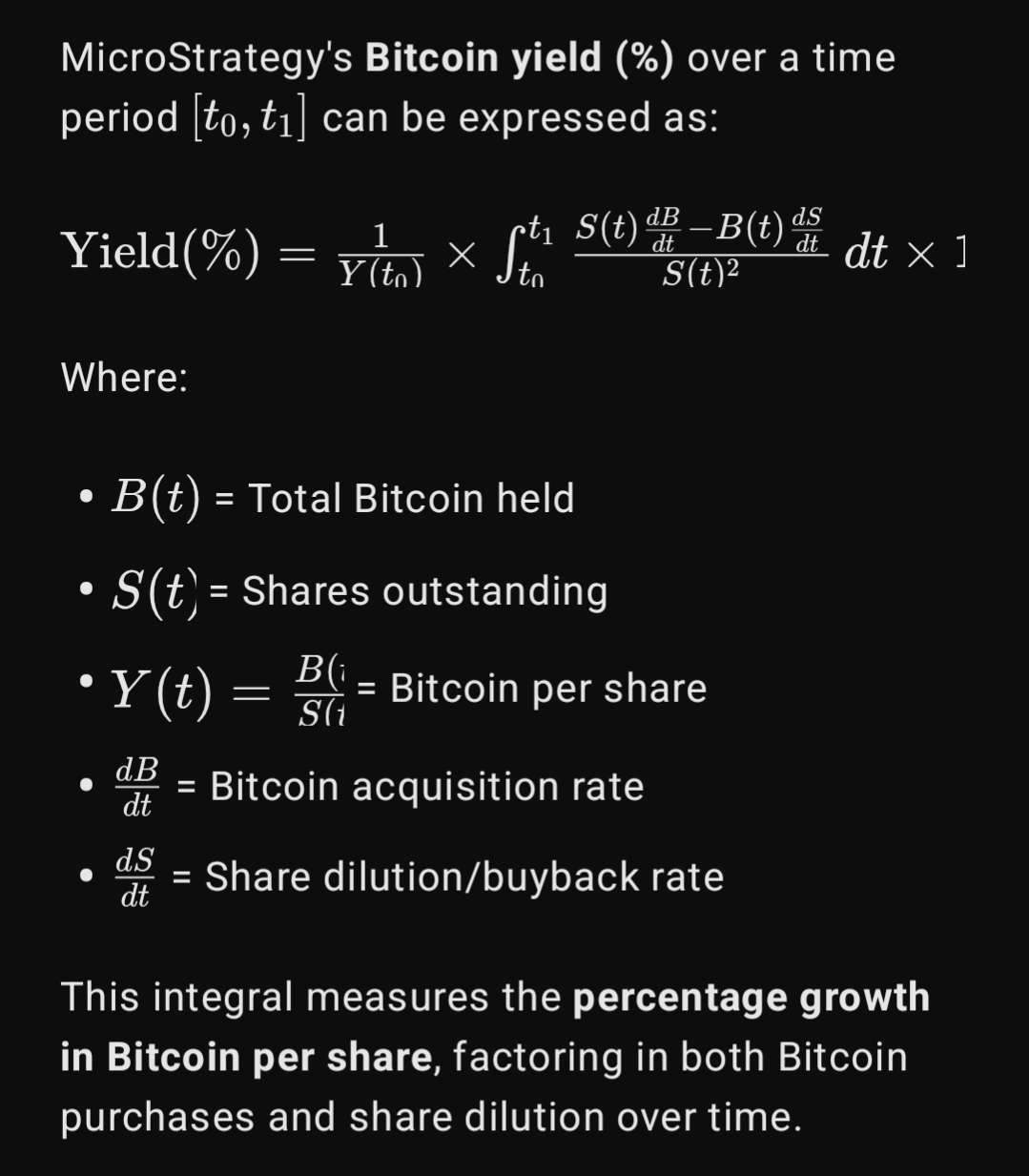

Can someone explain to me what the "BTC yield" is that MicroStrategy advertises?

Discussion

Sounds so fiat

WHERE DOES THE YIELD COME FROM?

Noh all i can say is it is probably grossly intentionally misleading as far as the choice of words

Great question.

Fiat bullshit

can someone explain to me what micro strategy is

I'm no expert, but seems like fiat fuckery to me.

Tbh MSTR playbook sounds like a Ponzi scheme. The people buying convertible bonds have no claim over MSTR bitcoin holdings nor do their shareholders have claim over it. Also no one till now has been able to verify their on-chain holdings. It’s just saylor posting on X.

Ratio of Bitcoin holdings to outstanding shares increases over time

Growth of bitcoin / share

Important: It doesn't take the company's debt into account. If the company buys with a pure loan (convertibles are good), the number goes up.

Sounds like bullshit wrapped in bullshit.

You must be new around here. Low tier plebs like you can benefit from applying to Real Plebs®. This program is designed to help people like you increase your personal value in the Bitcoin community. No guarantee that you would be accepted. Apply here: https://podconf.xyz/real-plebs/

I've already applied and kindly waiting for your swift reply.

btc/share - it’s gone from ~0.0011 btc/share in 2021 to 0.001697 btc/share today. This is total shares outstanding including dilution from convertible debt. The yield is generated by accessing btc restricted pools of capital via public equity and debt.

What is bitconnect?

for the equity investors your ‘Sats per share’ goes up whenever MSTR issues USD debt to buy more BTC.

$ yield = Dollars per Share 📉

฿ yield = Sats per Share 📈

Saylor is literally saying please value our stock with BTC as your ‘unit of account’

just my educated guess, happy to be corrected by WallStreet gurus 😀

Think about the 'yield' blackrock is now getting on the ETF. They hold and custody the Bitcoin, people pay them a fee to own a chunk of it.

That's one way.

the yield is the friends we made along the way

What do you say to yield?

I wrote an article trying to explain it simply: https://www.verdict.co.uk/microstrategy-bitcoin-accumulation/

NICE ARTICLE!

I PESONALLY CONSIDER EQUITY. SHARES ALSO DEBT, BUT THAT'S JUST ME.

We just have to go through the same shit again on a larger scale, just like 4 or 8 years ago 🤷♂️

means they're buying Bitcoin for you at some rate per year. for some it's worth it, others not