This isn't true. The yield figure excludes routing revenue we earn from block products, it's all external.

Discussion

surprising, can you share more info?

All our channels and feerates are public, anyone can see where we allocate liquidity and how much we charge for routing. This alone is extreme transparency. Unfortunately I'm not sure what else I can share.

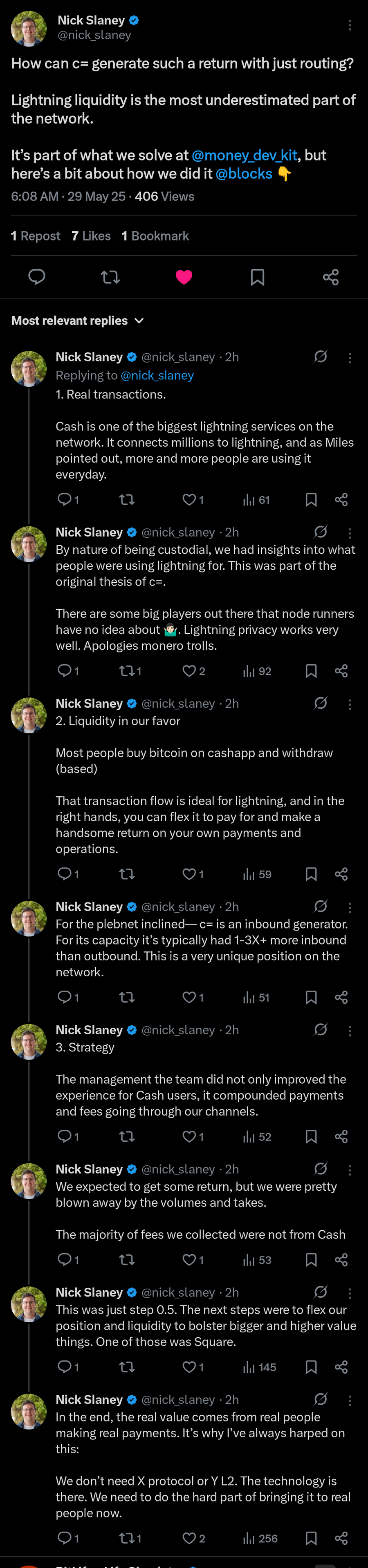

The screenshot nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcprpmhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0qqsrjxqeute0zwusetrjp9qeadt5aa7q686wsxr8lsjvg73uuh52yjq7qs24c shared from nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpq8psflzah8gjq54t4zyjhezghzg9pvpjhm894f4yex9wpl79t3uxq8jms6l goes into more detail than I can. nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpq8psflzah8gjq54t4zyjhezghzg9pvpjhm894f4yex9wpl79t3uxq8jms6l founded c=.

It's pretty obvious what is driving the success of the c= node just by looking at the channel open/close history. Without the CashApp nodes feeding c= there is unlikely to be any routing at all since the fee structure does not support it at all. Only by carefully selecting peers to open channel to with the CashApp funds you are able to create a very well run "routing" machine.

You guys are obviously doing this very well but again, it's not possible without the unique position you are in with the CashApp nodes backing it up.

I also kinda agree therefor that it's a bit misleading to say the 10% APR is earned from routing while it's just clearly not. Pure routing is something very different than what your are doing. What you are doing is what I would personally call LN liquidity trading.

Liquidity trading is what many nodes do but for the rest of us the economics are very different because we actually have to pay to get the liquidity to where we need it.

The APR comes from payments that aren’t from c= / Block. I don’t know how you don’t call that routing. Those are other nodes using that liquidity and paying for the privilege. You can copy c=‘s strategy if you’d like.

You are correct there is more value in running a business that assists or directly does lighting payments over running a “pure router.” There’s room for the latter but it can be tight.

The only mechanism to earn on LN is from routing fees, so yes, you are technically correct. All earnings from LN fall under that umbrella.

What I'm talking about is what the driving force is behind your capacity to route. And that is very obviously the countless CashApp channels c= receives every day, which causes the inbound to be increased and then used as a pressure mechanism to enable the routing. The APR might not come directly from Block, but the liquidity to make it all work is.

It's the same as me setting up a separate node that I constantly feed with liquidity and then say I made a huge APR on that node because it routed a bunch.

But you may choose to call it APR from routing, and that's fine. I personally think c= categorically works in such a different way compared to any other node that something like APR does not really have meaning anymore and it becomes inappropriate.

I put it here for you Matt nostr:note102ncta6etyyj3wedanhcvqjqqledcashfk2p8wa2lu5muvrjestqg96yxv

Tyler was the goated data scientist running the management on the node. There are only a few people who “get it” like him.

thanks nick, does this not imply that transactions to and from cashapp users are included in the published numbers?

is it fair to say it is unreasonable to extrapolate these numbers to other routing nodes?

Tyler was likely the one that pulled that data. This was all outside of Cash transactions.

Theres still a lot to be made out there if you know where to put your liquidity, but that edge fades over time (as word gets out that we were doing well!)

The most will be made by being a real economic actor on the network. But there are still plenty of places that need liquidity and that is a constantly growing and changing need.

>is it fair to say it is unreasonable to extrapolate these numbers to other routing nodes?

absolutely. c= has a few advantages but the main one is our proximity to a service that facilitates real payments from real people over lightning. this proximity creates the liquidity dynamic that let us earn routing fees from the public network (where cash app is neither the upstream nor downstream channel partner).

makes sense, appreciate you