Do you have any interesting reading material on this topic? I've heard nostr:nprofile1qqsyx708d0a8d2qt3ku75avjz8vshvlx0v3q97ygpnz0tllzqegxrtgpr9mhxue69uhhyetvv9ujuumwdae8gtnnda3kjctv9usy2c9y mention a book by prince Adam.

Books, articles, anything.

What's with vs code?

Well put.

It's underestimated how powerful the ability by itself is.

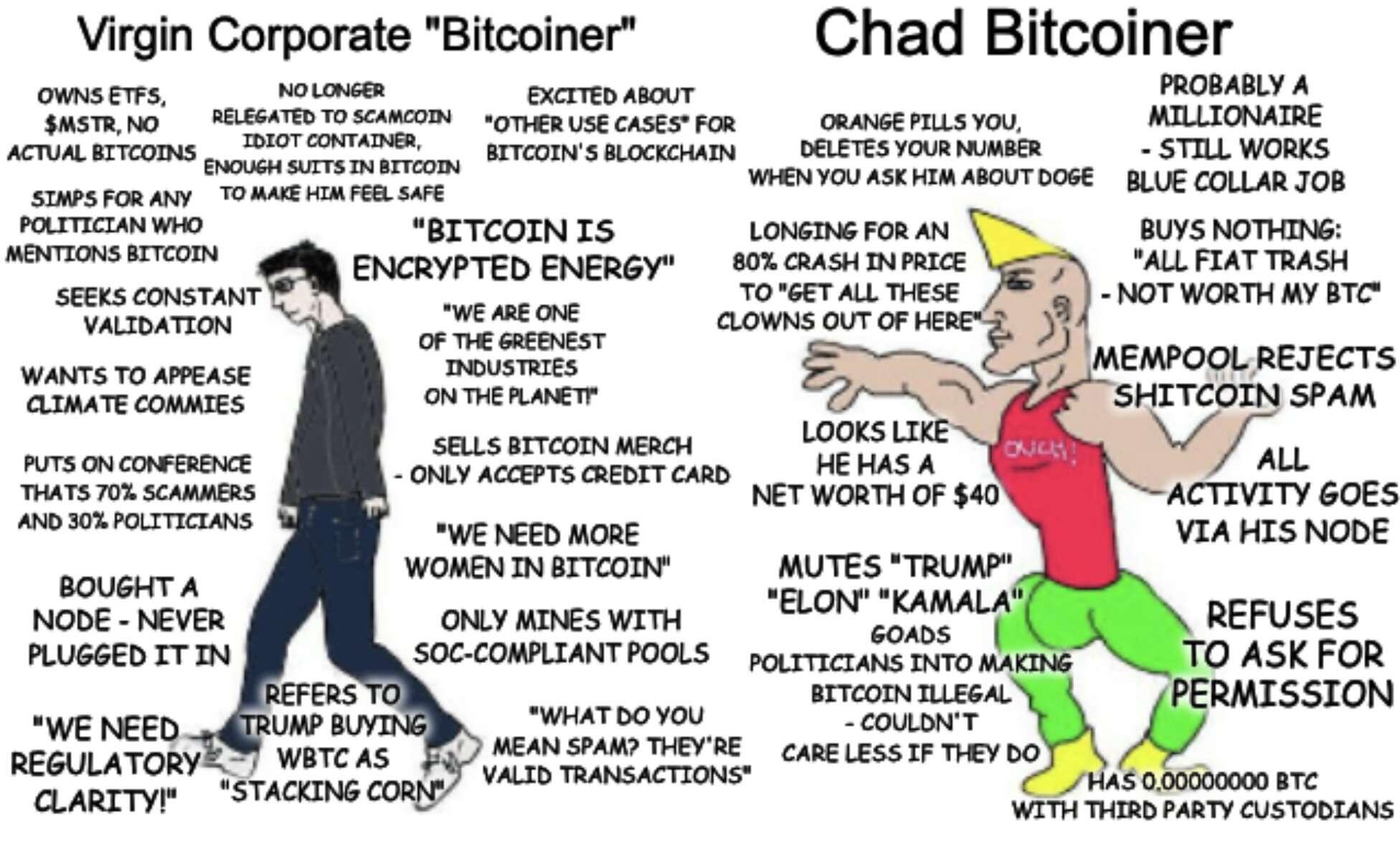

Isn't there? It's not guaranteed, but if there is increasing competition for block space then the spam will have an increasing price card attached it. The more valuable the transaction is to the sender, the more he's willing to pay in fees. Assuming the spam is not really of any long term value to anyone, I'd say it's quite likely that less and less people will be willing to pay the fees.

If it does not get priced out over time, then apparently it is valuable enough to enough people. In that case I'd say it's fair to ask "who am I to declare it spam?"

Of course it does. Bitcoin is permissionless which means abuse-cases become everyone's problem not some centralized service provider.

I talk about it a little here - https://www.youtube.com/watch?v=ne-UvFMzVrE&t=4s

I'm not a fan of the spam personally, but my point was merely that not everyone who allows (not promote) for it to happen, belongs on the left side of the meme 😃.

Whilst I'm not a fan of the spam, I also don't think there is a need to do much about it. I think it'll simply become irrelevant over time. Anything useless will quickly be deemed far too expensive.

The SEC has repealed SAB 121, opening the door for banks to custody #Bitcoin. While this sounds like progress, the risk of fractional reserves & rehypothecation could spell disaster.

Congress must act NOW to protect BTC’s integrity.

Full read here: https://egodeath.capital/blog/too-big-to-fail-banks-amp-bitcoin-custody

I'm on the fence here.

On the one hand I hate the idea of BTC rehypothecation, but I also think it is just inevitable. You can't fix the system from within the system.

The only way to "fix" this is to have them blow themselves up, and lose the actual BTC. The incentives to do this are just too big, for them not to abuse their position.

On the other hand.. the criminal thing in this scenario is that they're losing other people's BTC. Not theirs. Given that they have no way to print it, this would probably harm the customer most of all.

Which brings me back to my earlier comment; you can't fix the system from within the system. What we really want here, is for the customer to be much more self reliable, or at least make very strict demands when having a bank hold the BTC. Neither of these are likely to happen on a really big scale right now, because our current system is the result of good times. Good times create weak men.

Isn't the only real path forward here pain? A lot of pain?

What kind of decibel does this produce?

What are we looking at here?

Deep Nutrition w/ Dr Cate Shanahan on nostr:nprofile1qqsyx708d0a8d2qt3ku75avjz8vshvlx0v3q97ygpnz0tllzqegxrtgpzdmhxue69uhhwmm59e6hg7r09ehkuef046hce4 's podcast was the video that managed to flick a switch in me regarding physical health. I went from total junk food guy to anti blue light carnivore within 2 years.

#carnivore

Liked that podcast. She has a blog too 😃

What changes do you expect to see from them?

It can be quite exhausting at times. As you talk to those people you truly realise how much you yourself have changed. How much you've unlearned and how much new stuff you've picked up, all of which has completely changed your world view.

Insanity. Just sad 😅

OUR BOY nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle IS LIVE WITH TIM POOL:

The live chat.. my god😅

Fund the war with what? It depends on what is accepted as payment; if this is only Bitcoin then they will be limited.

Of course there are many ways around that, trying to force it upon everyone.

Right.

So interest would be paid on loans because the lender is at risk of default. But unlike with fiat, there is no one to bail you out if this does happen. No FDIC insurance if the bank blows up. No click of a button to reimburse you in case things go belly up.

You'd have to ask yourself whether that risk is worth a bit of interest. Is the interest needed in today's world, where Bitcoin already keeps going up in price as people figure out its value proposition?

And after that? In a hypothetical world where Bitcoin is the standard? The interest you're looking for is found in the productivity improvements in the world, which will show up in Bitcoin price deflation. nostr:nprofile1qqsg86qcm7lve6jkkr64z4mt8lfe57jsu8vpty6r2qpk37sgtnxevjcpzpmhxue69uhkummnw3ezuamfdejsz9rhwden5te0wfjkccte9ejxzmt4wvhxjmcprfmhxue69uhkummnw3ezummjv9hxwetsd9kxctnyv4mqgevlfj wrote an interesting book called "The Price of Tomorrow", which goes into this subject. Worth a read 😇.

"Mine!" 🤣