Been dealt with before but....

1. forecast on what an economy would look like without a growing money supply, as food-for-thought to those that can not see past the current inflated-fiat system.

2. value of risk reward via 'profit sharing' when investing / writing business loans versus risk reward via 'interest'

3. validity of Michael Hudson's historical justification for Jubilee / loan forgiveness to the small cap players. Hudson's idea has legs, I simply would like to hear a second opinion on it. At a micro level, many say humans should not be judged by their worst offence, but by how high they bounce back from their worst offence. Can such forgiveness at a personal level apply to an entire level of society?

4. How can money be useful for helping society choose wiser goals...

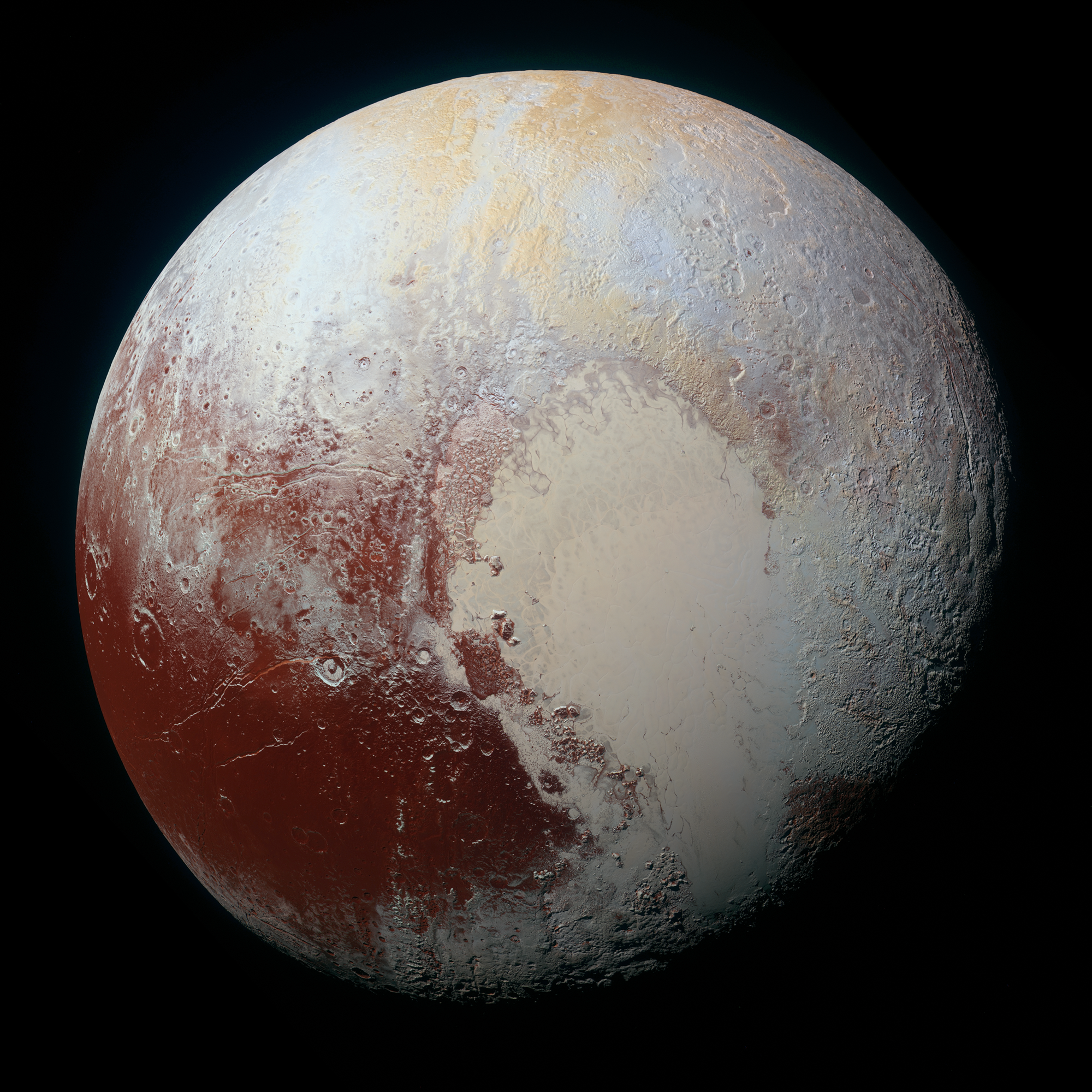

Paul Watson -of Sea Shepard- calls the current financial system 'economics of extinction'. The current system is not working well for many species: we can call that simply human-induced evolution and walk away. I understand how living systems inevitably trend in repeated trends and cycles. I understand how (seemingly inevitably) 99% of all species have gone extinct. And I understand how money based on energy incentivizes energy efficiency. But is there a way to change money and/or the current economic system to better prioritize goals of :

a. courage to tolerate differences

b. wisdom (to predict the future more accurately)

c. learning not earning

d. mastery not salary

e. relief from command (as demotion not exclusion) for those deemed by 360 judgment to be out of step with larger goals of the group.

I am not sure at 8+ billion population, that largely libertarian principals are viable, but I am open to be proven wrong.