What about fund managers with specific equity and bond mandates? Institutions could buy bitcoin before, although more friendly options (hopefully like SC will be) are a good thing. The bigger question is how does the monetary premium move from equity and bond markets to bitcoin?

I’ll send you a draft. Keen to hear your comments. TL;DR is that whilst there will be lots of froth (and some scams), there needs to be a path created for wealth to get from the equity and bond markets to Bitcoin. The big money cannot just sell and buy Bitcoin in self custody (although some of that will happen too).

I wrote an article on the plane home to try to tease out the nuances…

Picking up on nostr:nprofile1qqsp4lsvwn3aw7zwh2f6tcl6249xa6cpj2x3yuu6azaysvncdqywxmgprpmhxue69uhhyetvv9ujuumwdae8gtnnda3kjctvqyvhwumn8ghj7ur4wfshv6tyvyhxummnw3ezumrpdejq4k23nj ‘s sharp take on BitBonds. They aren’t just the new junk bonds. They’re a confession of where fiat is headed.

The state needs convexity. Bitcoin provides it. BitBonds are the vehicle.

What starts as a workaround becomes a benchmark. Junk bonds did it. Mortgage-backed debt did it. BitBonds will too. if Bitcoin survives the volatility.

But this isn’t just about finance. It’s about nation states survival imo,

The fiat system is drowning in its own promises. Yields are rising. Buyers are disappearing. And BitBonds is a hybrid bond wrapped around Bitcoin. A last-ditch play to roll sovereign debt with digital collateral.

Here’s how it works: governments issue bonds with ultra-low coupons. 90% of the proceeds go to state spending. 10% buys Bitcoin. Investors get fixed income plus a piece of BTC upside. If Bitcoin rallies, it’s a convex windfall. If it collapses, governments still win: borrowing at a discount compared to traditional rates.

The pitch is seductive: “safe” Bitcoin exposure, no custody headaches, all within a regulated wrapper. Ideal for pension funds, family offices, and bureaucrats pretending they understand innovation.

But every financial product with asymmetric payoff begins the same way: hype, leverage, and someone eventually left holding the bag.

We’ve seen this movie: junk bonds in the ’80s, mortgage-backed securities in the 2000s, ESG debt in the 2010s. Each began as a workaround, not a solution. Each ended with a “correction” and survivors who shaped the next cycle.

If pilot programs succeed, BitBonds could hit $2T by 2030. They’ll reshape how governments borrow, how allocators think about #Bitcoin, and how systemic risk hides in plain sight.

#BitBonds are not a financial innovation. They’re a monetary confession. The dollar needs Bitcoin more than Bitcoin needs the dollar.

Watch what they do, not what they say.

nostr:nevent1qqsqepxunrwwvkscxpzpvu3t0c5tw5j6zzmjx8hpv4kpwapja5umylgz9td5e

Yes. Bitbonds are part of the transition to a bitcoin standard.

⚡️🇲🇽 WATCH - Mexico's 3rd richest man just said he's considering putting 100% of his portfolio in #Bitcoin.

https://blossom.primal.net/0cff51f0991da4227d6856ba20941c883a75de479b3498666a2d95f05d4b9f80.mp4

It was even more interesting that he is 80% bitcoin and 20% gold.

Catch nostr:nprofile1qyw8wumn8ghj7mn0wd68yttsw43zuum9d45hxmmv9ejx2a30qythwumn8ghj7un9d3shjtnswf5k6ctv9ehx2ap0qyfhwumn8ghj7ur4wfcxcetsv9njuetn9uq3samnwvaz7tmfwdkxzmny9ehx7um5wgcjucm0d5hsz9thwden5te0wfjkccte9ejxzmt4wvhxjme0qqst5teefqektpr4aytgpwyclxlq78v9q9nvd2pem0sgf5pxdttwyzscqt3ve , Host of the Once Bitten Bitcoin Podcast & Author of Choose Life - Escaping Fiat Hell, as we dive deep into the philosophical aspects of Bitcoin at various Bitcoin Roundtables and discuss:

🔸How To Meet Up Harder

🔸An Orange Pill Best Served

🔸How To Kill Bitcoin

and more!

📍: nostr:nprofile1qqs9a6hqlezphzpvf2j5xsqy6kxyffkadfqr5qd2lr98ad7e9wn9k4cnmyv4e

🗓️: 31st May/1st June, 10AM onwards

🎟️RSVP: https://events.cyphermunkhouse.com/bloomfest

#Bitcoin #Nostr #Community #Meetups #London #LondonMeetups #Plebchain #Culture nostr:nprofile1qyv8wumn8ghj7enfd36x2u3wdehhxarj9emkjmn99uq3zamnwvaz7tmwdaehgu3wwa5kuef0qqsra2ey033mkdwl5w8q0jss9ak69zafh82xsuvhwsaauw3trkq2amgvvanjv nostr:nprofile1qqsyr7599w7z8w6v2xua8z7fvesjt33sjsqrcfpp7ah4r0k44aahwps9qmnyr nostr:nprofile1qqs8znsmjg8h9a3rfuq0ag20dqwgshget4pdf4hwxpjnlx2565pqd6svzqtmd

“Meet up harder” 🤣👍

295 billion teeth 🦷 in the world (approx)

Only 21 million Bitcoin.

Gotta love the FT🙄

cc nostr:npub1lr2zzf989mvf393y0tv39ara6a4vddkd6y87z784up9vl6ks6j3qtudl6a

Yes, but you haven’t done the maths properly. She has only 32 teeth (approx) and she finds them very useful. So that works out to be at least 656,250 bitcoins per tooth! Or 0.0000015238095 of a tooth per bitcoin! Maybe she could tokenise her teeth?

Spot on! The answer is easy: everyone should go all in and spend bitcoin to kick start the circular economy.

A minor transitional tweak could be to only spend fiat on a credit card so that you are consistently negative fiat…

⚡️🇬🇧 NEW - Britain could face blackouts because of net zero.

https://blossom.primal.net/8f876c52337ea1565d064a10fe7373bbf3cadc07e28e62116a666f50eb65a829.mp4

So predictable. Sigh….

We desperately need some Bitcoin miners plugged in!

How do we know that they didn’t?

Presumably you mean Yorkshire playing Essex on the second day of their County Championship match? Can Yorkshire get a first innings lead? Looks like a good day for batting though.

Scott Forte makes a good point about the Libertarian Party in New Hampshire. If you’re running for office, it’s wise to stay within the Overton Window and remember that anything you say can be used against you by your opponent. Once you’re in office, that’s when you can begin gradually shifting the window in a better direction. I think that’s a good strategy.

https://fountain.fm/show/xudG4tsYH5TimGLfAmqn

nostr:nevent1qvzqqqpxquqzqvpz5w32ap7k64tyl9xztju295f6ehs5jze5k9azfnl30m97z3s55j2n2h

Welcome to Nostr Peter! I tried to zap you…

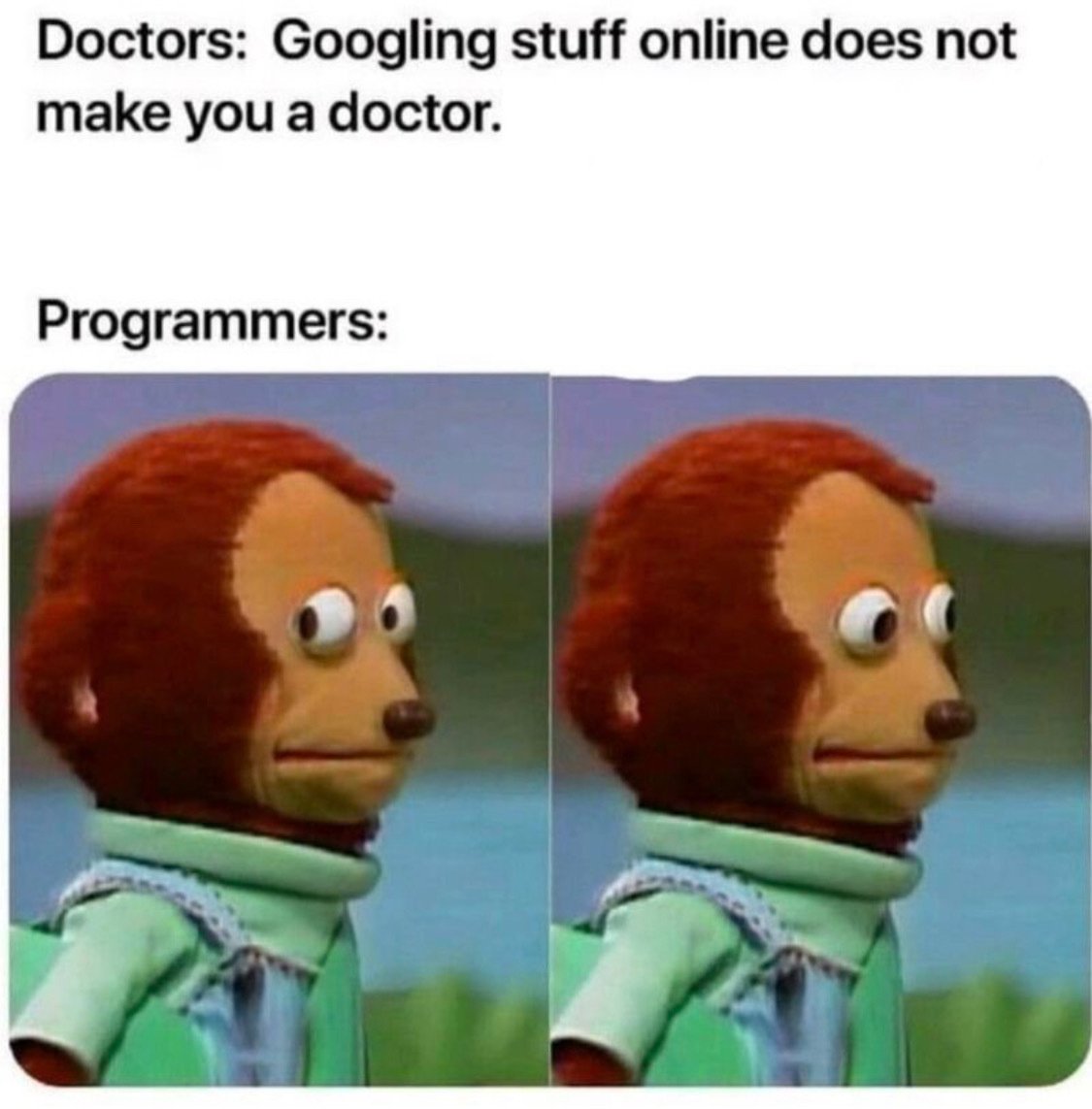

This is the funny because in the UK doctors literally google stuff online in front of you! Good thing that the internet always knows the correct answer!

When each person’s bitcoin balance is large enough they will naturally start to spend it. Adoption takes time.

Confusingly, arguably bitcoin is a “commodity money” if we extend Mises’ definition for a pure monetary asset. It’s not credit or fiat.

Ah, I see. You could change to football then. Cricket is a low time preference sport.

Hey! What’s wrong with cricket?

I hope they gave credit for the idea to Andrew Hohns at Battery Finance.

Any way of buying Sun Armor in the UK without huge shipping costs?

Many people ask why.

The short answer is because nothing stops this train.

The longer answer is that 1) the rest of the world isn’t buying as many Treasuries anymore, 2) investors prefer cash to Treasuries, and 3) there are now balance of payments issues and so the United Stated has EM-like characteristics where stocks and bonds can struggle together due to capital outflows.

nostr:nevent1qqsyalrlpf2zggf7dqm3x42w9zw7u5nhv6jgxfyuclcr4mt3en0275qurnxr0

EM with US characteristics