I just watched HodlHang9 https://youtu.be/lMZ2JOHjslY?si=4uXUgoWKHxyHTkFV and it's so amazing that I have to give it my highest recommendation and express my heartfelt gratitude. It's like being in a room with the brightest minds in Bitcoin, yet it feels as intimate and friendly as a chat with close friends.

Two moments in this episode really struck a chord with me:

1. nostr:npub15vzuezfxscdamew8rwakl5u5hdxw5mh47huxgq4jf879e6cvugsqjck4um Insightful Moment (48:10): When Robert delves into the 'false dichotomy of left and right' and our power to redefine meanings, it's not just insightful – it's transformative. The conversation elevates to an entirely new level of depth and understanding.

2. nostr:npub1hk0tv47ztd8kekngsuwwycje68umccjzqjr7xgjfqkm8ffcs53dqvv20pf Poetic Freeze (2 hr 10mins 56secs) Erik ends his beautiful channeled rant from a higher dimension, it’s like a Bitcoin poem that ends with "ONLY YOU CAN DO IT," And then his Zoom freezes.

It's as if the universe itself is highlighting the importance of his words. It's a magical and memorable moment. Please check it out, it genuinely feels special.

A huge shoutout to all four HodlHangers: Robert, Erik, nostr:npub1cqm6dztalp4l6n04f9k20c333xftgangjla337736dr6faz9na0qf2hjec and AmericanHODL. Your discussions are enlightening, helping me learn more about #Bitcoin and, importantly, more about myself. Thank You

Below is a transcription of Erik’s Bitcoin Poem!

“…..Some things that I see is like this totally new paradigm

like what I do see it having corollaries to it is……..

…….an individual having a true transcendental experience that converts them. Because after that conversion, there's a radical new perspective of the world that allows for it to be totally different!

Yet somehow the same. And it's interesting because there's a passage from Walter Benjamin where he talks about what the world looks like after the eschaton.

He says, everything is exactly the same but slightly different; and that's one of the things about Bitcoin……….

It’s that, all of the same things that seemed so maniacal and hateful and destroying of humanity, there's now this strange little inversion that can happen where, just like how bitcoin is a trap door out of the bottom of hell. It Changes that perspective!

And it allows for an ability for us to actually rescue ourselves from the circumstances.

And to me…….. like this is the most important part……

It’s that like, very similar to the religious conversion……..

ONLY YOU CAN DO IT!”

the world feels so much less lonely, so much more hopeful, getting pumped on content like this.

nostr:note1q2rjp0ecru79lgler92qpn3fj5hn7zqv77lgla29rs9lmhr597yqm786ew

Friends and family:

What good is Bitcoin when large-scale disaster strikes the Internet and power grids?

Me:

The world is a big place, and disasters like that are localized. I suspect Bitcoin is the safest place to store long-term wealth because if disaster strikes leaving your community, state, or country in shambles, you can effortlessly relocate with all of your wealth intact.

I understand the tendency for people to expect fiat to persist alongside Bitcoin for decades because it feels presumptuous and reckless to say the big ship of fiat will quickly sink. But I don't see any first principles that keep fiat afloat. It's headed into rapid debt default. How can the USD survive for more than ~10 more years?

The natural behavior for prices is for everything to get cheaper and cheaper. As technology advances, production becomes easier and thus cheaper. But since 1913 the Fed has printed money with the specific goal of reversing this natural trend so that instead everything gets more and more expensive.

For those using dollars over the next 20 years, it will look like everything is continuing to get more and more expensive.

For those using Bitcoin, it will look like everything is getting cheaper, just as it should be and should have been.

There's no need for complex conspiracy theories to explain societal decay when fiat monetary slavery is perfectly sufficient.

I want to know what the regular people think and feel. Not the political activists, not the militant leaders. The regular people, the families, the parents, the children who are doing their best to live a happy life.

Inflation (money printing) is UBI for asset owners.

2 hrs, Newark airport to Long Island. First Uber driver got us all loaded up in his car at the airport loading zone, routed the destination, and was like "oh, um, no. I can't go that far." So we unloaded and waited 15 minutes for the next guy, crossing our fingers he would go the distance.

Slowly reading and contemplating the Tao Te Ching and A New Earth by Eckhart Tolle together as complimentary works is amazing.

You know that part of The Big Short where the corruption of the banks and the credit rating agencies not fairly pricing the CDSs becomes blatantly apparent?

That's how this part of Bitcoin's price history feels.

Bitcoin links the collective mind together with incorruptible connections.

A master class of corporate accounting clearly explaining why big businesses dominate and consume small businesses, and why corporate debt runs hot.

The economic problems were suffering through are systemic, logical, and fixable by moving to a Bitcoin standard.

Was just telling my kids about these commercials, but failed to make this hilarious connection. Next time I will not fail 🤣

This episode was awesome, by the way. Loved the passion and fire coming from you aimed at making life better for your family, friends, and community! This episode some to my soul!

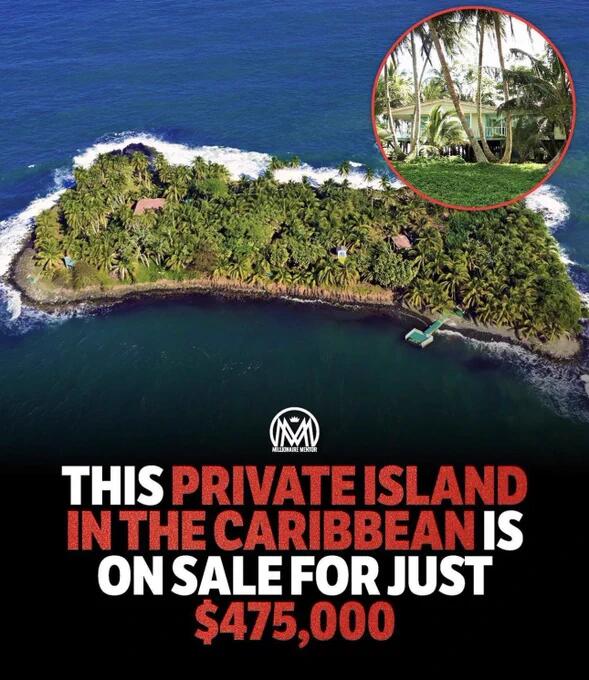

Crowdfunding freedom land development is definitely going to be a thing.

If you want to create a money that nobody can counterfeit, then you have to peg it to the only thing in the universe that nobody can counterfeit, namely energy itself. - nostr:npub15vzuezfxscdamew8rwakl5u5hdxw5mh47huxgq4jf879e6cvugsqjck4um