That could be. It’s Gresham’s Law. People spend their worse monies first and hoard their best money. It’s the reason that, if I have both fiat and BTC, I prefer to spend fiat first. You always keep the money that preserves your purchasing power the best.

Sure, we were all were interested in it when it started. But we don’t care anymore. I’m sure you’ll figure it out eventually too. Good luck!

Not sure what world you’re living on. In my timeline, we’ve watched monero continuously decline to irrelevance. I get why you’re upset. Every year fewer and fewer people care.

The ETFs are recent. For years monero has been destroying the value of your savings. Don’t get mad at me.

It’s amazing to me that there are people who believe debasement is necessary to create a store of value. What’s next? Do we need central banks too?

I was just informed that debasement is required to make money a good store of value. 🤷♂️

Bitcoin doesn’t need monetary debasement to be a better store of value.

Even if everyone were a hodler, there would still be transactions because hodlers need to eat too. (And businesses would need to buy supplies and pay workers. Etc.)

It strikes me as this line of thinking is looking to solve a problem that doesn’t yet exist. The mining industry is growing nicely and bitcoin is already the best long term store of value in the way it has protected people’s saving compared to everything else.

Hotez wants the WHO to partner up with NATO because pandemics are now a security issue due to “anti-vaccine aggression”.

I keep saying these people are psychotic and will do it again because none of them faced any accountability.

Either they go or we do; and they’re already preparing for it to be us. https://v.nostr.build/UcAJidRwKHxvE8li.mp4

🤢🤮

Apparently Bitcoiners don’t want to learn from other open source projects mistakes: https://lunduke.locals.com/post/5819317/nixos-commits-a-purge-of-nazi-contributors-forces-abdication-of-founder

If there is a crisis with the core team I hope it is at least open and visible. It would be worse if an infection grows silently and unnoticed for a while. That might cause greater damage.

Mentally ill Bitcoin Core developer’s (achow101) excuse for not acknowledging and then slow rolling the response to Peter Todd’s recent security vulnerability report is they haven’t liked his past “antagonistic” behaviour.

Good to know that Andrew (she/her) is actively policing language with regards to the security of Bitcoin.

Absolutely nothing to see here. This is completely fine.

https://github.com/bitcoin-core/meta/issues/5  nostr:note1dkcnlmp5c2xe6gle543wftcdvyl2vvsg6tqdre7vj9z0sp88yars4swpss

nostr:note1dkcnlmp5c2xe6gle543wftcdvyl2vvsg6tqdre7vj9z0sp88yars4swpss

The last thing we need is for the core devs to be infiltrated woke ideology. The core devs are already a massive centralized point of potential failure.

Pretty sure the public is not involved in any of this. Just elites fighting amongst themselves.

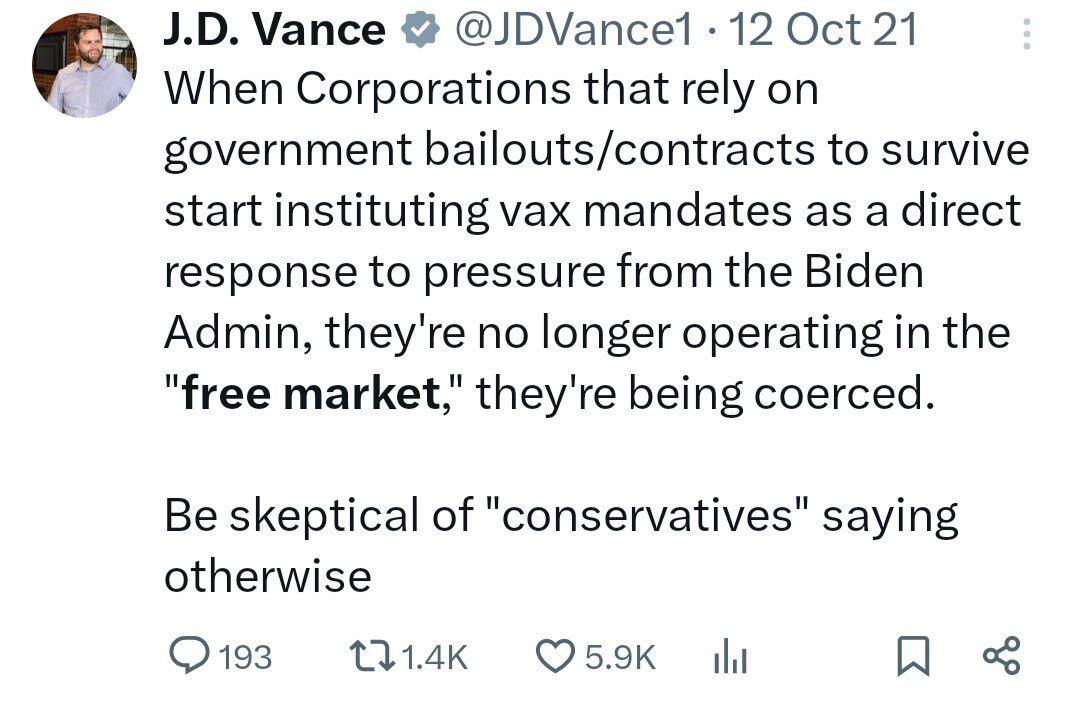

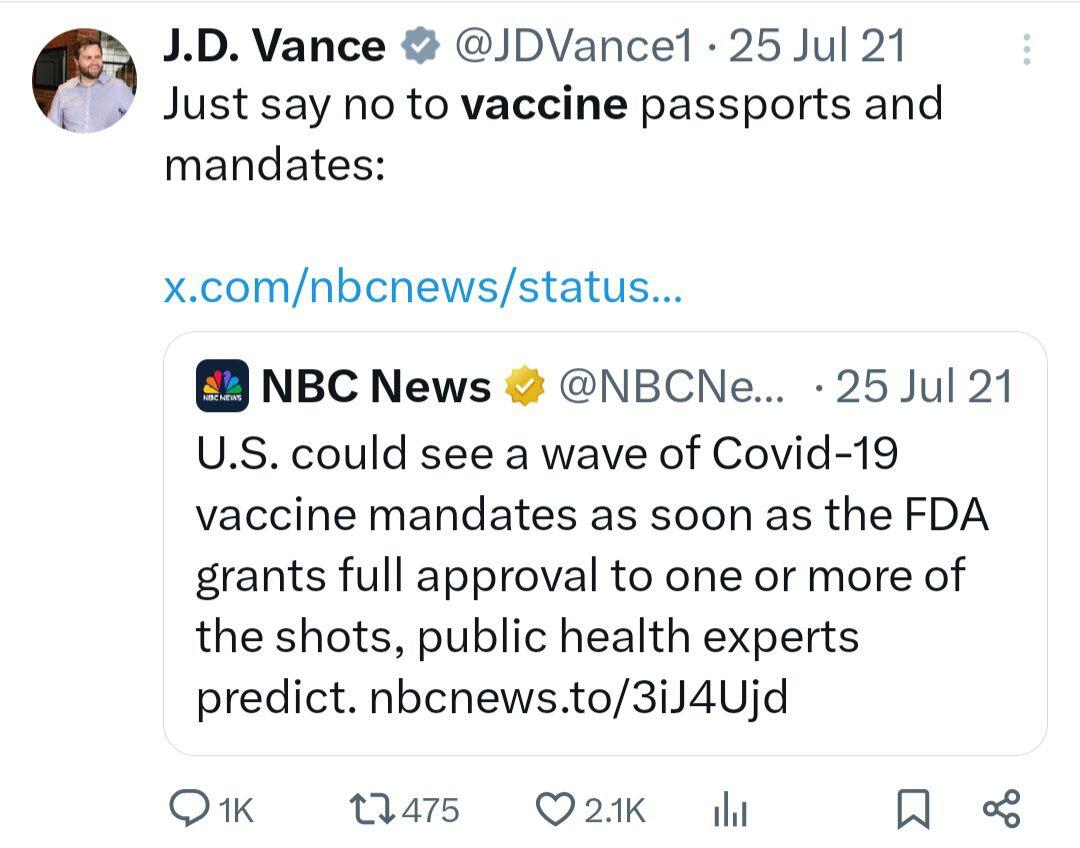

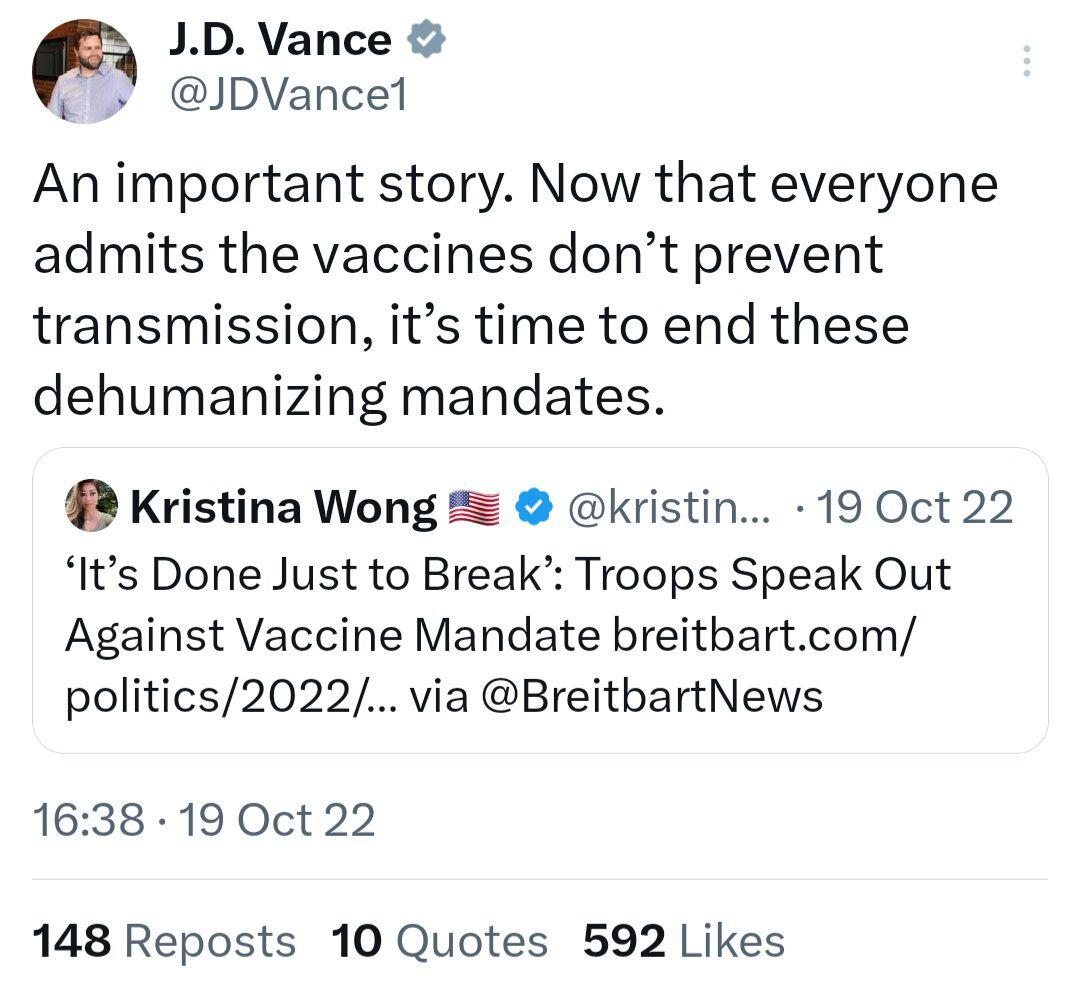

I don’t know much about him either. Good to know he was on the side of freedom with the vax mandates.

Trump picks JD Vance. Pro bitcoin 👍

Apparently the secret service is supposed to secure all nearby sniper perches. Did that sniper know that the rooftop closest to Trump would be not secured? 🤔

If I were Trump, I would use my own security from now on.

Surprised that the dems are not using the opportunity to call for more gun control…

How is pear different from http? #asknostr #dev

Can't http and ftp be done p2p ? nostr:nprofile1qqstnem9g6aqv3tw6vqaneftcj06frns56lj9q470gdww228vysz8hqpz4mhxue69uhk2er9dchxummnw3ezumrpdejqzrthwden5te0dehhxtnvdakqz9rhwden5te0wfjkccte9ejxzmt4wvhxjmcjgxv3n nostr:nprofile1qqst69c7cwzh54r2n3n9uqtfx8t3wldatf5g0xfzwenrnqzg8vdvc9gpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsxvtdhr I'm very interested but off the cuff, without a lot of digging on my part I don't see how it helps p2p. Eli5 🙏🏻

IP addresses are often dynamic.

Also difficult to connect to computers behind WiFi routers.

Have you read it yet?

Those silly people will find another way to hurt themselves like destroying another working nuclear plant.

My lovely wife nostr:nprofile1qqsfg2spq35fak0xfwjn5lfumpn59h0ka4n8n3yux3d9fnlegyq9pxspr9mhxue69uhhyetvv9ujuumwdae8gtnnda3kjctv9ucg730w has just had an abysmal experience with lightning and nostr. She had ln.tips set up a long time ago, which she was unable to access because when signing in to telegram she was prompted to use her number, which did not being her to her old account. Luckily I set up lndhub with nostr:nprofile1qqsrf5h4ya83jk8u6t9jgc76h6kalz3plp9vusjpm2ygqgalqhxgp9gpr3mhxue69uhkummnw3ezumt4w35ku7thv9kxcet59e3k7mgpzemhxue69uhkkmr0vd4k2mn8vyh8xmmrd9skcqguwaehxw309ahx7um5wghxy6t5vdhkjmn9wgh8xmmrd9skctylktc and was able to access her old ln.tips account. I told her to get primal on my way out the door to head back to work. Naturally she downloaded and made a new account on primal because she was unaware it was even a nostr client and thought it was just a wallet. Then she transferred her sats there. Although she had to leave around 500 sats behind in ln.tips because... Lightning architecture. Then texting back and forth I explained she should have used her existing key to sign into primal. So I said just send me your sats and sign it and you can sign in with your existing nsec. She did, but again had to leave 100 sats behind.... Except now, her email is associated with a primal wallet that's not her actual account. This whole experience involves several apps, friction, pain points, terrible UI/UX , lost time, lost sats. This shit has GOT to improve. Adoption is going nowhere until it does. Can someone help associate her current email with her actual nostr account?

It’s another good reminder that we’re all beta testers and we need to keep that in mind when inviting others.

I suspect that, long term, most users will gravitate to custodial solutions because there will be folks like Milan who can assist. Sovereign lightning is frustrating but it still exists in consumer apps because we want to believe it’s for everyone.

Just like how we no longer use the L1 chain for everyday payments, I suspect that over time we’ll no longer use self-sovereign lightning and instead use custodial lightning and federated ecash. Probably only exchanges and federations will use sovereign lightning.

It feels a bit like we’re in this in-between place because federated ecash isn’t yet a viable mainstream service.