Libro sobre bitcoin en español desmontando los principales FUD

How to get rid of $38T debt:

while (1 $ > 1 sat):

{

print $1 Billion

buy sats

}

Pay $38T debt

Don’t panic. He is building consensus and it is a very good thing to remove that activation method as it was rejected by most users. If Luke wants the reactive way he can make his own fork proposal to do it. Indeed I think it is a good idea to separate both. I would support one and reject the other one.

Why not separating both? 1.- Reactive/emergency UASF and 2.- UASF planned 1y ahead but permanent, not temporary.

I think Emergency UASF will have way less consensus around it and when/if the offending block happens IMO it will generate a split chain. The chain with the offending block will be considered bitcoin by most people (including miners, exchanges and businesses)

Planned UASF can have way more consensus around it. I think we could limit OP_Return to 80 in CR and also make inscriptions way more expensive. Maybe we could just remove the segwit discount, or at least, change the 4x to 2x (with the additional benefit of having blocks smaller)

How does your wallet verify that a tx sent to your wallet is valid? How does it know the inputs in the tx are in the UTXO set if it hasn’t verified the whole blockchain?

Not so unpopular…

Truth, the noun, is objective. There is only 1 truth, not multiple conflicting truths.

Sentences as “cats are prettier than dogs” are neither true nor false, just opinions. There can be a lot of opinions but it’s not precise to say there are a lot of truths. “Subjective truth” is just an opinion.

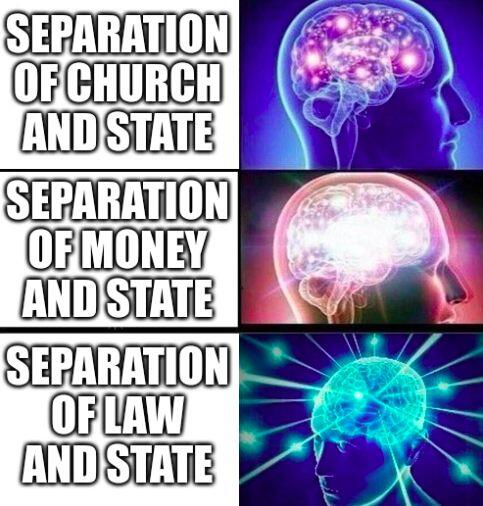

KYC laws are evil

Unfortunately it’s not paid. He is so stupid to believe what he says

Do we need to trust the CEO of Signal? I thought the protocol is safe and built with strong privacy so the communications are private. I dont have the skills myself to review the source code but a lot of people have and I think they have reviewed it. Isnt that the case?

Isn’t enough 2T???? I think is a giant amount! Its ridiculously big.

I think millionaire. And I think it would mean “rich” again.

Exactly! The best investment strategy is to bet all in Vegas, to black or red. If you win you have 100% profit, if you lose, don’t worry… loses are socialized.

Or

Better… you do it multiple times. 50% of the times you get the profit. 50% of times everybody share the loses. So statistically you only win.

I don’t understand who sells bitcoin. No ratio makes sense. Why sell 1 scarce unit, the sat, for whatever amount of dollars when an infinite amount of $ can be created at 0 cost? No ratio makes sense.

And what is worse, the game it plays is to break fungibility. In its game each sat is different and unique.

Agree! One of these is an attack vector that helps to slow the transition between the slavery based fiat world to the freedom based bitcoin world.

Easy to determine. No bank is safe. Bank is synonym for counter-party risk.

Es una cuestión semántica. Depende de lo que signifique que sea tuyo. Si es “legalmente”, sí es tuyo. Si es que puedes hacer con él lo que quieras cuando quieras, claramente no. El dinero en el banco está lleno de restricciones. Una lista cada vez mayor de restricciones. “Otros” juzgan permanentemente si aceptan o no lo que quieres hacer con tu dinero.