I find bitcoin's adherence to the Power Law fascinating, and for me it has become my favoured price model. It is so beautifully simple, with only one input variable: time.

I built this Bitcoin Power Law web page because the other couple out there didn't allow me to do what I wanted:

- To choose a date (e.g. your retirement, or a major purchase goal), and to see where price might be. Not only the fair price, but perhaps more importantly, the floor price below which bitcoin should never go under again.

- To choose a price (e.g. $1m), and to see the probable date (when fair price reaches the price) and very high probable date (when bottom price reaches it).

- To remind me to stop making too emotionally fantastical price predictions whenever price takes off on one of its major spurts, or I read some ultra-bullish article.

And more importantly, just to be able to show the chart while talking to a noob, with price indisputably sloping from bottom left to top right. Message: it's not too high to buy ;)

Of course, models are not guarantees. They all have their flaws, and the obvious one in this case is the model does not take into account the 4 year halving cycle to refine its price predictions.

But I believe there is less likelihood of this stock-to-flow cycle repeating indefinitely (as the halving becomes a less and less significant part of the bitcoin stock), than of nature's Power Law continuing as we go through the global adoption curve.

Enjoy!

(no ads, trackers, spammers, or VPN blockers)

Bitcoin Power Law is the simplest of the long term trend models, and imo is quite beautiful.

I've just built this page showing the beautiful straight log-log regression line, with a price/date calculator. No trackers and no VPN blockers (I'm talking to you, Bitbo charts). Just a free service from one bitcoiner to others.

ChatGPT fans need to be aware that they will increasingly be fed propaganda and have "inconvenient" narratives censored.

Alternatives do exist and I would suggest using them.

An example that just launched is https://venice.ai (needs to prove itself but on a quick comparison is way better: not censored and cheaper/faster than ChatGPT).

This is an extraordinary clip from the Chair of the Council of Economic Advisors.

https://twitter.com/RnaudBertrand/status/1786272981058220187

There is zero competence at the helm of the fiat financial system.

Choose #bitcoin, and choose sooner rather than later.

GitHub owned by Big Brother, Microsoft, who will scan all your documents with CoPilot?

Git - excellent idea.

GitHub - not so much.

Opt out to bitcoin.

Defund the war machine.

Tax payers don't fund wars on the other side of the world, and would elect out politicians suggesting higher taxes for war.

Governments that can print infinite money don't care what the people think.

Totally worth it if you type all day. You'll never look back.

Keychron Q series keyboards are amazing.

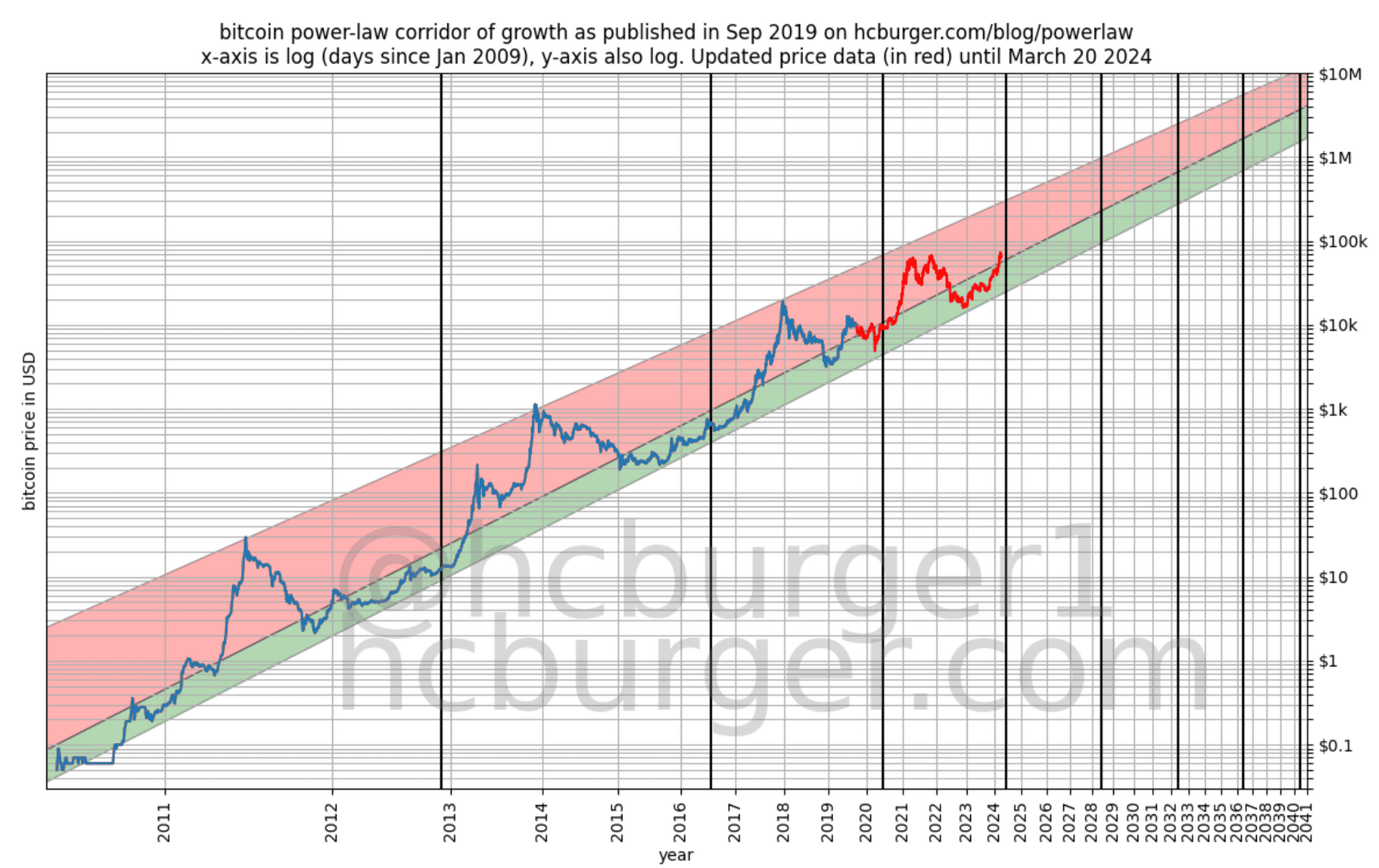

There has been a lot of recent discussion on the Power Law model (https://hcburger.com/blog/diminishingreturns) which gives a prediction of a range of bitcoin price against time.

It's noteworthy because price has continued to conform to the channel shown in the picture many years after the model was published - the red part of the line.

A model is just a model, and they can break. The log range used in these types of models is huge, so of course they are anyway useless as trading or timing tools. And as many people have pointed out, these chart models cannot take into account the real world fundamentals, such as the recent launch of the ETFs.

But there is still signal in these charts:

- we can expect ever increasing returns

- returns are a multiple of adoption increase (e.g. 10X adoption = 100X price)

- those returns are DIMINISHING rather than exponential.

You don't necessarily need a Power Law chart to work those things out, but the chart verifies the logic, and is currently the best model when correlating price against time. I don't suggest anyone (seriously) predicts price against time, because it will make you look like a fool.

But it is fun. And it is good marketing for bitcoin, which brings new adoption - and that is good.

A live chart is available at https://charts.bitbo.io/long-term-power-law/.

We've told you 476 times before that bitcoin has died - are you stupid?

I know an Arena FIDE (International Chess Federation) Master.

He's a young, enthusiastic and friendly guy who does chess tutoring online.

I'll DM you his contact details if you're interested.

nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m and COPA are legends!

Craig Wright finally destroyed.

🙏

Hi Nostr!

My name is Haldis, and I’m @dirtybee.co and @haldisinwonderland over on TikTok. #introductions

I’ve never really been into FB and deleted Instagram as soon as they got bought. TikTok and Pinterest have been my only social media Platforms…until today. 🤗

Like many newcomers today, I stumbled upon the viral video nostr:npub1r8wdfruydenz84fxfespcswuhcvyatx6umtd5xguexup49u500xskf50hn posted, and I’m thrilled such a fantastic protocol exists.

I’m a late-in-life diagnosed PDA AuDHDr, and my special interests are #honeybees, #flowhive, and AI - I know, I know…my guilt hits me in the gut with every prompt.

I mostly use social media to share my tips and tricks on #beekeeping, learn more about my brain (PDA ASD ADHD), ancient history, witchy, woo woo, the universe, gossip and craft ideas. #wherethefiskatemiddleton

I take care of lots of living things and anthropomorphize everything else. I'm super nerdy. Halloween is my favorite holiday, and cosplay is rad.

Not sure what to expect with Nostr, but it’s fun to learn new things. ☀️

Welcome.

Excited for people to come to Nostr, a land without the trolling and more people helping each other, and making the world better.

Unfortunately the ATH is not keeping up with the actual price.

You might want to fix it 😃 .

It's so tiring trying to help loved ones.

When you gently show them all the reasons that bitcoin is the apex store of value, why do they always choose to base their thinking as if they bought the ATH and sold at the bottom?

A family member just sent me this even though they are currently up 7X on their first (and only) small allocation to bitcoin:

"Yes, but do we know what's round the corner. Anyone who invested say $110,000 in BTC in Nov 2021 would have seen its value fall to $34,000 by the following July, and $26,000 in Dec 2022. Have any of the other assets had such extreme roller coaster rides? Does anyone know what caused such violent swings? Are we in a more secure place now?"

Exhausting.

RELYING ON PROPERTY AS AN ASSET HAS BECOME DEFECTIVE.

"It was the best idea 200 years ago, but if you own a thousand acres and then someone establishes a state, and a mayor gets elected who decides to spend lavishly, raising your taxes once, twice, thrice, soon the farming family can’t afford the taxes. Then, the government decides you’re the bad guy, takes all your land, and evicts you. Maybe it doesn’t happen directly; maybe first, you mortgage the farm, then can’t pay the mortgage, and the bank seizes your property."

"[...or] the great-grandfather buys a farm, the grandfather and the father both farm the land, but now they can’t pay the taxes on it and have to sell it, moving into apartments"

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m at Bitcoin Atlantis in 2024

Fantastic to see how the bitcoin guys come in to correct false narrative.

Great job nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m, nostr:npub1n3sjlzmhpu8rl56umtptc4lua6zkretq2p82yhytnmlcuq639vlqd0te5l and nostr:npub1pyp9fqq60689ppds9ec3vghsm7s6s4grfya0y342g2hs3a0y6t0segc0qq. 🙏