Great point. They’ve done economics at university, so I’m hoping they can handle a challenge. At the same time, it might be more powerful to hammer down on the essence of the problem rather than theory…

Both are great books.

If you/they normally read fiction and don't will reject anything overtly Bitcoin, The Mandibles is a great subtle approach.

If the group normally read non-fiction - Broken Money is great. Same with The Bitcoin Standard.

Tangential - but if you're ever looking for Bitcoin Fiction - give us a shot.

Mysteries of the Bitcoin Citadel (Audio Drama)

Bitcoin. Secrets. Betrayal.

I’ll check it out!

What is the best book to orange pill someone?

My friends and I do a yearly reading challenge where each nominates a book and we have to read them all by the end of the year.

This year, I want to nominate a book that teaches about the monetary system and about #bitcoin. I am not allowed to nominate a book I have already read, so I am currently torn between nostr:nprofile1qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncpzfmhxue69uhhqatjwpkx2urpvuhx2ucpz4mhxue69uhhyetvv9uju6mpd4czuumfw3jsswxj5g's Broken Money and The Mandibles.

My friends are smart, interested, and open to impressions, but have not gotten around to do the deep dive on the fiat system. Which should I nominate?

#bookstr #asknostr #AskNostr

Will check them out - thanks! 🙌

What are some good resources to learn about running a personal server?

- Full node

- Lightning node

- (cashu mint)

- (nostr relay)

- Email server

- Cloud services & storage

- (websites)

- Other freedom tech

Is there a comprehensive, easy-to-follow guide to digital sovereignty out there?

I am technically inclined, but a beginner.

#AskNostr #asknostr

This is awesome! Very excited for this project. Will we be able to test it out at some point?

That’s a good point, thanks! I guess since prices are set at the margin, fresh supply might be a very significant part of the traded volume on a given day.

I might be a little slow here, but why does this mean that the production cost can serve as a floor for price?

But adjusted so that the fresh supply remains constant, right? 3.125 every 10 minutes on average?

I don’t quite understand this relationship. When gold miners halt production, no gold is mined. But with Bitcoin, isn’t a new block mined every ~10 minutes regardless of the amount of active miners? I.e., isn’t production relatively constant?

I'd never thought of this before, but what would happen if all civilian vessels in the Mediterranean sailed for Gaza with supplies, in your opinion? Surely Israel couldn't get away with bombing/boarding them all? Wouldn't that have to get food to the Gazans?

Or even let the content creator set the rules and prices for comments?

I'm having the exact same problem...

Still nothing, I'm afraid... I'm very far from an expert here, but could it have to do with the relays we're using?

I'm just getting "unknown user" whenever O try to add someone. But I'm eager to test it out. Send me a test message if interested: npub1f4psynj6w2etm55rykhkn8l6aw9ashhkc4cvtmy3fgtuayyujutqa35k0a

Side note on diversity:

Diversity of thought breeds better ideas. When ideas are challenged from all angles, they are improved upon.

If one seeks to build a well-functioning society with people from diverse backgrounds, then diversity of origin might very well be the source of the diversity of thought required to succeed.

Whether you want to build such a society or not is another question altogether. There is much to be said for a relatively homogeneous population, in terms of ease of governance at least.

Diversity of thought is always good.

And some of the most multicultural cities in the world are amazing. There is something beautiful about the places where everyone truly is created equal.

There is an argument to be made that "being forcibly shoved together with outsiders who hate them" is not what is going on here, even if it can feel that way.

First of all, most immigrants are simply looking for a better life without hating anyone. Problems arise since culture clash makes assimilation difficult. Managing this is up to each country sovereignly responsible for its own border policy. It is also a very human reaction to begin to resent those who treat you poorly, so if immigrants aren't treated well, hate will grow.

Second of all, being too one-sided (ie. "outsiders should not be forced upon us") risks missing an important part, namely why people want to emigrate in the first place. Colonial history is often brought up, but just look at what is going on today. Constant meddling in foreign countries' politics, sponsoring coups, forever wars, destabilising regions, as well as nostr:nprofile1qqs9336p4f3sctdrtft2wlqaq5upjz9azpgylhfd3dplwf005mfrr9spzamhxue69uhkummnw3ezuendwsh8w6t69e3xj7spz3mhxue69uhkummnw3ezummcw3ezuer9wct4lwjj's work on the IMF/World Bank... If countries with predominantly ethnically White European populations want to stop the inflow of immigrants, the first and most obvious action should be to stop causing chaos at the source of immigration. Of course, as is so often the case, there is a profit motive here that might hinder such action.

Blaming the desperate people who, through no fault of their own, seek to escape tragedy is a slippery slope. The West should take a look in the mirror and help the rest of the world prosper. A prosperous Africa, Latam, Middle East etc. is a benefit to The West. 8bn people in service of 8bn people. No-one leaves their country in favour of one where they do not feel welcome unless they feel forced to.

nostr:nprofile1qqsg86qcm7lve6jkkr64z4mt8lfe57jsu8vpty6r2qpk37sgtnxevjcpz4mhxue69uhkummnw3ex2mrfw3jhxtn0wfnsz9rhwden5te0wfjkccte9ehx7um5wghxyecpr3mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmqug4hxr often talks about how the idea of growing out of debt is not realistic. The idea is that as technology improves and productivity grows exponentially, prices will fall, and the real value of the debt will grow, making it harder in real terms to repay.

This makes sense for private debt, but wouldn't this kind of growth solve sovereign debt problems?

If the Fed/CB aims at 2% inflation, this will in time require an ever increasing expansion of the money supply, and if that money enters the system by buying treasuries, then eventually the Fed/CB should end up owning all the debt, at which point the debt crisis is essentially "averted". (Of course, while Cantilloning the benefits of technology away from the many and towards the few...)

Am I missing something here? Any macro #nostriches on here got some thoughts? nostr:nprofile1qqsr8djpqa2nr8cm8zuuxly3gfgujk58wmaweh3ke58uvdwr2kc88fgpzpmhxue69uhkummnw3ezumt0d5hsqmlaf0 nostr:nprofile1qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncpz4mhxue69uhhyetvv9uju6mpd4czuumfw3jsz9nhwden5te0wfjkccte9ec8y6tdv9kzumn9wsq3yamnwvaz7tmsw4e8qmr9wpskwtn9wvql3tqm nostr:nprofile1qqsvf646uxlreajhhsv9tms9u6w7nuzeedaqty38z69cpwyhv89ufcqpzamhxue69uhhyetvv9ujucm4wfex2mn59en8j6gpzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqg5waehxw309aex2mrp0yhxgctdw4eju6t0t25cfd

Definitely agree with the calling other opinions into question thing. I try to use that to check myself whenever I'm listening to someone I think initially has a lot of good points.

There are a couple of topics where it for me shines through if people on the right politically will actually reflect deeply to find the "correct" answer, or whether they're willing to regurgitate every talking point of the right.

Likewise when people on the left know all the genuinely good arguments, but also subscribe to every single point of craziness from the woke left.

I'm always disappointed when good speakers turn out not to be good thinkers...

I disagree with nostr:nprofile1qqs0su5c53vjkxfutrt8jkpuhlxwv4n5xmkjgu85vmth6s82s0u9jkcpzfmhxue69uhkvmm89ejx2eredchxjmcppemhxue69uhkummnw3ezuct5ythzx2... He is a seemingly nice guy who has identified the same problem as bitcoiners, namely how the system (the monetary system, though he might say the financial system) is designed to steal value from the middle and lower classes to the benefit of the financial/capital classes.

He only really differs in that he hasn't gone far enough down the monetary rabbit hole as to realise how much of a problem our money is. So from his perspective, the system, or root cause, cannot be solved, so his solution treats the symptoms, not the problem itself (high wealth taxes to counteract the unjust effects of the system).

I know bitcoiners aren't the biggest fans of taxes, to say the least, but if you see what's happening without seeing the deeper cause, I think it is a logical solution (though one might argue authoritarian).

As to "bitcoin going to zero", I wouldn't spend too much time on it. He clearly hasn't understood it. And bitcoin does seem like a pyramid scheme before you realise it checks all the boxes to be a legitimate money.

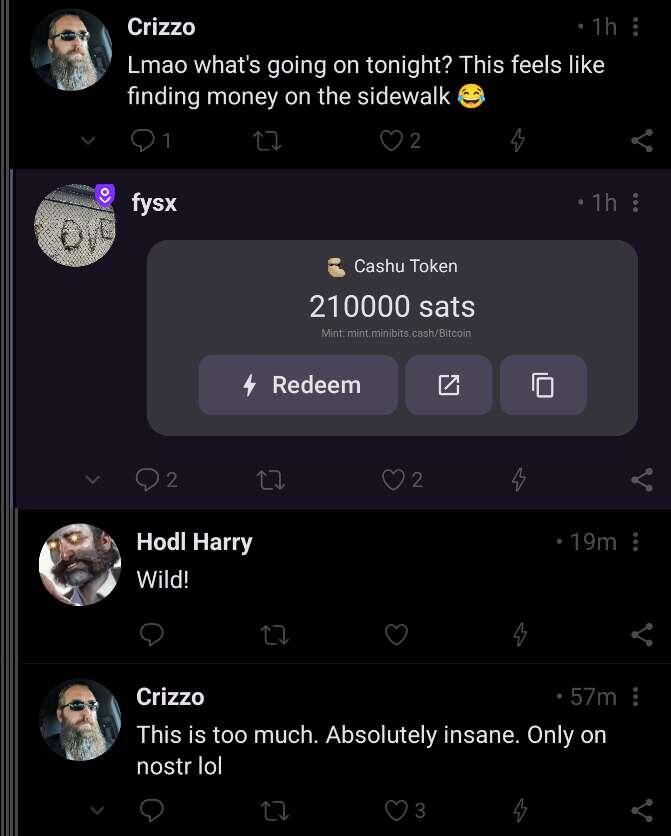

How do you make it show up as a redeemable Cashu token in nostr like that rather than the full token string I'm seeing?

"Price stability" translates this from the monetary pie to the economical pie of goods and services.

If a central bank achieves its goal of price stability - 2% CPI inflation - and we assume the inflation is weighed up for by a mix of stocks, bonds and interest on deposits, one's slice of the pie, or goods and services that can be afforded, stays the same.

This seems like a good thing, both to the central bankers and majority of the population, since we are used to inflation as a naturally occurring phenomenon. In fact, most people (and perhaps even many central bankers) believe that the central bank in this case has done a great job.

There are two main problems. Although people might not notice the pie growing in size (productivity gains) when looking at their own, unchanging slice. But they will notice that the contents of the pie changes. All necessities in their slice are slowly replaced by cheap consumer goods (the CPI does not include houses etc., and cheaper electronics and plastics will make up for more expensive food) - all the while the slice stays the same price on paper.

The second problem is that the ever-growing part of the pie ends up somewhere (ie. those closest to the money creation). This is the most dangerous, as when inequality gets out of hand, societal unrest risks getting out of hand as well.

The slice of the bitcoin pie remains constant as a proportion of both the bitcoin pie and the economical pie of goods and services. In nominal terms, while the slice of the bitcoin pie remains constant just like in the fiat pie, it translates to slice of the economical pie of goods and services that grows in proportion to the pie itself.

I love the pie analogy!

I'd say the monetary premium tending to zero (rather than the money itself) is more likely. Gold price would in that case go to its utility value. Debt tokens would perhaps be repriced in the winning money to some extent? Imo if there's a chance the monetary premium of gold disappears, it'll happen far from now. Most likely some of the monetary market cap should still be captured by other monies than the main winner.