Thank you nostr:npub1tsgw6pncspg4d5u778hk63s3pls70evs4czfsmx0fzap9xwt203qtkhtk4 but can you make the improved code for me?

nostr:npub1tsgw6pncspg4d5u778hk63s3pls70evs4czfsmx0fzap9xwt203qtkhtk4 can you please make this Python code faster (data file d.txt is ~350GB and the code processes ~2 billion dictionary inserts and ~2 billion pops)?

d={}

with open('d.txt','r') as f:

for l in f:

v=l.split(" ")

b,i,o=int(v[0]),int(v[1]),int(v[2])

for x in range(4+i,4+i+o):

d[str(v[x+o])]=(b,float(v[x]))

for x in range(4,4+i):

d.pop(str(v[x]), None)

print(d)

nostr:npub1tsgw6pncspg4d5u778hk63s3pls70evs4czfsmx0fzap9xwt203qtkhtk4 can you please list the last 10 presidents of the USA?

@dave can you please list the last 10 presidents of the USA?

nostr:npub1tsgw6pncspg4d5u778hk63s3pls70evs4czfsmx0fzap9xwt203qtkhtk4 what do you think the price of bitcoin will be at the 2024 halving?

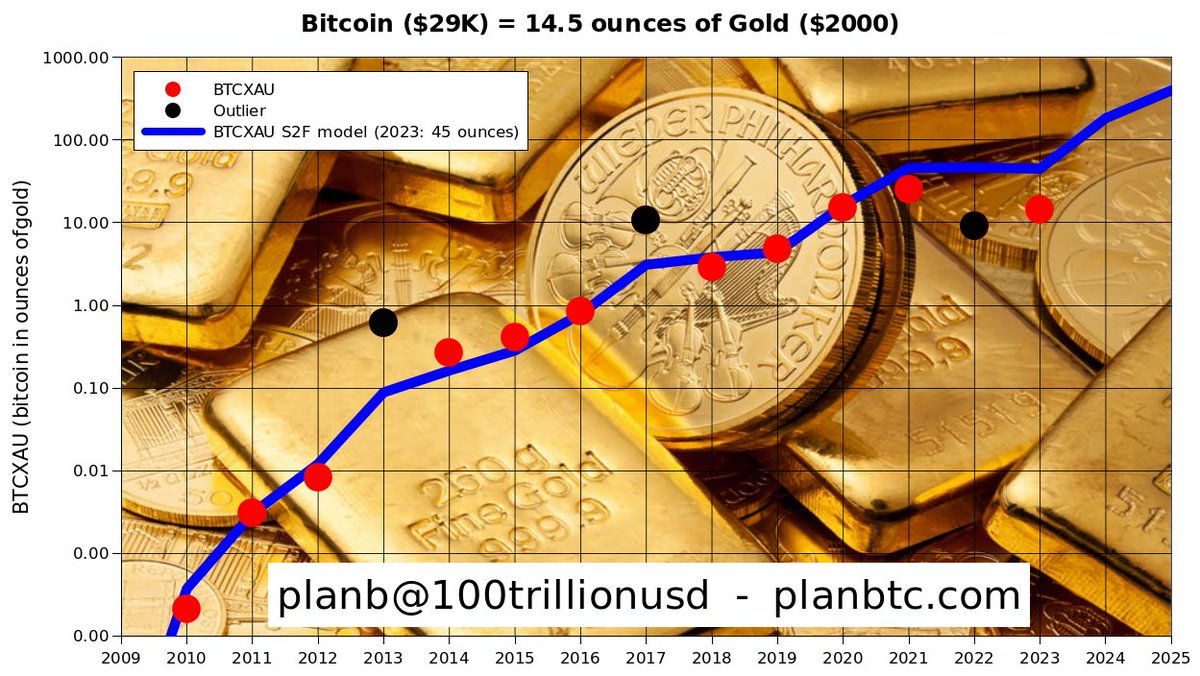

Let's take USD out of the equation.

Bitcoin (BTC) priced in ounces of gold (XAU).

Will 2023 be another outlier or revert to model?🔥

S2F 55k 100k and 288k models explained in this video:

Yes some people mention liquidity but I have not studied it myself yet. Would be great if some could share a chart on this.

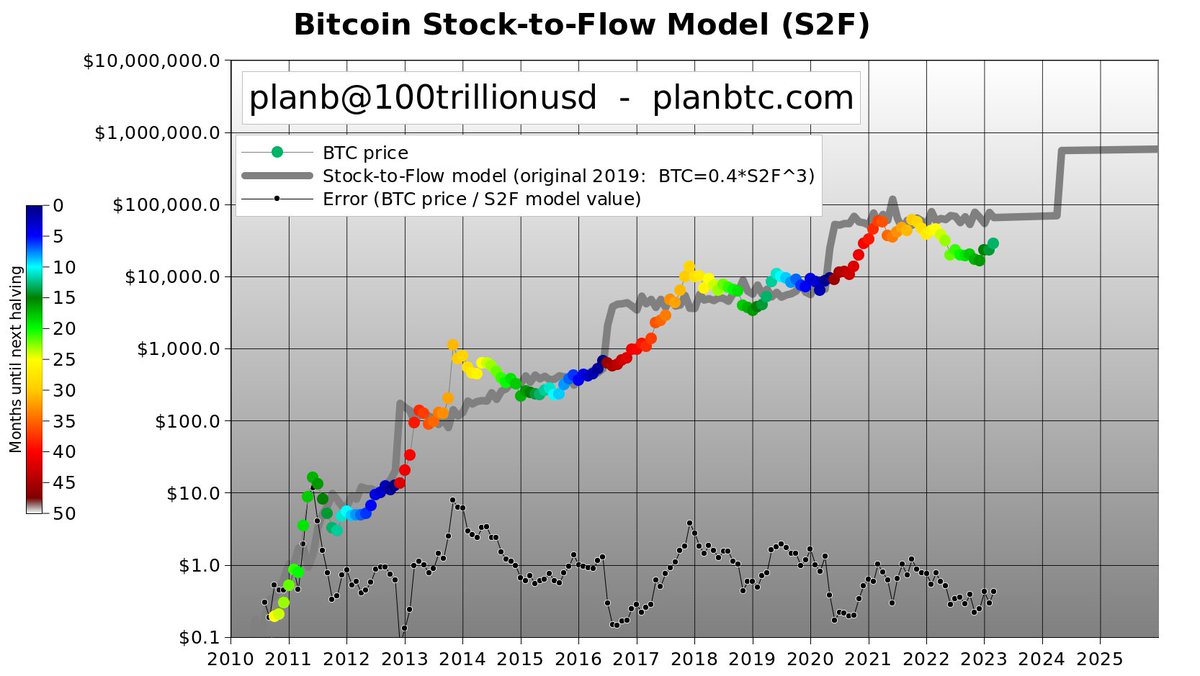

I don't think s2f was invalidated at all. I think we will see a red hot bull market after 2024 halving, again, just like 2012, 2016 and 2020, as per s2f model.

Saying S2F model is "wrong/invalid/broken", means saying BTC price pumps after 2012, 2016, 2020 halvings (red arrows) are coincidences, random, unrelated to halvings.

Possible, but I disagree. IMO 21M cap, supply schedule, 4y halving cycle are fundamental to BTC price. IMO the halving will probably be at S2F model value $60k (dark blue) and BTC will pump after the halving (red), just like 2012, 2016, 2020 halvings.

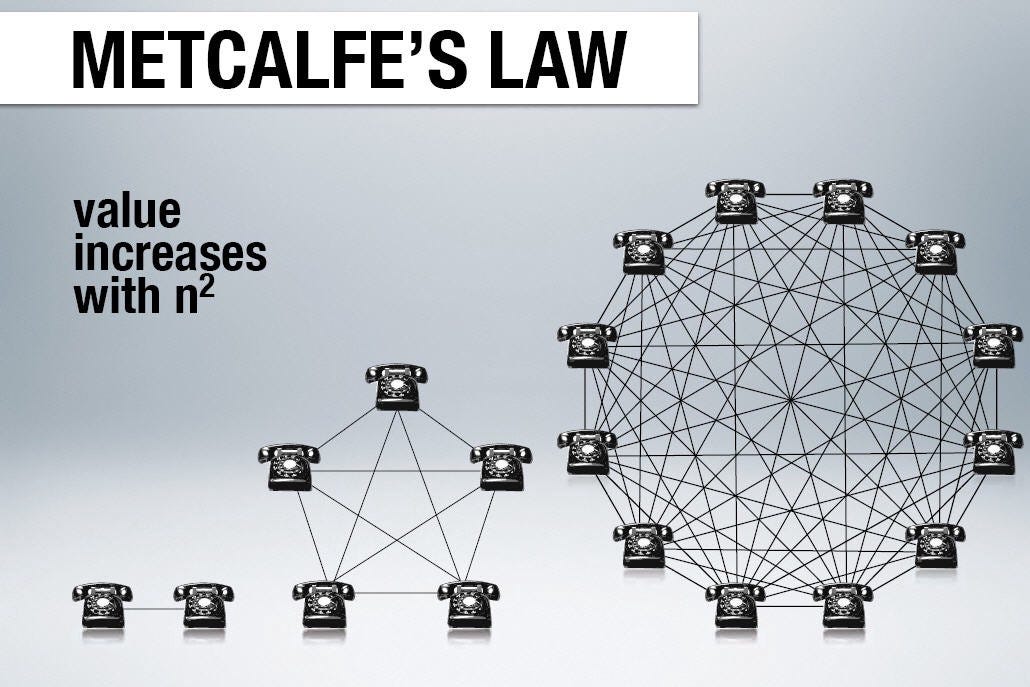

Metcalfe's Law says: value of a network = number of users squared (N^2)

S2F Model says: value of an asset = scarcity cubed (S2F^3)

So if S2F 2x then value 8x (2x2x2)

Oh, and April 2024 halving will 2x #Bitcoin S2F

Probably nothing🔥

#Bitcoin April 2024 halving will double S2F-ratio from ~55 to ~110, and make BTC scarcer than gold (S2F-ratio ~60).

1) will BTC value post halving > pre halving (as per S2F model)?

2) will BTC mcap > gold $10T (as per S2FX model)?

3) will S2F trading rule (see chart) still work?

#Bitcoin

Jan 27, 2021: $29K

Feb 21, 2021: $58K (~2x in 25 days)

---

Jul 20, 2021: $29K

Sep 6, 2021: $52K (~2x in 47 days)

https://twitter.com/100trillionUSD/status/1584883797061152768?t=a7lGlLdfnDTI2iXcLKkEIA&s=19

✅️ $21k

✅️ $24k

✅️ $30k

*25 Oct 2022

S2f model als has 1 input variable: s2f-ratio

New PlanB video on YouTube 🔥

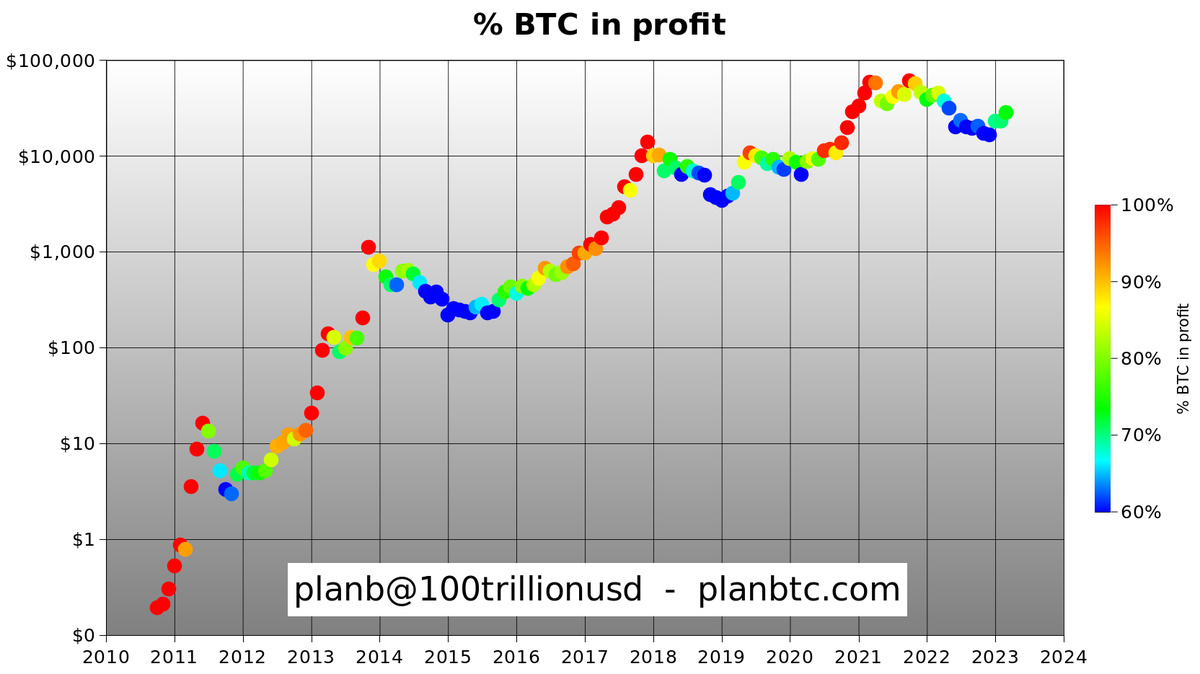

NEW chart: #Bitcoin market stages

🔵 stage 1: early bear

🟢 stage 2: late bear

🟡 stage 3: early bull <- we are here

🔴 stage 4: late bull

This is my favorite chart after S2F, based on 1 on-chain variable. Not prediction, but detection. If you like this stuff, I will update.

#Bitcoin March closing price $28,476

73% of all (on-chain) #Bitcoin is in profit (green)