Apparently, our inflation is back down to 2%. But now coffee tins are the height of tuna cans and cereal boxes have the width of credit cards.

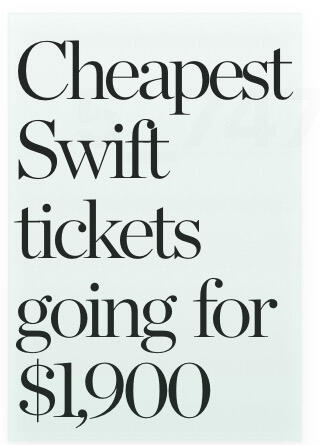

So you’re not buying Taylor Swift tickets?

People can’t afford food and rent in Toronto. Meanwhile, this.

That’s ‘management’

The two things that are the root of what matters in this ‘new economy’

1. Making of real things.

2. Management of real money (bitcoin).

Act accordingly.

BlueSky has the cool idea of Starter Packs. A user publishes a list of followers that they recommend to newcomers.

Any instructions on how to do admin on #ditto nostr:nprofile1qqsqgc0uhmxycvm5gwvn944c7yfxnnxm0nyh8tt62zhrvtd3xkj8fhgprdmhxue69uhkwmr9v9ek7mnpw3hhytnyv4mz7un9d3shjqgcwaehxw309ahx7umywf5hvefwv9c8qtmjv4kxz7gpzemhxue69uhhyetvv9ujumt0wd68ytnsw43z7s3al0v?

I've got everything set up and made my account admin as per instructions. But I can't seem to find anything on how to admin names etc.

Any help appreciated!

Yup. I run the zaps through different providers, relaysz mints and custodial systems before running it through #safebox. I was sweating bullets the first few times, but now it is becoming routine.

Zap test, please stand by...

Accepting #Bitcoin Ottawa Event*

Tues, Nov. 26th - 7pm at Sole Freedom in Ottawa.

Support a local business that accepts #btc while discussing the links between Bitcoin and health.

Refreshments will be provided.

https://www.meetup.com/ottawa-bitcoin-group/events/304389908

FWIW I went deep on central banking, monetary operations and modern monetary theory a few years back. I read most of the works by George Selgin and Larry White, plus recently, nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a ‘s most excellent book ‘Broken Money’.

I am using ChatGPT to refresh my learnings and sharing the good stuff.

How a Bank Loan Create More Money

A bank loan puts more money into the financial system by creating new money through the process of credit creation. Here’s how it works:

1. The Loan is Issued

When a bank approves a loan, it does not pull existing money from its reserves or from customer deposits to lend to the borrower. Instead, the bank creates a new deposit in the borrower’s account equal to the loan amount. This deposit is considered money, as the borrower can use it for spending, investing, or other purposes.

2. Money Supply Increases

The newly created deposit adds to the total money supply in the economy. While the bank records the loan as an asset (the borrower’s promise to repay), the deposit is a liability (the money the bank owes to the borrower). From the borrower’s perspective, the money is real and can be spent immediately.

3. Multiplier Effect

When the borrower spends the loan—for example, to buy a car or start a business—the recipient of that payment deposits the money into their own bank account, often at a different bank. This triggers a cycle:

• Banks keep only a fraction of deposits as reserves (as required by regulations or policy) and lend out the rest.

• Each round of lending creates more deposits, further increasing the money supply.

This process is referred to as the money multiplier effect, although in practice, the ability of banks to lend is often influenced more by credit demand and regulatory requirements than by reserves alone.

4. Debt and Money Coexist

The key insight is that when a loan is made, both the loan (a liability for the borrower) and the deposit (new money) are created simultaneously. The borrower’s repayments gradually destroy this money as they reduce the loan balance, but until the loan is repaid, the created money circulates in the economy.

5. The Role of Central Banks

Central banks indirectly regulate this process by setting reserve requirements, interest rates, and other monetary policies. These factors influence how much money commercial banks are willing and able to create through lending.

Example:

If a bank lends $100,000 to a business, it creates a $100,000 deposit in the business’s account. The business uses the funds to pay for equipment, wages, or supplies, injecting the new money into the economy. Even though the borrower owes the bank $100,000 plus interest, the money now exists in the financial system, facilitating economic activity.

This mechanism—credit creation by banks—is why banks are often described as “money creators” rather than just intermediaries of existing funds.

Very cool - I need to implement this asap for #nostr #safebox nostr:note13cjllqhhv9t2dyn8czxs85djfky6q65qmypsmftcee4cvrur70gqagnt4e

Pay by Zap > Pay by App nostr:note1k6pu3zudzlrhg9apk69xxvxnqrqpcpvnk0lgl2f2kqxptdwgj3cqmn2rcx

The Origin of Modern Monetary Theory: Warren Mosler’s Insight at the Italian Treasury

In the late 1990s, Warren Mosler, a former Wall Street financier turned economic thinker, found himself in Italy, engaging with officials at the Italian Treasury. Mosler was on a mission to understand the intricate workings of sovereign finances and public debt. At the time, Italy was managing significant public borrowing, and questions about its debt sustainability loomed large as the country prepared for European monetary integration.

During a meeting with high-ranking officials, Mosler posed a simple yet radical question:

“What happens if the Italian government fails to issue sufficient bonds to cover its deficit?”

The response startled him. Without hesitation, the officials explained that if the government didn’t issue enough bonds, the Bank of Italy would simply credit the necessary funds into the Treasury’s account. For Mosler, this casual admission flipped conventional economic wisdom on its head. It revealed a critical truth: a government that issues its own currency does not rely on taxes or borrowing to fund its spending. Instead, it creates money through its central bank, constrained only by inflation and resource availability—not by arbitrary budget limits.

This epiphany became the cornerstone of what would later be called Modern Monetary Theory (MMT). Mosler realized that sovereign currencies like the Italian lira—or the US dollar—operate fundamentally differently from household or business budgets. Governments do not “run out” of their own currency; they issue it. Taxes and bond issuance, Mosler argued, serve purposes other than “funding” the state: they manage inflation, influence demand, and provide a stable store of wealth.

Returning to the United States, Mosler began to share his insights with a growing network of academics and policymakers. Economists such as Stephanie Kelton, Randall Wray, and Bill Mitchell built upon his observations, developing a coherent framework that challenged the austerity-driven orthodoxies of the time. MMT emerged as a bold alternative, emphasizing the potential for full employment and public investment without the fear of fiscal insolvency.

Mosler’s conversation at the Italian Treasury became a pivotal moment in economic thought. It underscored the need to rethink fundamental assumptions about money, debt, and government spending—a legacy that continues to shape debates about fiscal policy worldwide.

The "Crown" has evolved to an abstract concept in Canada, which I kinda like. Hopefully we can dispense with "His Majesty" but that will take time. The "Crown" is really Canada's validation node - really tough to change by the government of the day.

Gm,

Merging pronouns into our protocol spec as a joke is demonstrating that maybe we aren't serious people

Perhaps next we should add a field for number of abortions or favorite bible passages?

Keep politics and ideology out of the protocol spec, anyone is free to add any field to their bios already, it was designed like this on purpose

I'm gonna open a PR to remove this today, we should have a proper discussion about it on GitHub without nostr:nprofile1qqs8d3c64cayj8canmky0jap0c3fekjpzwsthdhx4cthd4my8c5u47spzfmhxue69uhhqatjwpkx2urpvuhx2ucpz3mhxue69uhhyetvv9ujuerpd46hxtnfduq3vamnwvaz7tmjv4kxz7fwdehhxtnnda3kjctvll3q2p yolo merging things unilaterally

More serious people will likely fork the protocol repo, place it under a different governance, build serious solutions and render this community entirely moot. That’s the consequence.

Yep. It’s Internet Protocol (IP), but for money.

Really interesting… I tried to connect with someone on LinkedIn to message them but I couldn’t unless I upgraded to Premium. Tried numerous time. I finally figured out why - they are associated with an industry that LinkedIn must not like.