Also, at the 1:09 mark, they discuss the zombie companies, including the publicly traded miners, going into the BTC treasury paly.

GM. This is worthwhile (IMO) listen. These are 2 great TA guys discussing the MSTR trade, past, present and future.

MSTR new purchase of BTC. It is not as big as recent purchases and the price was quite high and an average of 106,000.

MicroStrategy has acquired 5,262 BTC for ~$561 million at ~$106,662 per bitcoin and has achieved BTC Yield of 47.4% QTD and 73.7% YTD. As of 12/22/2024, 444,262 BTC acquired for ~$27.7 billion at ~$62,257 per bitcoin.

Hard to come up with a better Monday morning Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk than this. I’m sure Mallory would love a slow dance with you.

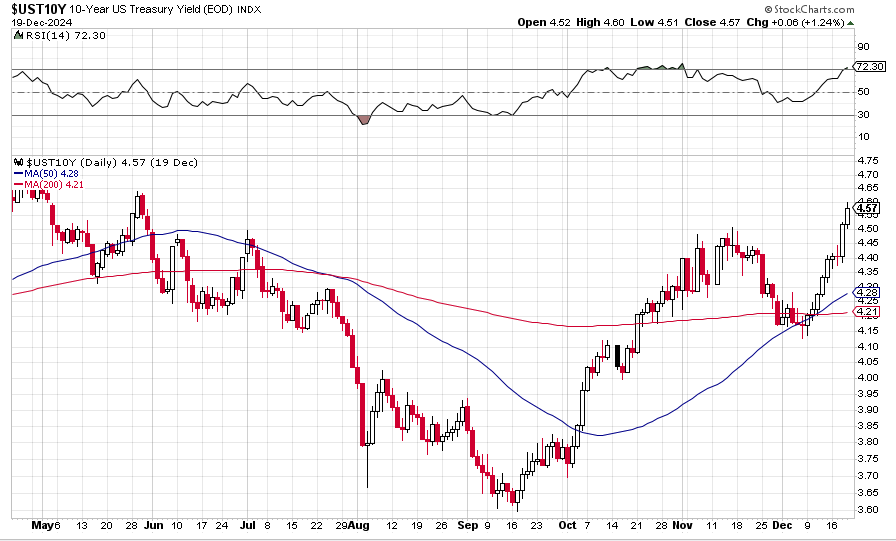

Yes. It’s been amazing (not in a good way) what has happened once it has hit 5% in the past.

It seems like the companies doing a ₿Itcoin treasury strategy are really just zombie companies that were doomed and are trying this strategy for pure survival purposes.

This means he bought more and will announce tomorrow morning same day he gets added to QQQ.

Over the last 6 weeks MSTR has purchased 186,780 BTC - Blackrock during the same timeframe only purchased 118,954 BTC.

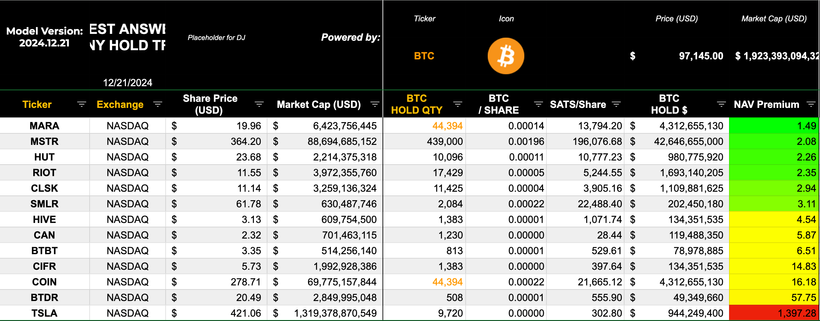

The easy way to interpret the model is look at the very last column on the right hand side. It is ranked based on NAV premium.

MARA now the lowest, MSTR #2. Yesterday MSTR Nav Premium shot under 2 for first time this year. It is slightly above it now.

MARA is 1.49 ie 2/3rds of MARA Market Cap is BTC.

Some consider Tesla a BTC proxy but in reality it is NOT! The market cap is far too high in relation to their BTC HODL.

InvestAnswers

Welcome to the universe of Nostr :-)

Economists and armchair economists online think Bitcoiners are very, very dumb.

“The debt is fine”

“Us global reserve currency is fine, you don’t need bitcoin”

“But when you sell the bitcoin, then what [they assume bitcoin won’t be involved in international trade]

It’s been 16 years and as nostr:npub10cxz2h7n6rumfpuf49zt4uvm7skzqk5u25vesp0tzdtnkvsnwjyqaffcj3 said recently on WBD, this thing created by some internet nerds now has a market value of $2 trillion and we’re winning so hard.

Major economists, journalists, and online “experts” will say how stupid we are, even as bitcoin becomes the new standard. We won’t be right on everything, but they refuse to acknowledge the movement and realities that exist.

I'm a fan

Washington, we have a problem. The day before the Fed cut interest rates on September 16th, the 10-year Treasury closed with a yield of 3.64%. The Fed has cut 100 basis points off its target rate since then. The 10-year yield has climbed 87 basis points. It’s up eight of the last nine trading days.

Official rates are going down. Market rates are going up. The bond market doesn’t like the idea of getting rid of the debt ceiling. It doesn’t like the idea of adding $2 trillion a year in new debt and paying $1 trillion interest on the $36 trillion we already have. And–this is arguable–it doesn’t seem to like the idea of borrowing even more money to ‘pay’ for new tax cuts.

The bond market can’t talk. It’s not a real person. But prices are information. And the 10-year Treasury price is the most important price in the market. The last several times the yield on the 10-year approached 5%, something ‘broke’ in the banking system (the assets of banks, when marked to market, dropped precipitously). What will happen next time? And could we find out as soon as next week/ Stay tuned.

Bonner Research

Happy winter solstice. The dark scatters when the light comes in.

nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk Daily Dose time. The circus is fun but it’s always better live and direct. Compare and contrast. You

Enjoy Myself live.

https://open.spotify.com/track/1li6Y2MPA2fJ4a9jWK9RPg?si=Di8YbHxPRsSltV2keQIbCg

Officially dipping into a ₿uy right now

The circus set up their tents yesterday and haven’t left yet. So, here is the perfect sound track for all of this for today’s nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk Daily Dose 🤪

https://open.spotify.com/track/6wRgknJXUfNGbcumtALNQH?si=jWZjHt0gSQOR63XuAa0JTQ