Excerpt on Kelly optimization of Bitcoin in a portfolio, with Sina of 21st Capital #bitcoin

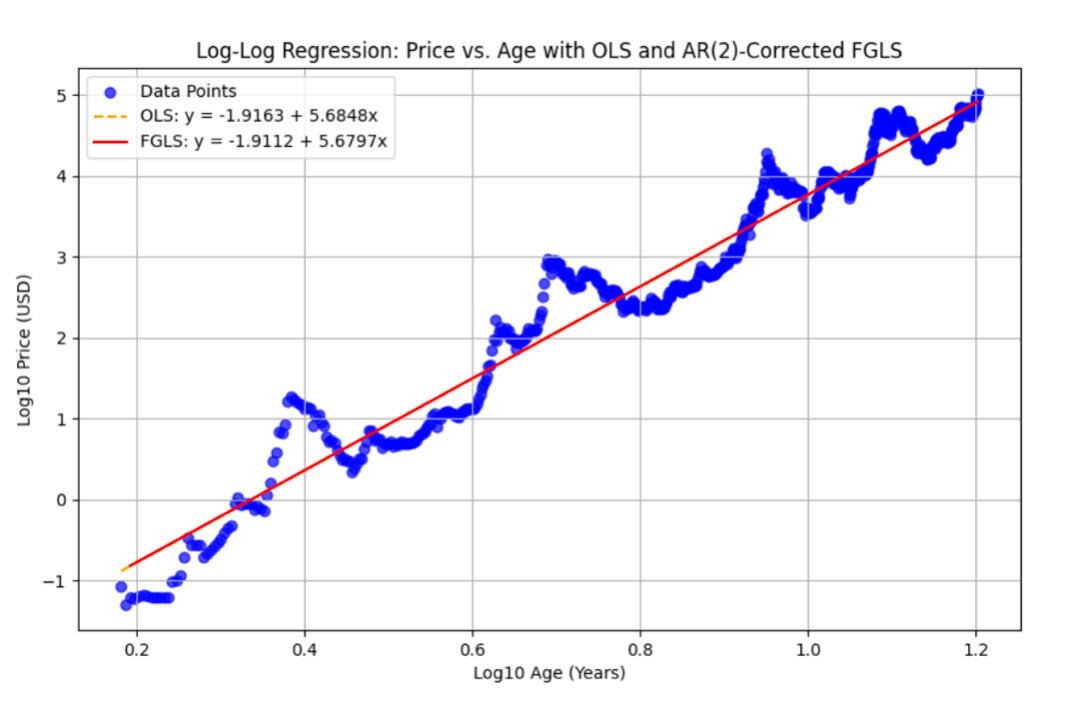

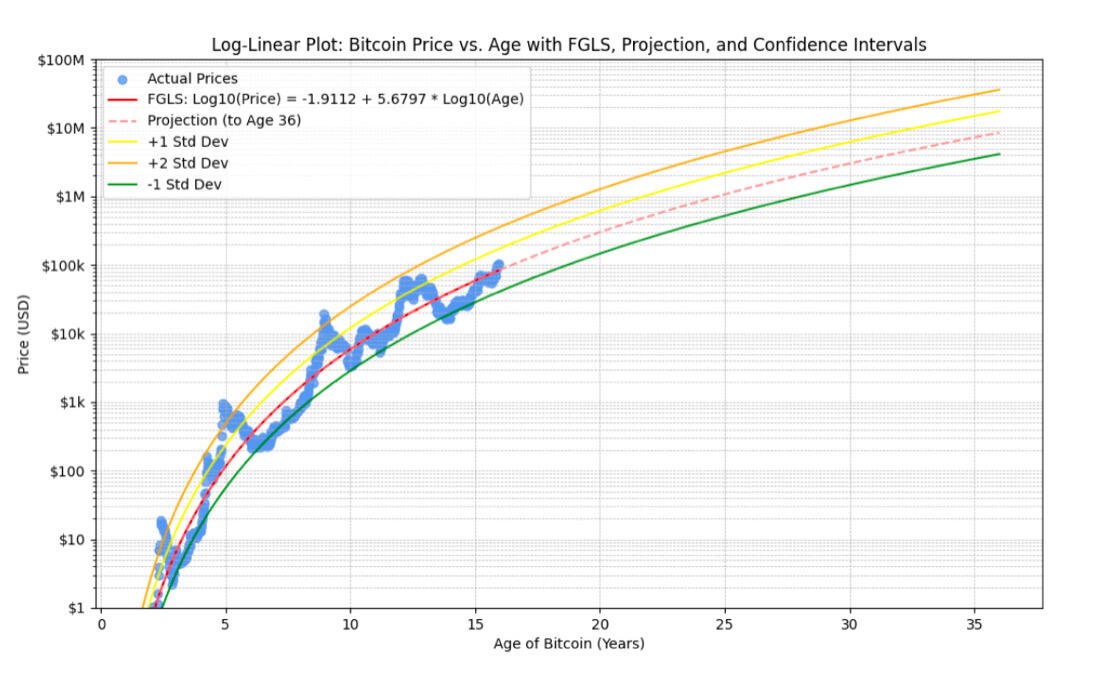

The #Bitcoin power law persists. Autocorrelation of weekly history corrected to second order.

Left chart: Log-log thus a straight line. Age^5.68

Right chart: Same fit log-linear plot, so curved lines, added -1, +1, +2 standard deviation lines and projection forward for next 20 years, if the anti-fragile and Lindy power law continues in similar fashion.

On other thing, a disinflationary currency can be (is) more natural for this demographic era with population peaking in Europe and East Asia incl. China and workforce age cohort shrinking in the most productive economies (US peaked 2020?, that are also loaded up with debt and facing slow growth). #Bitcoin Not discounting rapid tech-driven AI and more growth but population segment in prime spending years is falling in wealthier economies.

If the fiat authorities are provoked to global thermonuclear or global ‘conventional’ war by some cascade of events related to defending, promoting respective currency regimes (e.g. $,€ vs. BRCS+). ‘Spreadsheet’ term feels weak, given extreme security with Zettahash scale of enforced scarcity: an exponentially hardened and decentralized ledger

Front run another millionaire every month #Bitcoin

Money center banks rule the central banks

Taleb doesn’t know it yet but once again the SEC suits against CZ and Coinbase have shown #Bitcoin is highly anti-fragile. Here are 20 ways https://medium.com/the-capital/bitcoin-is-anti-fragile-20-reasons-b299e2d734b0

Reupping this one now that CZ has been accused of money shuffling between the exchange and his companies, Frodo FTX style. nostr:note1ej0qsql3ufg4hf09qpcjwpmwfmzhqwv3607f3gd3ynhv8umma0csgy8239

Ivory and antler snow blindness preventers

The FAST Act reduced the dividend rate applicable to Reserve Bank depository institution stockholders with total assets of more than $10 billion (large member banks) to the lesser of 6 percent or the most recent 10-year Treasury auction rate prior to the dividend payment.

https://cryptoassets0417.medium.com/tenth-cryptosuper500-report-72f66ee20850 Medium blog on Tenth CryptoSuper minting report, total dominance by #Bitcoin, sorry Elon. Full report is free no reg. wall at OrionX.net/research

Voting (POS) does not create value. It apportions it.

Work, energy = power x time (POW) creates value. #Bitcoin

#Bitcoin Maximalism is self-evident since Bitcoin has always had, and will continue to have, the highest market cap. As a result of maximal energy input. We hold this truth to be self-evident.

Gold coins all had a standard amount of metal and fineness defined. All identical until a debasement declared. #Bitcoin is fungible but each from a different block has a different amount of energy, time, and crypto power encapsulated. #invert

The only proof of work coin that greatly matters is Bitcoin. The only one with 1/3 of a Zettahash of global supercomputer power is Bitcoin. And only proof of work coins can be fully honest. Tenth semi-annual Crypto Super mining report will be released in a week.

It’s the hash rate: 0.43 Zetta, value and security reflexive feedback loop #Bitcoin. BCH .0017 Zetta and value also less by roughly 2.5 orders of magnitude.

I was at a party and a young girl was trying to impress me that she was at McKinsey. I have a Harvard PhD since 1977, did not mention that. Probably helped me understand Bitcoin, but it was the exponential hardening of all prior blocks that really did it for me: