That interview was great-thank you!

They know their billionaire donors would head for the hills if they were serious.

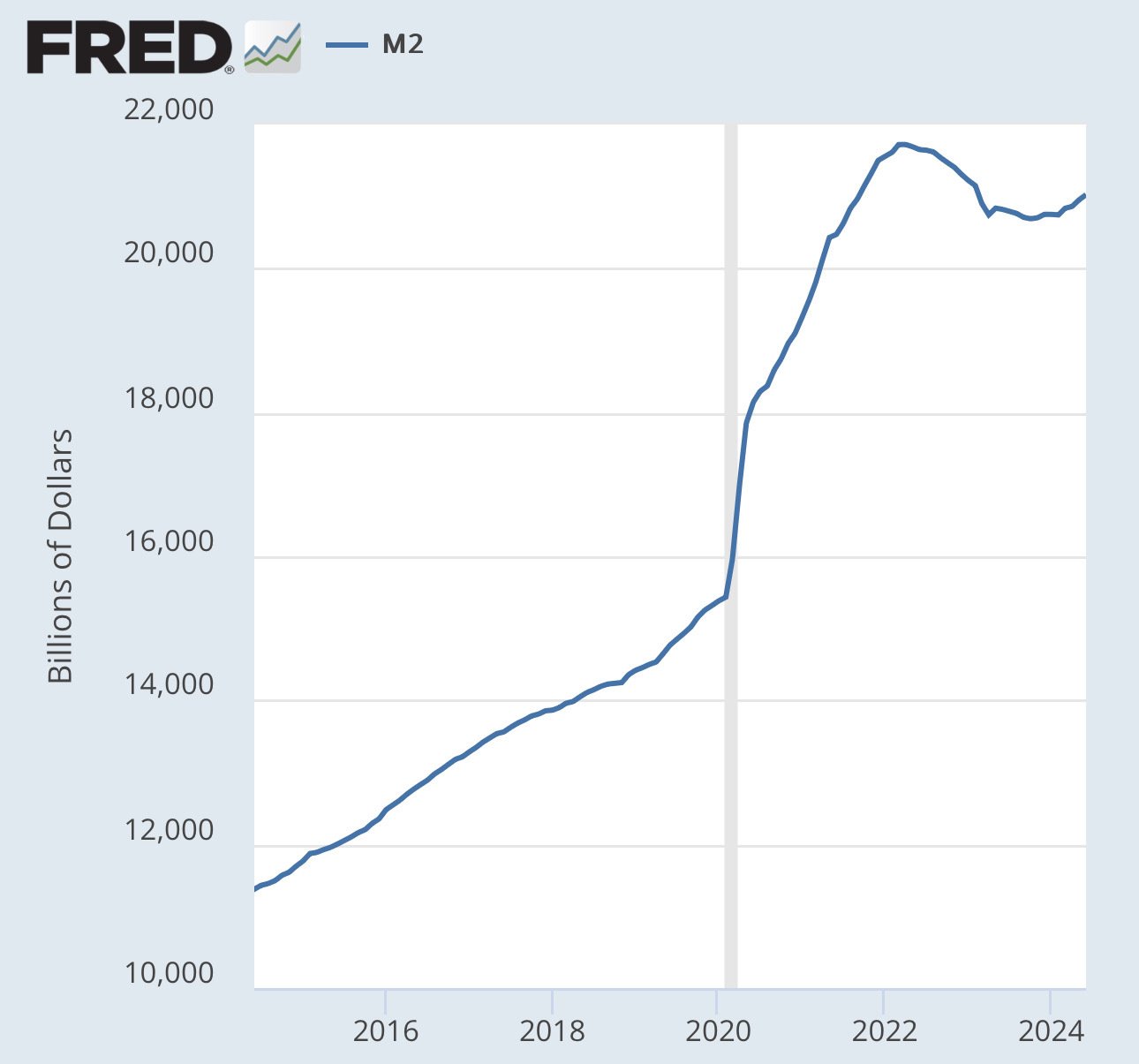

Want to understand how inflation impacts your purchasing power?

Let's look at The New Yorker, which publishes the price of each copy right on the front of the magazine.

1925: 15 cents

2024: $8.99

What the heck happened to make The New Yorker so much more expensive?

It's important to understand that technology is naturally DEFLATIONARY.

Everything should be getting cheaper over time, including The New Yorker.

Think about it: printing, writing, & editing technology has improved tremendously since 1925.

So, why is the magazine more expensive now?

From 1925 to 1971, The New Yorker increased in price from 15 cents to 50 cents, an increase of 233.33%.

That's pretty dramatic, but not THAT bad...

But from 1971 to 2024, price increased from 50 cents to $8.99, an increase of 1698%.

So, WTF happened in 1971?

In 1971, Richard Nixon "temporarily" suspended the convertibility of dollars to gold, ending the Gold Standard.

This meant that the Federal Reserve could now print dollars out of thin air without restriction.

Increasing the money supply by creating new money out of thin air is literally "inflation."

"Prices rising" is the result of inflation.

When more monetary units are created, the purchasing power of the monetary units that already exist decreases.

When the government/central bank prints money out of thin air, they are STEALING your purchasing power.

Here's The New Yorker over a few decades:

1971: $0.50

1980: $1.00

1990: $1.75

2000: $3.00

The magazine did not become more valuable, our MONEY became LESS valuable.

https://m.primal.net/KEpn.webp

https://m.primal.net/KEpo.webp

https://m.primal.net/KEpr.webp

https://m.primal.net/KEps.webp

By looking at this example of The New Yorker, which cost 15 cents in 1925 and costs $8.99 today, we see that the U.S. dollar has lost approximately 98.33% of its purchasing power in less than 100 years.

This is what happens when you print money out of thin air...

When money is controlled by the State, you are powerless to stop the destruction of your purchasing power.

Technology should be making everything LESS expensive over time, but even something as simple as a magazine gets more and more expensive over time.

So, what can you do to protect yourself from the government/central bank printing money out of thin air and destroying your purchasing power?

Study #Bitcoin with nostr:npub10qrssqjsydd38j8mv7h27dq0ynpns3djgu88mhr7cr2qcqrgyezspkxqj8

There will only ever be 21 million bitcoin and no government or central bank can print more.

The majority of money supply increase since 1925 is not through “printing”. It is through the process of loan creation by banks.

Deleted Twitter a long time ago so yes please!!

nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a Let’s say the economy (GDP) is represented this year by the harvesting of 10 apples, and that is the whole economy. Let’s say that there are $10 total in circulation. In this case, each Apple would be worth about $1.

Let’s say there was some technological advancement and the economy was able to harvest 40 Apples in the next year. Let’s also say there are $20 in circulation in the next year. Now, each Apple is only worth about $0.50 each.

Money in circulation is generally correlated with GDP of course (money created through bank loans and central bank money “printing”, generally goes up with GDP growth) but in theory they are independent of each other.

So we had monetary inflation of 100%, but the general price level DROPPED by 50%. The actual economy is infinitely more complex of course but I think this explains the general idea.

Welcome to social media with no risk of cancellation.

They are coming gradually……

In other words there can be positive monetary inflation and a general price decline IF the GDP increase is higher than the monetary inflation.

Exactly. The LAG allows Trump to blame Biden, but most of the of inflation under Biden was caused by Fed monetization while Trump was President.

However, monetary inflation does NOT cause general price increases IF growth in GDP is equal to or more than the monetary inflation.

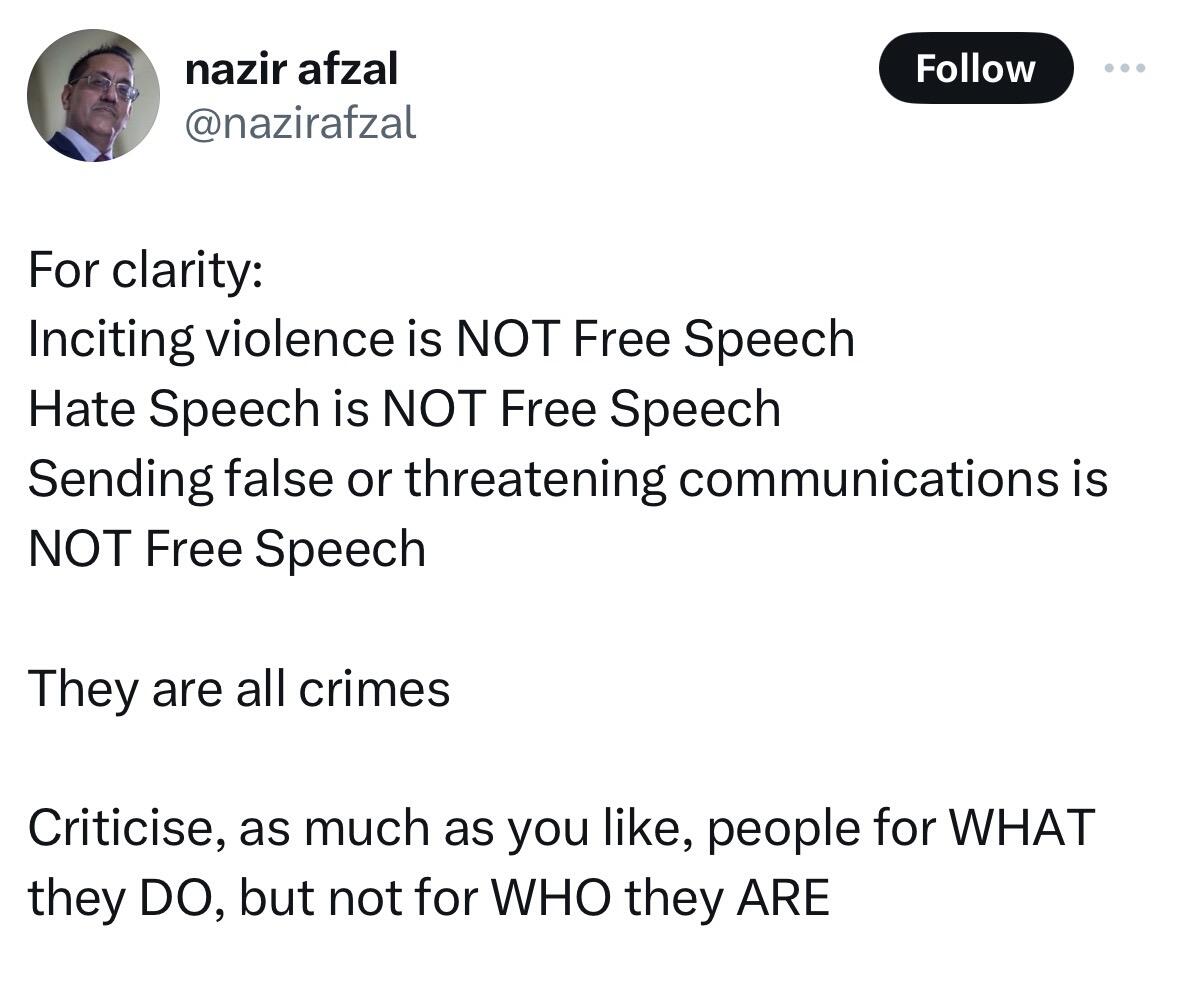

Sending false communication is a crime? I guess Nazir should be prosecuted for his false tweet then.