What I'm watching... 👀

Some anti-bear porn.

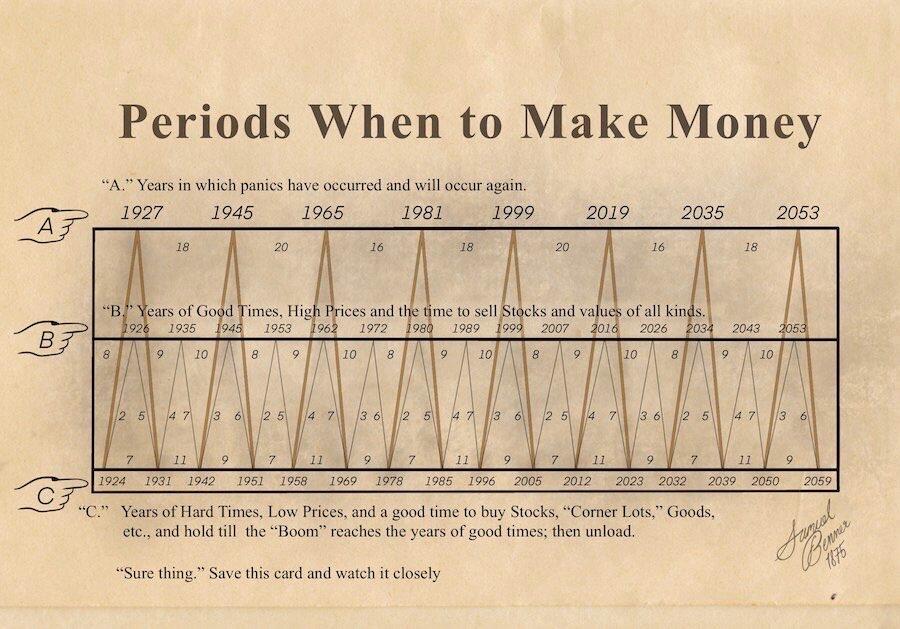

A provocative chart from Yardeni Research, suggesting that (if history repeats) we may see ongoing and increasing annual gains in the S&P 500 (and related assets) through the rest of the 2020s.

This flies in the face of the myriad #recessionistas, who have been wrong about an IMMINENT RECESSION since 2020.

My generally rosy #macro outlook remains that we will not see a full-fledged recession in the United States for the foreseeable future.

If conditions change, so too will my outlook for risk assets.