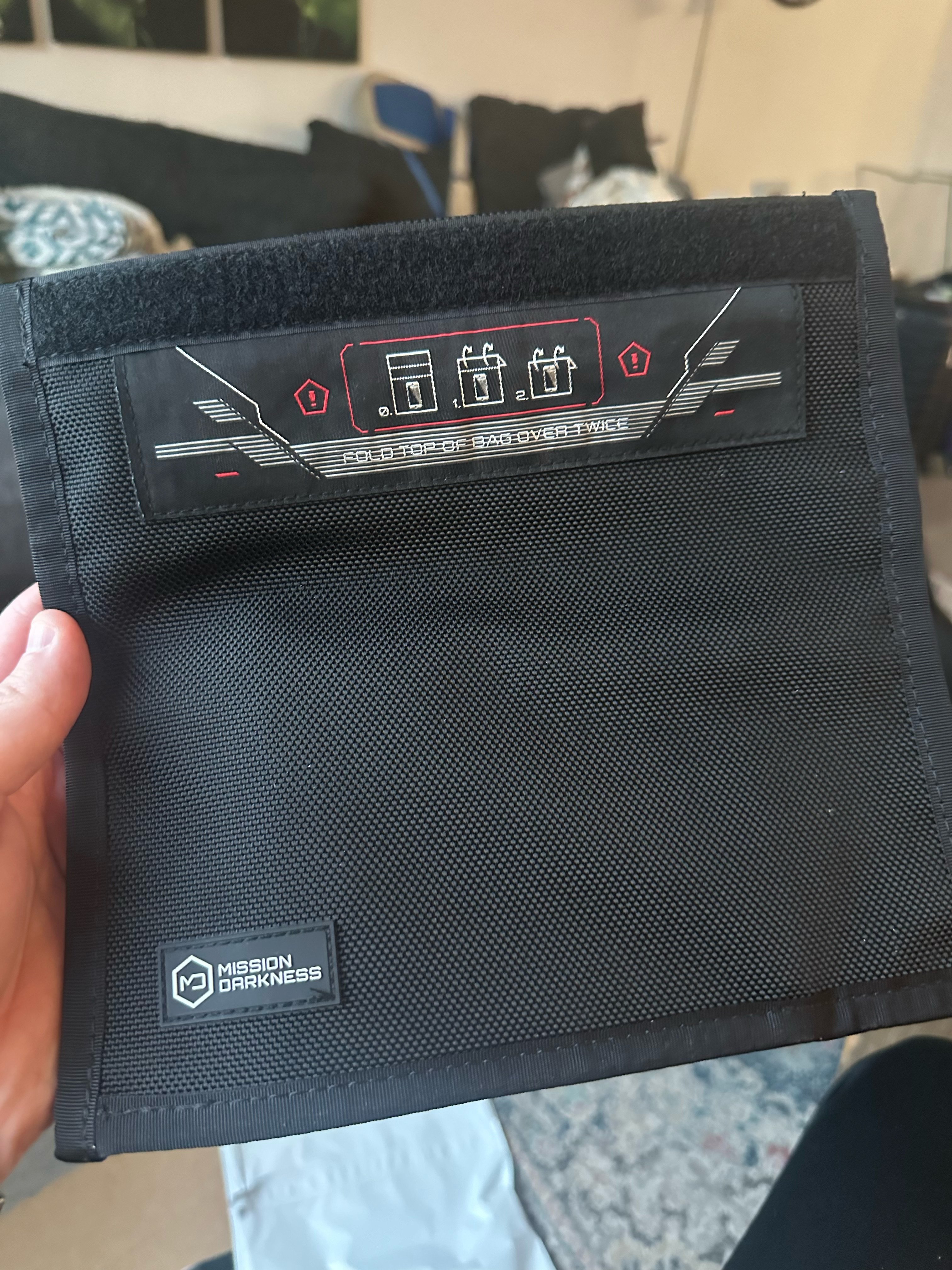

I’ve tested a few and am planning to put them up for sale with nostr:npub1qvwdl9rp7a5ghrxv57wnml5ehg2whjh708vys6kaxpkgu0z3aclsuy2h4p but still haven’t found ones that are optimal. We would not only use it for phone, but also for signing devices.

Oh and on another note. If you drop your phone or laptop in a faraday bag make sure you put it in airplane mode or turn it off before you do. If you don’t the machine ramps up power towards WiFi/Cellular to establish connection again. This drains the battery quicker.

Nice! SLNT has a magnetic mechanism that addresses this. https://slnt.com/collections/teams-top-picks/products/privacy-plus-starter-kit

I love the SLNT ones, but the issue is the shipping from the US and the relatively high cost…

I’ve tested a few and am planning to put them up for sale with nostr:npub1qvwdl9rp7a5ghrxv57wnml5ehg2whjh708vys6kaxpkgu0z3aclsuy2h4p but still haven’t found ones that are optimal. We would not only use it for phone, but also for signing devices.

I think it’s great when someone triggers an explanation like this. The question of history is information belief of the masses that triggers physical results.

Are you scared of what it might bring? I know I am when I currently see mainstream media in the Netherlands. The “sneuvelbereidheid” (willing to die for the country) is almost half of the “fatherland”… https://www.telegraaf.nl/nieuws/1016119199/sneuvelbereidheid-onder-nederlanders-groeit-bijna-de-helft-wil-vaderland-verdedigen-in-oorlog

I just became your 38th follower. 🔥

“After careful consideration, bunq has decided to change the commercial terms towards crypto companies. The high risk profile of parties active in this sector no longer fits the risk that bunq is prepared to and is reasonably willing to take at the current pricing.

Companies in your sector inherently pose higher operational, legal and reputational risks for bunq compared to banking services to companies from other sectors. This has led to a change in our T&C's. Please find our updated terms and conditions attached to this email.

In the amended T&C's and Annex 1, the monthly fees are adjusted for companies with an average deposit balance of less than €2,000,000 held with us in the previous quarter. Since your group has been below this average deposit's amount, this change will affect our relationship with you. This means that the monthly account maintenance fees for bunq's Crypto Desk will amount to €4,999.

Kindly be aware that these adjustments will be implemented starting from 31th March 2024.

Please note that if you continue to use our services after that date, you will be accepting the modified terms and conditions.”

It’s good to hear about what’s going on other than USA thanks to nostr:npub14mcddvsjsflnhgw7vxykz0ndfqj0rq04v7cjq5nnc95ftld0pv3shcfrlx we sometimes hear about UK but it’s annoying to hear this from Netherlands. For some reason in my mind Netherlands always supposed to be the poster boy for Proof of Work. Especially if it makes the trade channels available for everyone. But government and big corporations doesn’t hold the culture of the nation I guess.

I’m in parliament on Tuesday discussing exactly this.

nostr:npub1yy73ar2d4g0g07gx28ywh0x3zs5ymauzdwglnp006dql2afxvm6s9uhmd2 an Iranian Bitcoiner is translating 'The Genesis Book' to Farsi. He started a donation campaign. Please encourage him and donate satoshis to help him finish this translation. Your support is very valuable. Link for donation 👇

#bitcoin #nostr #bookstr

You need an “invite code” to register on that website…?

It’s actually funny that I can finally read nostr:npub1ccsfkkfk46jsjtn80cup0vjn98slkheqd65t36tut822kddvdcxqxjdc57's stories again. I have no idea why he blocked me a couple of years ago on Twitter 😂

I was intrigued by the stories of Mircea Popescu years ago. This story is a nice read: “You've got to earn your place on it by doing real things that serve other people, without fear or favor.”

nostr:note1x8yelchrkyk0q8yxk2car9synugp8acndpjzmdmcj0p276lluawq024dcp

It’s still in the planning. But we already had unrealized gains taxed. And that just got killed by court. So a lot of people are able to buy bitcoin soon as billions are coming back to the hodlers that were taxed over the past few years 🔥

At least we see an increase in people educating themselves with nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak ‘s bitcoin standard in Dutch…

nostr:note17d94jdw6c7u6m7u7y6uht9uz3vmsdv09slrkkamns88v3awmr6tqfcydaj

This sounds like you used ChatGPT 😂 I would stick with bitcoin only and not advise people to walk down the path you’re suggesting. Every hardware wallet/signer/electrum/sparrow can work with bip39 native Bitcoin backups. I would always advise a Bitcoin only setup for the hodling of bitcoin. It’s multi generational so I would go for a more “standard” approach. Single sig with passphrase or a multisig is easy these days.

Have you ever tried a passport or a seedsigner? I would advise you to try it.

There are multiple options. For 20,24 or 33 words you could multiply the number of disks for your need.

The question is if the Shamir split is optimal.

Looking at the current single sig + passphrase options or multisig options I believe these suit better than the Trezor option.

In general we prefer to use open source, bitcoin only, air gapped options for signing. Currently only nostr:npub17tyke9lkgxd98ruyeul6wt3pj3s9uxzgp9hxu5tsenjmweue6sqq4y3mgl nostr:npub1s0vtkgej33n7ec4d7ycxmwt78up8hpfa30d0yfksrshq7t82mchqynpq6j Passport and nostr:npub1jg552aulj07skd6e7y2hu0vl5g8nl5jvfw8jhn6jpjk0vjd0waksvl6n8n Jade are options in that respect.

It depends on who you’re helping with the setup and to what extent they should go with this. It would actually be nice to share our work we did with bitsave and bitcoinvoorbedrijven on this. If you want more info I can get you in touch with our group.

People don’t see what we’re dealing with behind the scenes.

As a chairman of the United Bitcoin companies the Netherlands (VBNL) a lot is happening. In the last few months we had serious issues with the bank that facilitates most on/off ramping for exchanges in the Netherlands.

In January a large part of the bitcoin exchanges received a cost increase from €499,- to €4999,- per month for their bank account. In April they received a letter that the companies had until 10th of June to move their funds and operation to another bank. The bank accounts were going to be closed down.

The issue is that many exchanges have built extensive API’s for smooth on/off ramping with this bank. So this was a move that caused a lot of stress for many people. Communication with the bank was impossible. So every individual company took them to court. Only one case was actually brought into the court room and the company won. The other companies received a message they could hold their bank account.

The insane cost increase is still there and creeping further through the list of bitcoin companies.

We’re now looking at a way to reduce the cost, because for small companies it means bankruptcy.

This we do as companies together. And VBNL has been doing this for over a decade now.

For now it’s a bank, and on 10th of September we’re facing an even larger cost issue. The Dutch central bank. We won the court case with 11 exchanges but off course they appealed and now we’ll be standing at the Supreme Court. The central bank has burdened the exchanges with millions of regulatory oversight cost that were not lawful. A win during this court case would not only drop the cost for the exchanges between 2020-2024 but most likely also impact future cost under MICAR and the Authority of financial Markets. We’re currently looking at a €5.6 million cost from just AFM for the ongoing regulatory oversight for MICAR in 2025. Wish us luck.

nostr:note1q3nrt6tst8qhnel3ykcnd8pc3ymqkdy4rcs8c5vrerult7q98pqs8h6gpq

Our little sovereignty shop is now on Nostr. Follow it and enjoy what we’re building and working on. There’s a lot of news coming in the next months. First a lot of proof of work to be done, by many.

nostr:note12kwapwyefcdwtk5rpytyfkvfhztcps5sj770v6j8wklk28w90a3qxfkf6g

That’s great to hear. Thanks for the positive feedback. If you have optimisation hints please let me know.

Thanks for the single view! 🔥