I still find myself regularly thinking "Whooooaaah!" in appreciation of the concept of digital scarcity.

#gamestr

Now that I think about it a bit more, this is a really important point

Yeah, I hear you. The price is just information

I've come to associate the concept of price controls as a form of subtle moral evil, in that a ruler decrees a value for a good that does not accurately match the real value for that good.

So it has to distort the truth.

I think, in an indirect way, it is lying?

While I think all value is subjective (as a good has different utility for every individual), there is still a kind of market truth.

If money could not be manipulated, then the going price of a thing would accurately reflect its place in a society's hierarchy of value

In my home we call such a delicious but non-photogenic dish "super slop"

So I've never lived through a change of the world's reserve currency before, and I'm thinking it might be downright interesting

#Plebchain

#Bitcoin

I'll look forward to lending you my ear

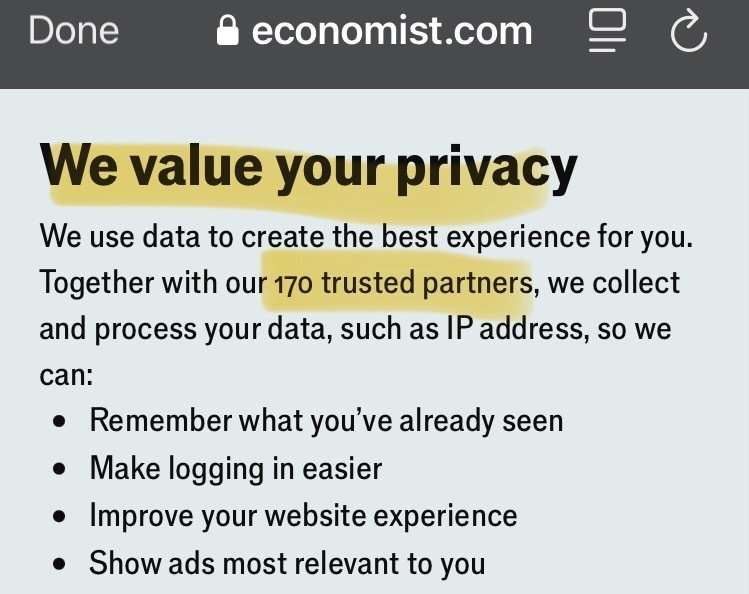

= "We value harvesting value from your 'private' data"

"In retrospect, it seemed silly that we'd been measuring value in variably-defined units. "

Imagine measuring distances with a stretchy, elastic ruler.

#Bitcoin

#Plebchain

Virtue. Now that's one of the aspects about the Bitcoin space that I like. It touches on virtue.

I like the fact that Marty Bent wants to open a brick factory so that people can make buildings that last.

Something I’ve thought about a lot in the past couple of years:

Money is the one good that every single person uses. It’s one half of nearly every trade.

As long as the price of money is set by a centralized entity, a true free market is fundamentally impossible, because every transaction is influenced by price controls.

I literally just had to pull the car over to start writing: while listening nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe describe “lightbulb moments” (in the context of free markets and deflation), a lightbulb — call it a zap — struck me profoundly…

Unlike the fiat system, Bitcoin IS a free market for money. Meaning that in Bitcoin terms, “half the equation” is already resolved into a deflationary free market system. Even with governmental price controls on many products, because of how radically free Bitcoin is, it completely changes the nature of the trade.

What clicked for me was this: Bitcoin exists — it’s already here — meaning that, humans already, here and now, have the choice to operate/participate in a free market, where prices fall forever.

It’s not “when we reach hyperbitcoinization” or “when Bitcoin is legal tender” or “when adoption happens on XYZ level” (although all off those help to can grease the wheels). It’s already here, if you CHOOSE to measure in Bitcoin.

No joke, my mind was blown so fully that I had to pull over so that I could write this stuff down. Now that I did, I realized it belongs on Nostr 🫡

Back to the drive, and to the podcast. Thanks for keeping my wife and I company, nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u and Jeff 🙏🔥

I've listened to this podcast episode 3 times, and often reposted to Jeff's other video interviews I've been surprised at how slow my mind is to grasp the concepts. The first time I listened I had a sense there was something important that I didn't quite grasp. So I resolved to listen again until I got it.

It really is a paradigm shift. And - as Jeff always says - of Bitcoin remains secure and decentralized, the world is going to change.

Yes, it's a good idea. I'd join you there

Cool how #Bitcoin reduces the otherwise present economic friction/drag

It's a money that gives advantage instead of disadvantage

The whole world rotates a few degrees when a new life comes into your arms

An interesting read for two reasons:

1) highlights the small victories won in court against warrantless surveillance, and

2) provides insight into how the IRS tried to implement new enforcements while also claiming they were not quite finished yet and therefore could not be challenged in court

What will happen when an expansive money like $USD gets crammed into a finite money like #Bitcoin

Low time preference.

#Bitcoin

#Plebchain

I might decide to get some just in case it catches on fire

So cool to be living during a time of not only new discoveries, but meaningful and deeply important new discoveries.

(And memes)

There is risk in the banking system:

"The Federal Reserve is a trusted party in all three senses of maker, man-ager, and mediator - it is the monetary trinity.

The Fed makes the dollar.

The Fed manages the funds of other banks.

And the Fed ultimately serves as the central mediator for digital dollar transactions through services like Fed Wire.

In sum, managers offer convenience and peace of mind. Mediators maintain financial plumbing. And makers enable economic stability and exchange through a common medium. Users of modern money trust these parties to do their jobs well. This is a tradeoff and involves risk. As cypher-punk Nick Szabo says, trusted parties are "security holes." Managers sometimes fail, leaving their customers with pennies on the dollar. Mediators sometimes block lawful commerce. Makers also make mistakes. They might print too much money and, as inflation soars, put on the brakes too late. Then they might slam the brakes too hard and, as a recession looms, keep the brakes on for too long. Sometimes makers know which levels they'll pull and, as private citizens, execute a series of, let's say, well-timed trades in the stock market. This is insider trading, not with company stock, but with what company stocks trade against - a national currency.

As a group, these trusted parties can and sometimes do imperil our financial privacy, our funds, our freedom to use them as we'd like, and their value. Some will judge that the benefits of trusted parties outweigh the risk. They might be right. It might also be true that we would benefit from having options without one or more of these trusted parties so that participating in the economy doesn't force us into a single set of tradeoffs."

- Resistance Money

#Bitcoin

#Plebchain

"Prior to bitcoin, DIGITAL seemed incompatible with CASH"

- Resistance Money

#Bitcoin

#Plebchain

To increase #Bitcoin adoption...

....the Bitcoin CEO should have Bitcoin's marketing department try using more squiggles and curly script fonts and a Spirograph and a stampy seal and someone's official serious-looking portrait photo and an official certificate number and an appeal to authority or two or three and some nice marble statue or monument or building with columns that looks classic and historical and a has big "5 FIVE" on it or something that refers to no specific or consistent amount of value in particular.

#Bitcoin

#Plebchain

“Bitcoin was designed to be protected from the influence of charismatic leaders, even if their name is Gavin Andresen, Barack Obama, or Satoshi Nakamoto.”

Excerpt from:

"The Blocksize War: The battle for control over Bitcoin’s protocol rules" by Jonathan Bier

#Bitcoin

#Plebchain

🎈Pumping air into a thin. stretchy, rubber birthday balloon... (= saving in fiat money)

vs.

🛞....pumping air into a steel-belted radial tire ( = saving in sound money)

-------

One will inflate, pop, dissipate, the other will bear a load and take you places

#Bitcoin

#Plebchain

I'd say the money, which is a representation of human time and effort, is in theory owed to any creator or saver of value in the USD system, whose time and energy could have gone to either improving their lot (personal well-being, family wellbeing, community wellbeing) or providing security for an unknown future threat.

But Instead, their money was funneled into malinvestments, wars, and the hands of those who are closest to the printed money supply and produce little but through a sneaky, roundabout way, lay claim to the wealth of others. A mechanism that makes this possible is the inflation of the money supply via debt issuance (and pretending that that debt obligation is actually an asset) which diminishes the purchasing power / work of every USD earner or saver.

So the money is owed to the future wellbeing of those who earned it by creating value.

I wonder: What if all the destruction of wars, for example, had instead been positive cooperation and construction? How might the world we pass on to a next generation be better?

In my opinion that's an example of what has been taken away, and where the true debt lies.

But I'm still trying to figure it all out.