I approve this message. Love the simplicity.

nostr:npub1gmr63m3a7zr8v5xq4vphwz4f45cfev4ytglq83mze9uvae3khevsege7cw you just sent me my first zap ever. Thank you <3

Question for Chatgpt. Answer is why we Bitcoin.

Answer as an expert for austrian economics: How can a fiat monetary system of a democratic society undermine the political influence of the people?

From the perspective of Austrian economics, a fiat monetary system within a democratic society can indeed undermine the political influence of the people in several ways. Austrian economists emphasize the importance of sound money and the potential dangers associated with fiat currencies (currencies not backed by a physical commodity like gold or silver). Here's how such a monetary system can erode political influence:

1. **Inflation and Hidden Taxation:** In a fiat monetary system, central banks can create money out of thin air, leading to inflation when the money supply grows faster than the economy. This inflation acts as a hidden tax on the purchasing power of the currency. As prices rise, individuals' savings and income lose value. This erosion of wealth can disproportionately affect the middle and lower-income groups, reducing their economic well-being and limiting their ability to influence political decisions.

2. **Manipulation of Interest Rates:** Central banks in fiat systems often manipulate interest rates to stimulate or cool down economic activity. This can lead to distortions in investment decisions, asset bubbles, and unequal distribution of wealth. Those with access to cheap credit benefit at the expense of savers and those who lack access to financial markets, exacerbating income inequality.

3. **Government Spending and Deficits:** In a fiat system, governments may find it easier to finance deficit spending by borrowing or printing money. This can lead to excessive government debt, which may eventually result in higher taxes or inflation. The burden of repaying this debt falls on future generations, limiting their political and economic freedom.

4. **Wealth Redistribution:** Inflation and monetary policy can redistribute wealth and resources. Those who receive newly created money first, such as banks and well-connected corporations, benefit at the expense of those who receive it later or not at all. This can create a sense of injustice and inequality, eroding trust in the political system.

5. **Boom-Bust Cycles:** Fiat monetary systems can contribute to business cycles characterized by periods of economic booms and busts. These cycles can disrupt lives, undermine job security, and create economic uncertainty, making it difficult for individuals to plan for the future and engage effectively in the political process.

6. **Centralization of Power:** The ability to control and manipulate the money supply lies primarily with central banks and government authorities in a fiat system. This centralization of power can reduce the effectiveness of checks and balances, as those in control of the money supply can exert significant influence over economic and political outcomes.

In summary, Austrian economists argue that a fiat monetary system can undermine the political influence of the people by eroding their economic stability, redistributing wealth in ways that favor the well-connected, and centralizing economic power in the hands of a few institutions. This can make it difficult for individuals to effectively voice their concerns, participate in the political process, and protect their economic interests within a democratic society.

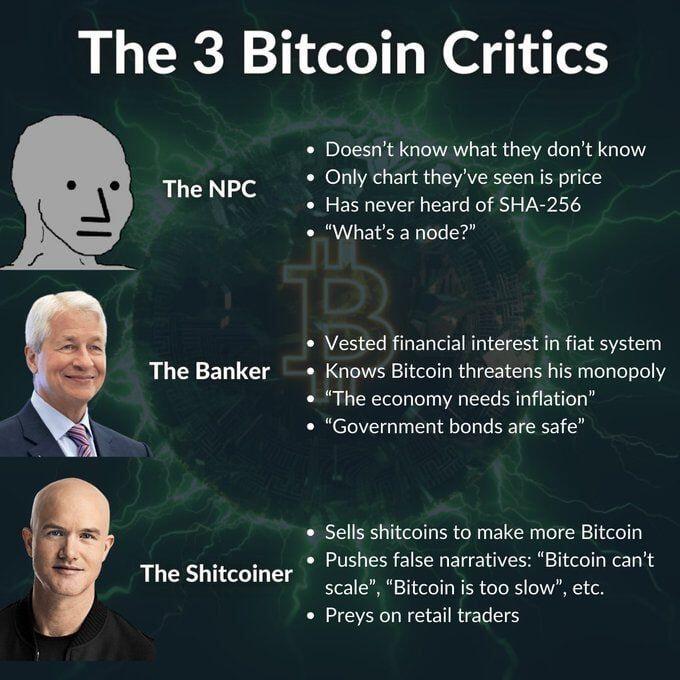

I think they're all accurate except the banker. Most bankers still have no clue that Bitcoin threatens them. They just think it's useless.

It's been a while but I don't remember anything close to the usual nonsense these days.

Just really enjoyed it and could draw lots of parallels to the society we live in. Very thought provoking.

I guess it's a peak fiat Business in a peak fiat world. So it fits. Their prices are still lower than the competition, while the quality of the competition suffered greatly as well. Some products are decent though I'd say (the purely wooden stuff for example).

It's the best reason for a wardrobe change!

Why is rice poison?

Love to see it!

Pura Vida from the Med! https://nostr.build/av/41553c9d605fb2f2fc8ada25abcfd7c3f8274f4fe912cf2ba65ba28e62a202d8.mov

This looks epic!

Amazing! I can't imagine what presenting your research will do to a people that is actually the victim of IMF policies and not a beneficiary like the west, when I as a westerner was already disgusted.