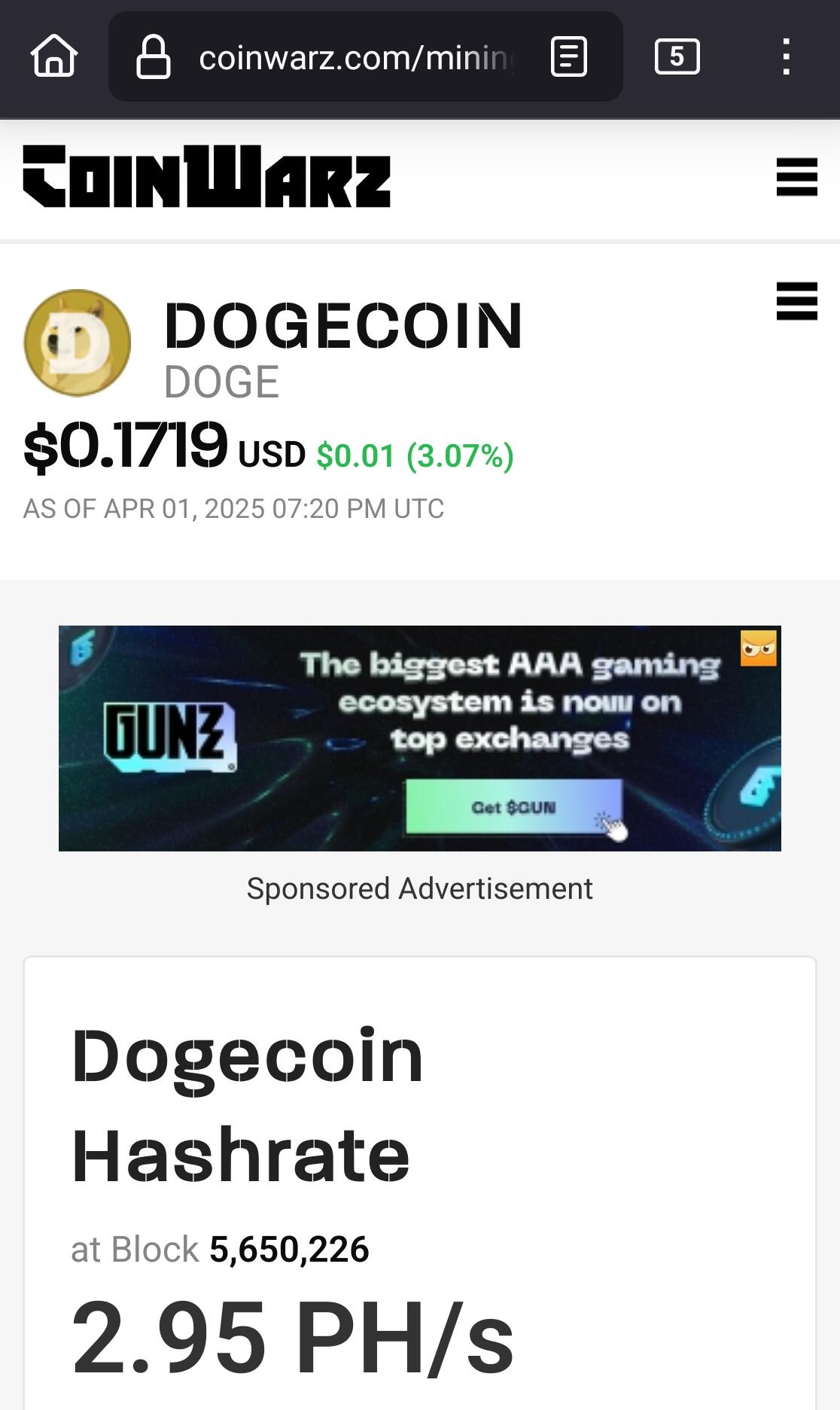

I assume it's legal to attack network. If successful price should crash. Shorts become profitable, and could in theory cover cost of attack.

I know such things have been discussed before, but never read any details.

And yeah, state attack to protect dollar is the real concern.

Not sure about reasoning that taking down doge would make BTC stronger (if that's what you're saying). Unclear to me, not disagreeing

I don't think there's a law against a 51% attack, but a trading firm could still just say they're not allowing short positions to be closed because fuck the law

They'd only let you do it if they're in on it, which they would be because they love dollars lol

Thread collapsed

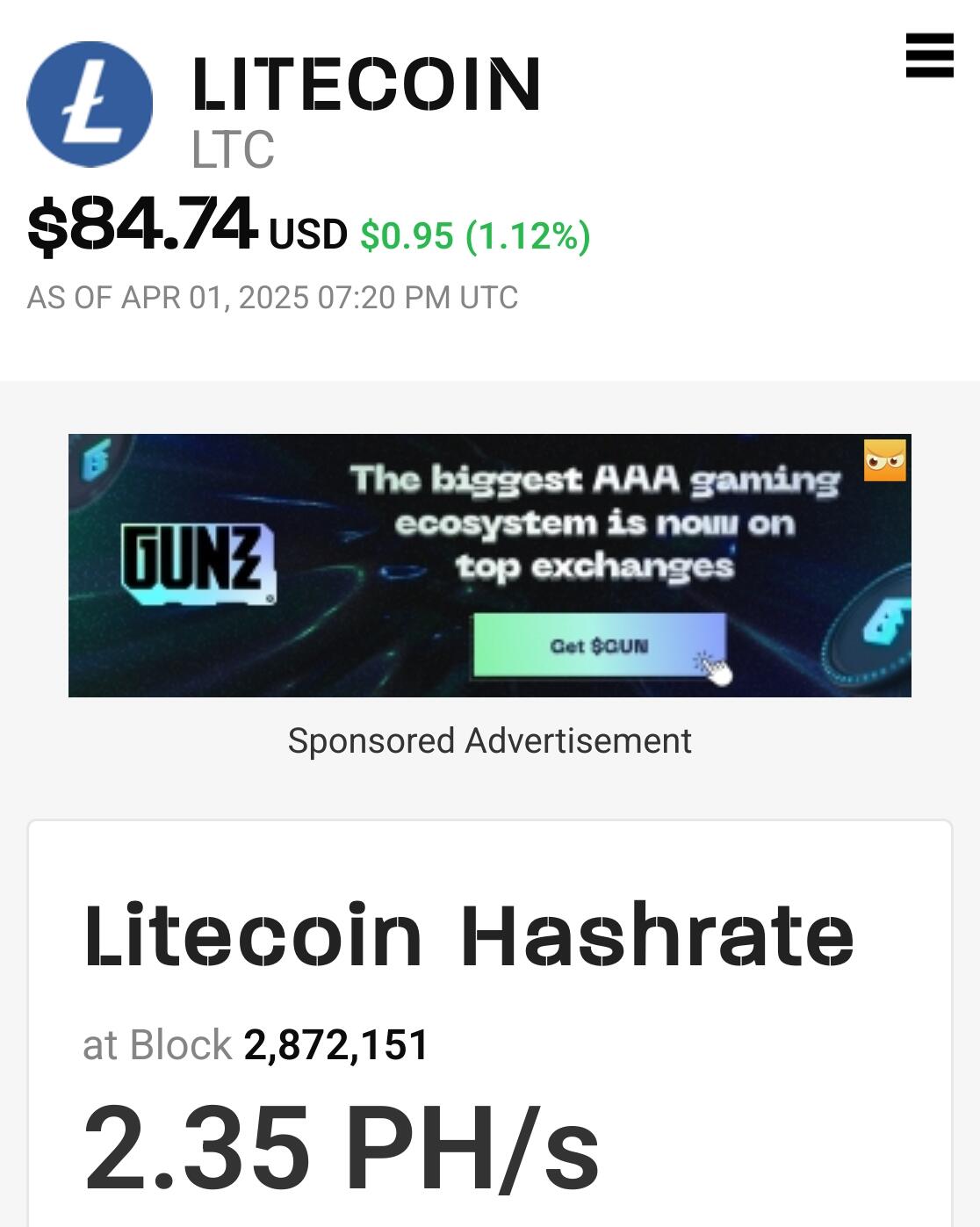

And taking down doge with a 51% attack would make Bitcoin stronger against 51% attacks in particular, because more like the whole cryptocurrency industry would be focused on making sure it can't happen to Bitcoin

Yeah, agree now that you put it so simply

You also just made me realize something

I thought it was suspicious how I couldn't find any publicly traded companies that are confirmed to mine & hold dogecoin last I checked

But a 51% attack for someone shorting mining stocks would be profitable - brokerages can't just refuse to let you close short positions on stocks

Maybe it's just not quite big enough for that risk yet

I mean, for that risk to be taken by a publicly traded company

Thread collapsed

Thread collapsed

Thread collapsed

Thread collapsed