**Where The Most Death Penalties Are Carried Out**

Where The Most Death Penalties Are Carried Out

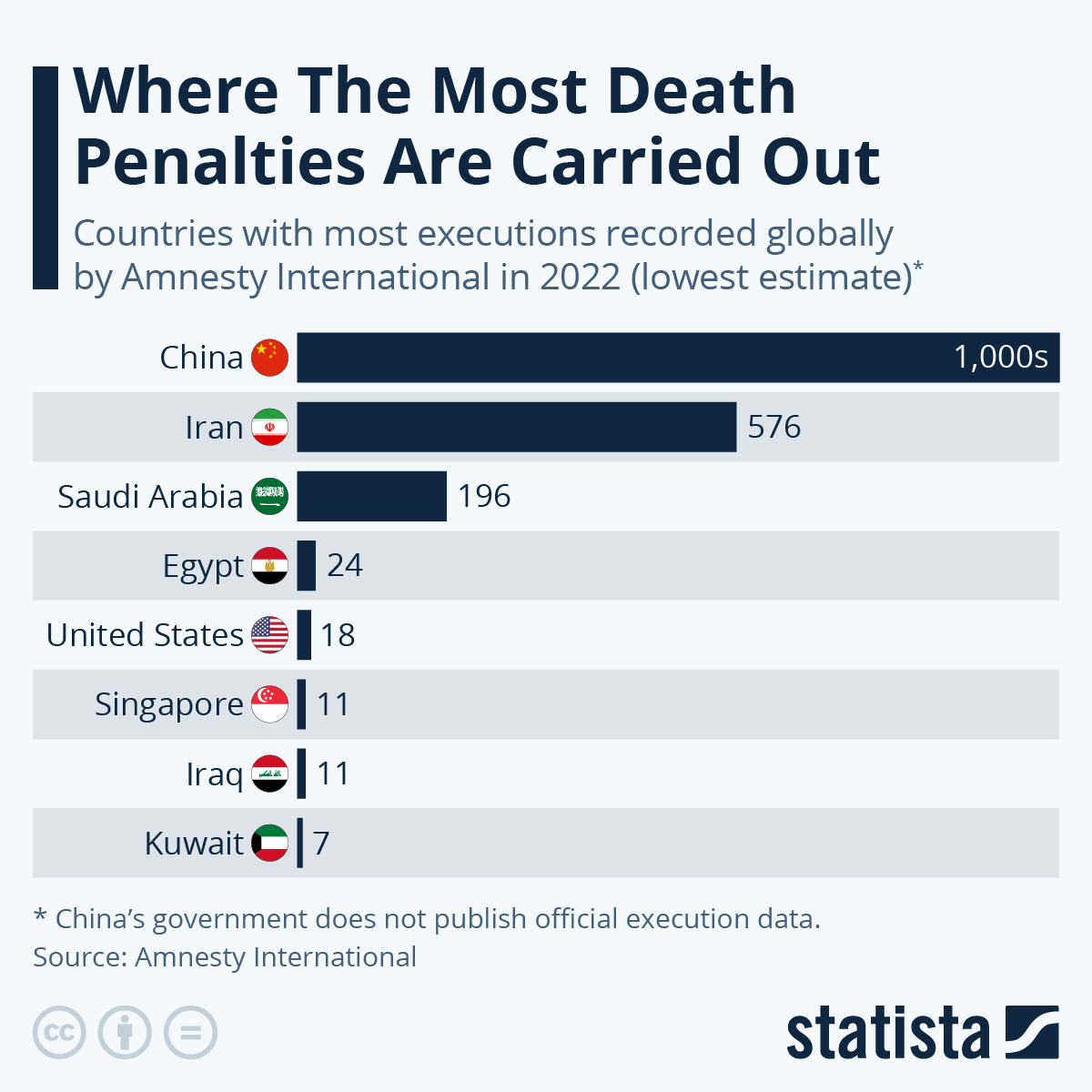

**At least 883 people are known to have been put to death last year,** according to Amnesty International’s annual review (https://www.amnesty.org/en/latest/news/2023/05/death-penalty-2022-executions-skyrocket/) of the death penalty. However, as Statista's Anna Fleck reports, (https://www.statista.com/chart/8921/countries-with-most-executions-worldwide/) the **true number is likely far higher,** as several countries do not publish accurate figures - including North Korea, Vietnam and Belarus.

In China, where numbers remain a state secret, thousands of people are believed to be executed and sentenced to death each year.

(https://www.statista.com/chart/8921/countries-with-most-executions-worldwide/)

(https://www.statista.com/chart/8921/countries-with-most-executions-worldwide/)

_You will find more infographics at Statista (https://www.statista.com/chartoftheday/)_

As Statista's chart shows, **Iran (https://www.statista.com/topics/2688/iran/) comes second only after China with at least 576 people known to have been executed in 2022, up 55 percent from the year.**

The crimes behind these executions are mostly related to drugs and murder, while 18 were for moharebeh (enmity against God), which can be connected to the protests surrounding the death of Mahsa Amini.

Amnesty International notes that **Saudi Arabia also saw a significant increase in death sentences since 2020, rising from 27 to a record high of 196 deaths,** 83 of whom were executed for terrorism-related crimes. In total, 55 countries still have the death penalty, 20 of which recorded executions in 2022.

**In the U.S. (https://www.statista.com/topics/5923/death-penalty-in-the-united-states/), 18 executions were recorded in 2022 across six jurisdictions.** These were Alabama (2), Arizona (3), Mississippi (1), Missouri (2), Oklahoma (5), and Texas (5). Meanwhile, there were 21 new death sentences recorded across 12 states. These included: Alabama (3), Arizona (1), California (2), Florida (5), Georgia (1), Louisiana (1), Mississippi (1), Missouri (1), North Carolina (2), Oklahoma (1), Pennsylvania (1) and Texas (2).

It is worth noting that while 2021 saw a 20 percent increase from the year before, both years represented the lowest number of executions since Amnesty International’s records began back in 2010. This lull, likely due to executions being put on hold because of the pandemic, seems to over, with the figures reaching their highest point since 2017.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Sat, 05/20/2023 - 23:00

https://www.zerohedge.com/geopolitical/where-most-death-penalties-are-carried-out

**Gun Industry Writes To Congress As Imminent Ban Threatens 40 Million Firearms**

Gun Industry Writes To Congress As Imminent Ban Threatens 40 Million Firearms

_Submitted by Gun Owners of America,_ (https://www.gunowners.org/)

On June 1st, the Biden Pistol Ban is set to go into effect. This rule, concocted by the bureaucrats at ATF, criminalizes ownership of an estimated 40 million firearms (https://www.gunowners.org/up-to-40-million-firearms-could-be-banned-overnight-due-to-new-atf-brace-rules/) currently in possession by law-abiding citizens.

According to the final rule, **gun owners who possess braced firearms will have to destroy, reconfigure, register, and turn in their firearms to ATF, or face NFA violations which include $250,000 in fines and a hefty prison sentence.**

** ?itok=F3gdumxH (

?itok=F3gdumxH ( ?itok=F3gdumxH)**

?itok=F3gdumxH)**

This rule will have some of the most wide-reaching impacts nationwide compared to other ATF administrative rulemaking actions. In comparison, ATF's bump stock rule (https://www.gunowners.org/goa-applauds-5th-circuit-bump-stock-ruling/) was estimated to have affected 520,000 Americans, whereas this pistol brace ruling affects **80 times** more law-abiding citizens.

In response, the No Compromise Alliance (https://www.gunowners.org/goa-leads-two-industry-coalition-letters-to-house-leadership-urging-action-on-pistol-braces/) sent a letter signed by notable firearms industry companies to Congress.

Among the undersigned are notable firearms industry companies such as Rifle Dynamics, Kahr Arms Group, KCI USA, Tippmann Arms, and more.

Additionally, two other letters (https://www.gunowners.org/goa-leads-two-industry-coalition-letters-to-house-leadership-urging-action-on-pistol-braces/) were sent to Congress, with notable people of influence throughout the firearms community – representing more than 30 million viewers – and local ranges & shops that are bound to be affected by ATF's overreach.

While these letters certainly make a statement, Gun Owners of America is working on all fronts to defeat the ATF's pistol brace rule before it goes into effect.

GOA has a lawsuit (https://www.gunowners.org/goa-and-texas-ag-file-suit-against-atf-pistol-brace-rule/) in the 5th Circuit with Texas AG Ken Paxton. This circuit is the same that recently overturned the ATF's bump stock rule (https://www.gunowners.org/goa-applauds-5th-circuit-bump-stock-ruling/) in January of 2023.

In addition, GOA has backed legislation targeting the root of the issue with the SHORT Act (https://www.gunowners.org/goa-endorses-the-short-act-to-repeal-nfa-restrictions/). The act itself would remove Short Barreled Rifles (SBR), Short Barreled Shotguns (SBS), and ATF's favorite, "Any Other Weapons" (AOWs) from the unconstitutional regulation of the National Firearms Act (https://www.gunowners.org/goa-endorses-the-short-act-to-repeal-nfa-restrictions/).

The NFA is the law that ATF derives its regulatory authority from on the brace issue, so the SHORT Act (https://www.gunowners.org/goa-endorses-the-short-act-to-repeal-nfa-restrictions/) aims to stop the ATF by removing its power over such items in the first place.

Lastly, GOA has fought hard with our allies in Congress to bring the ATF's pistol brace rule under scrutiny via the Congressional Review Act (https://www.gunowners.org/na04202023/).

For those unfamiliar, the Congressional Review Act (https://www.gunowners.org/na04202023/) allows Congress to file a joint resolution of disapproval, which would overturn agency rulemaking.

**This is where we need _your_ help.**

With our legal fight against Biden and his ATF coming down to the wire, please call your Senators and Representatives and let them know to support the Joint Resolution for Congressional disapproval (https://www.gunowners.org/na04202023/) of the ATF's rulemaking.

> 🚨ALERT🚨

>

> The below GOP representatives have STILL NOT cosponsored H.J. Res. 44 to stop Biden from banning 40,000,000 pistols on June 1st, 2023.

>

> We have 13 days. Call them NOW and ask them to support H.J. Res. 44. ☎️ 202-224-3121@SpeakerMcCarthy (https://twitter.com/SpeakerMcCarthy?ref_src=twsrc%5Etfw)@SteveScalise (https://twitter.com/SteveScalise?ref_src=twsrc%5Etfw)@GOPMajorityWhip (https://twitter.com/GOPMajorityWhip?ref_src=twsrc%5Etfw)…

>

> — Gun Owners of America (@GunOwners) May 18, 2023 (https://twitter.com/GunOwners/status/1659304261224726528?ref_src=twsrc%5Etfw)

**You can call your elected officials at (202) 224-3121**

Let them know to support S.J. RES. 20 (https://www.congress.gov/bill/118th-congress/senate-joint-resolution/20?s=1&r=70) if they're in the Senate & H.J. RES. 20 (https://www.congress.gov/bill/118th-congress/house-joint-resolution/44) if they're in the House of Representatives.

\* \* \*

_We'll hold the line for yo…

**Where 'Conversion Therapy' Is Still Legal**

Where 'Conversion Therapy' Is Still Legal

Conversion therapy has been banned in several countries around the world, including Canada, Brazil, Ecuador, Spain, Germany, France, Malta and New Zealand, according to data aggregated by the Global Equality Caucus (https://equalitycaucus.org/banct/info-hub/legislative-progress) and The International Lesbian Gay Bisexual Trans and Intersex Association (https://ilga.org/about-us) (ILGA).

**Conversion therapy is the process of trying to stop someone from being gay (https://www.statista.com/topics/8579/lgbtq-worldwide/) or trying to stop someone who wants to change their gender identity.**

Methods include spoken therapy and prayer, or even more extreme tactics such as exorcism, physical violence, or food deprivation, as reported by the BBC (https://www.bbc.com/news/explainers-56496423). The British Psychological Society and Royal College of Psychiatrists in the UK (https://www.statista.com/topics/755/uk/) declared that all kinds of conversion therapy are “unethical and potentially harmful (https://www.bps.org.uk/sites/www.bps.org.uk/files/Policy/Policy%20-%20Files/Memorandum%20of%20Understanding%20on%20Conversion%20Therapy%20in%20the%20UK.pdf)”.

As Statista's Anna Fleck shows in the chart below (https://www.statista.com/chart/27674/map-of-where-conversion-therapy-is-banned/), **in much of the world the practice of conversion therapy is still legal.**

(https://www.statista.com/chart/27674/map-of-where-conversion-therapy-is-banned/)

(https://www.statista.com/chart/27674/map-of-where-conversion-therapy-is-banned/)

_You will find more infographics at Statista (https://www.statista.com/chartoftheday/)_

**In multiple other countries though, although no explicit legislative ban exists, limited bans or bans through indirect prohibition have been introduced.**

For example, several countries have introduced a ban on health practitioners to carry out conversion therapy. These include Albania, Switzerland and Taiwan (the latter banning health care professionals from carrying out conversion therapies on minors). In India, Tamil Nadu became the first Indian state to ban conversion therapy (https://www.independent.co.uk/asia/india/madras-hc-conversion-therapy-pride-month-b1861601.html) after a court order issued by a justice of the Madras High Court in 2021.

Meanwhile, several countries, such as Australia, Mexico and the United States, have seen gains with implementing bans on a regional or more basis.

**The trend to enforce legislation banning conversion is slowly picking up pace,** with national governments and parliaments in Belgium, Chile, Colombia, Cyprus, Iceland, Ireland, the Netherlands, Norway and Portugal all in various states of pending legislation. At the same time, according to the Global Equality Caucus, Austria, Finland, Sweden and the United Kingdom have all expressed an intention to legislate bans.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Sat, 05/20/2023 - 22:00

https://www.zerohedge.com/medical/where-conversion-therapy-still-legal

**FBI Improperly Used Surveillance Program To Spy On Jan. 6 Suspects**

FBI Improperly Used Surveillance Program To Spy On Jan. 6 Suspects

_Authored by Zachary Stieber via The Epoch Times (https://www.theepochtimes.com/fbi-improperly-used-surveillance-program-to-spy-on-jan-6-suspects_5278721.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge) (emphasis ours),_

**The FBI abused its surveillance powers while spying on suspects in the Jan. 6, 2021, breach of the U.S. Capitol and Black Lives Matter protesters, a federal court said in a newly unsealed ruling.**

?itok=2KF6tan1\

?itok=2KF6tan1\

_FBI Director Christopher Wray speaks during a press conference at the Justice Department in Washington, on Jan. 26, 2023. (Mandel Ngan/AFP via Getty Images)_ ( ?itok=2KF6tan1)

?itok=2KF6tan1)

FBI agents flaunted standards the agency developed for the Section 702 program, which enables spying on Americans and others, more than 278,000 times, the Foreign Intelligence Surveillance Court said in the 2022 ruling, which was made public for the first time on May 19.

Section 702 of the Foreign Intelligence Surveillance Act enables agencies like the FBI to collect information like emails without warrants from foreigners, even if they’re in the United States, and bars intentionally targeting Americans.

**The FBI developed its own standard for Section 702 searches**, stating that queries “must be reasonably likely to retrieve foreign intelligence information, as defined by FISA, or evidence of a crime, unless otherwise specifically excepted.”

But FBI agents have been violating the standard, the court has found (https://www.documentcloud.org/documents/23817208-fisc-opinion-42122), with the newest ruling disclosing hundreds of thousands of abusive searches in addition to those already known (https://www.theepochtimes.com/fbi-abused-secretive-surveillance-program-court-finds_3794295.html).

The abusive searches include multiple improper queries targeting suspected or confirmed Jan. 6 suspects.

In one instance, an analyst searched for information on 13 people suspected of being involved in the Capitol breach. **The analyst “said she ran the queries to determine whether these individuals had foreign ties,”** but the Department of Justice’s National Security Division (NSD) “concluded the queries were not reasonably likely to retrieve foreign intelligence information or evidence of crime,” the newly unsealed ruling states.

In another case, widespread searches that in total consisted of more than 23,000 separate queries looked for information on presumed Americans to see whether the people were “being used by a group” involved in the breach.

“The queries were run against unminimized Section 702 information to find evidence of possible foreign influence, although the analyst conducting the queries had no indications of foreign influence related to the query terms used,” the court said. “NSD assessed there was no specific factual basis to believe the queries were reasonably likely to retrieve foreign intelligence information or evidence of crime from Section 702 information.”

Other Improper Searches

The new ruling, released by the Office of Director of National Intelligence, also revealed that FBI personnel improperly surveilled a congressional campaign.

An analyst conducted a so-called batch query, or a widespread query, for over 19,000 donors to the campaign. The analyst claimed the campaign was “a target of foreign influence,” but NSD officials found sufficient evidence for queries for just eight of the people who were queried.

**In another instance, a batch query was conducted on 133 people who were arrested “in connection with civil unrest and protests between approximately May 30, and June 18, 2020,”** the time period during which people, primarily Black Lives Matter members and supporters, were protesting and rioting over the death of George Floyd in Minneapolis, Minnesota.

“The query was run to determine whether the FBI had ‘any counter-terrorism derogatory information on the arrestees,’ but without ‘any specific potential connections to terrorist related activity’ known to those who conducted the queries,'” the court found. NSD said the queries violated the FBI standards, but the FBI disagreed, claiming there was a “reasonable basis to believe these queries ‘would return foreign intelligence” due to citations that were redacted.

Additional 2020 violations included queries using variations of “political activist groups involved in organized protests;” 697 queries using identifiers on scheduled visits to a place or person that were redacted in the ruling; searches for at least 790 defense contractors that the FBI was considering requesting cooperation from; and at least 330 queries conducted using identifiers o…

https://www.zerohedge.com/political/fbi-improperly-used-surveillance-program-spy-jan-6-suspects

**Visualizing The American Workforce As 100 People**

Visualizing The American Workforce As 100 People

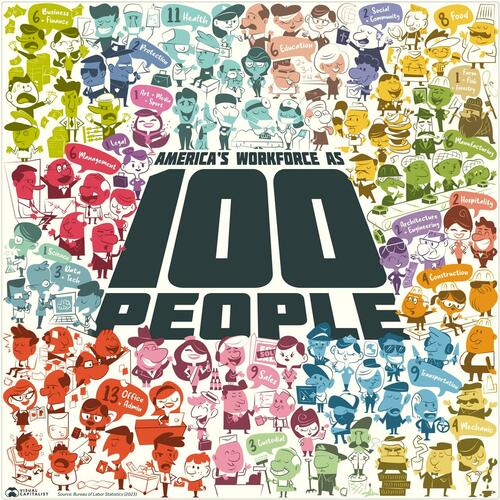

n 2022, the U.S. population stood at **333 million**. Of that, roughly 60% were employed (https://www.bls.gov/opub/ted/2022/employment-population-ratio-at-60-0-percent-in-july-2022.htm) in various jobs, positions, and sectors in the U.S. economy.

But where did all these people work? What jobs did they do and what positions did they hold? Where do most Americans do their nine-to-five?

Using data (https://www.bls.gov/oes/current/oes_nat.htm) from the National Occupational Employment and Wage Estimates (2022) put out by the U.S. Bureau of Labor Statistics (BLS), Visual Capitalist's Pallavi Rao reimagines (https://www.visualcapitalist.com/american-workforce-100-people/)the employed American workforce as only 100 people, to find out answers.

Interestingly, the data contains a mix of information demarcations. Some are job-specific (type of work), some are based on position (like Management), and some are broken down by industry (Transport and Health).

?itok=hUWOrO3S (

?itok=hUWOrO3S ( ?itok=hUWOrO3S)

?itok=hUWOrO3S)

The Most Common Jobs In the U.S.

By far, most of the American workforce (13 out of 100) are employed in **Office & Administrative** work. This includes a mind-boggling variety of jobs: receptionists, payroll clerks, secretaries, proof-readers, administrative assistants, and customer service representatives to name a few.

Notably, any sort of management role is absent from this, as well as any other job categories, since the BLS categorizes managers in their own class.

The industry which employs the second largest group of people is **Health**, accounting for 11 people from the 100. This category is a combination of two sectors listed in the original dataset (healthcare practitioners and healthcare support) and covers the entire industry: from physicians, surgeons, veterinarians, nurses, and therapists to technicians, assistants, orderlies, and home and personal care aides.

Here’s a quick look at all the major sectors most of America’s workforce actually works in.

RankJobsPeopleExamples1.Office & Admin13Receptionists, Clerks, Customer service, Secretaries.2.Health11Doctors, Nurses, Paramedics, Vets, Orderlies, Personal care aides.3.Transport9Warehouse workers, Packagers, Pilots, Ambulance, Bus, Truck, Taxi drivers, Ship captains.4.Sales9Sales representatives, Counter clerks.5.Food8Food preparers & servers, Bartenders, Dishwashers, Hosts.6.Management6Legislators, Chief executives, Directors, General & Operations managers.7.Business & Finance6Accountants, Auditors, Financial analysts, Logisticians.8.Manufacturing6Factory workers, Gas fitters, Machine operators, Cobblers, Tailors, Barbers.9.Education6Teachers (all fields, all levels).10.Construction & Extraction4Stone / brick / block / cement masons. Construction laborers. Roofers, Plumbers, Electricians, Mining workers.11.Mechanics & Installation4Auto mechanic, Farm equipment mechanic, Home appliance mechanic, Locksmiths.12.Data & Tech3Information analyst, Database architect, Software & Web

developers, Data scientists, Mathematicians, Computer support.13.Custodial3Cleaning, Groundskeeping, Landscaping, Housekeeping.14.Protection2Cops, Firefighters, Security guards, Lifeguards, Correctional officers.15.Hospitality2Animal trainers / caretakers. Ushers / attendants. Makeup artists. Concierge. Exercise trainers.16.Architecture & Engineering2All engineers and architects (excluding the information industry).17.Community & Social Service2Social workers, Therapists (counsellors) & Religious work.18.Arts, Media, & Sport1Fine artists, Designers, Actors, Athletes, Journalists, Writers, Authors, Musicians.19.Science1All scientists (not engineers).20.Legal1Lawyers, Judges, Paralegals, Mediators.21.Farming, Fishing, & Forestry1Farmers, logging workers.Total100

The third most common job is actually a tie between **Transport**—cargo moving workers, pilots, truck drivers—and **Sales**—retail and industry sales agents, counter clerks—with both sectors employing nine of the 100 people. In the Sales category, two of the nine people are cashiers.

Ranked fifth is **Food**, with eight people, ranging from private chefs to serving staff at fast food restaurants.

Another six all belong in some kind of **Management** role (across industry, and including legislators) with two of those six being “top level executives” like a CEO, a general manager, a mayor, or university president. Management shares its spot with Business & Finance, Manufacturing, and Education, all at six each.

The following jobs or industries also employ the same number of people:

- Construction & Extraction along with Mechanics & Installation, at **four** each.

- Data & Tech, with Custodial jobs, with **three** e…

https://www.zerohedge.com/personal-finance/visualizing-american-workforce-100-people

**"It's Criminal": Central Wisconsin Communities Unite To Stave Off Looming Wind Turbine Industry**

"It's Criminal": Central Wisconsin Communities Unite To Stave Off Looming Wind Turbine Industry

_Authored by Matt McGregor via The Epoch Times,_ (https://www.theepochtimes.com/in-depth-its-criminal-central-wisconsin-communities-unite-to-stave-off-looming-wind-turbine-industry_5268714.html?utm_source=partner&utm_campaign=ZeroHedge)

Central Wisconsin communities are coordinating efforts to shine a light into the flickering shadow cast by a looming wind turbine industry.

**“There is a revolt happening here,”** attorney Marti Machtan told The Epoch Times. **_“I’ve never seen our communities engage like this in my life.”_**

Machtan is a member of Farmland First (https://www.farmlandfirst.com/), an organization that aims to facilitate discussion among community members concerned about reported coercive, predatory tactics used by industrial wind companies to manipulate landowners into signing their property rights away in the name of green energy.

_**“These companies are sneaky about it,”**_ Tom Wilcox— also a member of Farmland First and chairman of the Town of Green Grove in Owen, Wisconsin—told The Epoch Times. “They don’t want to come right out and say how this will work. In fact, part of the reason why people don’t know this is happening is farmers have to agree to keep their mouth shut on the details of the contract.”

Wilcox is also on the Clark County Board of Supervisors and chairman of the Clark County Planning and Zoning.

?itok=dppQHqMu (

?itok=dppQHqMu ( ?itok=dppQHqMu)

?itok=dppQHqMu)

_Marti Machtan and Tom Wilcox at a farm free of wind turbines in Wisconsin in 2023. (Courtesy of Tom Wilcox)_

This month, at least 13 central Wisconsin towns have passed health and safety ordinances setting the ground rules for companies seeking to build wind turbines up to 600 feet tall as close as 1,250 feet from their homes.

The resolutions are written to mitigate the harm wind turbines have been reported to cause to people, their land, and their natural environment, including wildlife.

Word spread after some community members openly discussed rejecting alluring offers with payoffs of over $1 million over 30 years to have a wind turbine built on their farm.

However, Machtan argued that because turbine companies can exit the contract for any reason, the possibility of actually getting that amount wouldn’t be a safe bet.

For Wilcox, there are too many unanswered questions, like how it works and what it does to property values.

Initially, Wilcox said he held the attitude that people can do whatever they want with their farm.

“But as I got further into this, I realized that these wind turbines aren’t at all good for the farming community,” Wilcox said. “As I got deeper, I realized just what kind of a sham this really is.”

‘Imbalanced, Unfair, One-Sided’

Machtan has reviewed, negotiated, and drafted over a billion dollars worth of contracts with companies of various sizes.

His assessment of the contracts between farmers and wind turbine companies like RWE Clean Energy, which has advanced into central Wisconsin, is as bad as he’s ever read.

“I don’t think I’ve ever seen one that was more imbalanced, unfair, or one-sided to the benefit of the company and to the detriment of the farmer,” Machtan said.

Many provisions in these contracts give more power to the wind company over the land than the property owner.

The wind company can get out of the contract at any time for any reason, while the farmer must commit to a decade’s worth of encumbrances, Machtan said.

“There are liability shifting provisions for the big multi-billion-dollar multinational companies that shift risks onto these farmers,” he said.

There are also inadequate decommissioning standards, he added.

“One of the things people are worried about is, because this type of energy production really doesn’t make sense over the long term, there’s the risk that farmers are going to be left holding the bag,” Machtan said.

There’s no mutual sharing of opportunity and risk, Machtan said, leaving him to conclude that these aren’t green-energy projects.

_**“This is financial engineering designed to shift risk on the farmers and our communities while providing large stable returns to private equity,”**_ Machtan said. _**“What’s actually driving them is pension funds and other investors trying to get a stable return for their shareholders with as little risk as possible with the support of our federal and state government.”**_

?itok=323rUn8T (

?itok=323rUn8T ( ?it…

?it…

**Is Self-Defense Becoming Illegal?**

Is Self-Defense Becoming Illegal?

_Authored by Joshua Philipp via The Epoch Times,_ (https://www.theepochtimes.com/is-self-defense-becoming-illegal_5273007.html?utm_source=partner&utm_campaign=ZeroHedge)

If someone you love were threatened, or physically attacked, do you have the right to defend them? **And even more so, when police are being defunded and when criminals are being released on the streets, do you have a right to protect yourself?**

?itok=tK96ElOZ (

?itok=tK96ElOZ ( ?itok=tK96ElOZ)

?itok=tK96ElOZ)

**Do you have to just let things happen?**

Must you just watch while innocent people are victimized by criminals?

**Well, that’s the question currently on trial in New York.**

That’s the case of Jordan Neely.

Now, if you read most news outlets (https://gothamist.com/news/who-was-jordan-neely-friends-recall-sweet-kid-talented-performer-killed-in-subway-chokehold) on the left, you’ll hear the **30-year-old black man was a street performer and Michael Jackson impersonator**.

You’ll also hear that his friends said he was a **sweet kid,** and that he later suffered from mental disabilities and became homeless.

If you read news outlets on the right, you’ll hear that **he was arrested 42 times between 2013 and 2021.**

In 2015, he was convicted of **trying to kidnap a 7-year-old girl** in Inwood, Queens, and was sentenced to four months in jail. Then, in 2021, he was **arrested for punching a 67-year-old woman in the face** as she exited a subway train in New York’s East Village, breaking her nose and fracturing her orbital bone.

He pleaded guilty, and while facing 15 months in an alternative-to-incarceration program, he skipped his court date, and had a warrant out for his arrest since February.

**Both sides of Neely’s story are true.** He was a talented dancer who suffered from mental problems, and had become a criminal menace. The New York justice system repeatedly let him off the hook. Even outside of his arrests, people were posting online (https://twitter.com/MrAndyNgo/status/1654949802235555840?ref_src=twsrc%5Etfw) about personal experiences of being threatened or attacked by Neely.

And then, on May 1, Neely was allegedly threatening (https://www.reutersconnect.com/all?id=tag%3Areuters.com%2C2023%3Anewsml_WD205212052023RP1%3A4&search=all%3A%22tag%3Areuters.com%2C2023%3Anewsml_WD205212052023RP1%22) passengers on a New York subway car until a former U.S. Marine intervened; he restrained Neely with a chokehold while two other men helped subdue him. After Neely lost consciousness, the men placed Neely in a recovery position, and yet, Neely died.

**Nobody was initially charged. Video of the incident, which was limited to when Neely had already been restrained, was quickly picked up by political actors to play into the country’s race narratives.**

Democrat Rep. Alexandria Ocasio-Cortez (AOC) of New York wrote (https://twitter.com/AOC/status/1653880169516466178?ref_src=twsrc%5Etfw) on Twitter a couple days later that “Jordan Neely was murdered.” She claimed he was “houseless and crying for food in a time when the city is raising rents and stripping services to militarize itself while many in power demonize the poor.”

**She said it was “disgusting” that the man who allegedly killed Neely wasn’t charged.**

Others on the far left came forward also to criticize (https://www.yahoo.com/lifestyle/ny-dems-turn-other-over-192029567.html) the case as being about race, and to suggest that justice was needed, although, even among Democrats, not everyone was in agreement.

**The political attacks sounded like a dog whistle to radical groups in New York.** There were no major protests like those that were common with the Black Lives Matter summer riots a few years back, although a few dozen protesters went viral when they jumped (https://nypost.com/2023/05/06/protestors-clash-with-nypd-over-jordan-neely-chokehold-death/) on the subway tracks and forced a Q train to slam on its brakes.

It also turned out the protesters weren’t grassroots protesters. They were with an organization called Voices of Community Activists and Leaders, which has funding from billionaires including Meta (https://apps.irs.gov/pub/epostcard/cor/820962378_201912_990_2021030217780020.pdf) CEO Mark Zuckerberg through (https://dailycaller.com/2023/05/08/mark-zuckerberg-george-soros-jordan-neely/) the FWD.us Education Fund, and radical left billionaire George Soros (https://dailycaller.com/2023/05/08/mark-zuckerberg-george-soros-jordan-neely/) through his Open Society Foundations.

It also turned out that the radical organization that staged the subway protest had previously teamed up in other protests with the Young Communist League of the Communist Party USA.

**The outright communist group also w…

https://www.zerohedge.com/political/self-defense-becoming-illegal

**Exxon Crushes Progressive Dreams That "Net Zero" Has Any Chance By 2050: It Would Mean Collapse In "Global Standard Of Living"**

Exxon Crushes Progressive Dreams That "Net Zero" Has Any Chance By 2050: It Would Mean Collapse In "Global Standard Of Living"

In a world of suffocating snowflakery, ESG hypocrisy and, well... Tranheuser Busch, a corporation telling the truth without fear of reprisals from the Open Society-funded virtue signaling cabal is rarer than an mRNA-injected, genetically engineered hen's teeth. And yet that's what the company hated by every progressive, Exxon Mobil, did this week when it became the first corporation to denounce the insidious and laughable claims that "net zero" is even a remote possibility by 2050.

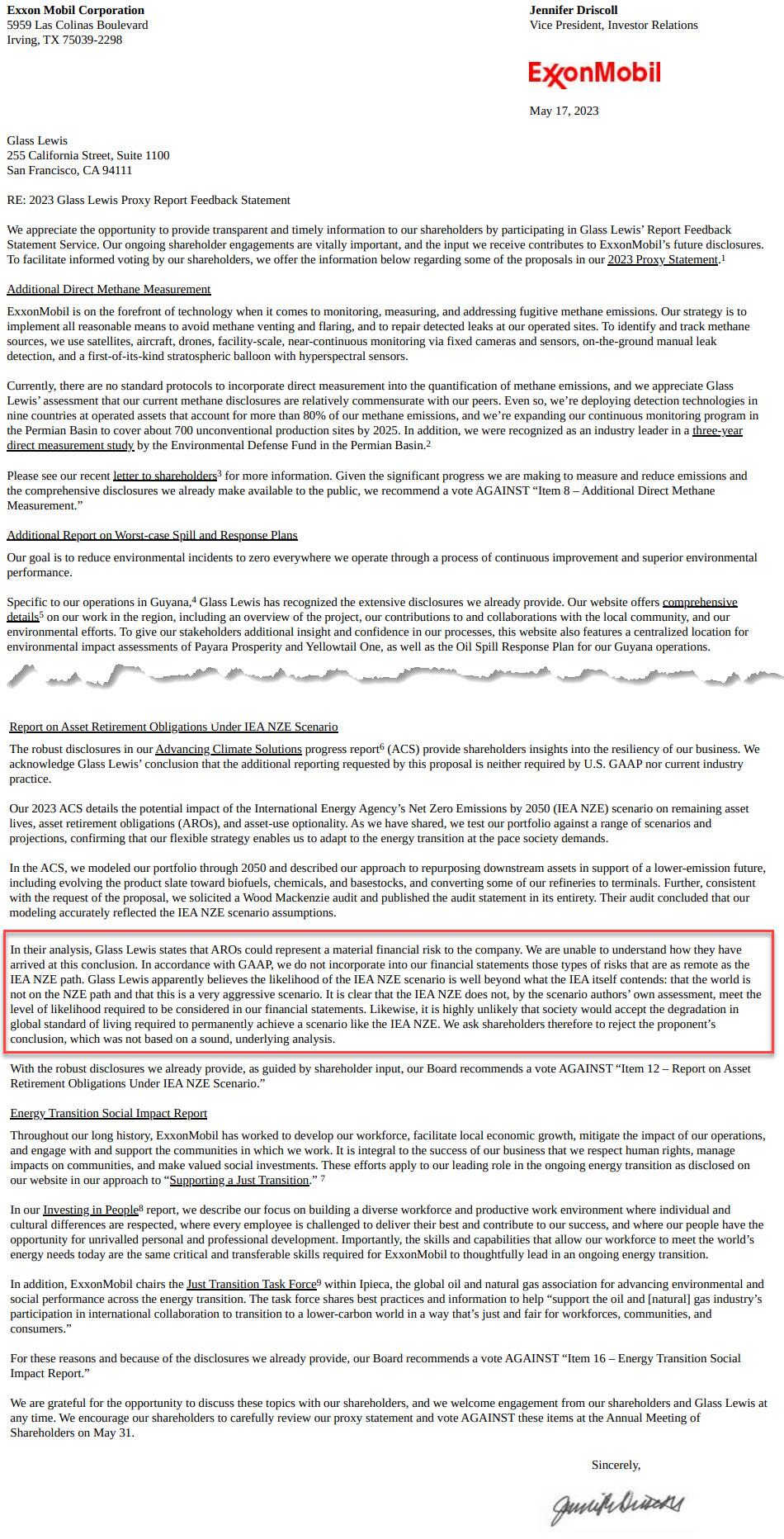

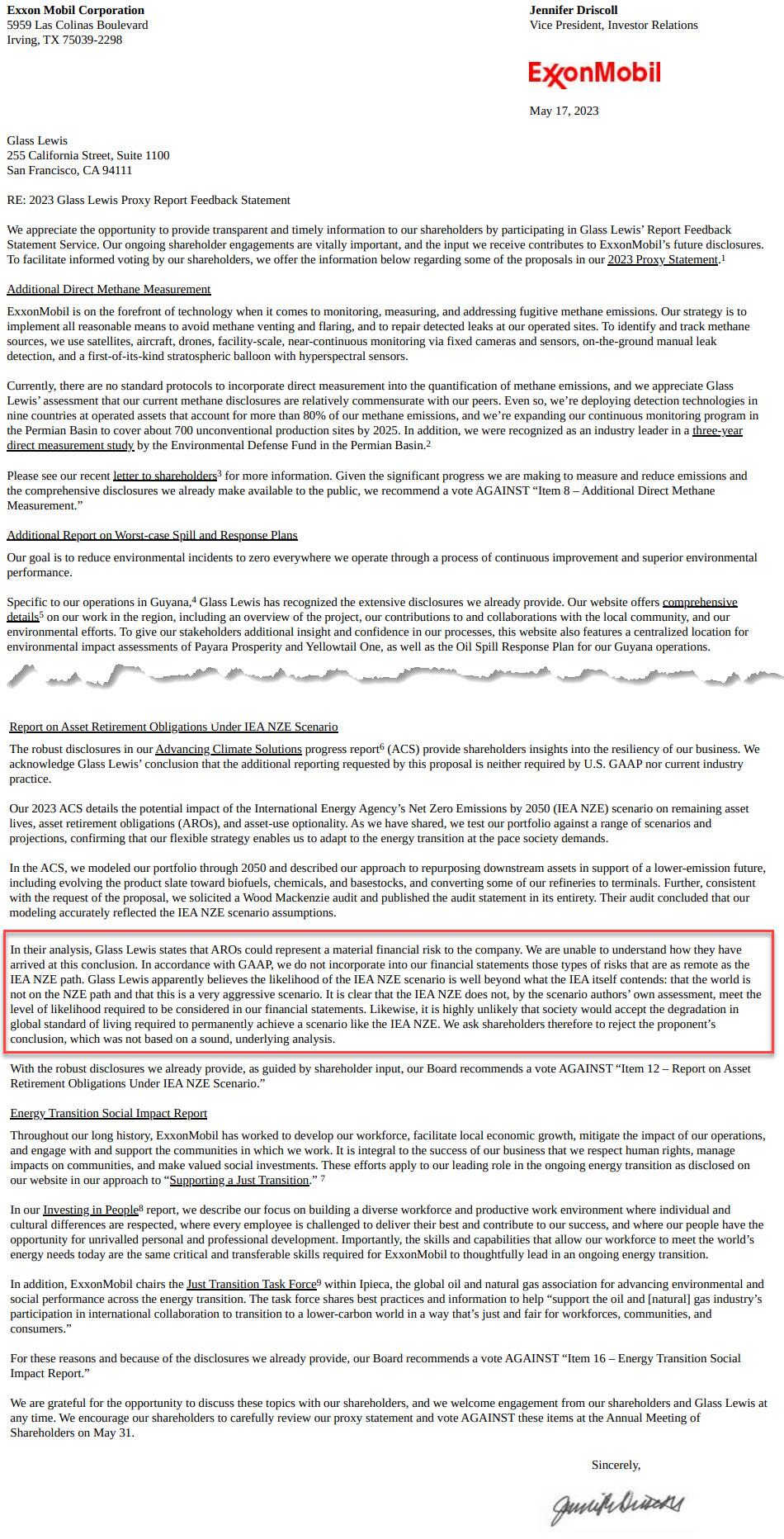

The US supermajor pushed back against investors pressing the company to report on the risks to its business from restrictions on greenhouse gas emissions and potential environmental disasters when in a reply to proxy advisor Glass Lewis, Exxon said **the prospect of the world achieving net-zero carbon dioxide emissions by 2050 is remote and should not be further evaluated in its financial statements.**

A shareholder proposal seeking a report on the cost of having to abandon projects faces a shareholder vote on May 31. Glass Lewis backed the initiative, concluding Exxon could face material financial risks from the net-zero scenario.

Exxon disagreed, and said **the world is not on a path to achieve net-zero emissions in 2050 as limiting energy production to levels below consumption demand would lead to a spike in energy prices, as observed in Europe following oil sanctions against Russia over Ukraine.**

Exxon, is of course, correct however that won't stop the green fanatics from beating the drum that somehow the world can transition to "green" energy (at a cost of some $150 trillion mind you (https://www.zerohedge.com/energy/one-bank-reveals-dismal-truth-about-150-trillion-crusade-against-climate-change)) in the next 27 years without an energy cataclysm.

At the heart of the issue is the 2050 net-zero emissions (NZE) scenario of the International Energy Agency (IEA) which envisions a path to limit the global temperature rise to 1.5 degrees Celsius. For the NZE scenario to be met, the IEA had hilariously said new oil exploration would have to have stopped in 2021 and nations would have to switch to renewable energy from fossil fuels (good luck with that). Exxon is among the companies heavily investing in new exploration to generate oil and gas for decades to come, and in retrospect, one can thank their deity of choice for Exxon's decision to do so as opposed to sending the world back into the dark ages, an outcome which so many from the World Economic Forum seems to aspire to.

"It is clear that the IEA NZE does not, by the scenario authors’ own assessment, meet the level of likelihood required to be considered in our financial statements," Exxon said in a response filed (https://ir.exxonmobil.com/static-files/da018d10-fb85-4eb9-9251-d2e04f1923d5)with the U.S. Securities and Exchange Commission on Wednesday.

"It is highly unlikely that society would accept the degradation in global standard of living required to permanently achieve a scenario like the IEA NZE," Exxon said in dismissing the proposal.

?itok=O_oi463F (

?itok=O_oi463F ( ?itok=O_oi463F)_Source:_ (

?itok=O_oi463F)_Source:_ ( ?itok=O_oi463F) _Exxon (https://ir.exxonmobil.com/static-files/da018d10-fb85-4eb9-9251-d2e04f1923d5)_

?itok=O_oi463F) _Exxon (https://ir.exxonmobil.com/static-files/da018d10-fb85-4eb9-9251-d2e04f1923d5)_

Exxon also rebutted the woke proxy firm's recommendation that it evaluate the impacts of a worst-case oil spill at its offshore Guyanese oil platforms. Exxon leads a consortium responsible for all of Guyana's offshore oil production and its board has recommended against the proposal.

"The requested report clearly would not provide new, decision-useful information," Exxon said, adding the shareholder request "ignore(s) the time, additional cost, and resources every report takes for the company to prepare."

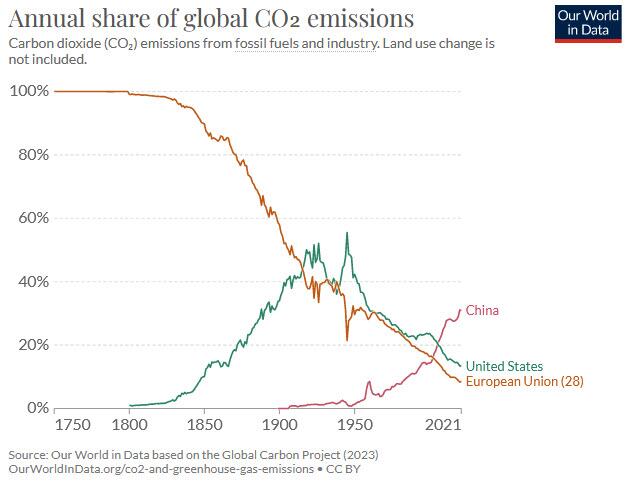

As for the IEA, instead of targeting those companies - which despite every effort by the senile US president to drain the US SPR and make the country once again dependent on outside energy sources - are doing everything in their power to retain US energy independence, perhaps it should bring its message to downtown Beijing. We are confident that China will listen to their pimply teenager-inspired "proposals" in a cool, calm and collected manner.

?itok=QQSv4Ox5 (

?itok=QQSv4Ox5 ( ?itok=QQSv4Ox5)_Source:_ (

?itok=QQSv4Ox5)_Source:_ ( ?itok=QQSv4Ox5) _Our world in data (https://ourw…

?itok=QQSv4Ox5) _Our world in data (https://ourw…

**G-7 Leaders Respond To China’s Economic Bullying At Hiroshima Summit, Warn Of 'Consequences'**

G-7 Leaders Respond To China’s Economic Bullying At Hiroshima Summit, Warn Of 'Consequences'

_Authored by Emel Akan via The Epoch Times (https://www.theepochtimes.com/g-7-to-issue-candid-response-to-chinas-economic-bullying-at-hiroshima-summit_5279713.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge) (emphasis ours),_

Economic security was a major focus on the second day of the Group of Seven (G-7) summit in Hiroshima, with leaders outlining actions to counter Beijing’s “economic coercion” and non-market practices.

The G-7 countries—the United States, the UK, Japan, Canada, Germany, France, and Italy—announced on May 20 their plan to address the “disturbing rise in incidents of economic coercion.”

> _**“We will work together to ensure that attempts to weaponize economic dependencies by forcing G7 members and our partners, including small economies to comply and conform will fail and face consequences**,” the G-7 leaders’ statement on economic security read._

>

> _“We express serious concern over economic coercion and call on all countries to refrain from its use.”_

?itok=okbIVgzd\

?itok=okbIVgzd\

_(L-R) Italy's Primer Minister Giorgia Meloni, Canada's Prime Minister Justin Trudeau, France's President Emmanuel Macron, Japan's Prime Minister Fumio Kishida, U.S. President Joe Biden, German Chancellor Olaf Scholz, Britain's Prime Minister Rishi Sunak, and European Commission President Ursula von der Leyen participate in a family photo with G7 leaders before their working lunch meeting on economic security at the Grand Prince Hotel in Hiroshima on May 20, 2023. (Jonathan Ernst/POOL/AFP via Getty Images)_ ( ?itok=okbIVgzd)

?itok=okbIVgzd)

National security advisor Jake Sullivan, who briefed reporters on May 20 on the sidelines of the G-7 Summit, said the leaders agreed to deploy “a common set of tools” to confront China’s economic coercion.

“ **These economic security tools will include steps to build resilience in our supply chains.** They will also include steps to protect sensitive technology, like export controls and outbound investment measures,” Sullivan said.

However, the leaders are emphasizing that their goal is to de-risk, not decouple from China.

“Our policy approaches are not designed to harm China nor do we seek to thwart China’s economic progress and development,” according to the G-7 Summit communique released on May 20.

“A growing China that plays by international rules would be of global interest. We are not decoupling or turning inwards. At the same time, we recognize that economic resilience requires de-risking and diversifying.”

Leveraging Economic Power

In recent years, China has increased its efforts to leverage its economic might to force political change around the world.

For example, after Australia called for an independent investigation into the origins of COVID-19 in April 2020, the communist regime announced trade sanctions on select Australian products.

?itok=0EUjAZtu\

?itok=0EUjAZtu\

_An employee works as Australian-made wine (on display shelves on the right) at a store in Beijing on Aug. 18, 2020, the same day that the Chinese regime ramped up tensions with Australia after it launched a probe into wine imports from the country, the latest salvo in a bitter row after the Australian government called for a probe into the origins of COVID-19. (Noel Celis/AFP via Getty Images)_ ( ?itok=0EUjAZtu)

?itok=0EUjAZtu)

**The Chinese regime’s economic coercion of Australia has served as a “wake-up call” to other countries, Liz Truss, the UK’s Foreign Secretary at the time, warned.**

There have been other instances of Chinese coercion in the past, including with Japan, which saw Chinese shipments of rare earth metals blocked due to a territorial dispute in 2010. South Korea faced business boycotts from China in 2017 after installing a U.S. missile defense system. And recently, Beijing retaliated against Lithuania after it attempted to strengthen ties with Taiwan.

China has recently pressured U.S. companies as well. For example, in reaction to the United States placing export bans on advanced semiconductors, Beijing launched a probe into memory chip company Micron. Furthermore, in March, Chinese police stormed the Beijing office of Mintz Group, an American due diligence firm, and detained five Chinese citizens working for the company. Later, Chinese police questioned employees at the Shanghai branch of Bain & Co., an American c…

**Kremlin Responds To Ukraine Intel Chief's Threat To "Kill Russians Anywhere"**

Kremlin Responds To Ukraine Intel Chief's Threat To "Kill Russians Anywhere"

Maj. Gen. Kyrylo Budanov, the head of Ukraine’s military intelligence agency, in an interview with _Yahoo_ News published Friday addressed the recent string of assassinations (https://www.zerohedge.com/geopolitical/prominent-russian-novelist-wounded-car-bomb-assassination-attempt) and cross-border attacks on Russian territory.

In reference to the August car bombing death of Daria Dugina ( _Yahoo_ underscored in its lead-in that "U.S. intelligence has attributed Dugina’s killing to the Ukrainian government (https://www.nytimes.com/2022/10/05/us/politics/ukraine-russia-dugina-assassination.html#:~:text=WASHINGTON%20%E2%80%94%20United%20States%20intelligence%20agencies,fear%20could%20widen%20the%20conflict.)"), Gen. Budanov offered the following ultra-provocative statement (https://news.yahoo.com/we-will-keep-killing-russians-ukraines-military-intelligence-chief-vows-232156674.html):

> _" **we’ve been killing Russians and we will keep killing Russians anywhere on the face of this world** until the complete victory of Ukraine."_

?itok=oQEQS4vP\

?itok=oQEQS4vP\

_Maj. Gen. Kyrylo Budanov. Image: government of Ukraine_ ( ?itok=oQEQS4vP)

?itok=oQEQS4vP)

He seemed to be owning up to Ukraine being behind the assassinations. **What Russia calls "terrorism, we call liberation,"** he had said when asked whether Kiev was behind the attacks, which also included the April cafe bombing and death of Russian blogger Vladlen Tatarsky.

Kremlin spokesman Dmitry Peskov blasted the threatening remarks, calling them **"truly heinous"** while "vigorously" condemning them. In the Monday response, Peskov said (https://www.rt.com/russia/575961-kremlin-ukraine-peskov-budanov/), "What Budanov said is **a direct confirmation that the Kiev regime isn’t only sponsoring terrorist activity, but is a direct organizer of this activity**."

He further emphasized that Russia's own secret services "will be doing everything that they should be doing against the background of such statements."

"It’s very difficult to imagine that such terrorist statements from Kiev will remain without condemnation. Therefore, today we will be waiting for these condemnations," he followed with, in reference to the international community.

But the White House has remained mum on the **emerging covert 'dirty war' targeting Russian officials and 'pro-Russia' journalists and mere activists**, and may even be assisting with intelligence and planning for such operations. Moscow has leveled this charge precisely. None of those killed so far have actually been Kremlin decision-makers, but are **civilians**...

> Over the past year, in Russia, there were the assassinations of Daria Dugina, Vladlen Tatarsky, and today—an attempt on the life of author Zachary Prilepin. All were bombings, all linked to Ukraine. None of these targets are decision-makers, but rather opinion-makers.

>

> — Nina 🐙 Byzantina (@NinaByzantina) May 6, 2023 (https://twitter.com/NinaByzantina/status/1654869010461372416?ref_src=twsrc%5Etfw)

Russia’s Security Service (FSB) has said Tatarsky's assassination was the work of "Ukrainian special services and their agents, including fugitive members of the Russian opposition."

On Saturday, one of Russia's best-known novelists, Zakhar Prilepin, was targeted (https://www.zerohedge.com/geopolitical/prominent-russian-novelist-wounded-car-bomb-assassination-attempt) in a car bombing near the city of Nizhny Novgorod. He survived the attack which took place on a highway when a device under his car detonated, but his driver was killed.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 05/08/2023 - 10:50

**Key Events This week: CPI, PPI And The All-Important SLOOS**

Key Events This week: CPI, PPI And The All-Important SLOOS

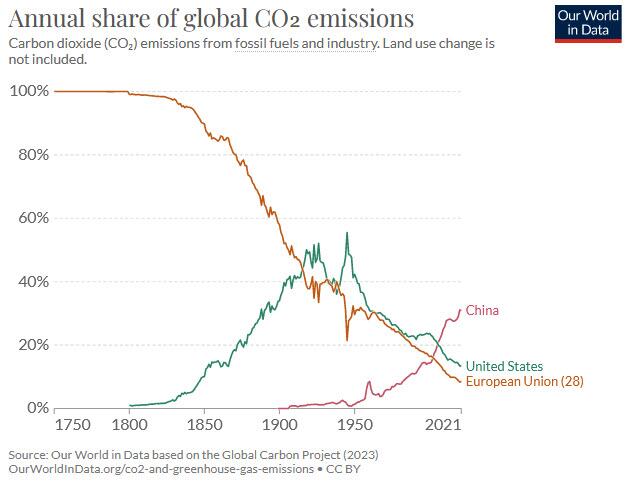

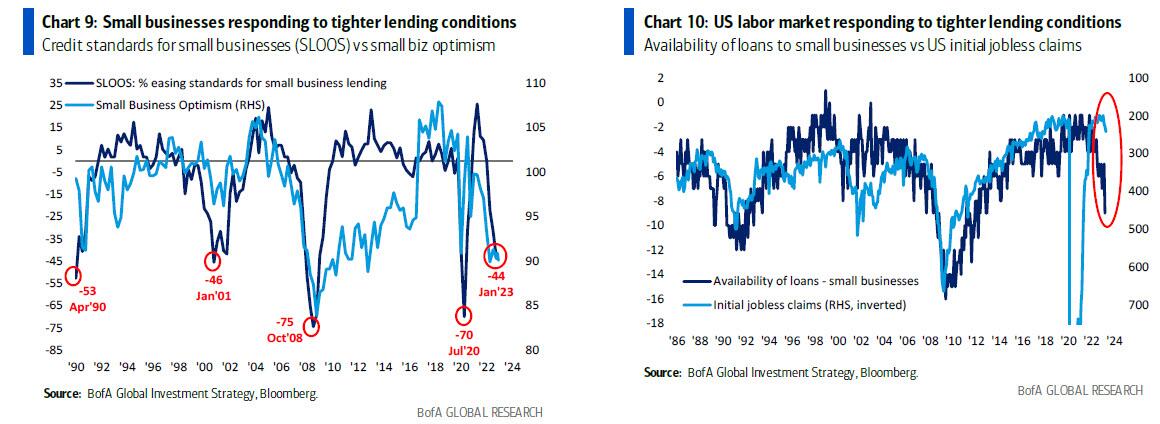

With the bulk of Q1 corporate earnings now in the history books - and coming in much stronger than most, certainly permabear Mike Wilson, had expected - and with the key central bank decisions and econ data out of the way for the near future, two calendar highlights stand out this week: Wednesday's CPI report in the US and today's senior loan officer opinion survey (SLOOS).

While we believe that today's SLOOS will be the week's most important event, many still are focusing on the CPI report, which according to economic consensus will rise by 0.4% leading to an annual increase of 5.0%; for core inflation, consensus expects a 0.3% print, and a 5.5% annual increase. Within core inflation, BofA expects core goods inflation rose by 0.2% m/m and core services inflation increased by 0.4% m/m.

One day after the CPI, on Thursday we get the PPI where consensus expects a 0.3% M/M headline PPI increase following the 0.5% drop in March. This would result in the y/y rate falling to 2.5% from 2.7%. The increase should be driven by a rise in energy and food prices. Excluding food and energy, core PPI will rise by a modest 0.2% m/m, reversing the prior month’s decline. However, this would lead the y/y rate to fall to 3.3% from 3.4%. Trade services (margins) were a big drag on core PPI in March, declining by 0.9% m/m, but BofA expects a more modest decline of 0.2% m/m this month. Last, look for core-core PPI, which excludes food, energy and trade services, to rise by 0.2% m/m or 3.4% y/y.

Turning to the all important SLOOS, which as Michael Hartnett shows last Friday is a leading indicator to virtually every key US data metric...

?itok=GceHrnv6 (

?itok=GceHrnv6 ( ?itok=GceHrnv6)

?itok=GceHrnv6)

... Goldman expects that the lending standards measure for commercial and industrial (C&I) loans in the Fed’s April Senior Loan Officer Opinion Survey tightened by 15.4pt to 60.2, reflecting an increase of 33.3pt to 77.0 for small banks and a more modest increase of 10.3pt to 56.0 for large banks. **This would bring the SLOOS’s measure of C&I lending standards to a level tighter than the dot-com crisis,** if still less extreme than during the financial crisis or the height of the pandemic. A few more bank failures, however, and we will have a new record print. The April SLOOS typically reflects responses collected between the last week of March and the first week of April.

_A day by day recap of the biggest global events is below courtesy of Rabobank_

- **Today:** has the minutes of the BOJ March meeting, NAB business confidence/conditions in Australia along with building approvals. Germany has industrial production, seen -1.5% m-o-m. The ECB’s Lane speaks, and the Fed releases a senior loan officer opinion survey and the --ironic-- 2023 financial stability report. The Fed’s Kashkari speaks on US minimum wages.

- **Tuesday:** has Aussie Westpac consumer confidence and Q1 retail sales ex-inflation as a feed into GDP, seen -0.5% q-o-q. China has trade data excepted to underline that it exports lots and imports less, and runs a staggering surplus that it sits on. The ECB’s Rehn, Centeneo, Lane, Vasle, Vujicic, and Schnabel all speak. We also get the Aussie budget, with the usual flourish of political theatre. The US NFIB small business survey has less flourish but is often as political – let’s see what it says about credit availability. The Fed’s Jefferson and Williams speak too. Chinese aggregate financing data will be out at some point from Tuesday onwards.

- **Wednesday:** sees final April German CPI, Canadian building permits, and the week’s highlight – US CPI, where the y-o-y headline is seen sticky at 5.0%, and the m-o-m is seen up 0.4% vs. just 0.1% in March. Core CPI is seen even higher at 5.8% vs. 5.6% in March, albeit up 0.3% m-o-m vs. 0.4% last time. The ECB’s Centeneo speaks again, and the US monthly budget statement is out.

- **Thursday:** has Chinese CPI, seen falling from 0.7% to just 0.3% y-o-y – which is what happens when supply vastly exceeds demand both at home and abroad. PPI is seen dipping from -2.5% to -3.2% y-o-y. Yes, deflation is an emerging problem in China. Imagine what happens if the US fully adopts industrial strategy and/or mercantilism! The ECB’s De Cos, Schnabel, and Guindos all speak, and the BOE meet to set rates. The US has weekly initial claims data and PPI, seen 0.2% m-o-m and 0.3% core, 2.5% and 3.3% y-o-y.

- **Friday:** closes the week with Kiwi inflation expectations, UK monthly GDP and March industrial production and trade data, and provisional Q1 GDP (seen 0.1% q-o-q, 0.2% y-o-y). The BOE’s Pill speaks, and we shall see how many he manages to offend this time round. The US has import and…

https://www.zerohedge.com/economics/key-events-week-cpi-ppi-and-all-important-sloos

**The Neoliberal Globalization King Is Dead! Long Live The Mercantilist Industrial Policy King!**

The Neoliberal Globalization King Is Dead! Long Live The Mercantilist Industrial Policy King!

_By Michael Every of Rabobank_

The coronation of Charles III was a gloriously arcane ceremony that felt like the South Park Royal Wedding (" _The Prince is dipping his arms into the pudding, as is tradition_"); British social media noted the UK’s labor shortage and cost of living crises are so bad that a 74-year old man was forced to take his first real job. Charles III was preceded by the regalia of **US payrolls** **at 253K vs. 185K consensus**, with negative back-revisions, and unemployment at 3.4% vs. 3.6%. Yes, ‘gig’ jobs might now be recorded as real, but if this is full-employment near-feudalism, as under King Charles II, explain how average earnings growth leap to 4.4% y-o-y without saying “ _noblesse oblige”_ or showing knobbly knees in this intellectual beauty contest. Something, apart from wages, is up. Like short bond yields. Or air fares, as passengers’ willingness to pay high prices continues. Or wheat if the Black Sea Grain Deal falls apart, as was being threatened on Friday. And let’s see if US CPI is this week too. Indeed, as we say ‘Long Live the King’, another ‘king’ is dead – _neoliberal financial globalisation._

Adam Tooze says ‘Washington isn’t listening to business on China any more’, and while the US is not “ _eager_” for a war with it, one is perceived to loom in 2025(!), and businesses “ _peace interest_” has disappeared. He says **the only way to avoid war now is a “ _new security order_” for China in Asia, seen as “ _treasonous_” and “ _non-planetary_” in the US**(and much of Asia!); **as such, “ _the era of Davos man is over,_” and multi-billion dollar investments now hang by a thread.**

**The****recent policy speech** (https://pub.raboresearch.rabobank.com/public/r/vUfBkczoPiquRVhzhiLHyw/dbArgAJw216Uk9nkNck1jA/Efcru+1v_cg8rq2UTLNb6w) **by NSA Sullivan backed “** _**modern American industrial strategy**_ **,”** rebutted that free markets allocate capital best, and said geopolitics requires a new policy path to boost “ _specific sectors that are foundational to economic growth, strategic from a national security perspective, and where private industry on its own isn’t poised to make the investments needed to secure our national ambitions_.” As all 50 US states start what the Financial Times calls as ‘arms race’ for new investment under the recently-passed IRA, what Sullivan said is rightly seen as the death of neoliberalism (https://pub.raboresearch.rabobank.com/public/r/BMA4IuYMPY4wIG9wadXK7Q/dbArgAJw216Uk9nkNck1jA/Efcru+1v_cg8rq2UTLNb6w) by some. And the likely 2024 alternative is Trump’s mercantilism.

**Gcaptain (https://pub.raboresearch.rabobank.com/public/r/ygloGwBgzdWQ+i9i2yyQ8Q/dbArgAJw216Uk9nkNck1jA/Efcru+1v_cg8rq2UTLNb6w) notes the $25bn US Shipyard Act just introduced to the Senate** to revitalize US maritime infrastructure to out-pace China, with reforms to accelerate production over bureaucracy. Today, Wall Street won’t lend to the US Maritime Administration due a lack of transparency, and US Navy admirals “ _do not_ _understand Wall Street and are hesitant to learn about new financial engineering tools used by most large infrastructure funds today,”_ while Chinese shipyards can borrow cheaply. The Act aims to repeat the Truman Committee of 1941, which transformed US naval production into a WW2 colossus _._ Gcaptain concludes: “ _The urgency of this moment in history cannot be overstated. As_\[Senator\] _Wicker reminds the nation, we are in our most dangerous national security moment since WW2. He invokes the words of Winston Churchill, who once wrote that “the foundation of all our hopes and dreams was the immense shipbuilding program of the US.””_ This step, with more to come on support vessels and the merchant marine, were flagged as logically inevitable in 2021’s ‘In Deep Ship’.

**Germany is to subsidize up to 80% of energy costs for its industries** after awful March retail sales, import, export, and factory orders data: the cost will be high at present energy levels and extortionate should they rise; it could rip apart the EUs’ internal level playing-field; and may see an ex-EU trade response. This is also the scenario we warned of in ‘Balance of payments --and power-- crises (https://pub.raboresearch.rabobank.com/public/r/CyRXvP9WZGu3VzKMoTuLDg/dbArgAJw216Uk9nkNck1jA/Efcru+1v_cg8rq2UTLNb6w)’ \- and it does not end well for free-trade Europe or the Euro.

**Xi Jinping underlined China’s economic growth must focus on manufacturing (https://pub.raboresearch.rabobank.com/public/r/fJaON9Duz7fYY47NcaB65A/dbArgAJw216Uk9nkNck1jA/Efcru+1v_cg8rq2UTLNb6w)**, the “ _real economy_”, not bubbles in finance and property - Wall Street is not “productive”, as laid out here in…

**Regional Banks Rebound, But...**

Regional Banks Rebound, But...

_**Update:**_ It appears some have read the actual Fed data after all as regional banks are now red...

?itok=H_6xhAdG (

?itok=H_6xhAdG ( ?itok=H_6xhAdG)

?itok=H_6xhAdG)

Even PACW is fading fast now...

?itok=E2pqAdoW (

?itok=E2pqAdoW ( ?itok=E2pqAdoW)

?itok=E2pqAdoW)

Having rallied early after slashing its dividend.

\* \* \*

Regional bank stocks were soaring in early trading this morning prompting several talking heads to proclaim the end of the banking crisis and restating _**'there is nothing to fear but fear (and short-sellers) alone'.**_

There's just one thing about the rebound.

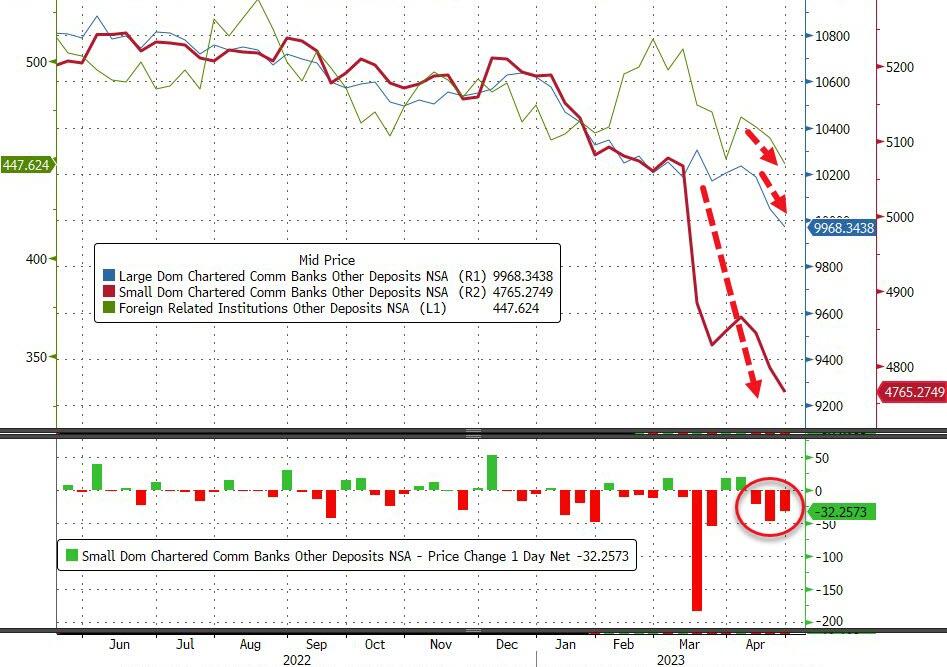

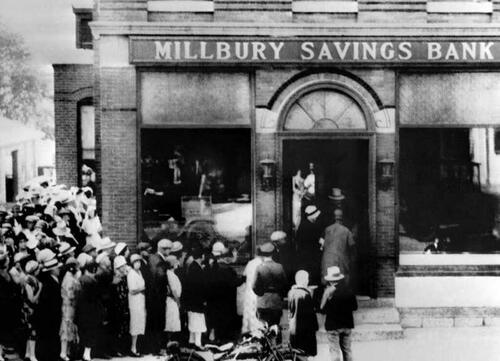

According to Friday's Fed data, (https://www.zerohedge.com/markets/deposit-outflows-continue-foreign-banks-bleeding-most) **deposit outflows continue**(non-seasonally-adjusted), especially for small banks...

?itok=SPpDtGeu (

?itok=SPpDtGeu ( ?itok=SPpDtGeu)

?itok=SPpDtGeu)

_Source: Bloomberg_

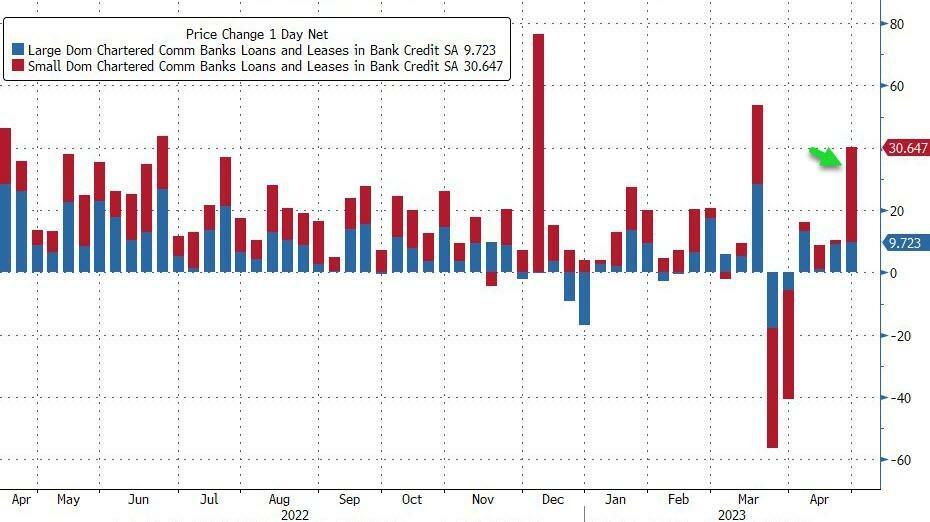

**BUT Small Bank lending also soared (https://www.zerohedge.com/markets/deposit-outflows-continue-foreign-banks-bleeding-most)**... especially in CRE loans

?itok=Dvm_Dbi6 (

?itok=Dvm_Dbi6 ( ?itok=Dvm_Dbi6)

?itok=Dvm_Dbi6)

_Source: Bloomberg_

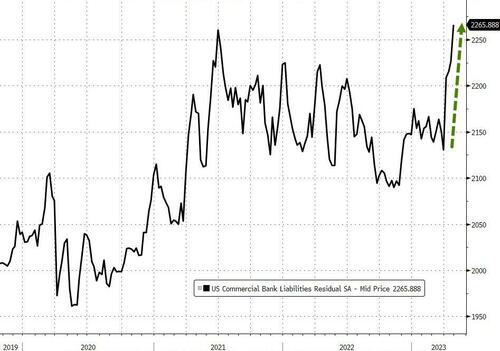

Which (theoretically) pushed implied US commercial bank **residual "equity" (assets minus liabilities) to record highs**...

?itok=PbOLS9TD (

?itok=PbOLS9TD ( ?itok=PbOLS9TD)

?itok=PbOLS9TD)

_Source: Bloomberg_

AND the drop in liabilities and rise in assets **pushed 'Small banks' away from the red line of reserve constraints (on a seasonally-adjusted basis)**...

?itok=gIOZukv4 (

?itok=gIOZukv4 ( ?itok=gIOZukv4)

?itok=gIOZukv4)

_Source: Bloomberg_

Which may help explain the squeeze higher in some regional bank names...

?itok=yRs7dOgT (

?itok=yRs7dOgT ( ?itok=yRs7dOgT)

?itok=yRs7dOgT)

**The question is - do you buy it?**

Do you believe in the miracle of Fed 'seasonals'?

?itok=3lUCdd8M (

?itok=3lUCdd8M ( ?itok=3lUCdd8M)

?itok=3lUCdd8M)

If you do, then the banking crisis is over and buying may make sense.

If you don't and this magical difference between SA and NSA is not an artifact of taxes (well past due now) or historical patterns (which it wasn't in January), then fade these bounces in regional banks as this is far from over.

> Here's a question:

>

> During a bank run when billions of deposits are getting yanked each day, do you seasonally adjust the bank run?

>

> Because that's what the Fed did and here is the deposit data:

>

> Seasonally adjusted: $12.5BN outflow

>

> Actual: -$120BN, or 10x greater, outflow pic.twitter.com/31wGBuXF4m (https://t.co/31wGBuXF4m)

>

> — zerohedge (@zerohedge) May 5, 2023 (https://twitter.com/zerohedge/status/1654597364731002880?ref_src=twsrc%5Etfw)

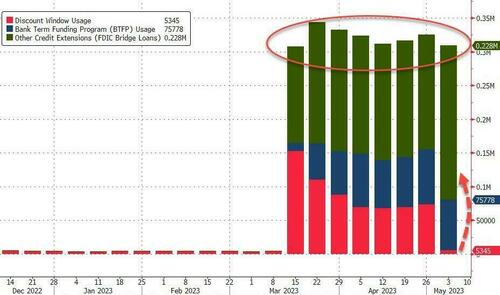

Finally, **we know some stress in the banking sector remains** as there are still banks who are paying above the top of Fed’s range for fed funds, i.e. 5.25%, to borrow reserves.

?itok=HX4zkqp1 (

?itok=HX4zkqp1 ( ?itok=HX4zkqp1)

?itok=HX4zkqp1)

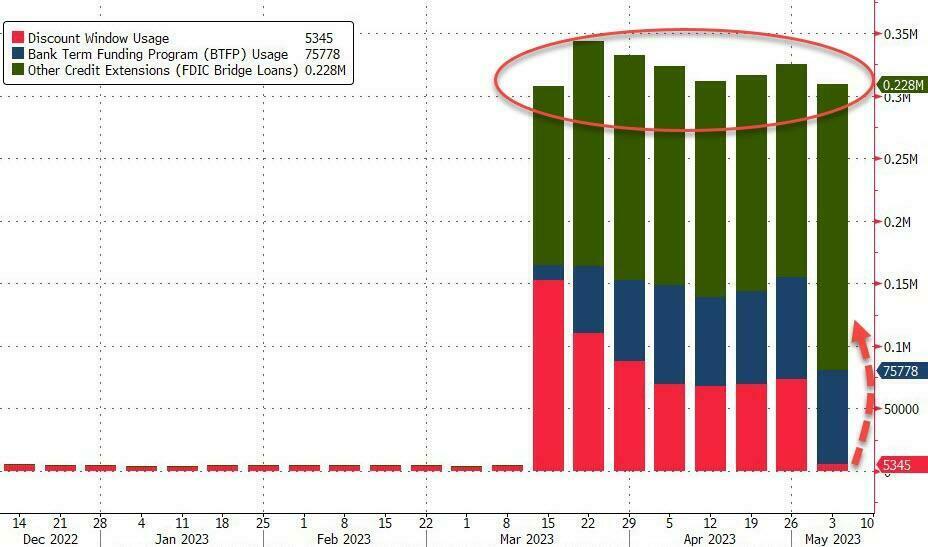

As Bloomberg's Simon White notes, discount window (DW) usage has fallen, but this has simply been transferred to the new BTFP facility, which has better terms than the DW.

**It is thus evident some smaller lenders continue to face fundamental problems.**

**And one more thing...**

> anyone who says bank deposit flight can reverse while Fed is doing QT has zero idea how the financial system works pic.twitter.com/rcPFOIdOrz (https://t.co/rcPFOIdOrz)

>

> — zerohedge (@zerohedge) May 8, 2023 (https://twitter.com/zerohedge/status/1655548408671662080?ref_src=twsrc%5Etfw)

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 05/08/2023 - 10:04

**Turkey Angrily Rejects US Request To Give Ukraine S-400 Air Defense System**

Turkey Angrily Rejects US Request To Give Ukraine S-400 Air Defense System

Turkey over the weekend announced that it has rejected a US request (https://www.hurriyetdailynews.com/turkiye-does-not-ask-to-return-f-35-program-but-wants-money-back-turkish-fm-182965) for Ankara to provide Ukraine with Russian-made S-400 missile defense systems, which it controversially acquired from Moscow in 2017, and which resulted in strained relations with the United States.

Foreign Minister Mevlut Cavusoglu revealed the request, and said it would be a violation of Turkey’s sovereignty, and strongly suggested the request was insulting in the first place. **"They made proposals that directly affect our sovereignty, for example, give us control over it, give it to another place. Where is our independence and sovereignty?"** Cavusoglu said.

?itok=pJyqpTJ7\

?itok=pJyqpTJ7\

_Turkish Defense Ministry/AFP_ ( ?itok=pJyqpTJ7)

?itok=pJyqpTJ7)

"The U.S. has made **various offers regarding the delivery of the Russian S-400s** missile defense systems in Türkiye to third parties, Çavuşoğlu also said," according (https://www.hurriyetdailynews.com/turkiye-does-not-ask-to-return-f-35-program-but-wants-money-back-turkish-fm-182965) to Turkish media sources.

He stressed that Turkey's answer is a firm 'no' (https://www.hurriyetdailynews.com/turkiye-does-not-ask-to-return-f-35-program-but-wants-money-back-turkish-fm-182965):

> The minister said one of the proposals made to Türkiye was to send the S-400s to Ukraine. “They told us ‘Will you send to Ukraine?’ We said ‘no,’” he stated.

Not only was Turkey hit with limited US sanctions in 2020 as a result of getting the S-400 systems, but the Pentagon also kicked Turkish pilots out of the F-35 training program, and halted delivery of the advanced Lockheed-made fighters.

Addressing this, Cavusoglu emphasized his government is demanding the money back which was spent on training.

"We are not saying ‘Let’s go back to the F-35 \[program\] right now.’ **We are saying ‘Give us our money back.’ Because we produce our own national combat aircraft**," he said.

US-Turkey relations also took a downturn over a period of years due to the Kurdish situation along the northern Syrian border. US special forces have long been embedded with the Syrian YPG and "Syrian Democratic Forces" - but which Turkey views as terrorist organizations with PKK roots.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 05/08/2023 - 09:50

**European Banks May Be Riskier Than US'... And More Regulation Won't Solve It**

European Banks May Be Riskier Than US'... And More Regulation Won't Solve It

_Authored by Daniel Lacalle,_ (https://www.dlacalle.com/en/european-banks-may-be-riskier-than-u-s-ones-and-regulation-will-not-solve-it/)

Deposits at U.S. commercial banks have fallen to lowest figure in nearly two years, according to the **Federal Reserve**. This figure has fallen by $500 billion since the Silicon Valley Bank collapse. However, total banking credit has risen to a new record high of $17 trillion, according to the U.S. central bank. **Fewer deposits, but more credit. What could go wrong?**

?itok=tUsheQlC (

?itok=tUsheQlC ( ?itok=tUsheQlC)

?itok=tUsheQlC)

**The inevitable credit crunch is only postponed by a consensus view that the Fed will inject all the liquidity required and that rate cuts will come soon.** It is an extremely dangerous bet. Bankers are deciding to take more risk expecting the Fed to return to a loose monetary policy soon and expecting higher net income margins due to rising rates despite the elevated risk of increasing non-performing loans.

The fact that the banking crisis has been mitigated does not mean that it is over. The banking system collapses are symptoms of a much larger problem: Years of negative real rates and expansionary monetary policy that have created numerous bubbles. The risk in the banks’ balance sheet is not just on diminishing deposits on the liability side, but a declining valuation of the profitable and investment part of the assets. Banks are so leveraged to the cycle and the expansion of monetary policy that they simply cannot offset the risk of a 20% loss on the asset side, a significant rise in non-performing loans or the write-off of the riskiest investments. The level of debt is so high that few banks can raise equity when things get worse.

**Deposit flight is not happening because citizens are stupid. The largest depositors are businesses, small companies, etc. They simply cannot afford to lose their cash if a bank goes to liquidation. Once the Fed introduced the discretionary decision on which banks’ deposits are made whole and which are not, fear took over again.**

Investors and businesses in America understand this.

**However, in the U.S. eighty percent of the real economy is financed outside of the banking channel.** Most of the financing comes from bonds, institutional leveraged loans, and private-direct middle market loans. In Europe, 80% of the real economy is financed with bank loans, according to the IMF.

You may remember in 2008 when European analysts repeated that the subprime crisis was a specific event that only affected the U.S. banks, and that the European financial system was stronger, more capitalized, and better regulated. Well, eight years later, the European banks were still recovering from the European crisis.

Why are European banks equally at risk, or more?

**European banks have strengthened their balance sheet with a very risky and volatile instrument, contingent convertible hybrid bonds.** These look incredibly attractive due to the high yield they have, but they can create a negative domino effect on the equity of the firm when things turn sour. Furthermore, European banks’ core capital is stronger than in 2009, but it can deteriorate rapidly in a declining market.

European banks lend massively to governments, public companies, and large conglomerates. The contagion effect of a rising concern about sovereign risk is immediate. Additionally, many of these large conglomerates are zombie firms that cannot cover their interest expenses with operating profit. In periods of monetary excess, these loans seem extremely attractive and negligible risk, but any decline in confidence in sovereigns can rapidly deteriorate the asset side of the financial system rapidly.

**According to the ECB, euro area banks’ exposures to domestic sovereign debt securities have risen significantly since 2020 in nominal amount.** The share of total assets invested in domestic sovereign debt securities has increased to 11.9% for Italian banks and 7.2% for Spanish banks, and close to 2% for French and German banks. However, this is only part of the picture. There is also a high exposure to state-owned or government-backed companies. One of the main reasons for this is that the Capital Requirements Directive (CRD), permits a 0% risk weight to be assigned to government bonds.

What does this mean? That the biggest risk for European banks is not deposit flight or investment in tech companies. It is the direct and uncovered connection to sovereign risk. This may seem irrelevant, but it changes fast and when it does it takes years to recover, as we saw in the 2011 crisis.

Another distinct feature of European banks is how fast the…

https://www.zerohedge.com/markets/european-banks-may-be-riskier-us-and-more-regulation-wont-solve-it

**Trump, DeSantis Beat Biden In ABC/WaPo Poll As Joe's Approval Hits Record Low**

Trump, DeSantis Beat Biden In ABC/WaPo Poll As Joe's Approval Hits Record Low

**A new ABC News/Washington Post poll (https://abcnews.go.com/Politics/broad-doubts-bidens-age-acuity-spell-republican-opportunity/story?id=99109308) has thrown a big splash of cold water on President Biden's nascent re-election bid**\-\- showing him losing in match-ups with either Donald Trump or Florida Governor Ron DeSantis.

In two 2024 matchups, here's how things stack up among Americans who say they would "definitely" or "probably" vote for a given candidate:

- **Trump 44% Biden 38%**. Undecideds lean Trump 49-42.

- **DeSantis 42%, Biden 37%**. Undecideds lean DeSantis 48-41

That's not all: **Biden's approval rating took a 6-point dive from its February level to reach an all-time low of just 36%.** Against data going all the way back to Truman, that's the **worst score for any first-term president** at this point in his term. Three predecessors who were in same ballpark -- Ford (40%), Carter (37%) and Trump (39%) -- failed to win second terms.

?itok=jgCHJHcO\

?itok=jgCHJHcO\

**Biden and DeSantis both top Biden -- but given a choice of 6 best-known GOP prospects, Trump trounces DeSantis among GOP voters 51% to 25% (** Getty Images via _WESH_) ( ?itok=jgCHJHcO)

?itok=jgCHJHcO)

The Biden administration's over-the-top emphasis on race in all manner of political nominations and appointments hasn't done a thing to improve his standing with blacks. In the most jarring of the new poll's results, **Biden's approval rating among blacks has fallen a staggering 30%** from his inauguration -- plummeting from 82% to 52%.

Heading into 2024, **watch for Biden to dangle an empty commitment to reparations** over the heads of black voters, just as he hit younger Americans with a loan-forgiveness head-fake (https://nypost.com/2022/11/11/bidens-student-debt-con-job-fooled-gen-z-for-the-midterms-will-the-kids-wake-up/) ahead of the 2022 midterms.

A hefty 56% disapprove of what Biden's done in office, and his perceived handling of the economy is a big reason why. **In a 54%-to-36% rout, Trump is perceived as having done a better job with the economy.** The economy ball-and-chain will only grow heavier for Biden as we move farther into the dark seas ahead.

Biden's age is clearly undermining public confidence. A full **68% of Americans think 80-year-old Biden is too old for a second term.** He's 80 today and would be 86 at the end of another term, assuming he lived to see it. While Trump is only four years younger, only 44% of American's think he's too old.

?itok=yz9nsTWs (

?itok=yz9nsTWs ( ?itok=yz9nsTWs)**Biden was** (

?itok=yz9nsTWs)**Biden was** ( ?itok=yz9nsTWs) **recently stumped (https://www.zerohedge.com/political/biden-forgets-he-went-ireland-tacitly-disowns-grandchild-stripper) when a child asked where he'd last traveled abroad -- forgetting he'd been in Ireland just 13 days before**(Win McNamee/Getty Images via _Fox News_)

?itok=yz9nsTWs) **recently stumped (https://www.zerohedge.com/political/biden-forgets-he-went-ireland-tacitly-disowns-grandchild-stripper) when a child asked where he'd last traveled abroad -- forgetting he'd been in Ireland just 13 days before**(Win McNamee/Getty Images via _Fox News_)

It isn't just age that worries Americans -- it's also Biden's observed condition. **Only 32% think he has the mental acuity to be an effective president.** Trump's score on having requisite sharpness has actually risen -- to 54% today from 46% in 2020. On physical fitness, only 33% give Biden a thumbs-up. Trump almost doubles him up, with 64% saying he's sufficiently fit.

Even the Blue Team groans in anticipation of a Biden 2024 bid: **Only 36% of Democrats want Biden nominated again**, with 58% wanting someone else.

**There's some bad news for Trump too**, as 56% say he should face charges related to alleged illegal attempts to overturn the 2020 election results, and 54% think he should face criminal charges over handling of classified documents and his actions relative to the Jan. 6 riots. Forty-one percent think Biden is honest and trustworthy, compared to 33% for Trump.

As much as these new results are likely to dampen Democrat confidence, **those hoping for a Republican takeover of the White House should remember that many a midterm poll pointed to a red wave that never materialized.**

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 05/08/2023 - 09:10

**The Trouble With 'The New Safety Trade'**

The Trouble With 'The New Safety Trade'

_Authored by Jesse Felder via The Felder Report,_ (https://thefelderreport.com/2023/05/02/the-trouble-with-the-new-safety-trade/)

There has been a lot of talk in recent months about the narrowness of the rally in stocks so far this year. **It’s no secret that the majority of the gains for the index have come from just a handful of stocks while many smaller names have performed much more poorly in comparison.** To wit, together Microsoft and Apple’s share of the the S&P 500 Index just rose to a new record high (https://twitter.com/jessefelder/status/1651978912627580928) while the Russell Microcap Index just fell to a new multi-year low (https://twitter.com/MichaelKantro/status/1653491070171226112).

?itok=0Ll9xq54 (

?itok=0Ll9xq54 ( ?itok=0Ll9xq54)

?itok=0Ll9xq54)

Some have explained the phenomenon by noting that investors now see Big Tech as the “new safety trade (https://www.marketwatch.com/story/its-not-the-twilight-zone-silicon-valley-bank-turned-big-tech-into-the-new-safety-trade-f3e9856?mod=mw_latestnews).”

_**“People are looking for safety and comfort given the cross-currents in the market, and tech gives them plenty of ease,”**_ as JPMorgan sales trader Jack Atherton tells the Financial Times (https://www.ft.com/content/b01c0a46-1162-4893-8b92-d42fbf4424a0).

That ease comes from the belief that Big Tech actually offers, in the words of Glenmede’s Jason Pride (https://www.wsj.com/articles/tech-stocks-appear-to-be-a-haven-from-the-banking-crisis-for-now-fd6dcf17), “downside protection during more difficult times.”

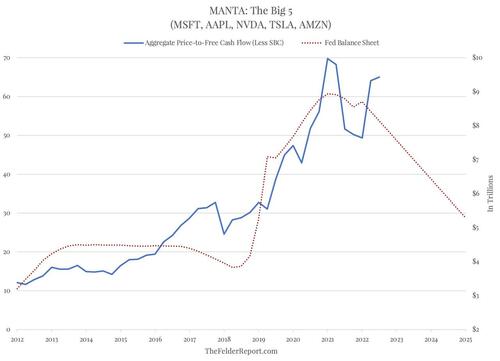

**Investors crowding into these names better be right because they are clearly making a major bet that these companies’ financial performance will not only hold up through the economic “cross-currents” to come, it will actually benefit from them.** How else can you explain that they are willing to pay 65-times aggregate free cash flow (less stock based compensation) for the five largest stocks in the Nasdaq (as of last year (https://thefelderreport.com/2022/04/27/the-trouble-for-big-tech-stocks-in-two-charts/))?

?itok=YYcRBk2h (

?itok=YYcRBk2h ( ?itok=YYcRBk2h)

?itok=YYcRBk2h)

**Over the past decade, their average valuation has been less than half the current level.** So it would appear there is a very real risk that if the economy enters recession and these companies are not immune to its effects their collective valuation could revert to some degree or another, a process that could prove inordinately painful given the extreme valuations they trade at today. Even assuming the economy manages to avoid recession, allowing the Fed to maintain its current policy of “normalizing” the balance sheet, that reduction of liquidity alone could exert downward pressure on valuations.

**Either way, the “new safety trade” appears to be priced for perfection – and by perfection I mean a return to ultra-low interest rates (supporting extreme valuations) along with a return to rapid top line growth while maintaining fat profit margins (supporting the figures those valuations are based on).** Absent such a pristine outcome, investors may be disappointed to realize that Big Tech isn’t so safe after all.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 05/08/2023 - 08:50

**Anheuser-Busch CEO Blames Bud Light Boycott On Social Media "Misinformation"**

Anheuser-Busch CEO Blames Bud Light Boycott On Social Media "Misinformation"

The CEO of the "inclusive" AB InBev blamed "misinformation" on social media for stoking a nationwide boycott of Bud Light following the brewer's move to promote the beer with TikTok trans influencer Dylan Mulvaney (https://www.zerohedge.com/political/bud-light-goes-woke-trans-tiktoker-boycott-calls-intensify).

> _People often talk about this topic in social media like noise... You have one fact and every person puts an opinion behind the fact. And then the opinions start to be replicated fast on each and every comment. By the time that 10 or 20 people put a comment out there, the reality is no longer what the fact is, but is more \[about\] what the comments were," chief executive Michel Doukeris told the__Financial Times_ (https://www.ft.com/content/dc63c64c-d32e-460a-afdc-458c94860c93?segmentId=114a04fe-353d-37db-f705-204c9a0a157b) _._

Instead of taking the blame for the company's catastrophic attempt to virtue signal, even if it means alienating the vast majority of its clients, Doukeris instead blamed online **"misinformation and confusion"**, including reports that Mulvaney's Bud Light can is "a production can and every can would be like the one that was in that post . . . We never intended to make it for general production and sale for the public." Well, that's just a brilliant way for InBev to **also alienate the progressives** after scrambling to distance itself from the entire fiasco.

?itok=FiaC_4r8 (

?itok=FiaC_4r8 ( ?itok=FiaC_4r8)

?itok=FiaC_4r8)

He said others thought it was a Bud Light campaign while "it was not: it was one post. It was not an advertisement." Narrator: it _**was.**_

> Dylan Mulvaney has become the new brand ambassador for Bud Light. 🍺

>

> The beer brand even made a special edition Dylan Mulvaney Can 🥤celebrating his 365 days of girlhood.

>

> (This is not April Fools, it’s actually real)

>

> 🍺🍻🍺😒🍻🍺🍻 #dylanmulvaney (https://twitter.com/hashtag/dylanmulvaney?src=hash&ref_src=twsrc%5Etfw)#trans (https://twitter.com/hashtag/trans?src=hash&ref_src=twsrc%5Etfw)#transgender (https://twitter.com/hashtag/transgender?src=hash&ref_src=twsrc%5Etfw)pic.twitter.com/xuu87WxrvZ (https://t.co/xuu87WxrvZ)

>

> — Oli London (@OliLondonTV) April 1, 2023 (https://twitter.com/OliLondonTV/status/1642270770146541568?ref_src=twsrc%5Etfw)

Doukeris was furious about videos of billboards with images of the Bud Light can inserted "electronically" and "10mn people \[were\] watching it and commenting . . . That had nothing to do with Bud Light, it was just like pure social media creation."

Last Thursday, Doukeris said in an earnings call that Bud Light's decline in US sales for the first three weeks of April accounted for 1% of the brewer's global volumes. He did not comment on potential full-year impacts, indicating it was "too early to have a full view."

During the earnings call, Doukeris attributed the Bud Light controversy to "misinformation."

> LISTEN: @AnheuserBusch (https://twitter.com/AnheuserBusch?ref_src=twsrc%5Etfw)'s CEO blames "misinformation" for @BudLight (https://twitter.com/budlight?ref_src=twsrc%5Etfw) being "pulled into" controversy/the political debate, following their sponsorship of trans-TikToker Dylan Mulvaney: pic.twitter.com/GEbbrI1juE (https://t.co/GEbbrI1juE)

>

> — Will Hild (@WillHild) May 4, 2023 (https://twitter.com/WillHild/status/1654164048676519940?ref_src=twsrc%5Etfw)

He noted the boycott is having a negative impact on overall sales.

> LISTEN: @AnheuserBusch (https://twitter.com/AnheuserBusch?ref_src=twsrc%5Etfw)'s CEO confirms the @BudLight (https://twitter.com/budlight?ref_src=twsrc%5Etfw) backlash is having an \*ongoing\* negative impact on their overall sales, saying it's "too early" for the company to "understand the duration and total impact..." pic.twitter.com/EVFTspIrft (https://t.co/EVFTspIrft)

>

> — Will Hild (@WillHild) May 4, 2023 (https://twitter.com/WillHild/status/1654168679355908113?ref_src=twsrc%5Etfw)

The latest data from Bump Williams Consulting based on Nielsen IQ data show boycotts of Bud Light collapsed sales by 26% from a year ago for the week ending on April 22.

Bud Light executives have been desperately scrambling to restore (https://www.zerohedge.com/political/weve-never-seen-such-dramatic-shift-bud-light-hopes-new-ad-blitz-can-overcome-corporate) the brand's image by accelerating the production of new ads, according to the Wall Street Journal.

Meanwhile, sales of rival brands Coors Light and Miller Light each grew 21% during the same period ending April 22.

Bud Light is now facing boycotts from both ends of the political spectrum as LGBTQ bars are displeased with the brewer's lack of support for Mulvaney.

Tyler Durden …

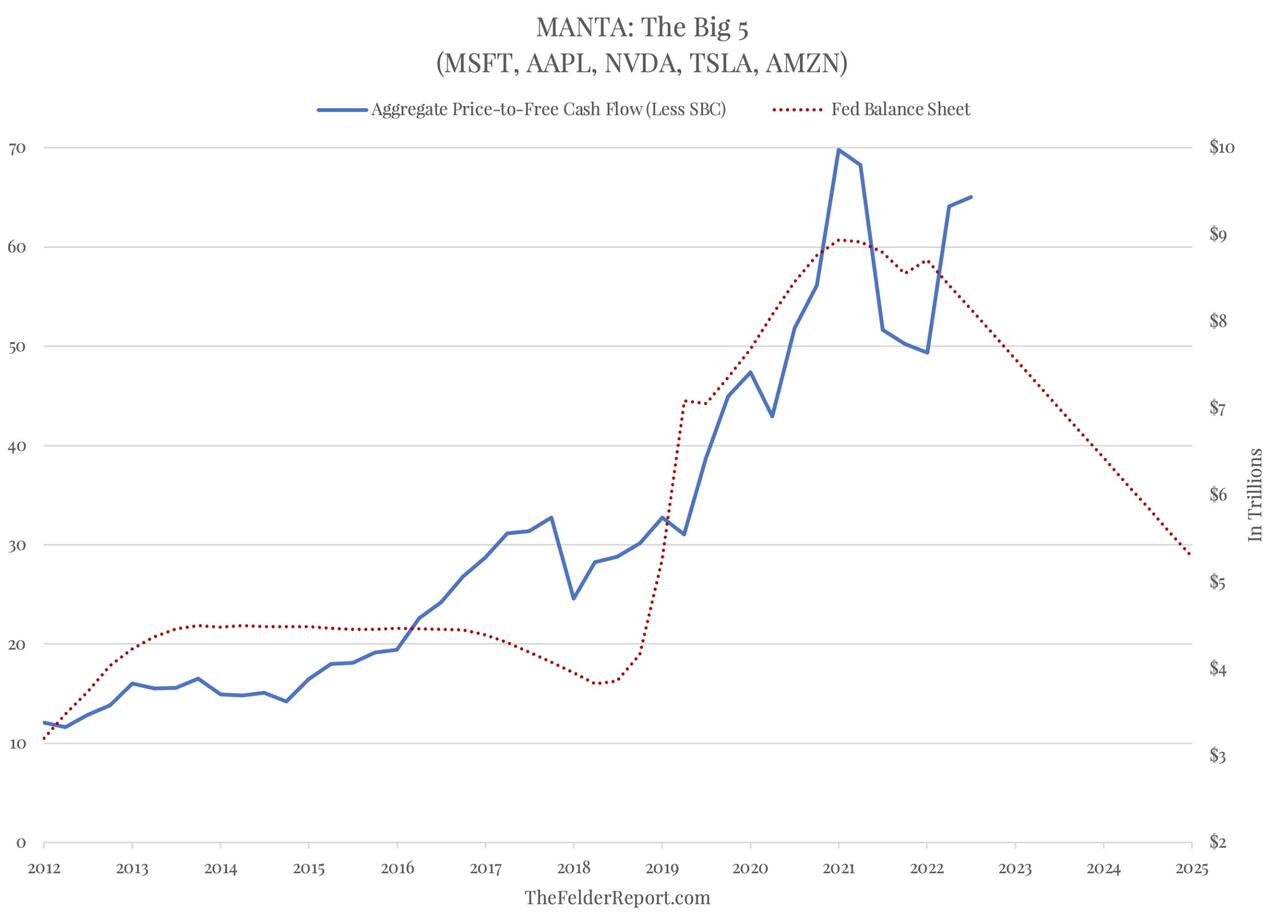

**Futures Rise As Regional Banks Squeezed Higher**

Futures Rise As Regional Banks Squeezed Higher