It’s almost like the past isn’t necessarily a decent guide to the future 🤔

So called “cycles” ending would be a great outcome for Bitcoin generally.

🤣 Firstly, I really do want some of what you’re smoking!

I’m very bullish MSTR, don’t get me wrong. Two big misconceptions here in my opinion. One is they will specifically try and game inclusion into S&P. Absolutely not.

Second is how much mstr move the market. Grossly overestimated I reckon. Sure, if they didn’t exist would Bitcoin be at a lower price? Probably. But all the shareholders would likely have found different ways to Bitcoin exposure rather than MSTR.

Why should the share price have this perpetual gravity towards 1?

Shares broadly trade at the value of their balance sheet, plus net present value of future profits. Why assume they can’t continue to make the future profits that they have been showing in their Bitcoin yield metrics?

I’ve argued before - you can put the case for mstr to be less than nav 1 (if you think they may go bust) or indeed greater - but 1 is never going to be the answer as to how to value them.

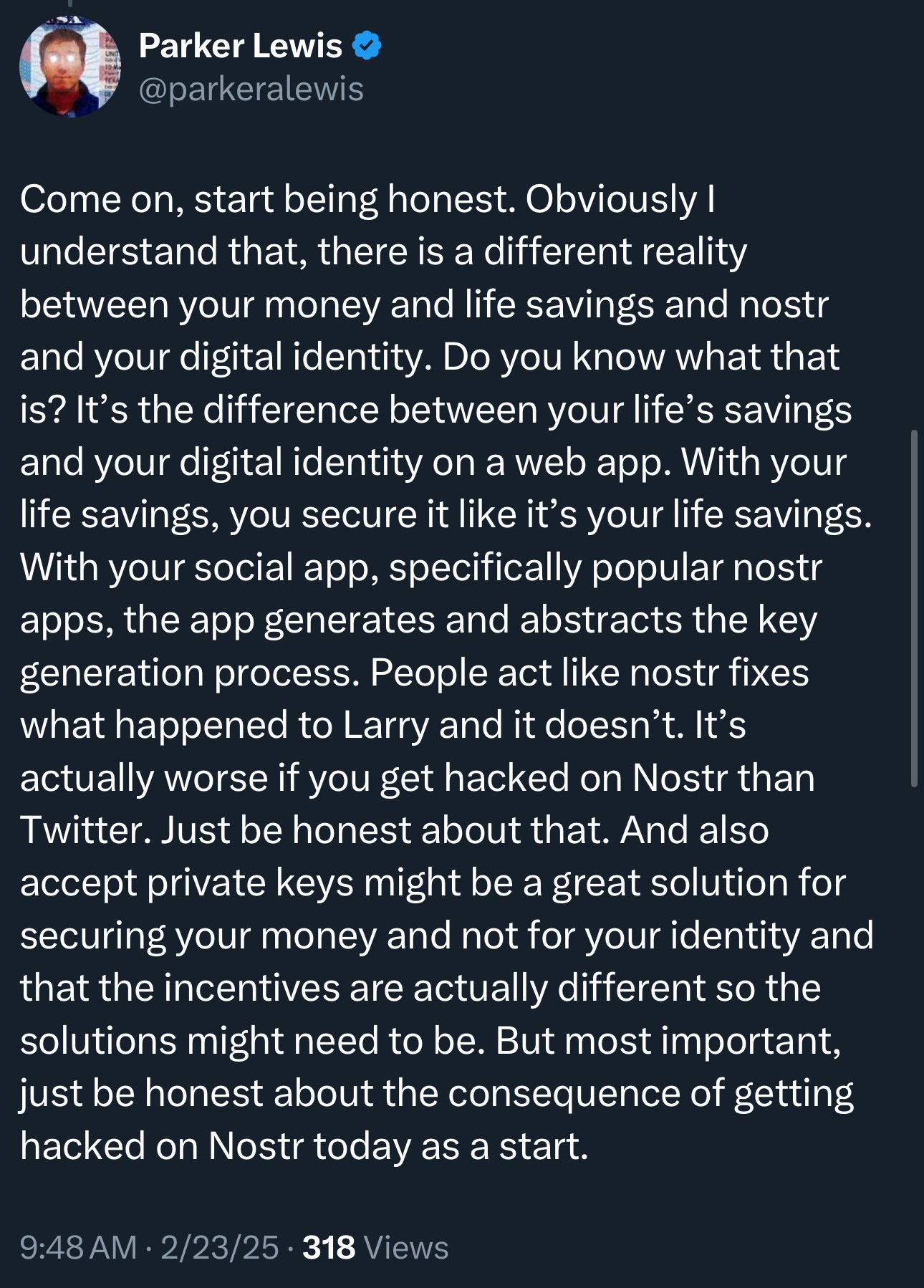

I know what you’re saying. I see nostr as like a real life conversation, online.

In a real life conversation you never get to take it back. You can clarify, augment, apologise.. but you can’t delete what you say.

Obviously nostr is potentially one to many so quite a different dynamic.

As #MSTR announced the first #$STRK preference share at the market offering today, some thoughts on how this might play out in the coming months.

Firstly, $11m is extremely small as a way to start. It would take around 1,900 weeks at this level to exhaust the $21bn! But what I suspect will happen is they will continuously ramp this up in the wake of bitcoin price appreciation in the months to come.

Let's consider how they might do this. The current price of STRK is $88.45, so MSTR are offering about a 9% yield in selling into the market at current levels. That price is made up of two components, essentially, the value of the perpetual fixed dividend payment of $8, and the value of potential future conversion to equity at 1/10th of the number of STRK shares held.

Bear in mind if bitcoin price rises, the value of that potential conversion to equity will also rise (eventually, if MSTR traded well above $1,000, STRK might end up trading more like MSTR stock since the $8 dividend would prove so small by comparison).

Just like when selling MSTR shares into the market, there is no free lunch - by selling more STRK ATM, it will depress the STRK price, and all else equal require them to pay a higher yield to the market the more they sell. Selling at $100 is clearly better for MSTR than selling at $88.

What they could do though, is decide that at any level of STRK price above X, say, they will relentlessly issue the ATM in to the market. Let's say this price is $100 (which leads to the originally 8% dividend). As the MSTR share price rises, the increasing value of the equity conversion, and perhaps the increasing security coverage on the dividend payments may help them to sell more and more STRK into the market at this level.

nostr:npub18ajqryse0ervr63wftx0h6vesah2rgmypxhxvxn08gz2jc5046jqk5dmq0

nostr:npub1zj4vtmgmsvjkhd3n0fv7tp4su5qml6mpg732pw8h8luwulu5z5kq70876g

Yes it’s a good question, but probably not to be honest. Lots of people predicted the same would happen to MSTR when the US ETFs came along, which turned out to be seriously wrong, so my guess is everyone tends to overthink these impacts.

Yep, I’m in the UK also! Albeit for me what started out as a BTC proxy has developed out as something quite different. He’s tapping into insatiable demand for return from the capital markets, and making positive BTC yield per share in doing so.

Updating my thesis on MSTR today. Anyone got opinions on the points below / any I have missed?

#mstr nostr:npub1qqvt0m3nlvjnssmrn33w9yh7cuq2dx5nkz8wxax9hk5hrjdnj4jqz8cn3w nostr:npub18ajqryse0ervr63wftx0h6vesah2rgmypxhxvxn08gz2jc5046jqk5dmq0

MSTR introduces counterparty risk - the Coinbase custody risk is worth a mention. So I would definitely mention that. Albeit custody has a cost regardless of who you are - even if it’s yourself - so arguably they may have an efficient model.

Of all the negatives I think regulation / tax is one of the largest - change can happen fast in future. nostr:npub18p63njhaxftx3m8luk2h0umj8p3cmfx09kv9hqhext7gr5ea585qsc0k8k klippsten’s race to avoid the war article is still valid

Oddly, one of the biggest drivers of NAV closer to 1 could be a sustained rapid rise in BTC, say to $1m - which might hugely constrain their ability to generate as much btc yield relative to the btc they hold. However in that case, shareholders would probably still sleep at night!

For all the #MSTR 1x MNav people out there.

I’m confused.. you want to value MSTR solely based on the bitcoin they hold, but that in itself has gone from 252,220 to 499,096 since the US election in November.

So which figure do you want to use again?!

Finally Saylor / Strategy talking dots again!

Did he spend $2 billion worth?

#bitcoin $mstr

https://x.com/saylor/status/1893660529131974865?s=46&t=TX3nD3foOnXSF5iRPh8m0A

If he did, the zero discernible impact $2bn+ buying has on the bitcoin price is remarkable!

Yeah I think that’s it - there are ways of securing your nsec and not exposing it etc, but once it’s out in the open that npub might as well be considered like any other imitation account of you.

Beginners question admittedly, but isn’t the point that on Nostr if someone got hold of your nsec you’d just start again with a new nsec?

And you’d achieve this via a social layer of trust, showing it to people in person who know you etc, and building up your network from there. And this would fairly rapidly overtake and discredit the former one.

The Motley Fool just endorsed XRP, saying:

“As an investor, it makes perfect sense to buy and hold both of these assets.”

But does it? Even they admit XRP and Bitcoin are very different. One is a censorship-resistant protocol, the other controlled by a company. One is sound money, the other a “zombie coin” (Forbes).

XRP has been tied up in SEC lawsuits, its price driven by speculation, and its supply controlled by Ripple.

On the other hand, Bitcoin is the only truly sound, permissionless monetary network.

The Motley Fool should know better.

https://www.fool.com/investing/2025/02/20/is-xrp-the-new-bitcoin/

My guess is the motley fool started back in the day with decent intentions, but don’t make enough money from their investing advice subscription services so are pretty much for hire nowadays.

Yes, the “reach” is greater on Twitter. Depends on your incentives in posting anything, I guess.

I’d argue talk is cheap, and in this instance by talk I mean posting both on Twitter and Nostr. Using nostr instead of Twitter and not in addition is the only way to really signal your views on which concept you’re really aligned with.

Yes great point. I’ve started to try to get away from my predictable phone addition and it has resulted in going back to more singular devices, which just do what they need to -

Alarm clock, torch (to separate from phone at night)

Notebook

Kindle probably also a good example especially if can be on airplane mode. I’m sure better e-readers are out there.

Was looking at a new TV for the first time in over a decade the other day also and wondering if there’s such things as dumb TVs nowadays

Good explanation. I don’t have a need for it right now but think it’s a really interesting product for producing a guaranteed income - if backing an annuity it would allow for a much higher annual income than you’d get on the market. Within that you have to weigh up the credit risk but it’s insanely covered by the bitcoin they own at present.

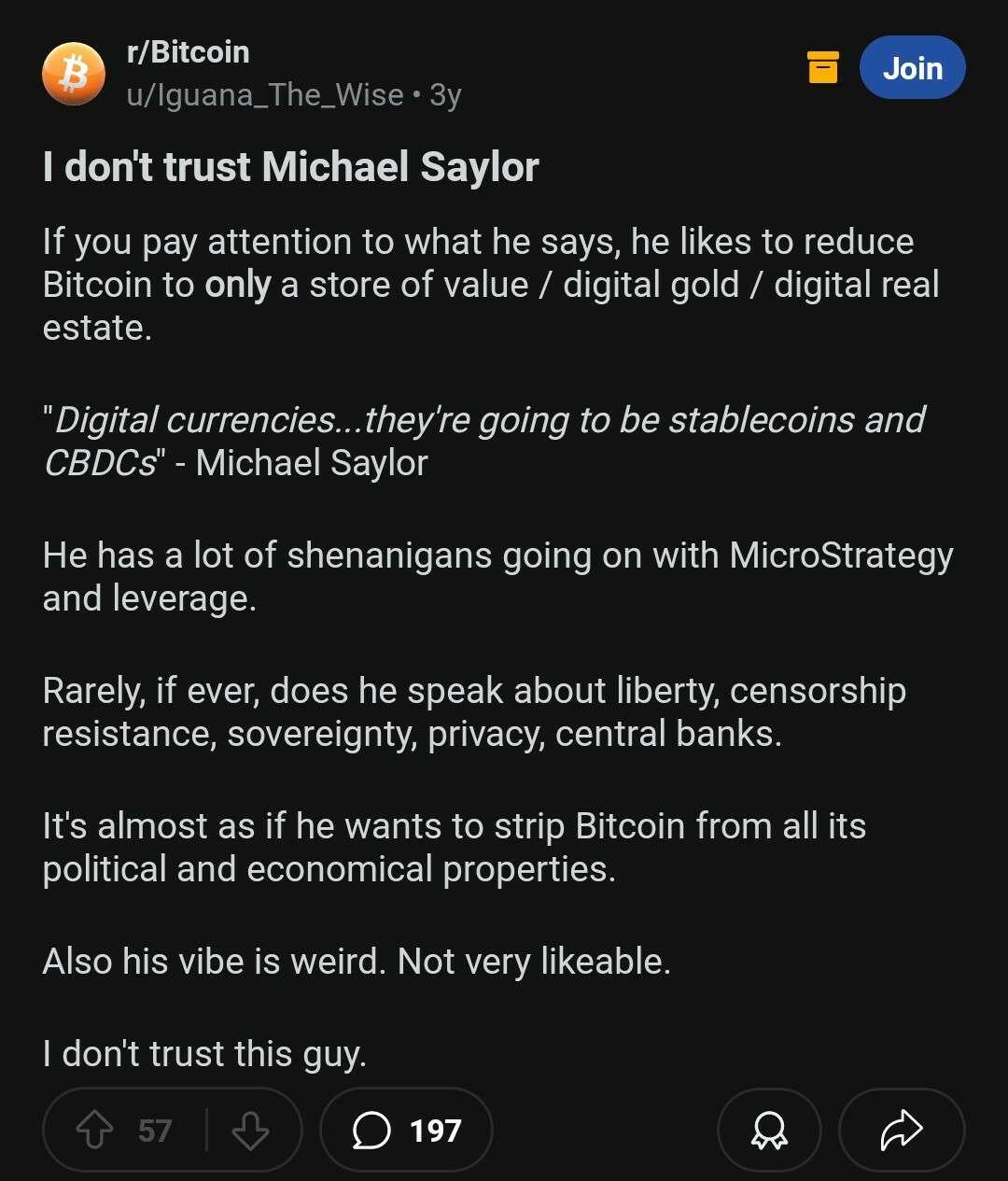

Yes all those “leverage shenanigans”… all so opaque. I wish someone would make a website to keep up with them all.

Oh wait!

strategy.com