2) take debt (not sure how) and leverage.

I am not happy with any of the debt products I've seen so far. Either counter-party risk is too high, debt term too short, debt amount too low. So I think I am leaning towards the take profits, pay tax, and although more expensive, less risk, and easier for peace-of-mind

Great problems to have!

Ps - I also like the idea of simply DCA out of Bitcoin as and when you need for expenses. I'd much prefer to be long Bitcoin, rather than be sitting on too much cash

Pps - this is a "hybrid trading strategy" in my mind, in that I am working on a multi-year time horizon, with the intention of re-allocating as the purchasing power alters

Paid a local farmer in Bitcoin for some meat today. Exchanging hardest money ever known to mankind, direct with the means of production, really is a powerful experience