This is a great book

https://onlinebooks.library.upenn.edu/webbin/book/lookupid?key=olbp26964

It would be far more entertaining if office cleaners accidentally cleaned out the hardware wallet and seed phrase recovery and the resulting garbage was shipped overseas to the Philippines.

I am building another python implementation. Much of the code originally comes from cashu but I had to modify extensively for my requirements.

not yet ready for testing. here is the repo

We might loose 60% of our right-leaning user base, but we will display pronouns for users that add them to their profile. We are here to serve users and if users want, even if it is a minority right now, they will have it.

https://github.com/vitorpamplona/amethyst/commit/4a80a16473f6a0357a367e40836089c16ff463f3

Just add it. It’s a stupid fight.

I know a lot of people dunk on Modern Monetary Theory (#MMT), but it’s actually quite good and illuminating (as opposed to its application).

The theory came about in the early 90s when Warren Mosler was trying to understand central bank monetary operations, during a time when fully fiat currencies were still relatively new (since 1971). He discovered that no one really understood what was going on, much less the implications.

Mosler was looking to purchase Italian government bonds that had a higher interest rate yield than what the Italian loan rate was (pre-Euro, lira). It was about a 2% spread, reflecting the fear that the Italian Government would default on its bonds. So he decided to pay a visit to discuss the issue with the Italian Treasury Secretary. He asked the question of the Secretary, what if you can’t pay for the bonds? He Treasurer said, ‘we just credit the account, that’s it’. They both realized that if you issue your own currency, there is zero risk of default, because you just issue more. So the market, fearing a default put a 2% risk premium on the bonds. Mosler borrowed what he could from the banks, bought all the bonds, and made 100s of millions over the years on the 2% risk premium that was no risk at all.

The moral of the story - if you are a currency issuer (like the US) you have lots of power and are immune to certain risks. It’s not unlimited though, I’ll explain that in a subsequent post.

#MMT

Since #nostr #safebox is coming along nicely, I am thinking about what the requirements would be for a corresponding #safeboxrelay.

I have stood up my own strfry instance for testing. It is working really well, and I test random relays using nostr.watch

So far, I haven’t identified any new functional requirements. I hope not, because I want #safebox to work with any standard relay.

Where there might be a difference in requirements from a regular relay, are non-functional, or service requirements, mostly related to availability and, of course, anonymity. Every #safebox has its own nostr identity, and though it is possible, I highly discourage anyone to create a #safebox using their nsec.

There is one requirement I keeping thinking about. Adding quantum-resistant encryption. If records are being stored for any duration, they risk being hoovered up by someone that has state-level patience and may be willing to wait twenty years before cracking the data. An outside possibility, but I would like to address this sooner than later.

In the end, I see #safeboxrelay as a service, where you alone control the data to safekeep your funds and private data, you can replicate at will, and no one can get your data.

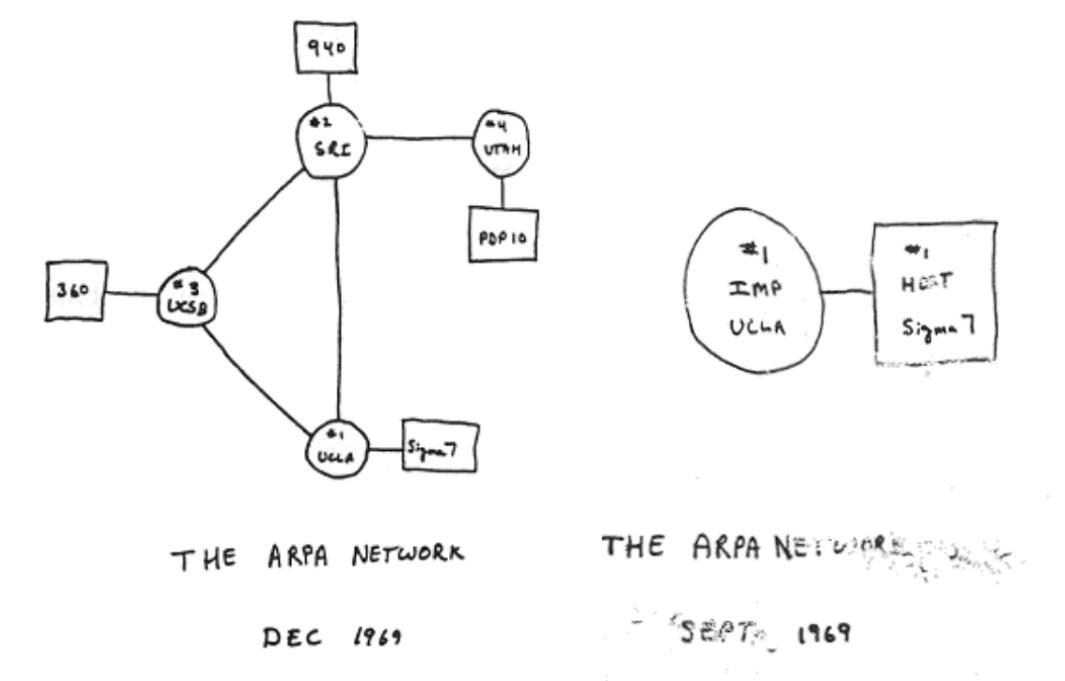

Early days of ecash micropayment networks.

I would really recommend nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg implement nip17 for messages, we really need to deprecate nip04

will save all other feedback for later 😄

Yup. I second this. This should be a top priority. nostr:npub16c0nh3dnadzqpm76uctf5hqhe2lny344zsmpm6feee9p5rdxaa9q586nvr

Just imagine a micropayment system that routes around everything…

Seeing the ultimate free digital reality where no app can restrict your zaps.

I’m also seeing some worrying stuff, like: ‘your personhood to government can be easily proven by your bank because you have an account with them’

Really interesting to see the lawyers hit the fintech conference circuit talking about custodial systems as ‘emerging technology’.

Real apps FTW. nostr:note1h9z3ge833k3ap76mwduxy96jqv496q94sd0cfsx5h4mc4kkvs4zslput5u

Yep, it could be done with a Chaumian-based ticket mint. Every issued ticked could have its own derived public/private key and the mint could take care of the swapping when it gets traded on the secondary market, and redeeming when it gets used.

It could be done easily- I’ve already hacked a version of the mint to derive a public key for an arbitrary amount. - could be easily extended to any identified thing (ticket). An organizer of an event would have a secret, and a set of uniquely defined tickets - these would be combined to generate a private key to issue the ticket, the corresponding public key would validate the ticket signature for swaps and redemptions (manage double spends). The mint would manage all the swaps and redemptions exactly like it does now with ecash.

Lots of fake resellers too. Every day a story about a bunch of Swifties bilked out of thousands of dollars.

The major ticket platforms have these markets locked up - not serving the artists and fans anymore. I think there could be a solution with #nostr. I don’t know this space well enough.

This is what the internet was designed for folks.

This is what #nostr is designed for, too! nostr:note1cy3gtyxjmmd8cwxl26q9rzyc3gn9qxde8a8csmjsy43gqag6tlwq086xqy

Hmmm…, I never thought of it that way - gas prices as a public sentiment control mechanism. If you need the public to double down during a crisis, raise the gas prices; you want them to experience relief, lower them. If the public is disagreeing with what you are doing, lower them further.

The bitcoin technology inversion event:

1 pizza for 10,000 bitcoin -> 10,000 pizzas for 1 Bitcoin

Similar to what happened to the internet:

Internet over the phone lines -> Phone lines over the internet nostr:note1p3664vq9f4aude3rgj5fn9thf26apqz3tuemmzytfvrt9eekveqqv7n6kp

Don’t pay by app.

Pay by zap! nostr:note1jsz4xvl69gn42am97g9g47tp7zfshyhep8d9jc8q6fnv0yt36uyqfn4rre