if u cannot use any coin from self-custody onchain with ANY OTHER LEGAL REG BIZ in EU what P2P accomplish ?

I made a quick first reading pass through the latest satanic EU thing. It's a wide ranging 324 page document, covering things like trusts, football clubs, dubious / tax optimized jurisdictions, the distinction between in house lawyers and law firms, beneficial ownership, reporting requirements, etc, etc.

https://data.consilium.europa.eu/doc/document/ST-6220-2024-REV-1/en/pdf

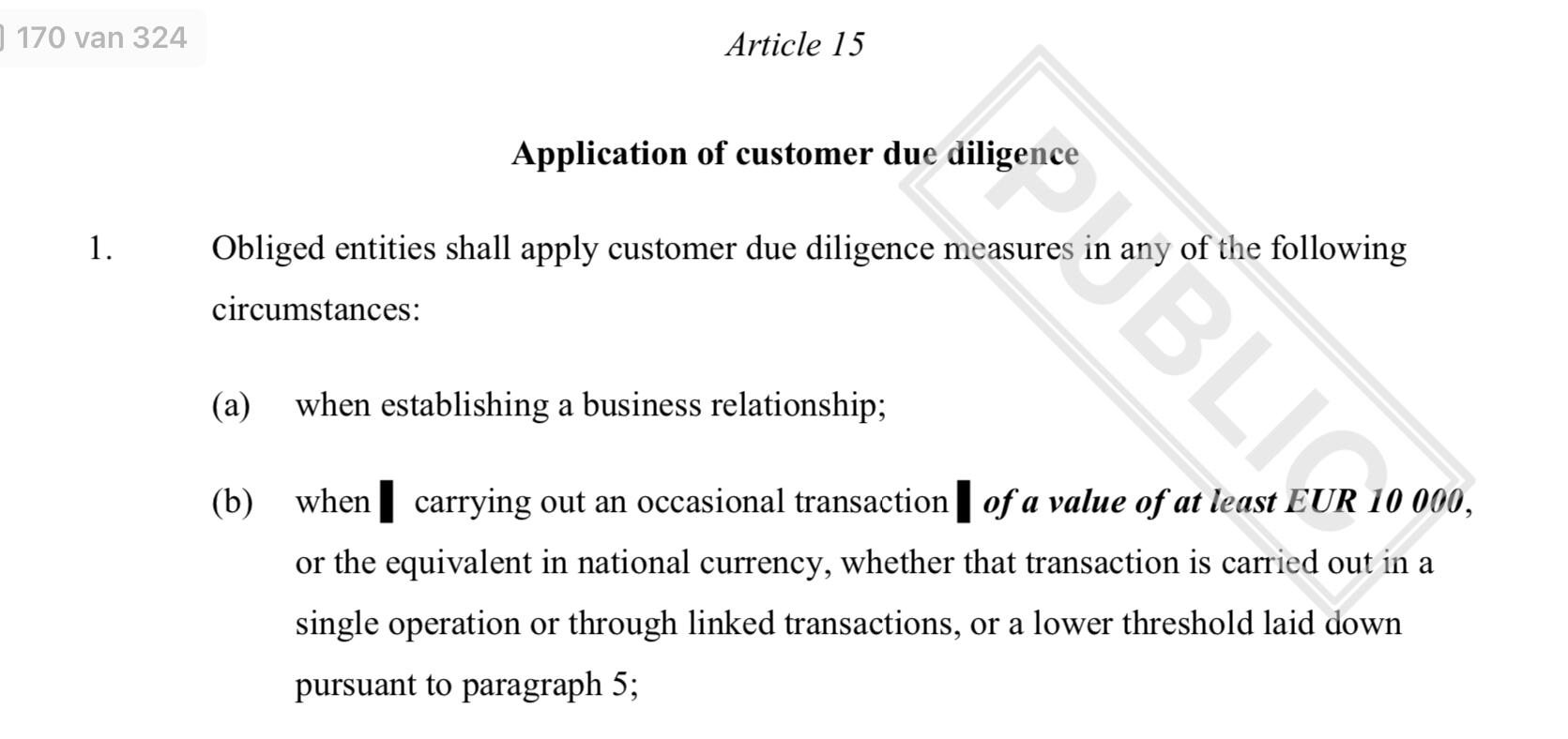

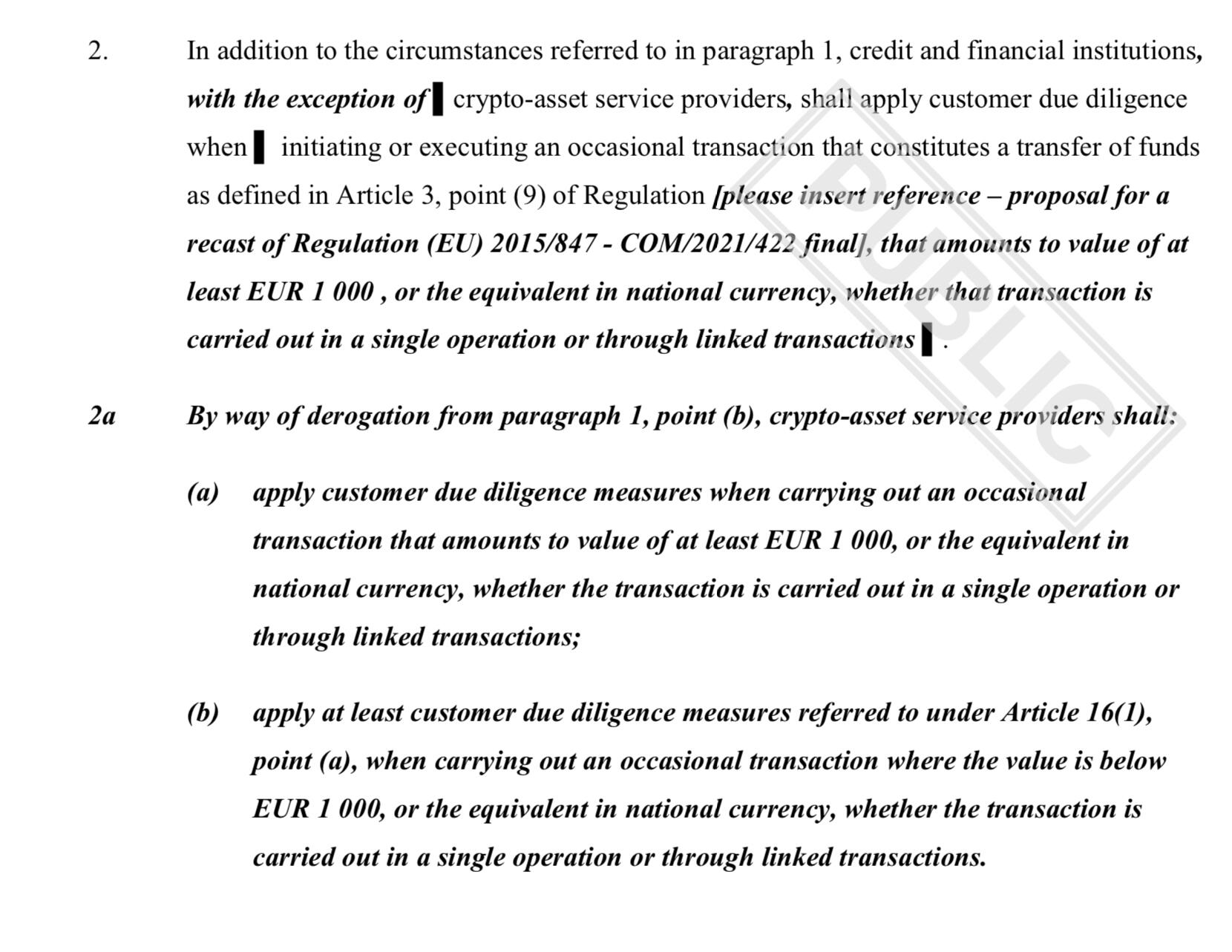

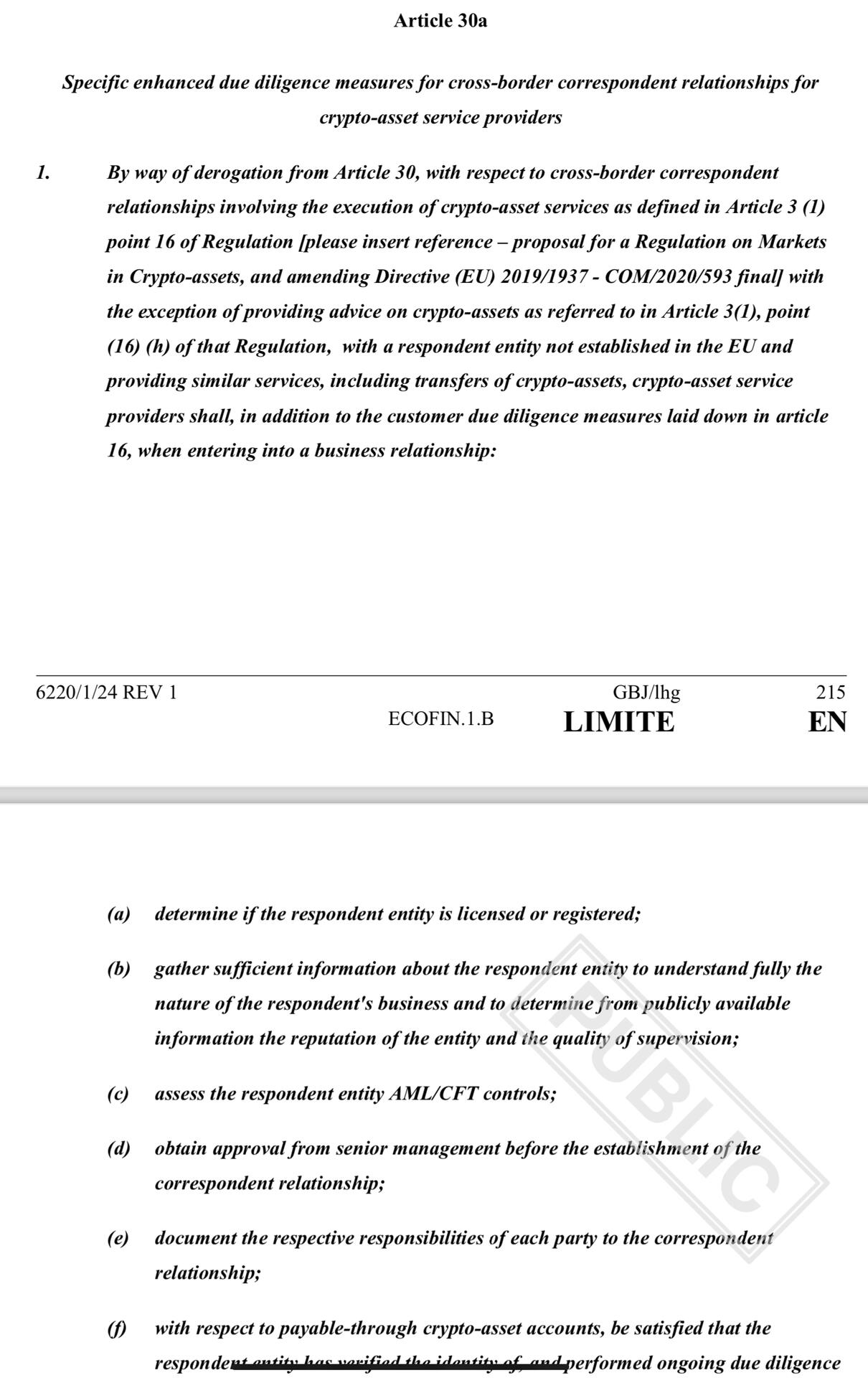

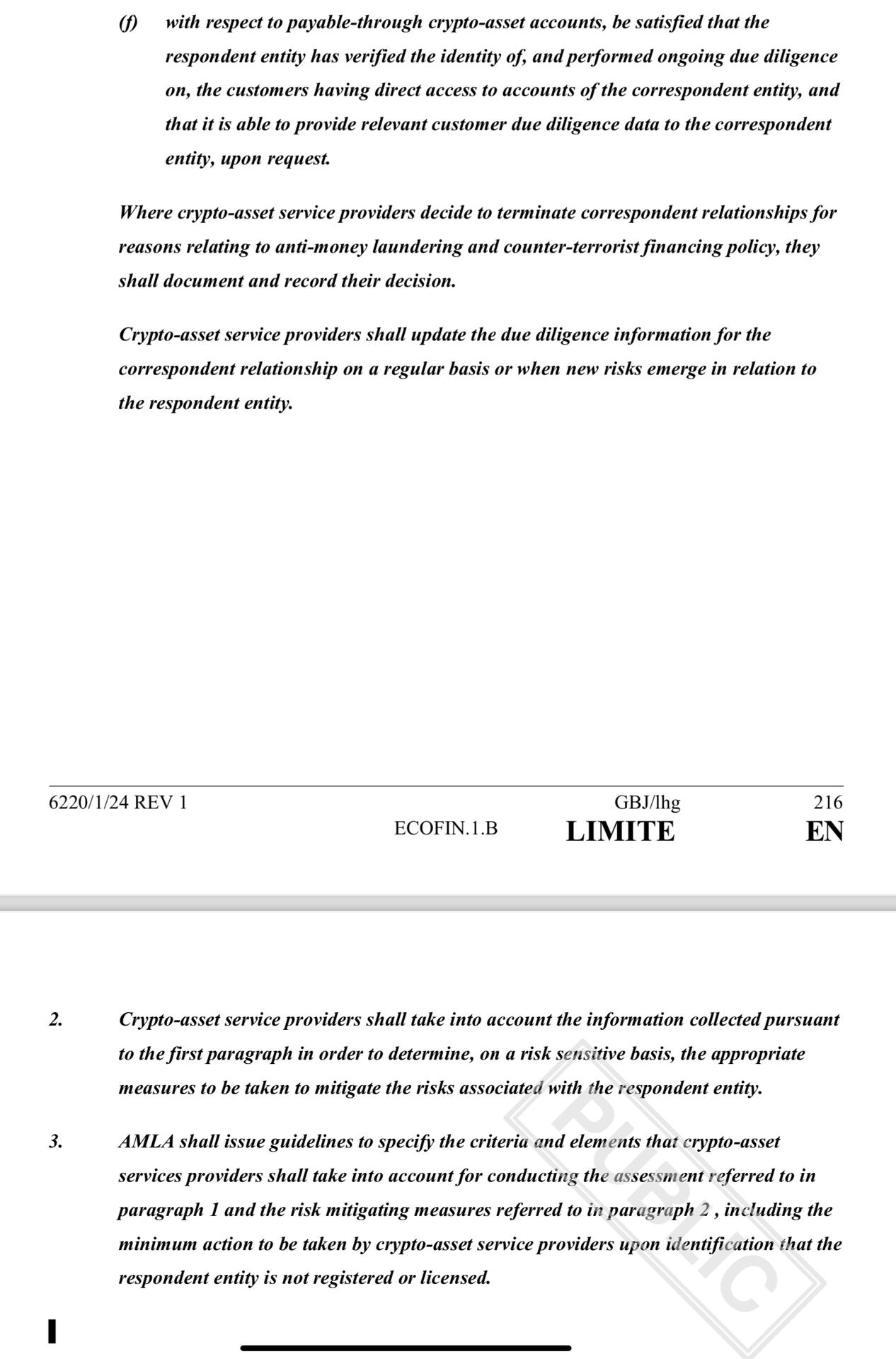

I tried to collect the bits that might impact Bitcoin. A minuscule fraction of the paper surface area. It's not like Bitcoin or even 'virtual assets' has its own chapter: in classic design-by-commission it just pops up in random articles.

Notably I'm ignoring cash: someone else will have to save that. But beware that 'cash' is defined much more broadly than the word suggests. It doesn't explicitly cover bitcoin, but I would expect that to happen eventually.

The first 100 pages (items numbered up to 103) seem more like an introduction than actual proposed law. Some of it seems to oversell the actual legal text.

One observation is that 'virtual asset service provider' (VASP, or what Americans would roughly call custodians and exchanges) is now considered a Financial Institution(tm).

My impression now is that only _custodians_ are not allowed to:

1. Have anonymous customers (i.e. anonymous accounts): they explicitly mandate KYC rugging existing accounts, albeit with a 3+ year heads up

2. Operating a mixer

They also need to verify ownership of destination address (wallet verification), which is bad, but far from a ban on self-custody.

The 'intro' text mentions mixers along with anonymous coins in a way that suggests banning transactions with them. But the word 'through' makes it really unclear what they mean. In the law text they define 'anonymity-enhancing coins' in a way that obviously implies Monero and Zcash in that order. Article 58 uses the vague term 'through' again. Does it mean they can't let you withdraw to it? Or just that they're not allowed to offer a pseudo-mixing service that *uses* these coins.

Anyway I'll have to re-read this a few times to grok. Keeping in mind that the politicians who wrote this don't have the brain cells to process anything more sophisticated than "monero bad, make law with fancy words!" and then the bureaucrats who write the law have no idea what anything means either. No tech literate person was involved in this process, that's very obvious from the language. But that does make it less dangerous.

The next step for me is more deeply understand what the proposal actually says, if there's any potential direct impact on myself (which might give me legal standing - now or in five years or so when stuff has really taken effect and local judges can intervene) or if it's merely bad in general (in which case perhaps all I can do is write an angry letter).

Eisenstein 1933 moment is coming !

what finally will matter is how much % of bitcoin will exchanged P2P (+ B2C where applicable)

So far just MOVING "1.5million is bitcoin economy" and rest is hoarded/hodl/lost/centralized

Rest all 58K 78K 100K gang is just sideshow n bread n circus . whatever flows in ETC/MSTR/RIOT will centralized kyced bitcoin. when that % is controlled 1 jurisdiction then u know centralization is complete. #finstr wait n watch the show

GAME changer will IF PEOPLE (excluding billionare/institutions) WAKES DOESN'T HANDOVER or ACQUIRE in CUSTODY WALLET above DOESN'T HAPPEN. yup that's reality show

yes 4kids - something phoenix wallet with frontend UI piggybank and coin IN only

nwc.dev #introductions

any suitable LN or LQ app?

thats the big issue bitcoin wallets NOW for newcomers n adoption

yup u have do it privately only not in merchants or shops

Meanwhile synchronized #FIAT Devaluation continues in Asia !!! bitcoin n gold r both winners

not2forget Japan raised YEN INTEREST RATE after 16YRS !!! (17T 3.3T 4.2T =25T GDP Trio)

The Indian rupee fell to a record low closing level Friday, tracking declines in emerging market peers against the dollar, after China jolted markets by loosening its grip on the yuan.

only 1% bitcoiners use P2P 90% is either in ETF / MSTR / under institution control

LoL we will always 99ers they will 1% who will hodl bulk of it

Government Pension Investment Fund (年金積立金管理運用独立行政法人) exploring to ADD Bitcoin Good but

Only Q - Are they going pile on Centralized ETF US NASDAQ? Are they buy onchian bitcoin from Mt.Gox Liq. ?

‚#Japan’s Government Pension Investment Fund (#GPIF), one of the world’s largest #pension portfolios, is considering #bitcoin as part of its diversification strategy.‘

https://bitcoinnews.com/adoption/japan-gpif-bitcoin-diversification/

Again are the buying Mt.Gox ONCHAIN SATS?

or Are the going pile on like Swiss Central bank onto centralized US STOCKS / ETF

That's what it matters

that's why every add-on must inspected n checked when needed - still far better installing on OS directly or APKs

At this point, as Mark Zuckerberg post reached to nostr:npub108pv4cg5ag52nq082kd5leu9ffrn2gdg6g4xdwatn73y36uzplmq9uyev6's mostr.pub, Feel free to guess how busy the bridge goes :)

only 1 bridge from metaworld central jail(s) - how busy will it when jail breaks exodus of digital prisoners arrives in nostrland

麒麟山ながれぼしは、淡麗辛口で香りも口当たりも爽やか、とにかく飲みやすい。あとボトルデザインがおしゃれ!

https://drive.misskey.nokotaro.com/files/webpublic-66d66597-a9cb-4951-b28f-e23575242975.webp

BlueSky Sake 🍶 🥂

rejecting duplicate recent events is painful in any sw of relay

it can enforced by prohibiting spending within jurisdiction legally - learn from Argentina Nigeria

very few bitcoiner understands that @note1lp6lpwd6pdfsdh0adcqvpt6dk2df0pzqxzf293gunur2m3qfacwspd9yaz

WTF "US Warned Russia Of Planned Terror Attack A Month Ago" why warning was not given in public just hrs after it happened released to press

grounding / earthing + metal contact

#[0]