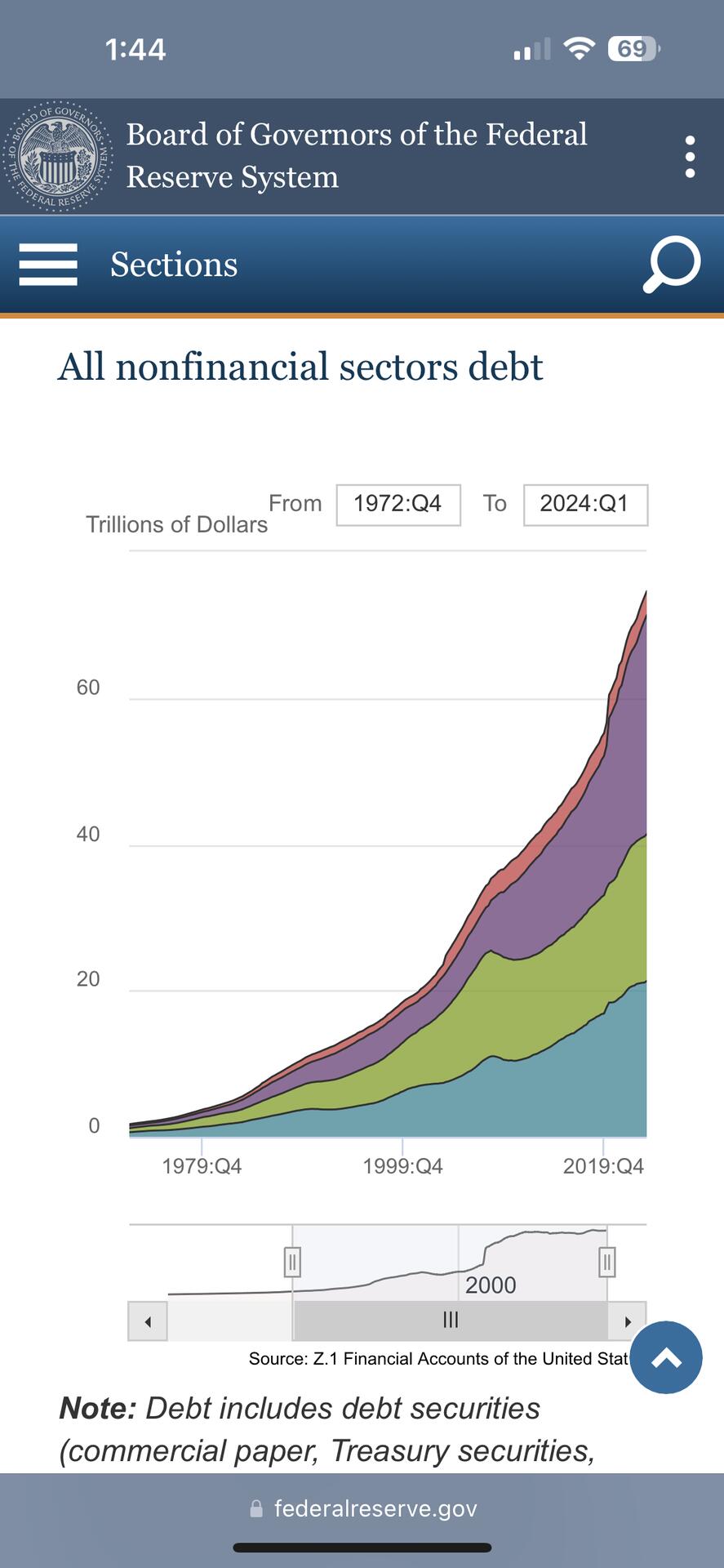

Your thesis regarding what CPI is, is wrong. Like the name suggests, the CPI measures price increases (even though manipulated). Thus completely useless data. Price increases are the trickle down, delayed effects of inflation. Inflating the money supply that is. Which, in a debt based system is debt. Total debt, including federal, state and local, business and private debt. Currently $80 trillion in the US. The purchasing power of #Bitcoin imho is currently more of a function of adoption. Unfortunately the exchange rate vs the USD is also heavily manipulated ever since the Government/Wall Street got involved. And they are slushing it around between the USD/Futures and ETFs, Strategic Reserves, Corporations, seized Bitcoin etc.

Discussion

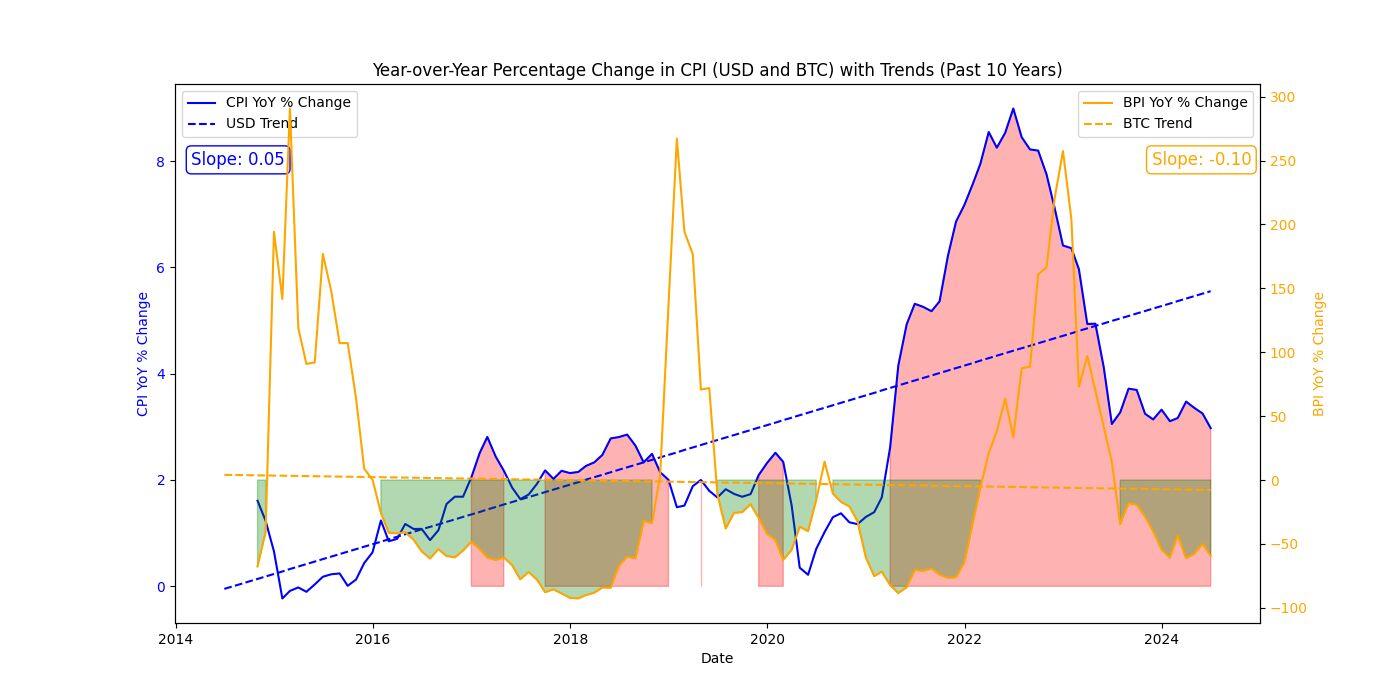

I get that consumer price inflation is a result of monetary inflation mainly via debt. All I'm trying to find is the increase/decrease in cost of consumer goods priced in BTC. If CPI measures price increases, would CPI denominated in BTC not show that?

I also understand that CPI is heavily manipulated, and so is BTC market price data at this point, but what isn't in a fiat world? I like puzzles and this one has a hold of me at the moment.

Maybe create your own sample of goods and services?