you're being a knob. the difference between a fixed supply and a low amount of tail emission is negligible and doesn't impact anything in real life.

the number of bitcoiners who don't care that chaumian ecash is custodial is frankly astonishing. this is supposed to be treated like an emergency. chaumian ecash throws trustlessness completely out the window. I am completely stunned by the mental gymnastics they are using to rationalize it.

I don't like this chicken and egg problem. I never totally bought into the narrative that if we attract enough agorism onto a basic crypto asset then eventually it will become stable. it's possible to make a stablecoin that isn't pegged to a government currency at all and that would be valuable for electronic commerce. maybe this type of stablecoin shouldn't be called a stablecoin, it's very confusing. people think stablecoin means dollar peg. it doesn't have to be.

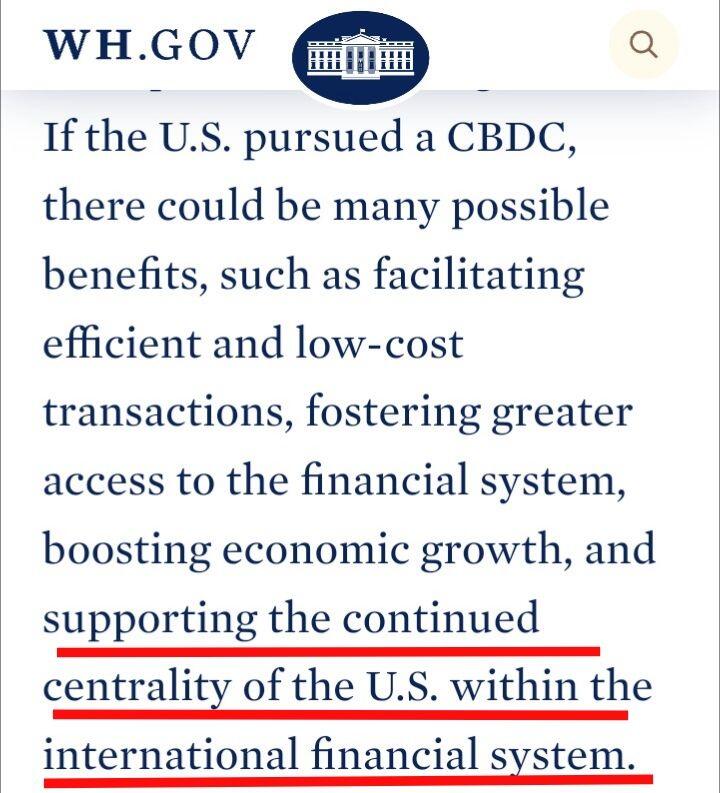

this admin already pushed people away from using the dollar. this can't possibly be the real reason

if someone wandered into https://ethresear.ch and proposed chaumian ecash, everyone there would have said "that's FUCKING stupid get out."

bisq has the same problem and nobody in bitcoin land even wants to do anything about it. I've never seen a bitcoin maxi use a real DEX

bitcoin would be treated like this if it did more than a tiny fraction of what its cheerleaders claim it does

1. ruin it. keep blocks small and introduce the lying notwork. pay influencers to misrepresent the usefulness of payment channels.

2. pump the crippled chain. attract speculators and drive away the original userbase. convince people that everything's fine because the market cap is so high.

3. teach people to use it wrong. trick vulnerable noobs into using custodial solutions like ecash and wallet of satoshi. lie if you have to.

4. wait for people to get rugged.

5. tell the public that the whole thing was a dumb idea. the plebeians can keep using venmo and fidelity.

bitcoin and monero are not proxies for a political process, you are right about that. it's still very ugly and embarrassing to bend over backwards for totalitarians. please let my number keep going up, I promise to be a good boy. absolutely disgusting. you shouldn't invite elizabeth warren into your version control system. if she is terrorizing you, go ahead and deal with her, but don't cripple your computer project in an attempt to appease her.

payment channels are a distraction. payment channels are never going to be the general purpose scaling solution for everyone. use sidechains to hold yourself over until rollups are completed.

I tried aqua and thought, if I end up generating liquid transactions every time I use it whether it's for lightning invoices or not, why don't people just use liquid instead for now? then it reminded me of ETH sidechains. they were sold as a temporary solution until rollups are completed and people were very happy with that.

the ETH people played with state channels for like 10 minutes and decided that they were bullshit, then they built a sidechain similar to liquid that saw massive popularity, and now they are working on rollups. you can follow the same path.

bitcoin maxis be like

>we must never sacrifice decentralization

>except for layer 2 and wallet infra then it's ok

brain damaged. to the glue factory with you!

I’m not sure how the difference of treatment between “cleaned” and “dirty” #Bitcoin by financial institutions will end up playing out but the worst case scenario would be a different exchange rate and market for each category. Unless Bitcoin moves to proof-of-stake I don’t think that the censorship of P2P transactions of “dirty” bitcoins is likely. Having two markets/exchange rates would already be a quite destructive consequence. https://casten.house.gov/imo/media/doc/blockchain_integrity_act.pdf

proof of stake doesn't have less censorship resistance than proof of work. both styles are observed to have the same degree of vulnerability to OFAC compliance (some), and the same mitigation (wait longer). if you want maximum censorship resistance, it doesn't matter if there is proof of work or proof of stake. you need to take away the ability for block producers to discriminate the transactions in the mempool by making them all look the same.

it looks like vaporware if you compare it to uniswap clones. it's not meant to be a piece of junk and that takes time.

wasn't decentralized. only a matter of time

what should happen is you take one look at something like ecash, notice immediately that it is custodial, and completely dismiss it. if you don't do this, you have severe brain damage.

it baffles me how many lightning nutjubs are gleefully throwing self-custody in the garbage. what is going through their heads? any system that doesn't have 100% self-custody is completely against the point of bitcoin.

>lightning makes monero obsolete

if that's true, why don't DNM admins believe a single thing you say?

I was around when monero had no official GUI wallet. it took forever. people swore it would never happen. then it happened. these things take time. if you slap it together it might break like some cheap uniswap clone. monero is better than that.

there are some markets that don't care about their customers. they allow things like bitcoin and fentanyl. they just want more money. very sad. there are other markets that don't allow these things.

listen, I remain totally unconvinced that monero is inadequate for building electronic commerce to trade physical goods, or that any bitcoin developer has a suitable replacement, specifically because of the behaviors of DNM admins. they have the capacity to build functioning electronic commerce platforms from scratch. but also, if any of it breaks they risk going to prison forever or maybe even execution. this is the most intense litmus test that we can observe anywhere in the world. bitcoin is failing the test. nobody finds himself saying "if I make the wrong choice I may be killed" and then picks bitcoin.