Does anyone have a chart like this with the 'democratically elected' EU Commission Presidents?

#EU #USA #debt #debtspiral #bitcoin #vdLeyen https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/a0d8e9b32e49e981a60b23e71947f930d1be26e1e3b37114ddf0eb5373da1d9d.webp

Come for 2 weeks over here. It's incredible if You discover some pearls besides the tourist trails

EUSSR: Light At The End Of The Tunnel

With its tax increase for the rich and companies, France will once again teach us an important lesson: there are no temporary tax increases! There is only the ever-growing bureaucratic state with its growing presumption to mess around with our private rights, which ends in disaster after all.

The fact that we have to go through all this crap again is only due to the fact that we are experiencing a true negative selection in politics, that the parties ultimately decide on the selection of political representation and that this is precisely where the hinge is to be found between the arrogance of power and the stupidity of politics in wanting to educate sovereign people by confusing them with infantile narratives such as the end of the earth via a halluzinated climate apocalypse.

But we know one thing for sure: maintaining lies costs immense energy (like operating a crumbeling propaganda ministry) and requires an effort that a decaying economy will not be able to sustain in the long term. Freedom always shines at the end of this dark tunnel!

#freedom #socialism #EU #europe #regulation #politics #wef #libertarian #climatescam #bitcoin

GM from Tarifa. Besides politics Europe is great. Have a lovely day.

#spain #andalusia https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/e0c141c2e2c23ede229bad4a9b615d7348437ba37d36e9c5506193b2de7ed27d.webp https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/1dab3e4d141de9cf9adc808b36d7c022c7fd1d473c0fb0cf9e2ac6afecebe492.webp

Eurozone's Economic Quagmire: The Keynesian Fallacy Exposed

In a predictable turn of events, the Eurozone's economy has once again fallen victim to the failed promises of Keynesian economics. Despite drowning markets in debt and flooding the system with artificially cheap money, the European Central Bank's misguided policies have led to an inevitable economic contraction.

The latest Purchasing Managers' Index (PMI) data reveals a stark reality: Germany, France, and Italy are all sliding backwards. The composite PMI has dipped below the critical 50-point threshold, signaling economic decline.

Even the services sector, long touted as the economy's savior, is losing steam.

This economic stagnation comes as no surprise to those who understand the fundamental flaws of interventionist policies. The ECB's relentless money printing and debt monetization have created a house of cards, built on the shaky foundation of market manipulation and capital misallocation.

As the Eurozone digs its own economic grave, we're witnessing the real-world consequences of centralized economic planning. The free market's natural adjustment mechanisms have been stifled, leading to zombie companies, malinvestment, and a severe misallocation of resources.

This data serves as a stark reminder: no amount of Keynesian trickery can outrun economic reality. The Eurozone's plight is a cautionary tale for those who still cling to the misguided belief that prosperity can be conjured through a printing press.

#Economy #EU #Socialism #CapitalMisallocation #KeynesianFailure #FreeMarket #Bitcoin #Euro

France raises taxes in the fight against fiscal bankruptcy

After France decided to extend AI-supported surveillance beyond the Olympic Games, it is now taking a significant step in the fight against excessive national debt: taxes on companies and the rich are to be increased, as they say 'temporarily'. We all know what temporary tax increases mean in this system - they are permanent

Not a word about spending cuts, fiscal discipline or a change in thinking about the welfare state. Thus, France once again offers the blueprint for the final chapter of a popular democracy that drains the purchasing power of the productive classes in order to gain ever new advantages in the struggle to buy votes. The economic crisis of the bankrupt state will deepen further and it will certainly not be able to get its debts under control in this way. The European Union is facing difficult times, as this political pattern is being repeated in all states.

But there is one good thing about this economic decline, as can also be seen in Germany: they will win the battle against the climate change they have hallucinated by reducing their emissions and industry ever further.

#france #taxes #debtcrisis #EU #socialism #wef

The political climate is poisoned in large parts of the West. Germany is no exception. Above all, the extreme left is extremely mobilized thanks to a completely unleashed media climate to physically bring political opponents to their knees. Values and ethics are disappearing, personal responsability need to build up again.

#Germany #west #violence #politics #politicalculture #culture

Brussels Bureaucrats Launch Fresh Assault on Digital Freedom

In a predictable move by the nanny state, EU apparatchiks are once again meddling where they don't belong. The European Commission, ever-vigilant in its quest to "protect democracy" (read: control information), has set its sights on TikTok, YouTube, and Snapchat.

Under the guise of the Orwellian-sounding Digital Services Act, unelected bureaucrats are demanding these platforms spill their algorithmic secrets. Because apparently, Brussels knows better than millions of users what content they should see.

The commission's thinly veiled attempt at thought control masquerades as concern for "systemic risks" - a conveniently vague term that can justify any level of intrusion. They're particularly interested in how these platforms might influence elections and "civic discourse." Heaven forbid citizens form their own opinions without EU-approved messaging!

In their infinite wisdom, the regulators have given these tech companies until November 15 to comply with their demands. Failure to do so could result in fines - because nothing says "free society" like financial punishment for non-compliance with government overreach.

This latest power grab is just another chapter in the EU's ongoing war against free expression and digital autonomy. One can only wonder what freedoms they'll target next in their relentless pursuit of a sanitized, state-approved internet.

#BigBrotherEU #DigitalTyranny #FreeSpeechUnderAttack #EU #Bitcoin #Freedom

These are catastrophic statistics! Southern Europe in particular was known for its abundance of children and is now becoming a victim of the centralists in Brussels. These economies cannot cope with the introduction of the euro, a currency that is as overvalued for countries like Greece or Portugal by up to 30%. The fact that young adults cannot afford to buy their own home, start a family or even found own companies thanks to capital mal-allocation and over-regulation after years of inflation is more than tragic. It is a socialist crime!

#eu #euro #ecb #inflation #socialism

US Private Sector Job Growth Surges in September

Private employers in the United States added 143,000 jobs in September, significantly outpacing expectations and the previous month's figures. The latest ADP National Employment Report revealed a robust labor market, with hiring exceeding the estimated 125,000 jobs. This marks a substantial increase from August's 99,000 job additions, signaling continued economic resilience. The Biden credit-pump seems to work... at least until election day!?

#US #LaborMarket #EconomicGrowth #EmploymentData

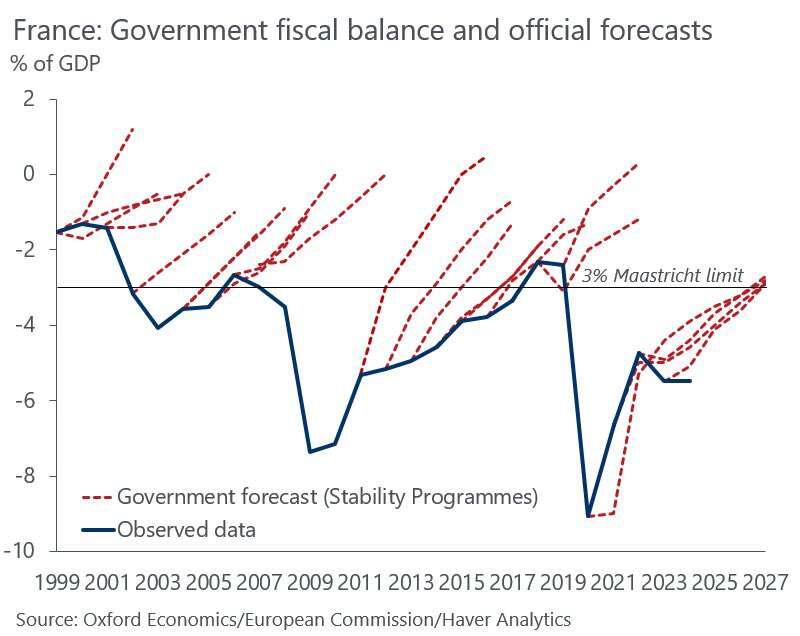

France's Debt Problem Hints At Serious Problems In The Eurozone

France provides the blueprint for fiscal policy and the completely unrealistic forecasts within the eurozone. The same applies to the growth forecasts, which always overstate the potential growth. If you reduce economic output by the state sector, which is merely a consumer and not a producer, the eurozone presents a devastating overall economic picture - if you now add the fact that all countries are in a serious demographic crisis, the orgy of debt is likely to accelerate.

#france #debt #eu #eurozone #bitcoin

A free life cannot acquire many possessions, because this is not easy to do without servility to mobs or monarchs.

Epikuros

Translation: Stack Sats as hard as You can

#bitcoin #freedom

When a politician parasite or fiat central bank clown says: we are fighting deflation, it means nothing more than: we are stealing your purchasing power and making you dependent on our welfare system. And now shut up!

#inflation #fiat #bitcoin #fed #ecb

If I haven't miscounted, 7 (sic!) Fed presidents have been announced today. If you want to calm the markets and the herd, don't run outside your palace spouting your nonsense like chickens on drugs!

#fed #fiatponzi #bitcoin

Japan: The End Of The 'Hiking Cycle'?

Japan's new PM is doubling down on the monetary merry-go-round, promising more easy money to "fight deflation." But let's call this what it really is - another sad chapter in the global farce of artificial GDP growth. During a recent press conference that could have been scripted decades ago, Ishiba demanded that the Bank of Japan continue its role as the nation's premier money printer.

Key points of this economic theater include:

1. Ishiba's call for the central bank to maintain its ultra-loose monetary policy, a strategy that has worked wonders for Japan's stagnant economy over the last 30 years (insert eye roll here).

2. The PM's carefully worded non-commitment to specific monetary measures, hiding behind the facade of central bank independence. How convenient.

3. The announcement of yet another "stimulus package" - because the previous dozen or so worked so well, right? This economic band-aid will allegedly include handouts to low-income households, surely solving poverty once and for all.

4. A vague promise to "reduce the burden of rising prices" - presumably by printing more money, which definitely won't contribute to those rising prices. Nope, not at all.

So far so good. While Japan fiddles with its yen printer, the rest of the world is busy with its own economic hallucination: the so-called "Green New Deal." This isn't about saving the planet, folks. It's about pumping up GDP numbers with monopoly money and feeding a new breed of parasite - the "green entrepreneur."

These eco-preneurs are masters of the government handout, experts at filling their pockets with printed cash while producing nothing the average person actually wants or needs. They're like economic vampires, sucking the lifeblood from productive sectors and leaving a trail of useless solar panels and bird-chopping windmills in their wake. The economic fall of Germany as a consequence of this accelerated mal-allocation of capital is the most prominent example of this terrible comeback of state interventionism and rainbow socialism.

What we need isn't more government "stimulus" or green fantasies. We need a free capital market to flush out these money-grubbing charlatans and force them to find real jobs. Imagine that - contributing to society instead of leeching off it!

But don't hold your breath. As long as the money printers keep humming - from Tokyo to Washington - these green grifters will keep thriving. Welcome to the brave new world of state-sponsored eco-socialism, where the only thing that's truly green is the freshly printed cash (at least in the US).

#MoneyPrinterGoBrr #climatescam #japan #grüne #ampel #wef #germany #eu #FreeMarket #Bitcoin

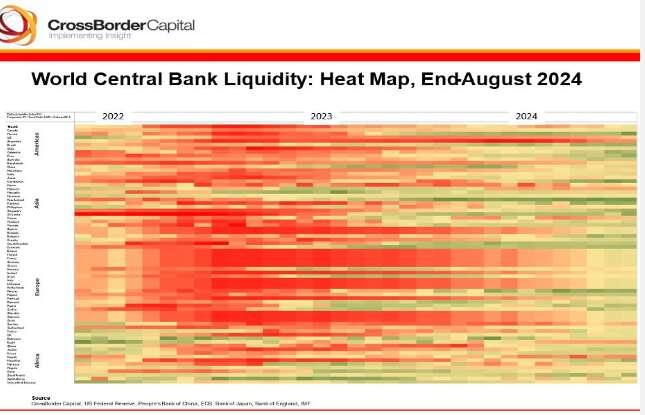

@crossbordercapital