Exactly … which means they’re an attack vector to bitcoin.

Dude, I support EVERYTHING Saylor says, his strategy is 100% on point…it is a speculative attack on fiat financial markets and I LOVE to see it.

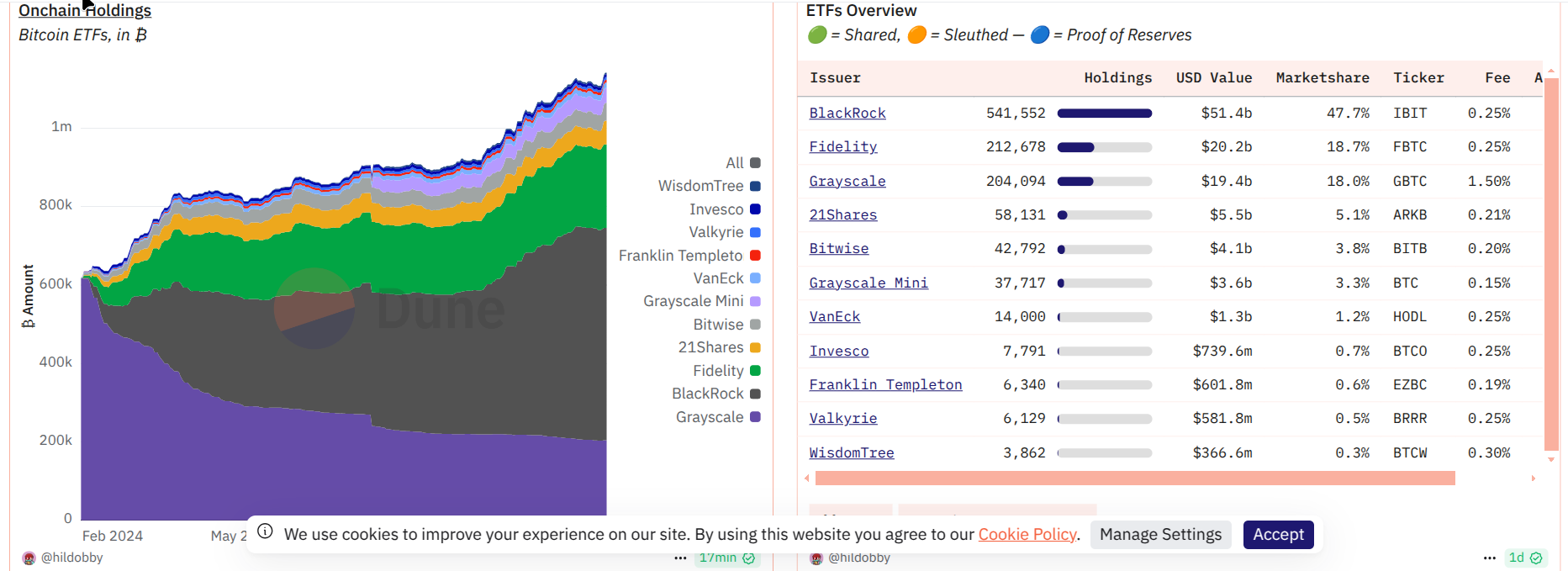

I am simply saying that because he “never” intends to sell the vast majority of the coins he is stacking, that is literally the perfect foundation for his custodians to FRACTIONAL RESERVE the mstr bitcoins. That’s not a negotiable like “nah, they won’t do that…” that’s a 100% the custodians are absolutely wanting to do that.

Show me the incentive and I’ll tell you the outcome. COIN is fractional reserve-ing MSTR’s Bitcoin. That’s putting downward pressure on spot Bitcoin’s price. The larger the entities are that get into the game, the easier it will be to fractional reserve the Bitcoin.

Eventually this comes home to roost. 2 years from now? 200 years from now? Fractional reserving won’t work with a 100% scarce asset. If Saylor is a “true bitcoiner” he should be providing proof of reserves on-chain.

Saylor knows the addresses and he can verify the bitcoin is there. Coinbase of Fidelity can’t sell or lend that bitcoin without MicroStrategy knowing about it. The custodians don’t know when MSTR will choose to move their bitcoin to another custodian. We don’t know the intricacies of their security protocols on both sides. Speculating about it being paper bitcoin is unproductive. I’m fine with people advocating for proof of reserves if they want, but the fud is unnecessary.

Thread collapsed