Notable BTC Catalysts

Countries/States that have bills to create a Strategic Bitcoin Reserve (SBR):

USA

Japan

Switzerland

EU

Czech Republic - 5% of $146 Billion of the bank’s

Vancouver passed BTC friendly

US States: in total 16 US States have some form of Bitcoin legislation in place.

SAB 121 - rule governing institutional inclusion of bitcoin at the banking level. I think it’s an SEC rule keep an eye on this. It hasn’t changed yet.

Trump / Lummis proposing a “strategic Bitcoin reserve” with the purpose of buying 200,000 BTC per year.

Florida and Pennsylvania are proposing legislation that would create a BTC Strategic Reserve.

The world‘s third largest pension fund, South Korea’s National Pension Service, has invested 34 million dollars into Microstrategy as a de facto Bitcoin investment. NPS is the countries largest institutional investor with $777 billion in assets under management.

The Swiss National Bank and Norway’s central bank have also begun investing in Microstrategy (MSTR).

Norway’s Sovereign Wealth Fund has purchased enough BTC that each Norwegian citizen holds the equivalent of $27 in bitcoin (5.5 million people x $27 = 148.5 million dollars).

11 Spot Bitcoin ETF approvals in the US including three of the biggest names in asset management: BlackRock, Fidelity, Wisdom Tree, Ark Invest, Grayscale Bitcoin Trust, and others all allowing access for TradFi. Shattering all inflow records. BTC can now be held in 401ks and tax-deferred retirement accounts.

Hong Kong ETFs for both BTC and ETH.

Financial accounting standards board (FASB): changes in accounting practices will allow for holding bitcoin on business balance sheets “at fair value” instead of only being accounted for at a loss as it is now. New rule changes Jan 1st 2025.

The practical effects of this is that more big businesses can do what MSTR took a chance by doing.

Bank for International Settlements (BIS): will allow central banks of all countries to hold up to 2% of their assets in bitcoin, stable coins, and other cryptocurrencies. The top three central banks in the world: the US federal reserve and the central banks of both China and Japan have combined assets of nearly $20 trillion alone. 2% percent of that is 400 billion. https://www.bis.org/bcbs/publ/d545.pdf

Markets in Crypto Assets regulation (MiCa): The European Union landmark legislation signed in 2023 and the BEGINNING of a 12 to 18 month process will allow 20% of the global economy to invest in spot BTC ETFs sometime in 2024/25. This will make International standards for AML/CFT will be achievable across Europe.

Read up on seed oils, like cottonseed… blech! Any info about algae oil? Just heard about it.

Curiouser and Curiouser

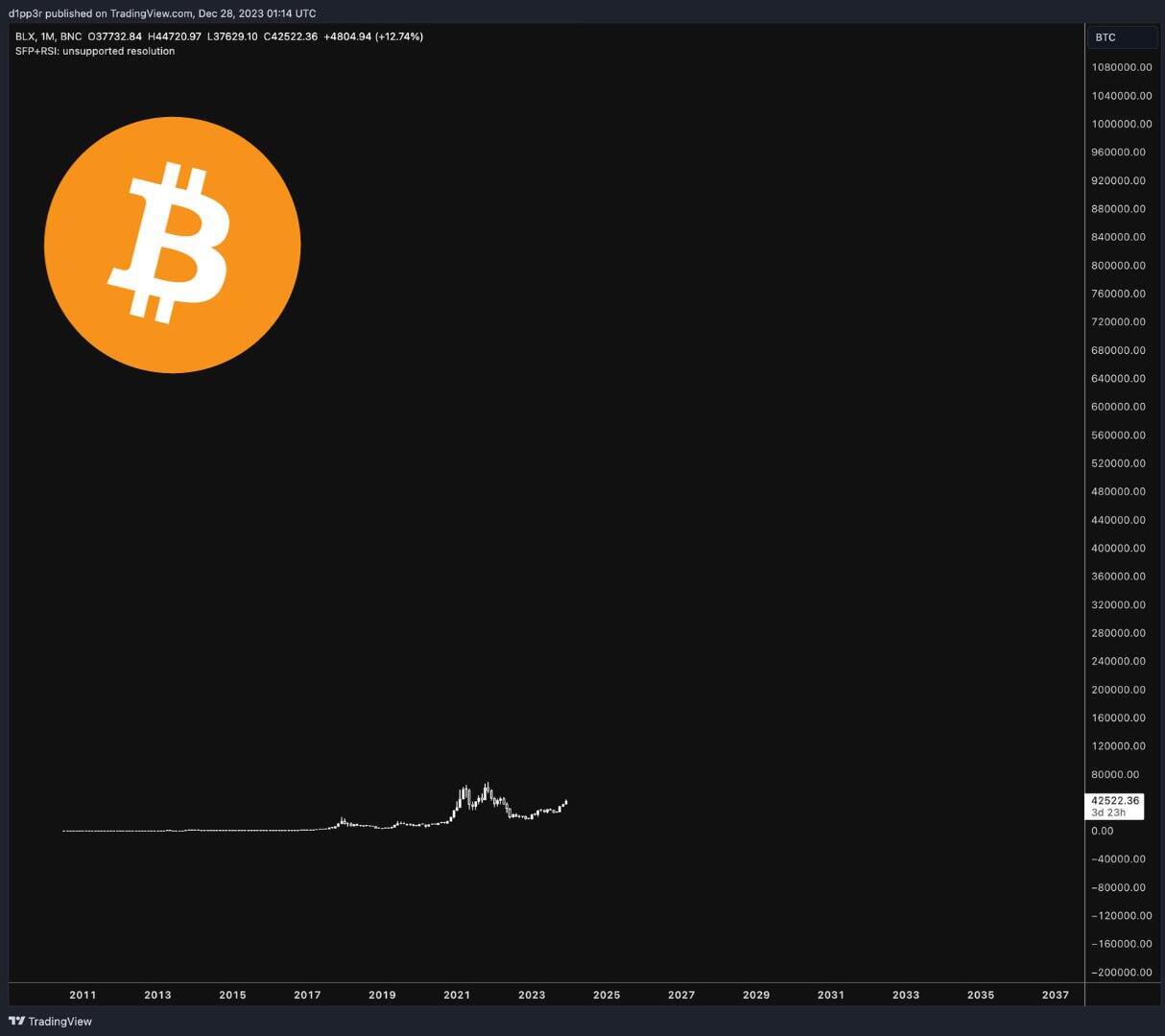

Bitcoin above 52k months before the halving? ETFs vacuuming up hundred of thousands of bitcoin per week? Imagine when the supply shock really hits?! Strap in internet frens!

A mainstream narrative that, I think, is about to change. The advertising blitz for the ETFs will first distinguish between Bitcoin and crypto. There will be ads everywhere.

Truly… happy to escape that paradigm.

We’re early. NOSTR’s young. Here’s a comment for ya!

My journey and introduction to #Bitcoin began in 2013, a couple years after Poker’s Black Friday event in which I had a $3k bankroll and a $500 a month average profit snatched from me by the US Govt. I eventually found out that I could use Bitcoin to deposit and withdraw funds on one of the remaining online poker sites. I started using Coinbase to get my money from A to B, but I didn’t understand anything about Bitcoin other than that.

Fast forward to 2021, and I hear Bitcoin is at $60k. I was dabbling with stocks and shiny rocks at the time and was looking for investment opportunities. Once Bitcoin dropped to $30k in late 2022, I started investing a little. Then I started studying on Saylor Academy online, and the seed that was planted in 2013 came to fruition and it finally clicked!

In 2023, I started buying steadily ramping up my intensity through the year. I liquidated my stocks and shiny rocks and went 100% Bitcoin. In 2023, I learned how to self custody, joined #Nostr, and continued to absorb any and all info I could find.

The original hook was obviously number go up. And, now I’m to the death with #Bitcoin.

My biggest mistake was not digging deeper in 2013. I caught a big downswing and it spooked me. At the time, all I was thinking about was poker and didn’t realize Bitcoin was the score.

I’d say I learned the most from Saylor Academy, but it’s been a mix of everything from audio books, podcasts, blogs, vlogs, memes, and shit posts on #Nostr that molded my understanding of Bitcoin and solidified my conviction to becoming a maximalist.

I currently use the nostr:npub1ex7mdykw786qxvmtuls208uyxmn0hse95rfwsarvfde5yg6wy7jq6qvyt9 app to purchase my Satoshis. Once I collect a few hundred thousand sats or so, I move them to cold storage. Strike is the cheapest and easiest way I’ve found to build my stack, plus it works great for #zaps!

I currently feel extremely positive about the future thanks to #Bitcoin, and I’m super pumped for the ‘24 bull run! LFG 🚀

Nobody knew. The important thing is that the scales fell away from your eyes and now you know. There’s no unthinking the thoughts you have. Good luck!

New to this… what do I do?

Most cultures outside of Europe and North America have insects in their diet somewhere. I’ve eaten a range of grubs, crickets, grasshoppers and ants but the one that blew my mind was the “toe biter beetle”. One of the street foods in Bangkok, I tried it on a dare. Their taste and texture were just like shrimp!