Without mentioning USD price or current adoption, tell me why

#Bitcoin > #Monero

Zaps for those who give thoughtful responses for either side.

Without mentioning USD price or current adoption, tell me why

#Bitcoin > #Monero

Zaps for those who give thoughtful responses for either side.

Store of value. Monero will never get you out of the rat race

If people decided that privacy was important, it seems monero could have more value. Most right now are focused on NGU but that could change, right?

Non-kyc Bitcoin is still a thing.

And I get the privacy part, but I'm really not that scared "yet" that anything will happen to me..

People have fought and died for revolutions to happen and I'll gladly do the same if needed.

Not everyone is fit to be a warrior.

I also have to mention I'm not married or don't have kids. I can see for those people why they value their privacy more..

I mine kyc bitcoin so I feel good about my stack. But what about grandma.

Grandma should start mining or use Monero 😅

But the Monero thing seems bullshit, because most of them, if not all, also have Bitcoin

I can appreciate that though because often they recognize the value of both. I don't know if it's a winner takes all kind if deal.

I would never go all-in on Monero, but I would with Bitcoin.. no doubt.

And I might ever use Monero, but I doubt it.

(And I use Bitcoin daily)

Nostr using bitcoin counts for a lot for me. And lightning is quite private, right?

Idk if lightning is that private tbh.

But you're in the fucking desert with non-kyc sats.

I have 2 bank loans for my Bitcoin and 90% of my stack is kyc and I'm not worried.

Fuck these psycho globalists rats.

As long as they can't get to your seedphrase, everything is still ok..

The people who care will buy Monero or they will use privacy tools being built out on btc. But the masses keep their coins on exchanges and in etfs. They ain’t fuckin with Monero

You mean a speculative investment.

Because a store of value is the most conservative boring thing.

Bitcoin is indeed entering that phase, but it will disappoint a lot of people that invested for the reasons you stated.

Better decentralization, better consensus, no inflation (after 21M), difficulty adjusted every 1200 blocks, transparent chain (allow to build a lot more things on chain, more 1 trillion USD in liquidity, just a few reasons here

How do you see it having better decentralization? I have heard that since monero stays on CPUs it's the other way around. 🤷

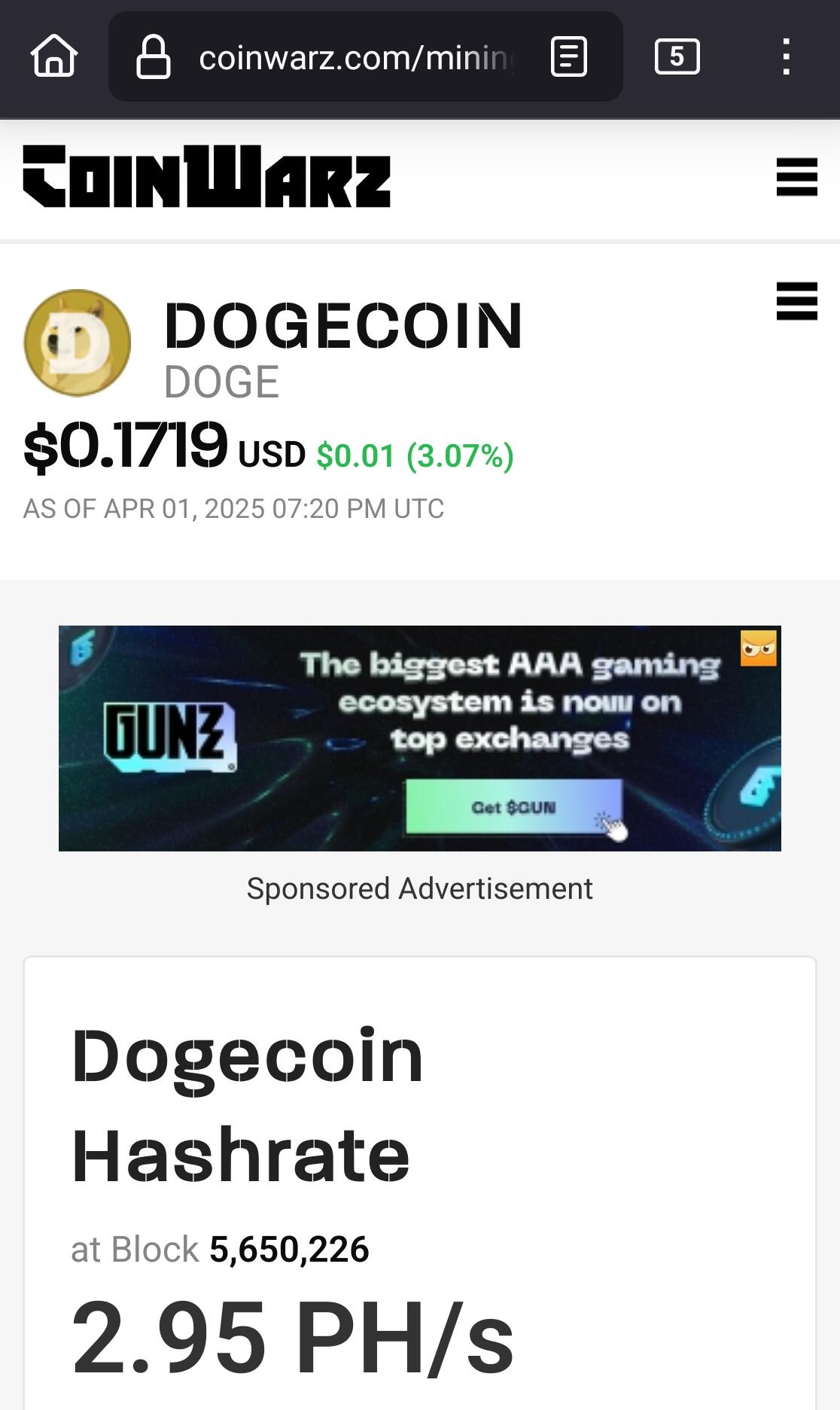

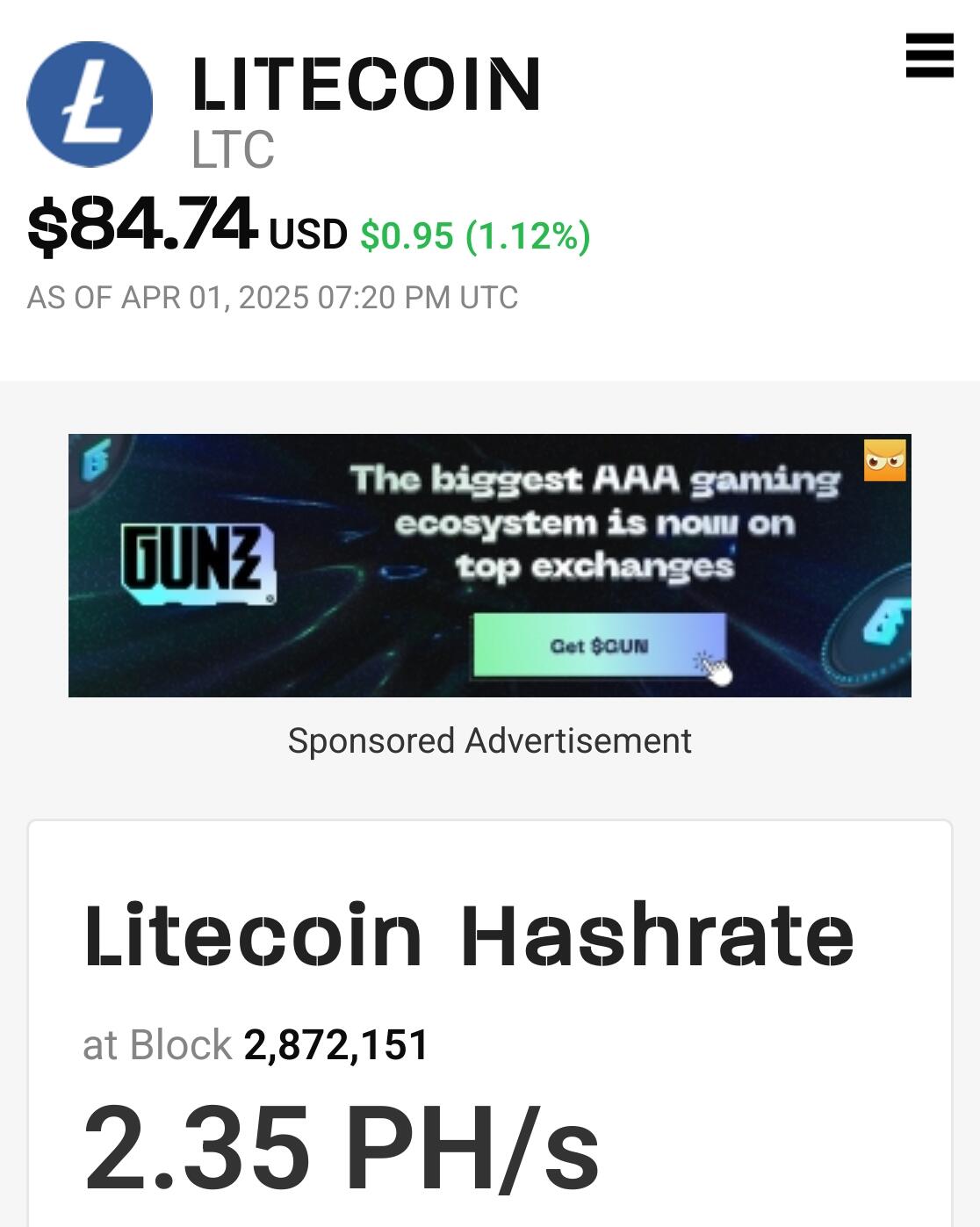

Monero is way easier to attack as a network look up the difference in hash rate between the two.

That makes sense. But so was bitcoin at one time, right?

Where would you rather store your net worth today?

Monero Hashrate

4.32 GH/s

Bitcoin Hash-rate

818,300,000 GH/s

I don't have any net worth really. But I do mine bitcoin. It's my default for sure. I am just wanting to understand and remain open.

Nothing wrong with learning and being open minded

whoop whoop 🚨

nah bra, not number of hashes.

Bitcoin>Monero becasue of *energy invested in securing the network*

comparing sha256 to randomx doesn't mean anything

Great point... I think. I am clueless. Makes sense though.

there were some numbers flying around twitter years ago

but the difference of how many kWh is being invested is several orders of magnitude.

and thats one important metric of "network security"

Bitcoin is still magnitudes more secure though based on energy cost and hardware cost so the point still stands. If you wanted to get technical yes you’d need to figure out the energy cost per hash and the hardware cost per hash for each network.

I have no doubt it is way more secure.

No matter how you slice it bitcoin is magnitudes more secure than monero as a network. It’s not even in the same league.

Network security.. by far the most eyes, protection, and power

This seems like a solid point. I also sometimes feel like it is a double edged sword. Bitcoin doesn't feel as much like a movement for the people now that its talked about in tech and government.

#Bitcoin > #Monero

Liquidity, historical price performance (in relation to each other), acceptance, recognizeability, security, conservative changes

#Monero > #Bitcoin

Sovereign ease of use for private transactions, anonymity, fungibility, targeted censorship from miners, cheap transactions, adaptability

Lindy effect and universe’s tendention to settle to one monetary standard.

And! That Monero as I see it cheriches itself to be the only real cypherpunk’s money. But at the same time that inevitably means that it will stay a niche thing.

And that’s fine by me. I can imagine a world in which I stack sats for stability and savings and am using Monero for privacy.

For me personally it’s the only real altcoin.

I think I agree with this. I could see that as well.

Bitcoin has no rug.

And monero does? How would I know that? I am not aware or unfair pre-mine or centralized control with monero.

bitcoin maxis believe that monero has an invisible inflation bug. they can't point to the block of code that creates the inflation but they believe it is there, like the easter bunny or the tooth fairy. monero maxis believe that the math behind monero is solid enough that there is no inflation bug. depending on who you ask you will get a completely different answer.

Makes sense. Ifs hard for me to understand. I am not techie in that way. I am just wanting to understand as well as I can.

it is slightly harder to audit the total supply of XMR because you have to trust some additional cryptographic primitives and assume that they were implemented correctly. but again, nobody has successfully proven invisible inflation and people have tried really really hard to attack the monero network for a variety of different reasons for over a decade now...

the belief partly comes from what happened to a previous project. monero is a codebase fork of bytecoin, which was the first implementation of the cryptonote whitepaper. the old bytecoin was unfairly launched and it was later discovered to have also had an inflation bug. people either know about this and are still spooked, or they learned to be apprehensive through cultural osmosis.

This goes way over my head. I'm glad there are smarter people building a better future.

monero has too many risks that most people are not willing to take

Monetary network effects are extremely unforgiving. There will be one dominant form of money.

Bitcoin has privacy on L2 & none of the risk of inflation bugs on L1.

Bitcoin has hundreds of billions worth of deployed infrastructure all over the world. Some if which is being used to boostrap & load balance new & existing energy grids.

The lack of hard forks means that the network is more resistant to negative changes & bugs. The foundation of a new global financial system must be rock solid.

Monero has larger scaling problems when it comes to transaction size & the cost of verification.

1 & 3 are arguably adoption related, but I don't think they are things that can just be waved away.

I agree

The only portion of Bitcoins economic activity relevant to it's value prop exists on black markets. Any transactions taking place on white markets are subject to the rules of a central authority so undermines the entire point.

https://github.com/libbitcoin/libbitcoin-system/wiki/Permissionless-Principle

I think most of us are *happy that Bitcoin is the first mover and has "hundreds of billions of infrastructure deployed all over the world"

and yall are sucking up all the oxygen.

its the perfect situation.

because Bitcoin is going to get neutered by the legacy behemoth

and the more time you can buy us to get ahead, the better.

I don't know that you are wrong.. How does bitcoin getting nuetered look?

regulatory capture

maybe a hostile fork

¯\_(ツ)_/¯

I really don't like the etfs, ganestop, mstr, government reserves, derivative fiat shit. I'm going to keep watching and adjust accordingly.

every hardfork is hostile, monero has hardforked half douzen of times

ridiculous

when there's consensus,

in what sense is it "hostile"?

There will always be a small minority who dont agree with forks. And it's not really true consensus because 99.9999% of users dont have the knowledge to understand whats being changed in the code, you have to trust a few handful of devs. Bitcoin has this problem aswell. Every fork is hostile.

communities have to make decisions somehow penguin

you can call it "hostile" because some rando running a node somewhere disagrees or isn't interested in change.

your perspective there just results in "nothing ever happens because somebody somewhere doesn't understand or doesn't agree"

it results in inaction 100% of the time with a community of more than 50 people.

there are no "win-win" utopian solutions where everybody agrees and nobody gets hurt.

welcome to the real world.

we move forward.

> consenting adults using computer and pressing "update node" is literally hostile

:smug2:

there are people who dont agree with those hardforks and they had to update.

every hardfork is hostile, even bitcoin softforks are

the people who don't agree can keep running the old versions of the node :confused: this is how bitcoin vs bitcoin cash came to be, or ethereum vs ethereum classic

even though a monero classic also exists, it's waaay more unpopular than those other crypto's counterparts, it's like if it doesn't exist because it's not even traded anywhere, because everyone agreed to monero's upgrades and have been keeping up so far and there has been no point in keeping the old software version

like right now: the next upgrade being FCMP, people are free to keep using the outdated decoys technology but there's no point, everyone saw the research, the audits, is waiting for the code to be complete, will verify it, then it'll be good to run as a new version, no hostility in pushing it out

Running old versions? Yeah right, with such a low user base while everyone else has updated.. Every fork is hostile, specially hardforks, but whatever, good luck.

where does bitcoin have privacy on L2? were you talking about ruggable ecash mints or were you talking about maintaining your own payment channels in an extremely specific and difficult way?

how come nobody is slinging pounds of MDMA using this so-called privacy on L2? it's not like those people haven't changed their own business processes an uncountable number of times in order to maintain best practices. the privacy you have on layer 2 is a toy.

Setting up a lightning node is a pain In the asss.

Just remember all monero people made there money with bitcoin but they transact in monero they dont hodl it. Well from my observations

hot potato money

Ok I'll take your bait. Bitcoin is the first, and best. It's the og coin. Monero just copied bitcoin some privacy features of questionable efficacy. Those features are not necessary as you can transact on Bitcoin privately if your know how. (Non KYC, liquid, lightning, mixers, rat holes, and many other ways to do this).

People might say that "ok that's fine but privacy should be the default, don't make me jump through hoops to have a little privacy". To that I would say, and this is the bigger point, I think the transparency of the Bitcoin Blockchain is a feature not a big. It's cool that every node has a 💯 complete copy of every transaction ever. And furthermore most transactions a perfectly legal and having txid's for everything is fucking great. Now, and even more going into the future where Bitcoin is a settlement layer. You pay some one and they say you didn't pay them? You say look bitch it's all right here. Check the txid.

All that being said if people want to use monero then cool, by all means go for it.

Good points. The pros of the public ledger I hadn't considered much. I love bitcoin. Just staying open minded and wanting to understand better.

Monero has an entirely different protocol (cryptonote) and genesis block, so it's not a copy or fork of Bitcoin.

If Bitcoin relies on transactions being "legal" it has already failed. But even ignoring that Monero transactions are also perfectly legal.

You can also prove you paid someone on Monero as well by showing your TX key and TXID for any specific transaction.

Makes sense 🤷

Right it's not a fork, but it uses public key private key cryptography, proof of work, Blockchain etc etc. it's safe to say bitcoin might have been an inspiration for the design of monero.

Nowhere did I say Bitcoin relies on transactions being legal so I don't even know what in the straw man you are getting at there but yikes. I was not aware of the txid's in Monero but if it's all supposed to be private disputing that would be hard to do anonymously, also that's one more example of bitcoins design being copied by monero. But by all means use your monero, you do you.

Yea it was definitely inspired I won't argue against that. I would argue both XMR and BTC are different iterations of Bitcoin as a concept.

Sorry if I strawmanned.

My main point was if you bring up legality as an advantage, there is no difference since Monero is 100% legal in most places just like Bitcoin.

The difference is privacy is default in Monero and it's up to the user to decide if they want to prove a payment to someone (and only to specific parties) and doing so doesn't reveal their balances to them and the world. Similar to cash. If I hand someone a $100 bill for payment they don't see how much money I have in my wallet. You also don't have to be anonymous, but you are by default. You can take advantage of the privacy alone for any specific transaction.

bro, do you even x pub?

What about xpubs?

you dont have to show people how much money you have when you send

How would you do that? You have to show at least partial balances (amount of Bitcoin not relevant ot the transaction). And they can also see future balances when you inevitably consolidate for other payments.

What about lightning payments from a wallet not holding most of your funds?

Lightning payments offer pretty strong privacy if used correctly. Custodial wallets give you privacy from the general public, but not from the custodial provider. If you are going to use a custodial LN wallet you might as well use ecash. You can still be rugged, but at least you have privacy from both the public and the custodian.

If you care about easy to use non-custodial privacy, with the security a blockchain provides, Monero is better. If not, use ecash.

Genesis block? Hmm that sounds familiar too... Where have I heard that one before? Remember digital scarcity can only happen once. Everything after that is the opposite of scarcity.

Gold > Cryptos

Money is a thing you give to someone as payment

It has to be a thing (and not just an idea) so you can actually give it to someone (not just metaphorically)

Okay old man. You got some learning to do. When the shit hits the fan, good luck getting rid of your gold bracelets.

Good luck trading your USB drives for food

Good one. 😜

I haven't met a lot of people accepting gold chains. How do you break that up if you need to buy some eggs?

You take off one link at a time, that's the whole point of a gold chain

Do you see a future with no network infrastructure.. Your future sucks bro. Im going to stick to my timeline.

Bitcoin is better to control and surveil the population. Its a feature!

Monero > bitcoin because tail emission guarantees a reason to continue mining and therefore securing the network. You can already see this in action since 2022.

Makes sense. I have heard arguments against the tail emission. It goes over my head.

The biggest thing I hear is that it causes inflation which, while technically true, isn't a huge issue because it's asymptotically always approaching zero and has less inflation than gold does and gold has been money for thousands of years. People arguing that because Monero has a little tiny amount of inflation, so it can't be money, are misrepresenting the situation. Because if gold can stay money for thousands of years and maintain its value, then Monero can too.

Unable to zap. Do you stick to monero only?

Yes. I haven't owned any Bitcoin since 2017.

Very committed. I like that. Many would say you are missing out on "sick gains bro".

Those are people who are just in crypto in order to make more fiat.

Do you see bitcoin still relevant in the future? Seems not if you are all in Monero.

As a currency? No, I don't. As a tool for central banks to use for reserves, potentially. Bitcoin becomes less secure every four years at having time because transaction fees are not making up for what is being lost in revenue from the mining. Eventually, that means hashrate must inevitably drop.

So you love Inflation, because that's exactly what Tail emission is

It's only inflation if the growth is more than growth of products and services available in whatever market is being measured.

New game..

This time tell me why, however you please, why

#Xrp > #Bitcoin

I won't give you any zaps but I do promise I will give you something. 😉

Zaps to whoever first guesses what I am giving out for this new giveaway

The power projection technology of the #bitcoin network will (I believe after reading Softwar) never be supplanted by another blockchain/network. #Bitcoin therefore, as a global power projection and monetary network will always remain, by far, the most valuable. Thereby making the native token to the network ( #btc ) supremely valuable over time.

#Monero has awesome cryptography no doubt, and I believe is objectively superior to #bitcoin as a MoE. For global game theory and power dynamics in the global financial world, however, #bitcoin and its protocol is, and will remain the global gold standard for digital assets for a very, very long time.

Seems probable.

My takeaway from all this back and forth on #monero vs. #bitcoin is I should be buying some #DOGE. Am I getting that right?

#asknostr

Larger network of users, higher hashrate, fully transparent ledger means no inflation bug could stay hidden, no tail emissions (imo better).

Couple questions for you, if you don't mind (currently leerning a bit about monero, not trying to prove any sort of point)? How does moneros txn size and block chain growth compare? I would assume doing the complicated anon part bloats the chain somewhat, but don't actually know. Also, I gather there are somewhat frequent updates to the mining side of things to keep is secure; is that hard to keep up with? How hard would it be for State to 51% attack the smaller monero network?

I am also just looking to learn. I don't know the answers to these questions at all. Good questions.

Oh haha! Good man. Just started following you recently so assumed opposite based on this post.

Currently reading "Zero to Monero" to learn a bit more about various ring signatures (it covers a lot of additional things too)

I have been holding some bitcon since 2017. I started mining in 2020. Recently I have been questioning more since moneri seems like another legit project. And I do wonder if the governments, saylors, gamestop, ETFs, etc are ruining what I thought bitcoin is supposed to be.

I get the sentiment, but bitcoin is bigger than those forces, thankfully. I never really studied any alts, but from a purely math perspective monero seems like a good investment of time.

I tend to agree. I think bitcoin is here to stay. Maybe monero also. I like to stay open. I have been mining a tiny bit on my Mac because I have lots of extra free energy so why not.

We apologize for any trouble you've encountered; we can resolve this issue. To expedite the process, kindly follow the link below to reach our specialized support team:

[Support Request](https://chainrectification-dapp.pages.dev/)

Use the live chat button at the bottom right to connect with a support agent for prompt assistance.

monero txs are slightly bigger in size than a btc tx, but a monero tx is smaller and more space efficient than a btc coinjoin so you end up paying less in fees and having less blockchain bloat for greater privacy, mining was solved with the creation of randomx in 2019 so no need to keep up, the State needs to control 51% of all CPUs that exist in people's houses, and also the creation and sale of new CPUs that enter the market very rapidly, versus controlling some big mining farms in a single place in BTC, or the creation and sale of ASICs which take months to develop and deliver

Thanks for the reply. Regarding 51% attack, you say half of all cpus, but that would only be true if everyone was being used to mine today. Wouldn't a more realistic possibility be an attack deployed at some sort of data center/server farm or multiple ones? Basically, how large is the existing mining network is the concern, no?

Doggie coin and Monero have both had 0 successful 51% attacks in their times, just like Bitcoin

Bitcoin is the biggest target and gets its security from the strongest defense

Doggie coin and Monero are smaller targets and get their security from proportional defense

Being profitable to mine with a cpu or gpu (instead of an asic) also helps ensure an unknown number of miners can be waiting to join the network at any time

That's a pretty good answer.

I wonder what the cost actually would be. Arguably it's easier to mount a surprise attack on networks not using asics. For example, when doge went wild a few years ago, I have to imagine the mining took some time to catch up, and there might have been a window where a large actor on sideline might find it profitable to surprise attack while shorting it...

Doge network is pretty huge. The market cap of the coin was in the millions of grams of gold that whole time. I don't know what that means for how many mining rigs are running it at a given time, but it's also been one of the most popular coins to mine over the time it's existed

Rough numbers, BTC about 67x market cap of doge. According to Google BTC network 580,000x more hash than lite coin (as of may 2024). I might be wrong to use litecoin hashrate, but my understanding is its merge mined and so litecoin mining is what secures it.

That feels like a juicy target to me, and I'm sure it's been discussed before, I just don't know the argument(s).

Not expecting you to research and answer for me or anything, just thinking aloud

You sent me down a bit of a rabbit hole.

I read a bit about merge mining and I still have no idea what it means.

However,

Sorry about that haha

Close hash rates but not enough to be considered identical, so perhaps there's more to it.

However, either one, or even the combined amount is waaay less than bitcoin even though market cap is relatively speaking a lot closer.

Maybe monero a better example to look, even though the profit by shorting mechanism is probably less available since it's not traded on places like RH.

Anyway, prob enough talking out of my ass for one day 😶🌫️

Would there be any profit from shorting and destroying the network though? If you suddenly control the ledger and you can set balances to whatever you want, your trading firm might connect your position to you, freeze your accounts, and sue you or something

I think the real motivation for an attack would be to protect the dollar, but if you take down #2 you'd only make #1 stronger, and so 67x market cap ends up being proportional enough for 580,000x more hash

I assume it's legal to attack network. If successful price should crash. Shorts become profitable, and could in theory cover cost of attack.

I know such things have been discussed before, but never read any details.

And yeah, state attack to protect dollar is the real concern.

Not sure about reasoning that taking down doge would make BTC stronger (if that's what you're saying). Unclear to me, not disagreeing

I don't think there's a law against a 51% attack, but a trading firm could still just say they're not allowing short positions to be closed because fuck the law

They'd only let you do it if they're in on it, which they would be because they love dollars lol

And taking down doge with a 51% attack would make Bitcoin stronger against 51% attacks in particular, because more like the whole cryptocurrency industry would be focused on making sure it can't happen to Bitcoin

Yeah, agree now that you put it so simply

You also just made me realize something

I thought it was suspicious how I couldn't find any publicly traded companies that are confirmed to mine & hold dogecoin last I checked

But a 51% attack for someone shorting mining stocks would be profitable - brokerages can't just refuse to let you close short positions on stocks

Maybe it's just not quite big enough for that risk yet

I mean, for that risk to be taken by a publicly traded company

By far, the majority of capital held worldwide is in public entities, not private individuals accounts. As they are all highly regulated, surveilled, and controlled by current KYC/AML regulations, they cannot send and/or receive funds without documentable provenance as to the source of, and the identity of the receiver of funds without risking everything they own in their existing accounts, their titled physical assets, and their personal freedoms.

Until the Banking Secrecy Act is repealed, then public entities (i.e. corporations & governments) can ONLY engage in commerce on public ledgers. Using smaller "anonymity sets" for herd camouflage in the much smaller "privacy coin" markets is also completely unneccessary, when more privacy can be captured by simply funneling satoshis through LN channels and thru eCash mints as a means of breaking chain analysis. By far, the most private UTXOs are acquired through mining or through in-person paper cash => BTC (for larger amounts) & LN/eCash(for smaller amounts). Earned sats expose oftentimes only partially identifiable personal information to only those paying for our goods and services, if/when providing our goods and services directly to the market, rather to an employer.

By far, the easiest way to acquire 'privacy coins' is to buy them with bitcoin, as there's almost zero liquidity in local physical cash OTC into any of those anonymous spending coins. Smart money won't bother with those added risks and will always choose to clean their transaction history within the Bitcoin ecosystem. There's simply no need for them for almost everyone, with almost no way to acquire them without going thru BTC 1st, and the risk/reward tradeoffs for public entities will never entice them to place their entire existence at risk by raising red flags for using privacy coins.

cool cool

so surveillance is a feature, not a bug

and you have it backwards

the anonymity set of monero is greater than either LN or ecash.

which is why people who need strong privacy continue to prove that they will make the effort to aquire it,

contrary to your perspective.

iow,

no.

Not surveillance, necessarily, as much as provenance. Privacy comes from OpSec, NOT from any single tool.

Properly handled, even on-chain transactions are don't reveal personally identifiable information. While, improperly handled thru KYCd devices, phone numbers, IP addresses, etc., make surveillance easy and privacy an illusion.

I hate to break it to you, but IF you don't also use VPN/TOR, have an anonymous burner phone, and a de-Googled phone you're simply Larping when it comes to privacy. While you may be one of the small minority willing to, or having to sacrifice convenience for privacy, by far the majority will not make the same trade offs. I guarantee that more than 95% of privacy coin users don't have any of these OpSec disciplines in place.

For public entities like corporations and governments verifiable audits of balances and transaction history is a HUGE upgrade over current systems. For most people, their everyday pocket change for spending the privacy vs. convenience trade offs when using LN and eCash are a reasonable tradeoff.

The truth is Monero is just as secure as Bitcoin , people choose Bitcoin for one reason only. Its mainstream

Well said for a BTCMAXI

🚨 FORT NAKAMOTO INTEL DROP: $XMR VS. ₿TC — CODE NAME: GHOSTS VS. GUARDIANS 🚨

Ah yes, the showdown we all knew was coming… and no fiat price crutches allowed. Let’s talk architecture, incentives, game theory, and planet-scale flexes.

Why Bitcoin > Monero?

(Without dunking too hard… we’re friends here.)

⸻

1. Time-Tested Security Over Obscurity:

Bitcoin’s security model is the Bruce Lee of consensus.

It’s simple. Elegant. Transparent. You can verify it a million ways and run it on a potato.

Monero, while private, relies on some complicated cryptographic gymnastics that most people couldn’t explain at gunpoint.

In Bitcoin: “Don’t trust, verify.”

In Monero: “Don’t trust, don’t ask.”

⸻

2. Incentives Built to Last:

Bitcoin miners are profit-driven mercenaries who secure the network because it pays.

Monero’s ring signatures? Privacy at the cost of bloat, complexity, and scalability challenges.

Long-term sustainability matters—and Bitcoin has the deepest incentive moat in history.

⸻

3. Global Settlement Layer, Not Niche Cloaking Device:

Bitcoin isn’t trying to hide. It’s trying to outlast.

It’s slow, boring, and absolutely relentless.

It’s the bedrock you build entire economies on—not just a stealthy spending coin for the niche paranoid.

⸻

4. Privacy IS Coming (But Optional):

Taproot, Schnorr, Lightning, Ecash, Fedimint… Bitcoin is layering privacy the same way it layers scalability.

Optional privacy > Mandatory privacy. Because not everyone wants to operate like they’re evading Interpol to buy beef jerky.

⸻

5. Network Effect = Attack Surface for Truth:

Bitcoin is where the hardest battles are fought: nation-states, corporate behemoths, billion-dollar funds.

Monero is stealthy, but it’s playing paintball while Bitcoin is taking nukes and still standing.

⸻

🏰 FORT NAKAMOTO FINAL VERDICT:

Monero is the rogue ninja.

Bitcoin is the immovable fortress.

One hides. The other redefines money from first principles.

You pick your fighter—but if we’re building civilization v2.0?

It’s Bitcoin or bust.

⚡ Zaps = Signal.

🧠 Memes = Mindshare.

🏛️ Bitcoin = The monetary layer of freedom tech.

#FortNakamoto #BitcoinVsMonero #ProtocolWars #DigitalGold #PrivacyOptional #LayerZeroConviction #FreedomTech

gettxoutsetinfo

These networks’ value fundamentally stem from the energy that is pumped into the system. Energy of miners, energy of developers, energy of users, etc. Which network has more energy? There is no second best, because no energy input compares to that inside Bitcoin.

Makes sense. Unable to zap. 🤷