In addition, if MSTR/nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m hang onto the stack into the future, there’s a very high likelihood that other firms and/or their owners end up *needing* Bitcoin because they don’t yet own any.

If that happens, MSTR gets to buy whole companies or large amounts of equity of other companies at great valuations *in Bitcoin terms* because he’s the only guy on the block w/ enough bitcoin to make these purchases.

If this happens, this is the beginning of MSTR becoming the new Berkshire which would make Saylor the new Buffett and that’s a role he’d play really well.

My guess is that others such as nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z & nostr:npub1k7vkcxp7qdkly7qzj3dcpw7u3v9lt9cmvcs6s6ln26wrxggh7p7su3c04l also see this as a very plausible long term outcome for MSTR/Saylor. nostr:note1rnt8cttfplvqtghjx7mpmeffqatncdcscplm4g3lwrnw887sr2sq6gq9gq

🎯

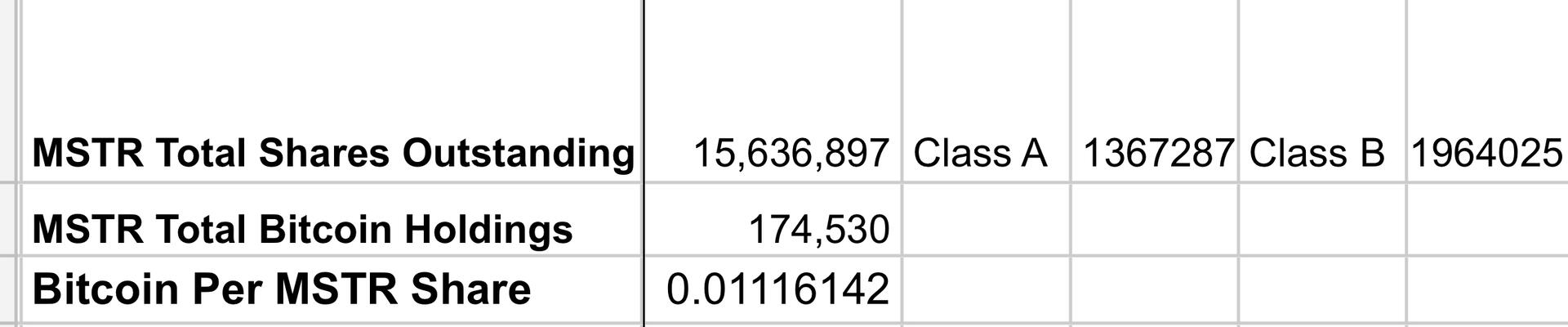

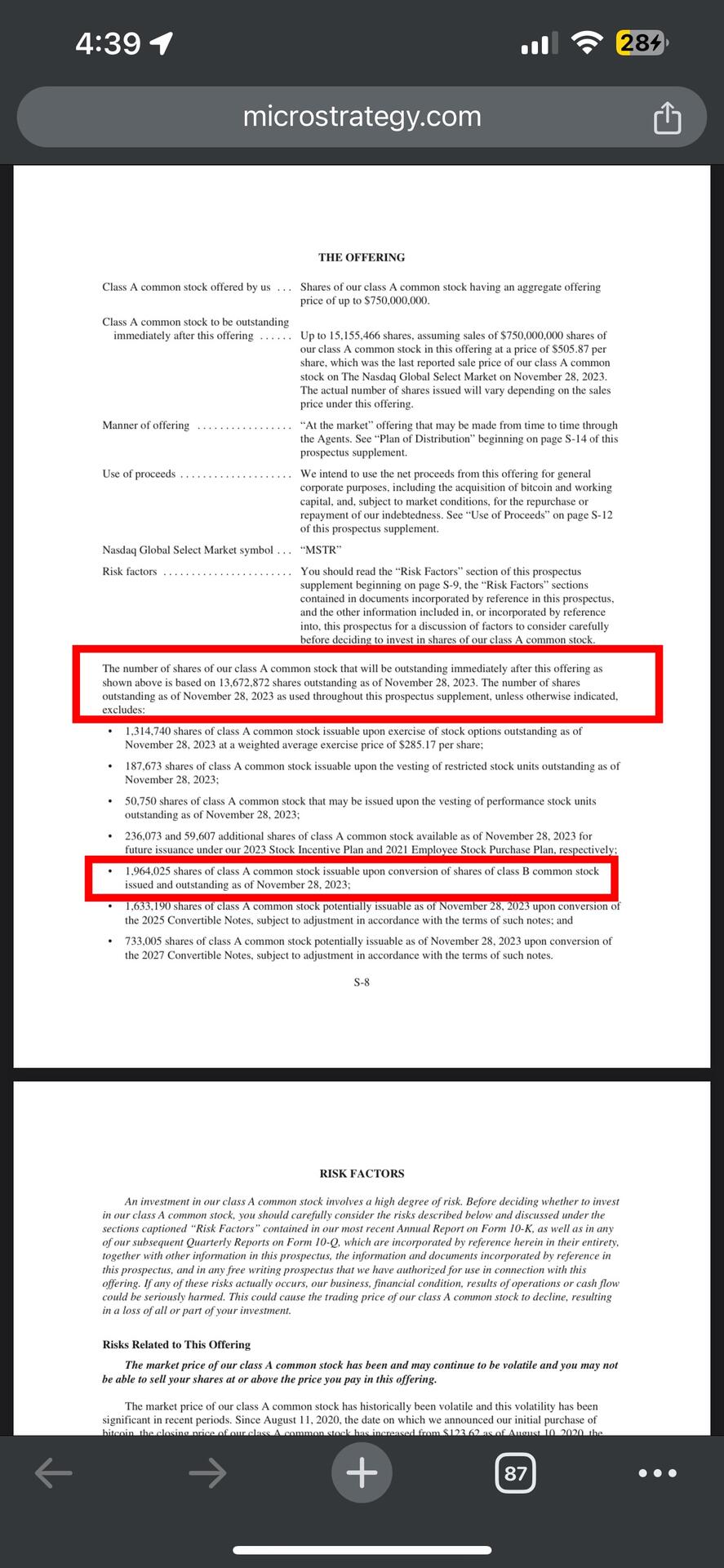

I think my numbers were off slightly. These numbers are taken from page S-8 of the supplemental prospectus and accurate as of November 28th. (I had to verify and kit just trust my work! Haha) https://www.microstrategy.com/content/dam/website-assets/collateral/financial-documents/financial-document-archive/prospectus-supplement_11-30-2023.pdf

Excellent, thank you! 🤙

Understood! I own a ton of $RIOT and $MARA stock and have been floating the idea of getting some exposure to $MSTR. Thank you for this framework! Time to dive into the numbers.

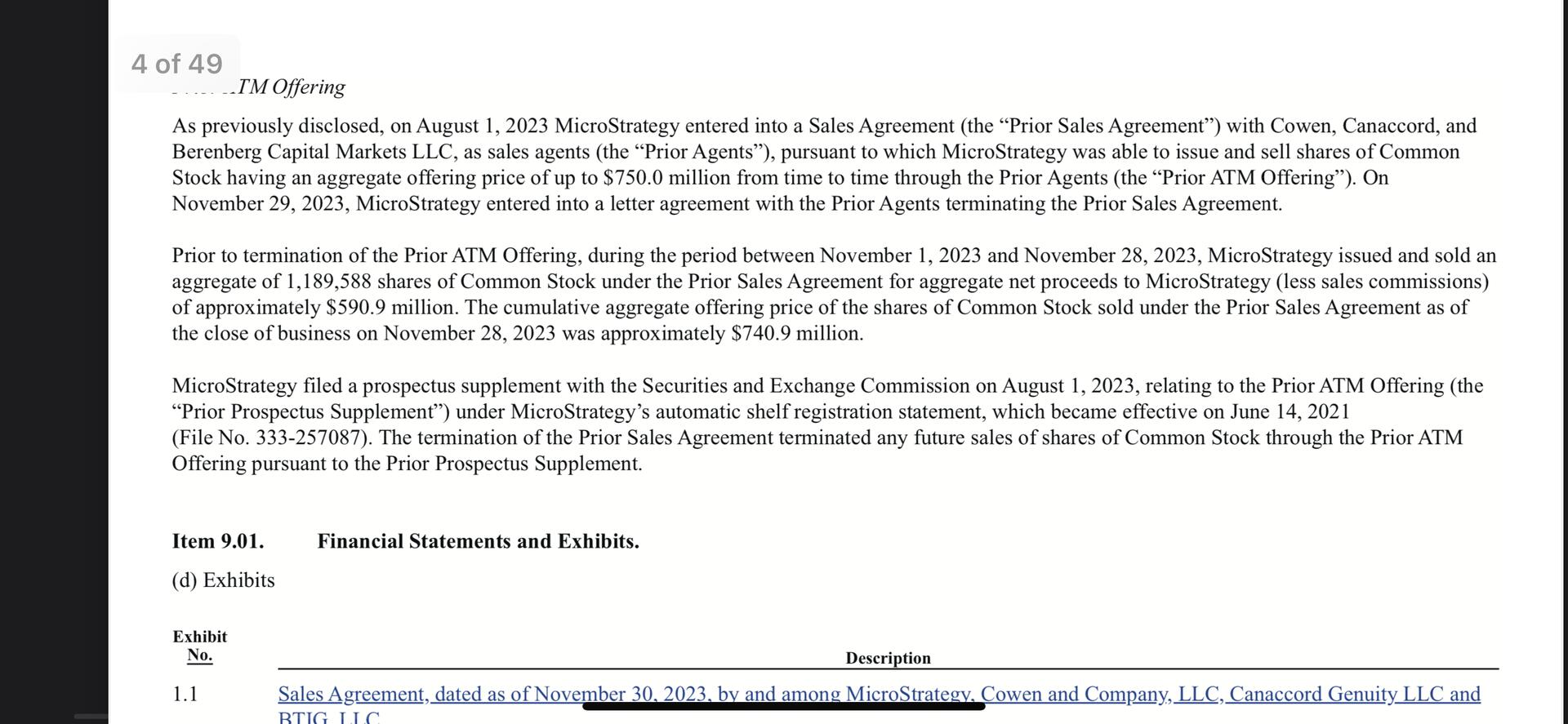

No surprise, $MSTR issued more stock to do it. (See below.)

This was the right move as the stock has been trading at a high premium above its #bitcoin holdings, higher than the operating company is worth. ($MSTR should trade at a premium above its bitcoin holdings as hr operating company also has value, the question is how much.)

I believe nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m is laser eye focused on one metric: *sats per share.* He’ll do anything that doesn’t threaten the stack to increase it.

IMO, he’s a brilliant capital allocator.

This is why I had my mom buy some MSTR shares back when the stock was trading at the price of the bitcoin plus $8 for the operating company. It’s was a steal. Since then both Bitcoin and the MSTR premium have soared.

Now, if only Saylor can enter into a tiny loan he uses to buy bitcoin. Then when Bitcoin goes down & every lazy person who can’t be bothered to understand the loan agreement thinks MSTR is going to default pushes the stock to a large discount, he *buys back* shares and demonstrate to Wall Street what real capital allocation looks like.

When Bitcoin tanked, and as a result MSTR tanked because lazy people thought MSTR was at risk of defaulting on the Silvergate Loan, I moved my GBTC into MSTR & netted a bunch of sats. I’ve since moved back into GBTC, then OBTC, and then back into GBTC again netting me a bunch more sats.

I’m waiting for the MSTR premium to come back down to move out of GBTC into MSTR which is, all things being equal, the better play. (No fee, an operating company that will keep generating free cash flow to stack more sats, and one of the best capital allocators in the business.)

My guess is the divergence between the GBTC discount and the MSTR premium closes when a Bitcoin spot etf gets approved/launched. So that’s what I’m keeping my laser eyed focus on.  nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

Great read, Nathan. Thank you for posting. What would be your $MSTR price target to go back in?

MacroChadegy Strikes again.

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m gobbles up another 16,130 #Bitcoin

That’s a lot of sats.

This is great, thank you! 🤙 I’m going to do this today

Love this. Which notifications did you leave enabled?

Was thinking the same exact thing, Jeff. It’s a brand new game.

In the same boat. It gives us so much optionally if rough seas are ahead.

Unfortunately the same for me as well. I’ve always thought it was the way I’ve explained Bitcoin but in reality, it’s been human nature.

Strike Upgrades: Direct Deposit, Wires, Cards, and more.

Strike getting bull run ready as SBF goes to jail. let’s fucking go

for those outside the US, for the first time in my career, i now get to start a blog about letting you buy bitcoin through strike!

🫡🫡🫡

https://jimmymow.medium.com/strike-upgrades-direct-deposit-wires-cards-and-more-6f1f1721fa21

LFG!! 🔥🔥

whenever Bitcoin pumps i be like

https://video.nostr.build/1ce0105cc51cad0f9468d7a5cd1bb411e4d00340b8a1fd76c89a3a56b846b805.mp4

😂🤣

Short video from my last project.

Tree removal, walls and steps: $53,500.00

Completion time: 9 working days, 2 guys.

Lessons learned: Building a 9 foot tall outside corner with the steps installed makes for some butt-puckering moments.

Homeowners were very satified.

https://video.nostr.build/7f2e6cd50a3cc4e34f0b2a521a5521e731415510eea190840cad398fdf673675.mp4

Looks awesome man. Thanks for sharing