Hopefully the painful lessons of paper-metal will prime the market to hold the real thing:

BTC way easier to self-custody and way, way easier to verify than metals

"Calm down Doctor. Now is not time for fear...

That comes later."

- Bane

Dark Knight Rises

NYT

Quiet Part Out Loud

Geng Ngarmboonanant

Managing director at J.P. Morgan Asset Management. He served as a deputy chief of staff to Treasury Secretary Janet Yellen from 2023 to 2025. The views he expresses are his own.

Gold at 32 trillion total value: based on 220,000 metric tonnes of gold above ground, at a USD exchange rate of $4530

Historic average annual production of gold is 3000 metric tonnes per year. This will no doubt trend up if gold keeps riping.

#bitcoin

NEW: 🟠 Traders on Polymarket give Bitcoin better odds than both gold and the S&P 500 to be the top performer of the three in 2026 👀

Source: https://x.com/BitcoinNewsCom/status/2004606541559951857?s=20

people buying gold and S/P arent on polymarket

Send it!!

Send all the short-maxis, the weak, the low-time-preference, tourist, traders, non-convicted, packing. F-them.

Money for Everyone

2017-2022 5-year even more brutal...

4 years from 2021 to now have been the worst of any other 4-year time span.....

brutal

shout out to the HODLers who started stacking xmas 2021

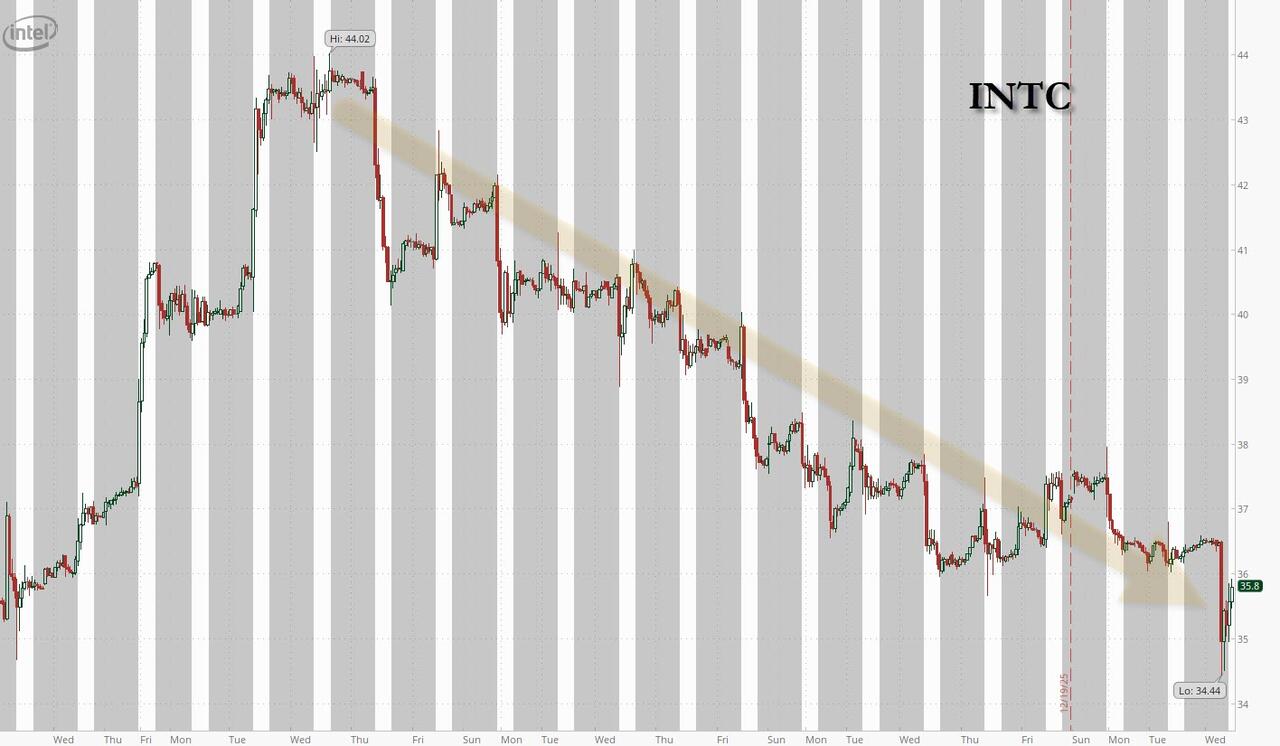

Intel Slides After Nvidia Halts Tests Of 18A Tech, White House Signals Chip Giant Not "Too Strategic To Fail"

Intel Slides After Nvidia Halts Tests Of 18A Tech, White House Signals Chip Giant Not "Too Strategic To Fail"

After President Donald Trump publicly attacked Intel CEO Lip-Bu Tan in August, writing, “The CEO of INTEL is highly CONFLICTED and must resign, immediately,” Intel rushed to arrange a White House meeting that became a turning point for the struggling chipmaker which was on the verge of failure, https://www.reuters.com/world/us/how-silicon-valley-dealmaker-charmed-trump-gave-intel-lifeline-2025-12-24/

.

Tan, a veteran venture capitalist with a long history of investments in China, prepared for the meeting, seeking support from influential allies including Nvidia CEO Jensen Huang and Microsoft CEO Satya Nadella.

The roughly 40-minute Oval Office meeting included Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent, and focused on how Tan would stabilize and rebuild Intel at a moment when US semiconductor policy had become a central national priority.

During that meeting, Tan agreed to the proposal which was already reported and which saw the US government receive equity in Intel in exchange for additional CHIPS Act funding. The agreement delivered $5.7 billion in cash, made the U.S. government Intel’s largest shareholder, and conferred on the company what many investors now describe as a “too-strategic-to-fail” status.... although maybe not.

?itok=aQLjBdp2

?itok=aQLjBdp2

After the deal, Tan pledged to “make Intel great again,” which Lutnick posted under the caption, “The Art of the Deal: Intel.” The government’s involvement quickly helped "improve" Intel’s standing with potential partners and customers eager to align with the administration’s industrial strategy.

Sure enough, since Tan became CEO in March, but really since the deal with the Trump admin, Intel’s stock has climbed about 80%, far outpacing much of the broader market. The new momentum helped secure major investments, including $5 billion from Nvidia and $2 billion from SoftBank.

Technology lobbyist Adam Kovacevich called the government deal a “lifeline” for Intel, suggesting the company’s leadership and strategic direction might have been in jeopardy without it. At the same time, Tan began a sweeping internal restructuring, cutting roughly 15% of Intel’s workforce, flattening management layers, and pushing for faster, more engineering-driven decision-making across the organization.

That's the good news. The bad news is that, well, despite the optics little has changed.

As Reuters notes, despite the improved deal flow (or at least perception thereof) and the political backing (in exchange for a pound of flesh equity), Intel’s core manufacturing challenges remain and the Commerce Department appeared to make it clear that they are not a guaranteed priority, and in fact more dilutions for the benefit of taxpayers may be on deck.

Intel is not "too strategic to fail" one official told Reuters refuting the prevailing market mantra which assumes the opposite, adding that "Secretary Lutnick talks to all parties rather than prioritizing calls for Intel’s sake."

And while the company claims that its advanced chip process is “progressing well,” there was more bad news - which apparently never rose to the level of 8K importance - after Nvidia recently tested Intel’s 18A manufacturing technology and chose not to proceed. Even after investing billions, Nvidia made no commitment to manufacture its chips at Intel, and Tan acknowledged the limited scope of the partnership, saying, “Right now we are focused on collaborations."

But now that the forced deal "honeymoon" period is over and the stock is once again drifting lower, Tan may want to consider focusing on delivering results because the goodwill that the CEO bought by going in bed with Trump is almost over.

In response to the Reuters report, INTC stock dropped as much as 4%, and down almost 20% from its recent high at the start of the month. It still has a long way to fall to the low $20 where it traded before the company announced its "tactical alignment" with the US government.

?itok=UPX0nFAs

?itok=UPX0nFAs

https://cms.zerohedge.com/users/tyler-durden

Wed, 12/24/2025 - 12:25

https://www.zerohedge.com/markets/how-lip-bu-tan-turned-trump-rebuke-intels-biggest-break

"AI backstop" will be the mother of all printing events.

"Too strategically critical to fail".......

The printing will make 2008 and 2021 look like child's play

hopeful he is on nostr as a nym.....

nostr:nprofile1qqsvf646uxlreajhhsv9tms9u6w7nuzeedaqty38z69cpwyhv89ufcqpzemhxue69uhhyetvv9ujumn0wd68ytnzv9hxgqgkwaehxw309aex2mrp0yh8qunfd4skctnwv46q52nf7x

Daring haters to short 21:

"Fade us at your own risk....clip that M-F-er"

🔥

Everyone eventually bends the knee.

killed vs wounded matters a lot, many wounds easily fixed/healed

Relentless stacking. Use a money they cannot control.

“On December 15, 2025, Ukraine opened a new chapter in naval warfare by using an underwater drone to strike a Russian submarine in the defended port of Novorossiysk. It was the first time a UUV had ever been used in a strike. The target was a Kilo-class submarine, valued at roughly $500 million.

UUVs operating in the Florida Straits and near the Panama Canal would put at risk the commercial arteries that carry half of American trade and the sea lanes that sustain military power projection. That is the kind of threat that changes posture overnight.

Venezuela has established a pattern of accepting foreign-enabled drone production, electronic warfare support, and strategic naval deployments. The regime has built the infrastructure (ports, coastal access, cartel logistics, sanctions evasion channels) that would support a UUV program. If Iran is willing to transfer drone manufacturing capability and deploy seabase ships into the Atlantic, the step to UUVs is not a leap. It is an extension of what is already underway. And it is the extension that would explain why Washington responded the way it did.”

https://medium.com/@mcnai002/the-venezuelan-drone-crisis-313dad18497d

Good thing about weapon tech upgrades - they get stolen/adopted VERY fast.

Then playing field is re-leveled - incentivizing peace

++ class of 2021 stacking pre-ftx at $40-55k - its been 5 long years for a less than 2x....

also crushed by Gold

Doing nothing is a superpower

ATH priced in Gold: 12/17/24

40 Ounces

✅Stay humble.

✅Stack sats.

✅Also, work to avoid force selling.

✅Also produce value - this will be best longterm method to get sats....

The Fiat-BTC transition phase might last longer than we think

Bitcoin is C A S H

as in

Peer-to-peer Cash

*Cash* as in the most liquid bearer asset that you can use without permission.

You keep cash to protect against future uncertainty.

Cash is king.

Bitcoin is the best cash.

So a lot of people seem to have the hope that Trump will pardon the Samourai Wallet developers.

While waiting for the Storm verdict, I took some time to read through the White House Digital Asset Report to see what this administration thinks of financial privacy, and my guys - if you still believe that the Trump WH is in *any* capacity friendly to these undertakings, you are in for a very rude awakening.

nostr:nevent1qqs8l0xmfnwuce7unyqyk2wtlpps0pq8p2wdyj9s9c4ajawgh35z7csfxfmx2

Effectively, the White House urges FinCEN to deem *all* privacy measures in digital assets a “primary money laundering concern” under the PATRIOT Act.

This includes:

-> single use addresses, wallets and accounts

-> swapping between networks & chains

-> mixers, obviously

-> “pooling” or “aggregating” cryptocurrencies from multiple wallets

Many will now say: oh, but there’s so much good language in the report as well, like the protection of self-custody.

That’s true, but the protection of self-custody is contingent on the *lawful exchange* of assets between users.

That’s why the White House additionally urges Congress to *expand the PATRIOT Act* and *amend the BSA to cover “DeFi” services*.

To ensure compliance in “DeFi,” the White House suggests the implementation of digital identities, that would tie all of your transaction history to your name, so that “DeFi” services have the power to approve transactions.

Even when implemented with ZKProofs, as the White House suggests, this would effectively turn a permissionless system into a permissioned one.

I know we live in the age of celebrating all the Bitcoin wins, but sometimes things that glitter are just a massive pile of shit, my dudes.

chill, how can they prove I have any pvt keys?

1994 Ill Communications - peak 90's - all downhill since

Bitcoin wasnt created/discovered for niche subgroups:

-not for devs to innovate on

-not for finance-bros to arb

-not for influencers to monetize

-not for gov insiders to front-run

✅ Bitcoin is for the PRODUCTIVE HUMANS - those making real stuff, in the real world - to save their work/talent/effort in a money that is reliable and secure

One winner. Completely ignores *who should win*

Chain with the most work is king, even if cheaters *slipped in* a double-spend

Generals had to have consensus on one thing before the headed off to their bunkers: message with the most work is the truth, that is it.

Yes. That also.

🍿

https://fountain.fm/clip/uVT9Wp93cDLYKhPG5y22

Worth a listen, but the begining of this TL;DR part was confusing.

Script contains

1) Opcodes

2) Data

One must satisfy the INPUT locking scripts, but as *the sender* i.e. the one *making* the transaction, you DO NOT CONTROL the output locking scripts - that was already defined by the person who made/created the addresses you are outputing to ....

EXCEPT with OP_Return: the transaction creator/sender adds one additional output with a zero sats and Op_Return as the script. An OP_RETURN locking script is unspendable, so there's no ScriptSig that can unlock it.

Op_Return was added as the 5th Legacy Standard Script type MARCH 2014. All legacy scripts (pre-Segwit) are unlocked via the ScriptSig field.