I dont give a fuck man, im not here to be liked, i dont need to fake like influencers do here to be well welcomed and followed.

If you are all for free markes you would care with the king of freemarkets, the most wifely used currency on free market.

Thats why i said ylur community is full of shit, you contradict you words with your actions.

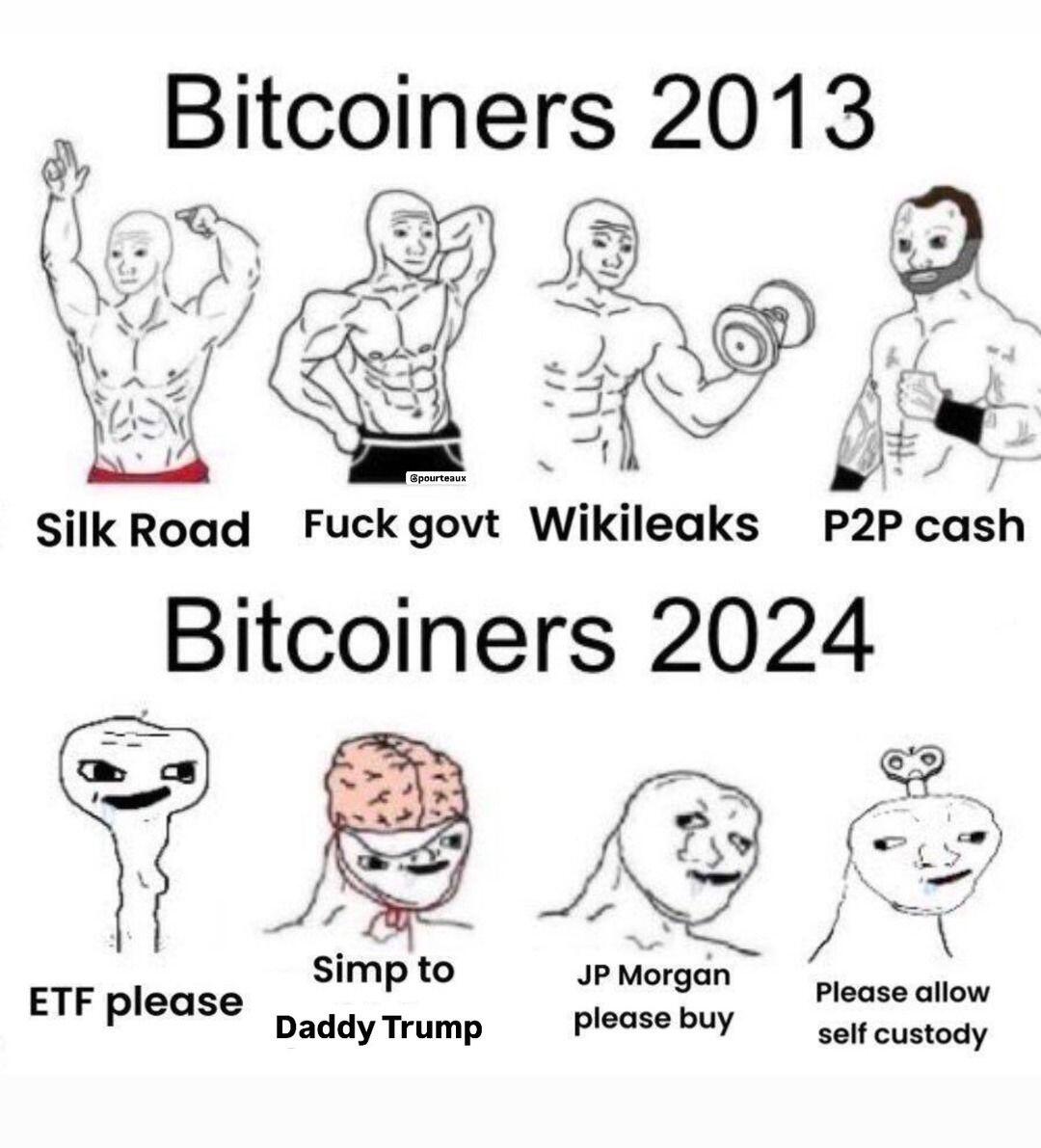

The ones that are asking daddy trump and etfs yo buy and pump and shill your bags is your comunity not mine.

If bitcoin maxi community wasnt full of shit this would not happen.

Yes, they are using custodial wallets and custodial clients on nostr, i can see them using all that shitcoin tech available on bitcoin, and think they are sovereign

It's normal, bitcoin community is full of FEDs.

Freedom figthers don't go hand by hand with them.

Working for and with state agencies, hidden in plain sigth.

Say to me one line of my text that is lie, try it.

It depends on your timeframe.

Because i didnt reduce my time frame to a spot where a mining attack backed by shaddy interests was done.

I would love to see a print with them with more than 50%, because until now i didnt saw one.

This is now 👇

It will be less scarce, but you will be not here to see for yourself, for now Monero is scarcer than bitcoin.

Less secure?

Monero has 100% up time, bitcoin dont because was hacked. Monero never was hacked.

Monero never needed to stop the chain to reduce the number of coins because infation bug, but somehow bitcoiners dream with the delusion that cant audit monero supply.

Less adoption? 90% of guys that "have" bitcoin never really touched it, only through centralized exchanges or third party financial institutions.

If adoption to you means market cap yeah, you have more adoption, if you mean number of people really using the software, Monero beats bitcoin everyday.

Where is the bitcoin demand?

All i see is institutions demand, not normal people demmand. Take off ETFs and compare demand again, maybe you will have s surprise

Where is the 51%?

Claro que fui eu que escrevi, mas eu vou escrever em Portugues para tu entenderes bem!

É preciso ser muito otário para dizer que uma pool com 31% de hashrate fez um ataque com sucesso de 51%.

É preciso ser muito idiota util para dizer que a moeda mais descentralizada a com maior percentagem de self custody ownership é uma CBDC, quando isto vai ser a tua realidade no maximo proximos 2 anos.

There is no second best is the best slogan to catch lazy dumb fucks that can't read more than a phrase and made them believe that they are the really smart ones.

I have to admit that was a brilliant way to implement a empty echo chamber!

Using the dumb fucks to make noise

Isto é noticia para otario ler, basta ir ao block explorer do Monero pars verificar que essa treta dos 51% do hashq é mentira.

Da boa vontade depende o bitcoin, não o monero meu filho.

Mas dizer que não dá para verificar o supply diz me tudo o que eu preciso saber sobre o que tu realmente entendes sobre Monero, software, bitcoin e o ecossistema.

No, never heard of it

Of course price action is confidence!

But if it was really feasible, monero would worth like 1€ or 2€ each coin, at this time.

The only this this attack showed is that Monero is anti-fragile and is ready to survive to this kind of attacks, even if playing dirt is needed, like DDOS the attacker to downgrade his hashrate.

DarkFI will merge mine with monero with the same ethos, so as time pass the chance of a sucessfull attack is going down.

P2P like always.

Always P2P, always works.

You have haveno, you have openmonero, you have robosats.

And more solutions are being build.

DarkFI will have the best solution as far i know, but not ready yet, only on testnet now.

## The Future of Bitcoin: A Threatened Ecosystem Under Centralized Control

The evolution of Bitcoin, once heralded as a revolutionary form of peer-to-peer (P2P) money, is now facing significant challenges from centralized forces. How various entities, including governments and financial institutions, are working together to undermine Bitcoin's decentralized nature, paving the way for central bank digital currencies (CBDCs) and regulatory frameworks that will stifle the original vision of Bitcoin.

### The Hidden Hand: Connections and Collaborations

## eCash and the European Central Bank (ECB)

The recent developments surrounding **eCash**, as highlighted in the article from Bitcoin Magazine, reveal a concerning connection between Bitcoiners and traditional financial systems. eCash aims to provide a private payment solution that integrates both Bitcoin and fiat currencies, potentially appealing to users seeking privacy in their transactions. However, this collaboration with the **ECB** raises critical questions about the implications for Bitcoin's future:

- **Centralization of Control**: If eCash gains traction under the auspices of the ECB, it could lead to a scenario where Bitcoin is utilized as a tool for state control rather than a means of financial freedom. The ECB's involvement suggests a willingness to incorporate Bitcoin into a framework that could ultimately serve centralized interests.

- **Regulatory Compliance**: The push for compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations will force Bitcoin users to disclose their identities, undermining the pseudonymous nature of the cryptocurrency. This shift will transform Bitcoin from a decentralized asset into a regulated financial instrument, aligning it more closely with state objectives.

- **State-Licensed Minting**: This connection indicates that only mints licensed by the state will operate the eCash system, creating a scenario similar to the current situation with ETFs that resell paper Bitcoin. These ETFs allow companies to gain exposure to Bitcoin without actually owning the underlying asset. eCash enables this model to extend beyond institutions, allowing regular users to engage with a system that not provide true ownership of Bitcoin. This will lead to an increase in "paper Bitcoin," where users believe they are holding actual Bitcoin while only possessing a claim on it, further entrenching centralized control over what was once a decentralized currency.

#### The Role of the World Economic Forum (WEF)

The WEF has been influential in shaping global financial policies, including discussions around cryptocurrencies. Their involvement with initiatives like the Lightning Network raises questions about:

- **Centralized Solutions**: While the Lightning Network aims to improve Bitcoin's scalability, its development by centralized entities could lead to a concentration of power, contradicting Bitcoin's decentralized ethos.

- **Influence on Regulation**: The WEF's advocacy for regulatory frameworks will result in policies that favor large financial institutions over individual users, further entrenching centralization.

### Centralized Mining Pools and Control

The rise of centralized mining pools poses another threat to Bitcoin's decentralized nature:

- **Concentration of Power**: As mining becomes more competitive, smaller miners will be forced to join larger pools, leading to a concentration of hash power. This will enable a few entities to control the network, making it susceptible to manipulation.

- **Regulatory Compliance**: Governments may impose regulations on mining operations, requiring them to adhere to KYC and AML standards. This could effectively eliminate smaller, independent miners, consolidating control within a few licensed entities.

### The Samurai Wallet Case: A Cautionary Tale

The case of Samurai Wallet illustrates the potential consequences of regulatory overreach:

- **Targeting Privacy Tools**: Samurai Wallet, known for its privacy features, faced scrutiny from regulators. This highlights how tools designed to enhance user privacy can be targeted, leading to a chilling effect on the use of Bitcoin as a P2P currency.

- **Implications for Users**: If privacy-focused wallets are restricted or banned, users will be left with no choice but to use government-sanctioned wallets, killing once for all the principles of decentralization and anonymity.

### The Future of Bitcoin as P2P Money

The trajectory of Bitcoin suggests a troubling future for its role as a P2P currency:

- **Licensing and Compliance**: Governments will implement regulations that require all wallet providers to be licensed and compliant with KYC and AML laws. This will effectively eliminate non-compliant wallets, restricting user choice and autonomy.

- **Empowerment of CBDCs**: As Bitcoin becomes intertwined with CBDCs, it may lose its status as an independent currency. Instead, it will serve as collateral and a tool for state control, undermining its original purpose.

### Last but not least

The convergence of regulatory pressures, centralized mining pools, and collaborations with institutions like the ECB, WEF, Blackrock is a significant attack to Bitcoin's decentralized ecosystem. As governments seek to control the narrative around digital currencies, the original vision of Bitcoin as a P2P money without third parties is death!

O 51% com 31% do hashrate.

Não sei que calculadora ou fontes usaste, mas os numeros não batem.

Cuidado com o 51% no bitcoin, porque no bitcoin é possivel faze-lo realmente, visto que têm 99% do hashrate em pools centralizadas.

O bitcoin só não levou um ataque desses porque o sistema já o controla, e as leis que vão entrar de KYC/AML, mostram perfeitamente isso.

Mas se algum dia o bitcoin realmente se tornar oposição ao sistema de novo, o 51% vai vir, e no bitcoin tu não tens para onde fugir com o teu hash, porque por mais que eu e outros tenhamos apontado e criado bases para descentralizar a mineração, a vossa comunidade e influencers sempre que foi apontada a solução varreram para baixo do tapete para ninguem a ver.

E se duvidas, pega nisto e pergunta a todos os devs e liders no bitcoin, porque raio abandonaram a unica solução que existe para resolver a centralização da mineração! 👇

https://github.com/p2pool/p2pool

He shared yes

It's crazy how long it takes nostr:nprofile1qqsvn0dkjt80raqrxd470c98n7zrdehmcvj6p5hgw3kyku6zyd8z0fqpz4mhxue69uhk2er9dchxummnw3ezumrpdejqzrthwden5te0dehhxtnvdakquw0j5p to process an osko.

Been sitting here for 10 minutes, checking the transaction details, checking the strike app, thinking I must have accidentally sent the money somewhere else, nope.

Just taking ages to process I hope.

Not your keys not your coins

Dont trust, verify 👀

The statistics based on the reaserch "money created out of thin air" says thats 99% of the companies are buying paper bitcoin from the ETFs.

ETFs already dont have it because they are buying it from Coinbase that says they have it.

But study shows that coinbase also uses the users bitcoin, to resell it to ETfs.

With this most of coinbase users will not have their bitcoin when then find this and start withdrawing like crazy.

Not your keys not your corns bros.

Conclusion: Where the fuck is this bitcoin they say they bougth?

#disclaimer

(This article is based in conspiracy teories and fake news)

This guys want more fiat gains than freedom gains 🙄🙄

All over the place 😅😅😅

Just a reminder to read the articles before getting a formal opinion..

Sepparating money from state hun? 👀

#bitcoin

#nostr

#grownostr

Take your own conclusions, this article says may things between the lines...

"You don’t have to be against the state to love Bitcoin. You don’t even have to believe in separating money from state,”

"The ECB is willing to also look into ecash systems that provide cash-like privacy for transactions under 300 euros. The Bank of International Settlements is piloting an ecash system right now. The National Bank of Switzerland and the Swiss Parliament itself are considering ecash deployments for their national digital currencies”

How he know ECB is willing to look into eCash is one of my questions.

Is he actively working with the enemie is another one..

https://bitcoinmagazine.com/business/ecash-makes-bitcoin-and-fiat-private-with-calle-cashu

If #Bitcoin Does Not Succeed, What Do You Think The Alternative Will Be?

Samson Mow- “The alternative is money as a surveillance tool - and that’s where you get banning, or discouraging, people from having their own wallet.”

#HosKasi Freedom Adi Money 🫵🏾🇸🇴.

https://video.nostr.build/5386931d093bcbf239c85fbf019f0c8b602d1d9e0724aacf19367bacc74efec9.mp4

Monero 😉