I just found out that the guy who ignited the Tesla truck also killed a bunch of people with a car. 😢

People are so evil and misguided.

Honestly it takes a special person to be as precise and accurate as a robot. Weirdos like me that obsess over logic have an edge in that department. Not to brag, I'm just part cyborg (I do have metal plates in my bones lol!)

Some very good points there. Layer 2 solutions on Monero should be interesting. However, for much of it you're also still comparing how things are now, and not paying too much mind to how they will develop. Lightning is very likely to become cheaper since the Bitcoin protocol consensus is most likely going to incorporate the CTV operation, which enables lightning to scale better. Existing implementations of Lightning are still in beta and will get better with development, and become more easy to spin up and to automate. Running a self sovereign lightning node even in this stage of development is quite easy for power users to do, and LSPs are plentiful and any one person can become one, so it's not a monopoly by any stretch of the imagination.

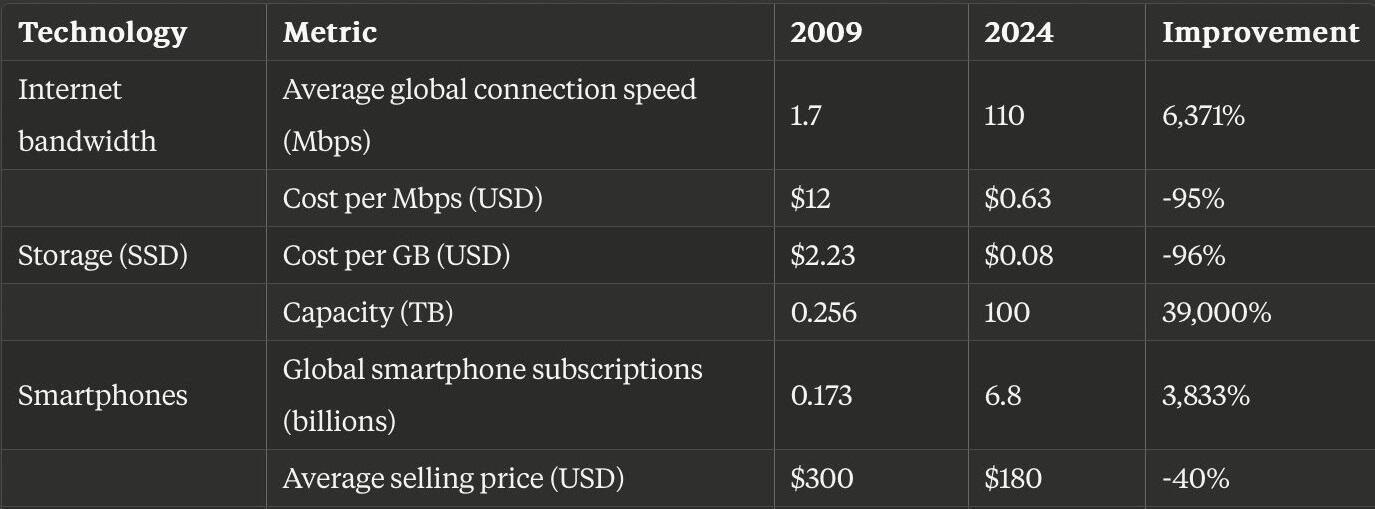

I'm uncertain how Monero scaling will work along with hardware and bandwidth constraints: these still have to be limited, I think, either to a specific maximum or average rate, or to some other kind of constraint specified and enforced by the noderunners. Bitcoin has this in simple form as a fixed number of weight units.

You may think bitcoin is bleeding value through transaction fees vs the alternative of bleeding very little value from low transaction fees, but this ignores the fact that holders of monero are paying _all the time_ for security of the network, via mild dilution of their holdings. It's a tradeoff. It's just a question of how do you want to pay for mining: mostly just transaction fees vs constantly while holding. You're paying for those tail emissions whether you think you are or not, unless you only use Monero as short term cash. I'm not implying that that's the only thing it's good for, but I am saying that that's the only way to avoid paying a nontrivial amount for security on it.

Arguably a non-transparent cash NEEDS tail emissions in the long run, in order to diminish the value of long term holdings that no one can audit, in case of someone who held on forever in the shadows gaining too much influence and destabilizing the price. Bitcoin makes more of that info of who holds what and who probably lost their coins public, which allows us to point to why sudden price volatility might be happening when old whales start exerting influence.

It's over, pack it up boys 🤕🤖

nostr:nprofile1qqst8vw4szfsd3jzklr7nuqulxnn48wgkd35vdmkxcwjthqfylds42qpg3mhxw309aukkenddackumtydp4xzae5w94kj6rkw95kwunp095h2umrd3n8z7rxdqexcapnvee8gmreddhkg7f4wamhvcmxd9jzummwd9hkutcc3wc0a nostr:nprofile1qqs9pregv44cmdpkz574yww72q62hsp4rwxfptpnu6c4d5075e9jjcqpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c33xfars6nnv468gvmtxee8vwtxvyexwatpw56hqdf5xpchyvncw4mx57ntwgux2dpnxfkkwmrpve48gwfewdckkaee0fkhs0mzwfhkzerrv9ehg0t5wf6k2qg6waehxw309aex2mrp0yhxummnw3e8qmr9vfejucm0d5q3samnwvaz7tmwdaekgunfwejjuctswqhhyetvv9usnly6cs nostr:nprofile1qqsvlca5x9keq5e4km8q26aqas3skkr6xdpcr6ptlxsz5xz095rglrgpz4mhxue69uh5yetkduhxummnw3erztnrdakszyrhwden5te0dehhxarj9emkjmn9qyxhwumn8ghj7mn0wvhxcmmvurc4ss

lol! I already predicted this. MORE common, idk, but very common for both sexes.

And the Liquid federation facilitating trade of shares and derivatives that the whole world can partake in for investing purposes

I love all the weird shit on nostr lololol

Private information metrics on a public good. Bitcoin is public and open by contrast. Enables a more informed economic actor to make the choice between systems 🤙🧡

One of the biggest issues with Monero is the blockchain bloat. Full, node space requirements are growing very fast and are not extremely scalable, as they are tied to Monero's transaction volume. This limits how decentralized it can be according to how popular it becomes. Even though there is a penalty for mining extraordinarily large blocks, the penalty is based on an average which can grow substantially due to user demand, user demand which is not checked by supply constraints in the long run, though it is in the short run. This means that the greater the number of transactions it gets as it becomes more popular, the more centralized noderunning will have to be, unless its popularity grows significantly slower than hard drive space.

One of the best things going for it, in light of this, is that it doesn't have mass appeal. This is enforced by the tail emissions, which although clever as a way to replace lost coins, dilutes people's holdings compared to Bitcoin's emission schedule of having a hard cap. Bitcoin is therefore so scarce that its NGU is stronger than any other currency in the world, and this is constantly drawing more people to it as a way to not only store wealth, but grow wealth over time compared to Monero. Bitcoin is also the most established player and it is scaling with layers and very slow iterative changes within a voluntary consensus.

For Monero to work for as many people as bitcoin can now, let alone the whole world, it would need to make further changes have some way of enforcing not only a mean reversion of block size as it has now, but also tailoring this mean to reflect the growth in hardware capacity of a typical person to keep the network decentralized on the full node level. If it got really really popular, it would then also likely need layered scaling solutions like Bitcoin has, like Fedimint, Liquid, and Lightning. Even then, it will not be a global settlement layer, as that needs to be protected by ASICs, not general purpose CPUs. And given the choice between a sound issuance schedule like Monero's and an extremely sound issuance schedule like Bitcoin's, people, especially the big players, are going to converge on Bitcoin as the store of most of their wealth. Monero, if it implemented some of these changes, could continue to be a compelling private electronic cash system as it arguably is now. Until then, its future is uncertain, and lightning with BOLT12, Liquid, and P2P exchanges facilitate a similar experience on Bitcoin that holds its value better and scales to many many millions without losing its decentralization.

https://www.youtube.com/live/1ahI41LXTT4

#anarchism #classicalliberalism #ancap #libertarianism

Another thing I like about being a scientist: discovering ways to earn income anyway, despite my lack of official opportunities

There is no distinction between a classical liberal who understands logic and an anarcho-capitalist. Government by consent of the governed === no government.

Hot take: information is not dangerous. The will to harm is.

What I love about being a scientist, even in our credentialist society:

Spending much of my time just pondering, asking questions, deducing, observing, learning new things.

What I dislike about being a scientist in a credentialist society:

No one gives a shit so I get no money because "the government funds public goods," and I don't live off the government dole, nor do I have an official higher level degree, nor do I have an income to speak of because again, degree worship.

It merely prompts me to ask questions about this and to be skeptical of claims in the history books that I thought were certain. It sounds like misinformation to me but I remain open minded, especially as I am aware of the frequent utilization of convenient scapegoats by state apologists.

How does one profit from asymmetric information? Idk, but I'm working on it, while developing a theory of property based on it.