If I decided to sell my bitcoin at a 50% discount to my friend am I suppressing the price?

If I decide to give away my bitcoin for free in the form of a zap, am I suppressing the price?

If I decided to sell my bitcoin at a 50% discount to my friend am I suppressing the price?

If I decide to give away my bitcoin for free in the form of a zap, am I suppressing the price?

Depends on the volume. Probably not.

2M+ bitcoin at coinbase … fluctuating their float by 100 bps to manage market volatility is very meaningful.

I’m not talking about exchanges.

I’m talking about Bitcoin to Bitcoin, electronic peer to peer cash. 1 BTC=1 BTC

If you were standing on dry ground, and you saw the water level rising, or water level dropping, would you say the land was going up and down?

1 BTC =/= 1 BTC if Coinbase, et al are creating a fluctuating paper supply.

Yes.

Based on the logic, if I decide to sell it Bitcoin a 25% premium I am inflating the price, correct?

Buying real world assets and doing real things serving real people the right way is the goal. Bitcoin is a tool for accomplishing that (but NGU has to happen.)

NGU is in regards to purchasing power and dollar denominated purchasing power is the simplest method for communicating Bitcoin’s purchasing power.

You forgot a key point, buying real world assets WITH BITCOIN PEER TO PEER is the goal.

NGU doesn’t need to happen for that to occur. Pricing things in bitcoin needs to happen for that to occur.

Adoption is driven by NGU. You won’t convince me otherwise.

People are self-interested. Self-interest drives behavior.

Congrats if you have principles that are above reproach…most others don’t.

Bitcoin changes you

Sure. I’m changed, too. But if my purchasing power doesn’t go up and I have to keep working within and for a system designed to suck out my soul vs. be free and sovereign then the theory doesn’t matter.

And all (or at least most) these dudes posting their bitcoin-enabled, sovereign lives are class 2017 or earlier.

NGU is critically important. Congrats if you can accomplish your dreams at this point … mine needs NGU.

It has gone up! What more do you need?!

It’s gone up more than any other asset. The sovereign part comes with running a node, taking Bitcoin off the exchange, not using ETF’s, and mining Bitcoin independently of others permission.

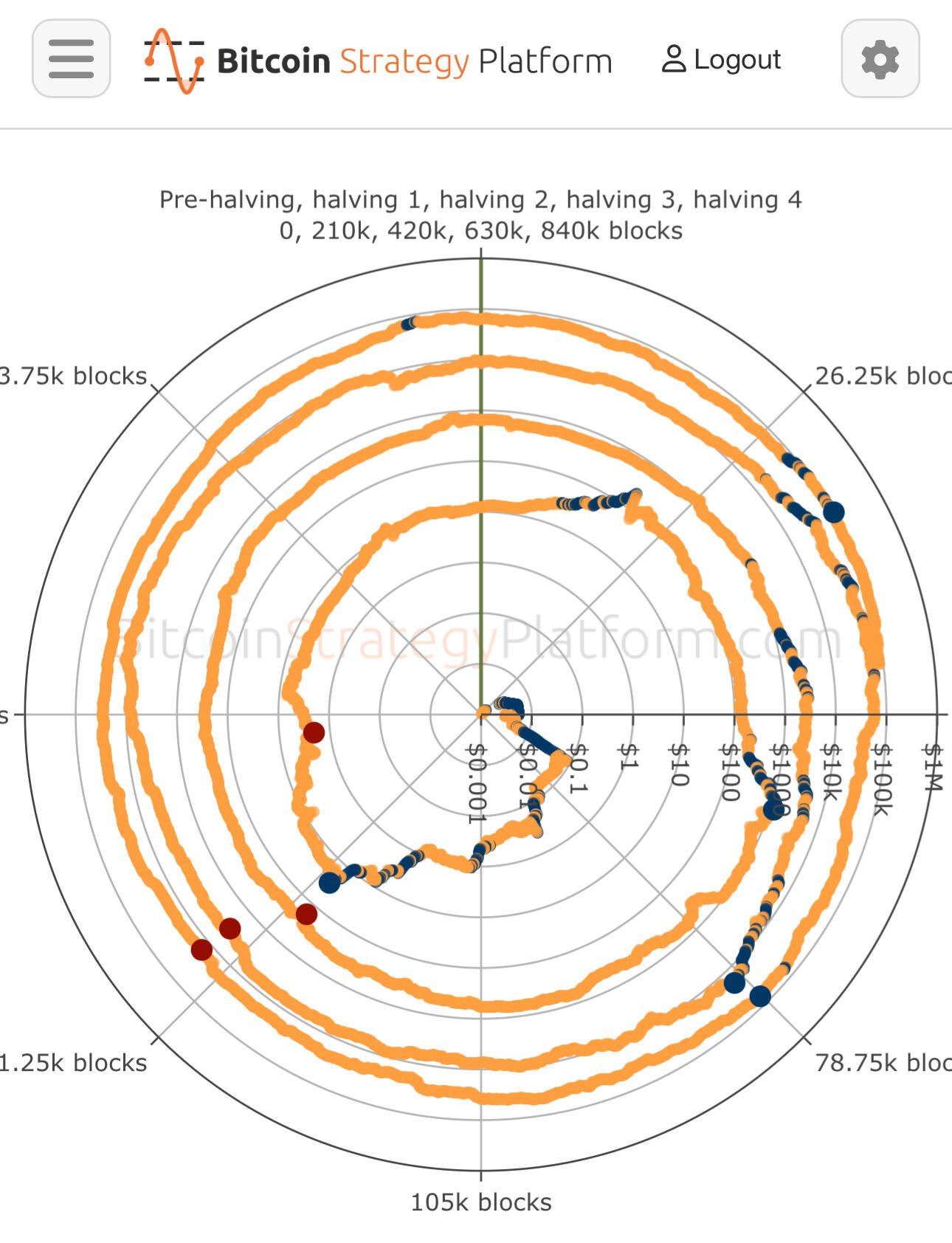

You don’t endure 80% drawdowns for 9% CAGR. Thats just bad risk management. I am expecting something much more aligned with prior cycles’ performance (which is where this tit for tat started). Somewhere around $250k/BTC, minimum.

I’m not trying to tit for tat

I’m just saying that if the real power of Bitcoin comes when you can start pricing services in the asset and you can use it without permission to buy items.

Until the fed changes the denominator (21M/♾️) and starts QE, we will just see more of the same. Don’t get overlevered or place bets about its price, that’s the real bad risk