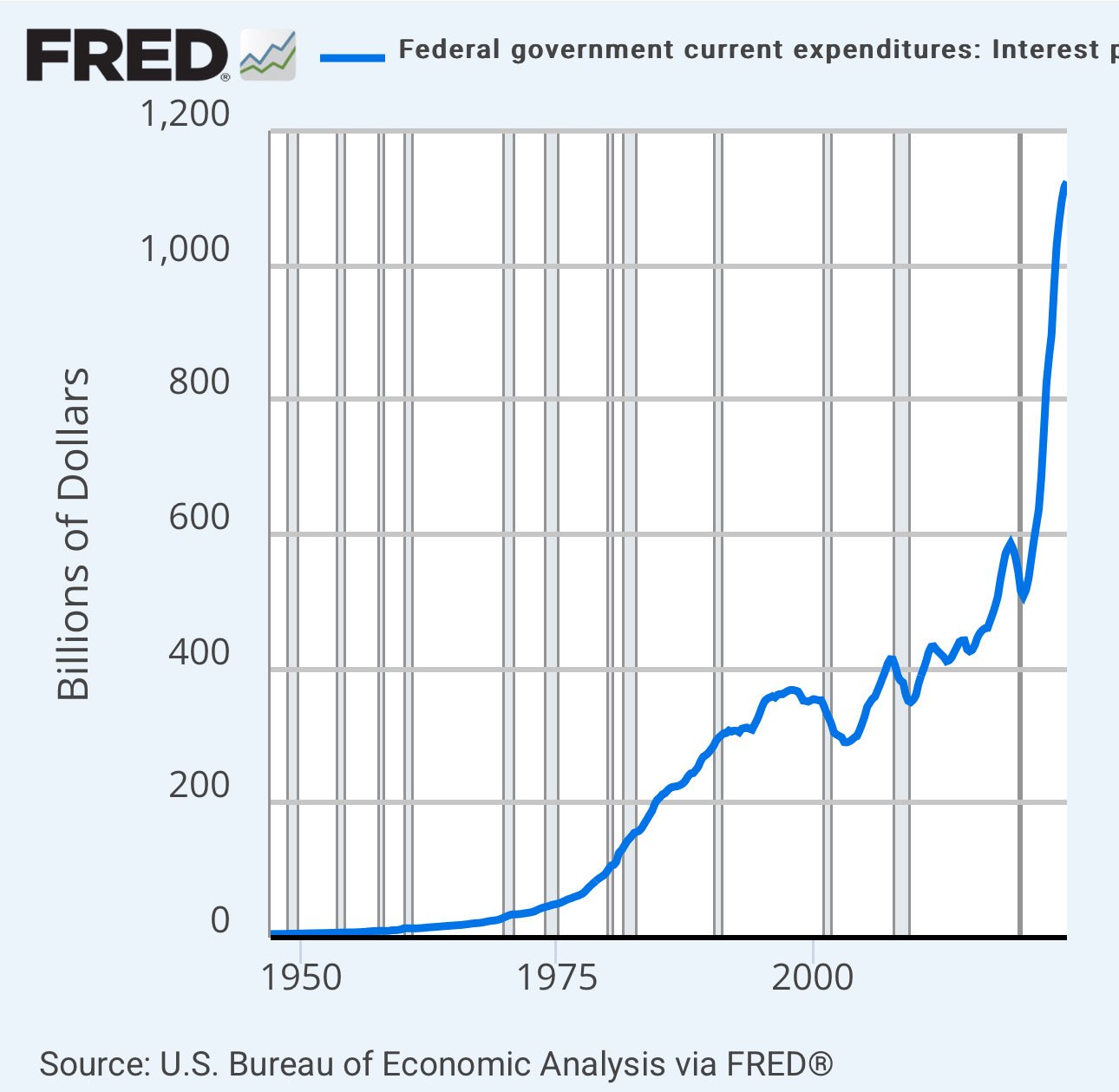

So, the Fed can buy up existing debt, which in itself doesn't increase the debt, but does increase bank reserves, and, most crucially, can serve as a market signal to bring interest rates down, as it shows investors that there's a bid on those treasury securities. This in term can allow the Federal government to roll its existing debt out at longer tenors (the Yellen treasury notoriously issued almost entirely T-bills), as well as at a lower rate of interest, to at least slow the bleeding.

The Fed can't in and of itself fix this, but it does have a roll to play. It'll probably also need a recession to push money out of equities into bonds, and perhaps most interestingly, things to sweeten up sovereign debt, such as the bit bonds we're hearing more and more about being proposed, where bond holders are given exposure to the upside of Bitcoin through a kicker made up of a portion of the bond's revenue going to buy Bitcoin, which gets split between the bond holder and the Treasury itself. The treasury thus recapitalizes (needing to issue less debt to stay afloat), and the bond holder is willing to take a lower nominal fixed rate on the bond as it'll no longer be the only source of upside. Meanwhile Bitcoin catches a steadier and steadier bid itself.

Might want to buy some, just in case it catches on.