That's what I built originally, but from the scaling perspective, the design looked terrible so had to manipulate the scale a bit.

Another dynamic dashboard with partially real-time data coming to nostr:npub1gkkahxwca30rf2td22u9p3jnmlh79dylgmm2et0kykftle6tdcysj4zden. Total Global Assets. As #Bitcoin continues its journey to the top of the global asset rankings, we’ll track its progress together in real time and watch the orange rectangle grow larger and larger. 🧡 🚀

GM Nostr! Attack your goals relentlessly. 🫡

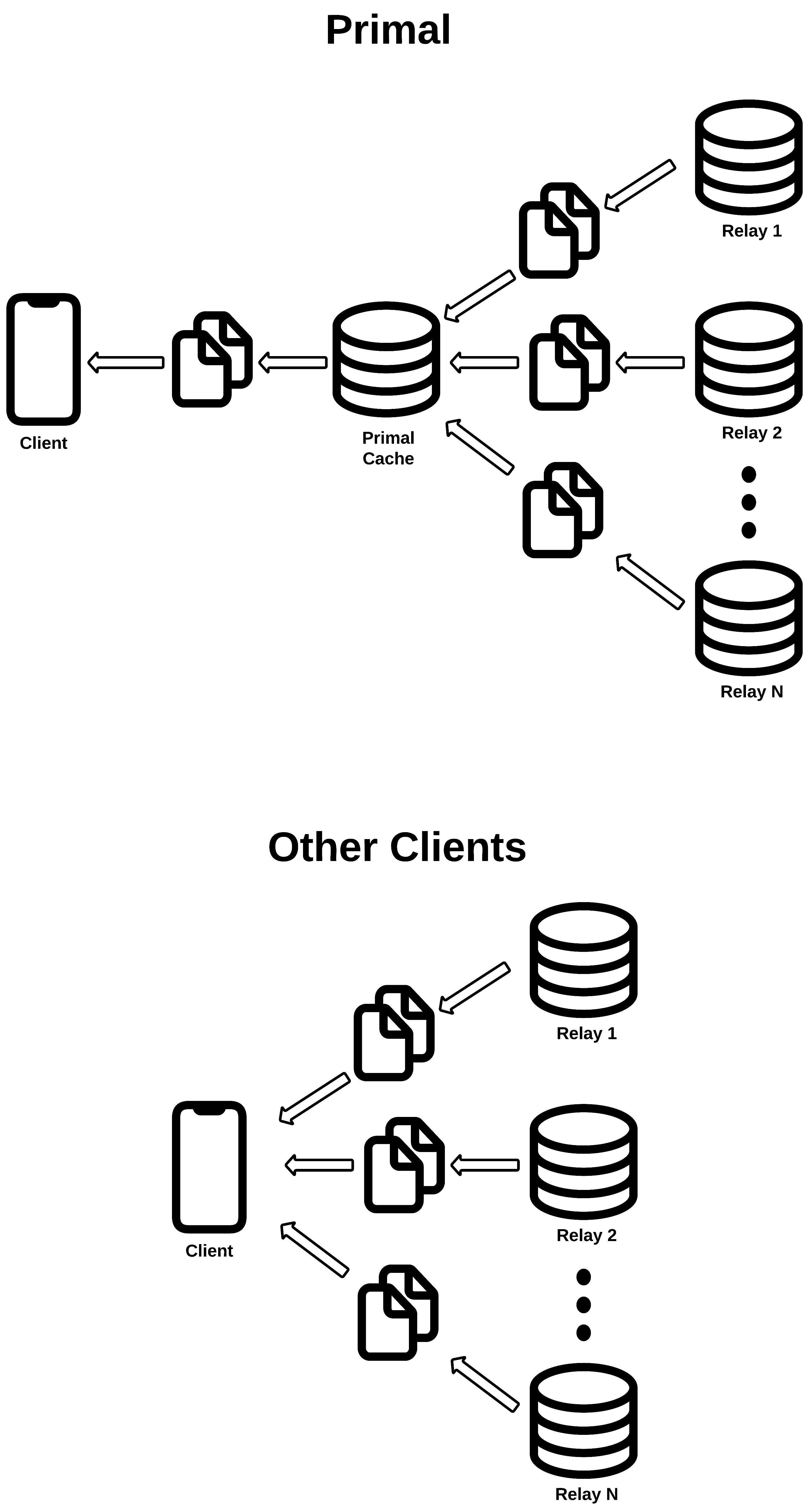

This is a great post. I sometimes find Primal cache very annoying. Check this note below and click on the image, you’ll understand. You meed to be on Primal to see the issue. Once in a while an API fails to deliver data whether a techincal issue or it gets rate limited momentarily but even if it gets fixed on my server after a minute or so, the cache prevents the update being pushed into the client. I don’t see this issue happening on Damus as it talks directly to the relays.

https://primal.net/e/note13z83kw6dr8dykan2cwck6ht69px39tde53hvmrh7wzha7lpqfycstgpl3s

This is a great post. I sometimes find Primal cache very annoying. Check this note below and click on the image, you’ll understand. You meed to be on Primal to see the issue. Once in a while an API fails to deliver data whether a techincal issue or it gets rate limited momentarily but even if it gets fixed on my server after a minute or so, the cache prevents the update being pushed into the client. I don’t see this issue happening on Damus as it talks directly to the relays.

https://primal.net/e/note13z83kw6dr8dykan2cwck6ht69px39tde53hvmrh7wzha7lpqfycstgpl3s

nostr:note1xxvqjgcgj4a30jwhvrcsryl3qt5spurdrk6kmc52yq39tl6nmtrsycg6t0

Sunday well spent! Introducing a new dashboard to nostr:npub1gkkahxwca30rf2td22u9p3jnmlh79dylgmm2et0kykftle6tdcysj4zden. Bitcoin vs. Gold Market Capitalization.

The S&P 500 Equal Weight Index (EWI) allocates 0.2% to each company regardless of size, unlike the traditional S&P 500, which weights companies by market cap. Yet, their performances are almost identical. Now, here’s a question that will blow your mind: How much does the money supply grow per year? 8 to 10%. How much does the S&P 500 average per year? 8 to 10%. And remember, 90% of hedge fund managers never beat SPY. The illusion of making money in the stock market is a big lie. You barely survive compared to the ever-growing money supply. Once you see it, you can’t unsee it.

Tu fines tuos. ( You are your own limit)

I’ve always been struck by the massive gap between being a millionaire and a billionaire in fiat terms. The difference is staggering, yet there’s no clear middle ground. That’s where the concept of a “wholecoiner” comes into play. In about10 years, it will represent a new financial tier: far larger than a millionaire, yet still smaller than a billionaire. A wholecoin symbolizes comfort, freedom, and true independence.

Spent my Sunday morning updating the GitHub repo for nostr:npub1gkkahxwca30rf2td22u9p3jnmlh79dylgmm2et0kykftle6tdcysj4zden. Feel free to fork it! 𐂐

In 20 years, the US economy may grow to min of $250T, 10x its current GDP driven by advancements in AI and robotics. Universal Basic Income (UBI) will become the primary source of income for the avg citizen, and fiat currencies will lose their meaning and value. Bitcoin will trade at $10M to $20M per orange coin, but no one will care about the fiat denomination as sats will become the base unit of account.

Fill … with some epic shit!