What the IMF really stands for IM F*

They’ve changed it immensely since last year. It’s still great but not nearly as useful.

Prompts that worked originally now basically comeback with reasons why it can’t or shouldn’t give that information.

Kind of stinks from that perspective.

Musk plays the game for himself.

Apple, Disney, the BIS and all other corporate giants play the game to the lowest common denominator because there is a ton of vig to be had there.

Said another way. Musk usually takes the hard road and pulls out all the marketing opportunities. He enjoys the game of cat and mouse and knows how to execute in a high risk/high reward environment. He’s also good at suckering billionaires who can’t afford to look bad so they bring in their friends and new money when the outlook isn’t looking so good; just to save face.

Disney/Apple, etc. take the easiest road possible (marketing to the masses) because they know little effort is required for easy profits and extremely high margins. Herding sheep isn’t exactly tough and a very profitable business in the digital age. Plus, it’s reliable and repeatable when the narrative changes. There are just so many new ways to spin up easy profits when dealing with the lowest common denominator.

If you think you can trust Musk on Monday, you know you can’t by Friday.

Now we know why fedwire is $25 regardless of amount?

Darkness = evil

Light = knowledge/understanding

Anyone confused or wishing to gain a better understanding, read:

Daniel

Hosea

Joel

In that order. Seek and practice the wisdom of proverbs and all will be good. All will make sense.

Prof Stonge makes nostr:npub1sn0wdenkukak0d9dfczzeacvhkrgz92ak56egt7vdgzn8pv2wfqqhrjdv9‘s point here about the religious side and having a division of knowledge around a critical topic/ tool.

https://x.com/profstonge/status/1723328492203356268?s=46&t=BCZ86Q6VE35kiDHSK1Vf6w

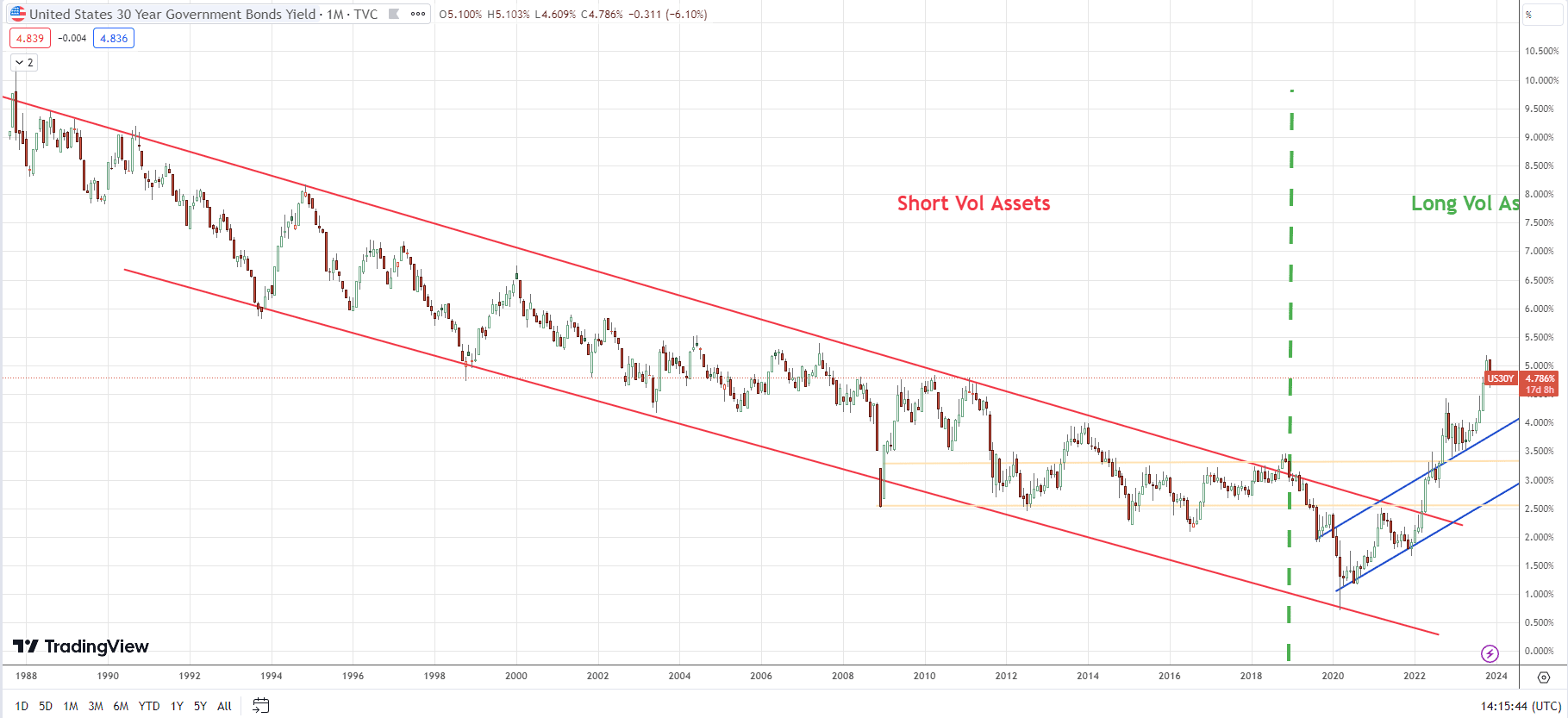

A structural market change not seen in decades is upon us. Here's why…

After WWII and until 1981, we lived in a long vol environment.

This forced capital to be allocated strategically as rates were rising.

In an inflationary system, this is a "normal" market.

https://fred.stlouisfed.org/series/FEDFUNDS

After 1981 as rates fell, short vol strategies and projects that didn't make sense became popular.

This brought on derivative games and private investment games of hot potato...

Place your bets, just don't be left holding the bag.

Post 2000, we entered into a deflationary environment.

After 41 years, we're now entering back into a long vol environment.

The ramifications are drastic for short vol strategies, projects, and deals that don't make economic sense.

Most of us don’t know who these people are until we see their net worth went from $500k to $50 million in less than 5 years, on a $200k gov’t salary.

The. We start asking questions.

Posted several places.

There is one mothership… The BIS.

Baseline government CPU excludes taxes, energy, and food. It is close to useless. As is often the case, a few Texans did the work to get you a much more accurate number. https://chapwoodindex.com/

🤝. Here’s one I noticed recently that really changes the game when applied.

You might enjoy.

https://x.com/kanemcgukin/status/1720438032560525568?s=46&t=BCZ86Q6VE35kiDHSK1Vf6w

The best home schooling we can do… 👇👇.

https://youtube.com/playlist?list=PLCjMxDfsnqjDvJNCjeXguQpsdX6WYe-Bo&feature=shared

It’s covered in Wisdom lessons 18-24.

Lessons 18 and 21 are A++. This is absolutely what the 🌎 needs at this moment.

The next generation is who we should be preparing.

Inflation = currency debasement. As debasement speeds up so does inflation.

An obscure property bought in 1992 for $100k, now = $498k; 398%/31yrs = 12.8% inflation.

Gold: 350 in 1992 & 1,964 today = 461%/31 yrs = 14.88%.

Little used objects of value prove what inflation is.

https://x.com/thomas_fahrer/status/1724350498793550119?s=46&t=BCZ86Q6VE35kiDHSK1Vf6w

nostr:npub129z0az8lgffuvsywazww07hx75qas3veh3dazsq56z8y39v86khs2uy5gm you will appreciate.

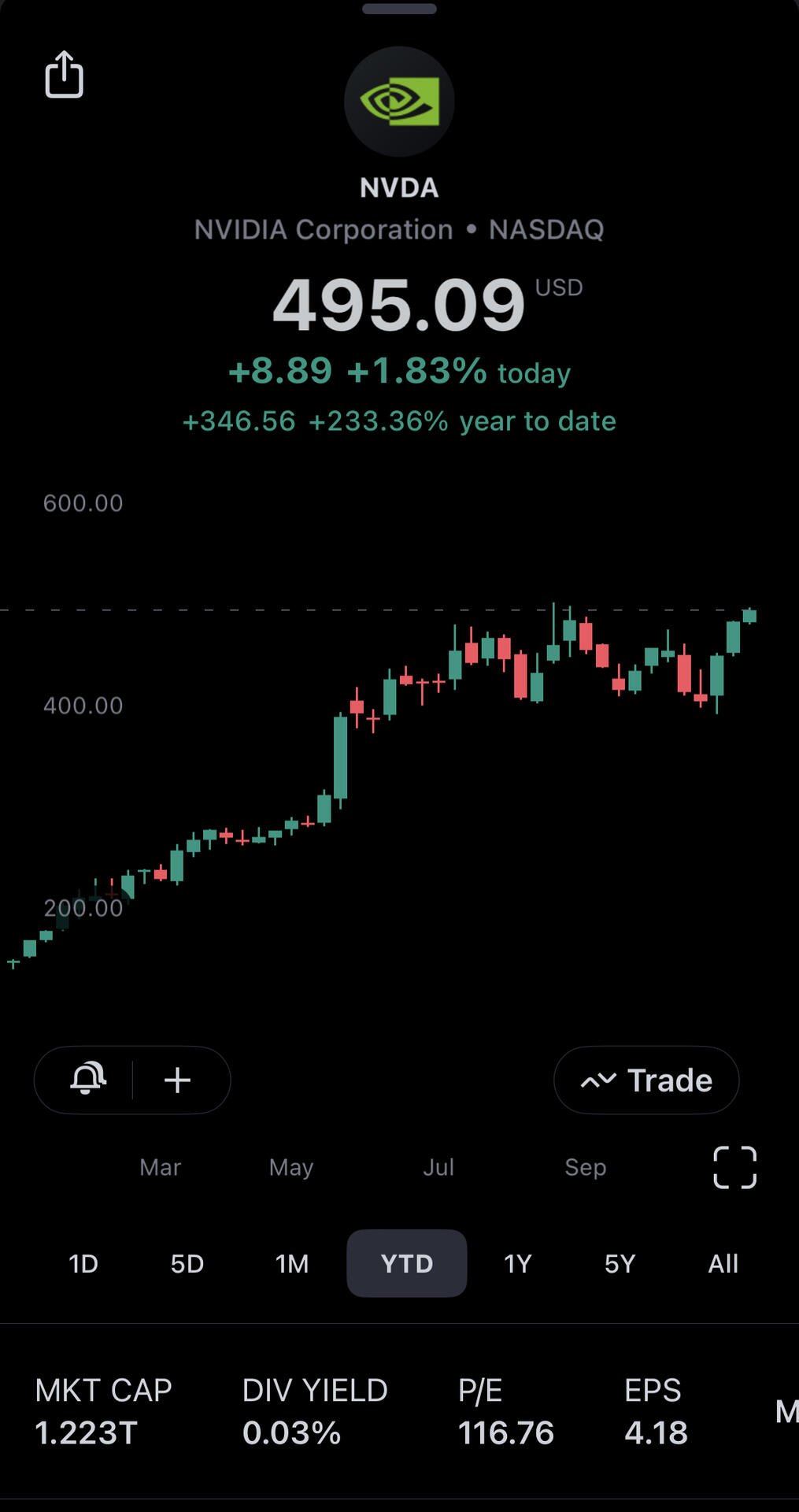

Data displayed as price is the signal, not headlines.

Price is the signal because of the data that makes it up. Headlines are emotional responses to the reality price is conveying.

Grab an IBD subscription. There are some fallacies to “high PEs”. A lot of the work behind IBD was effectively Jesse Livermore’s pyramiding strategy.

If you look at PEs in a vacuum you would and will miss every one of the greatest companies on earth because they will *always* look grossly expensive by this term.

Price action is the signal.