The Bitcoin network relies on common rules; not common code. While you could argue that in all practicality, Bitcoin Core is *the* codebase with *the* developers that are *too centralized*, it doesn't have to stay that way. There are other forks of the codebase that comply with the same rules that have their own developers. Any code change that introduces an incompatibility with the existing network rules effectively forms a separate forked network. As such, a code change to the rules (captured, coerced, or otherwise) is only effective to the extent that network participants choose to accept it.

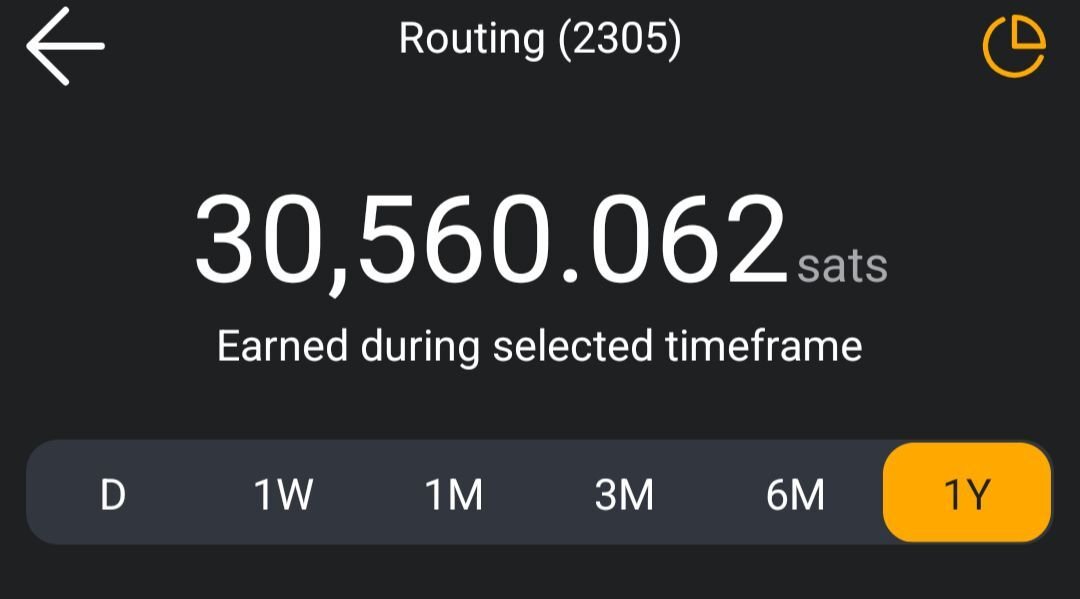

Cool. On a per hour basis, I see that's almost as much as you've been zapped for making this comment.

Respectfully, this seems non-response to my comment. Either it was meant to be a reply somewhere else, or we just simply aren't communicating clearly with each other.

On multiple occasions, Saylor refers to the non-fiat gold standard of the 1800s, or 200 years ago, etc. Then, at one point, Saif frames the conversation as "In a world in which you only have 21 million, and you don't have a lender of last resort, I don't see how this model survives." to which Saylor responds by again referencing the gold standard of the past - this time with the emphasis of "before fiat" - followed (eventually) by "the idea that I would get interest on a sound money asset, I don't think is unreasonable in the future because it wasn't unreasonable in the past."

To me, this can only be interpreted as analogizing Bitcoin's eventual fiat-less future to gold's fiat-less past. This, btw, does not contradict the notion that Bitcoin is not currently competing against the USD nor will it for the foreseeable future.

Ah, I think I see where our interpretations of Saylor differ. I think Saylor was trying to make a distinction between "risk-free" yield in fiat - which as he said "isn't going away in the next 10 years"; and an eventual non-fiat Bitcoin standard future. (I think he was having difficulty clarifying this distinction because they were talking past each other so much).

I believe Saylor's overall point was that there will always be willing borrowers and willing lenders of capital in exchange for a yield (I agree). In a fiat world that offers cheap money backed by a money printer, I agree that borrowing and lending 'risk-free' fiat will likely continue to make the most sense. However, as the world moves on to a Bitcoin standard - and pricing BTC in fiat terms becomes obsolete - borrowing BTC subject to counter-party risk will become normalized.

It seems Saif's position is that in this future, otherwise would-be lenders would necessarily receive shares of equity in exchange for their capital rather than yield. I don't really understand how that would work for someone who just wants to buy a car with capital they haven't yet acquired.

Maybe I'm misinterpreting you, but I don't follow the reasoning behind "getting interest in BTC" is simply impossible. For example, if I loan 0.5 BTC to someone who wants to use it to buy a car, would it be impossible (or even unreasonable) for that person to be able earn and pay me back 0.6 BTC over the course of 5 years?

Sure, there's always a risk that the borrower ends up defaulting; but that doesn't necessarily mean it was inherently a scam or irresponsible in any way from the start.

As an aside, I get that signatures prevent relay manipulation of the data; but, what prevents client manipulation of what is presented to the user?

Maybe aggregated data is good enough if the underlying source reaction notes remain available to be spot-checked for signature verification.

Blackrock filed for an amendment to its ETF:

“Subject to confirmation of the foregoing required minimum balance, Coinbase Custody shall process a withdrawal of Digital Assets from the Custodial Account to a public blockchain address within 12 hours of obtaining an Instruction from Client or Client’s Authorized Representatives.”

So, Blackrock didn't anticipate a need for this from the get-go? Maybe we really should be asking "What's going on with Blackrock?"

https://cointelegraph.com/news/blackrock-bitcoin-etf-amendment-coinbase

Great list! As for the first one, is it even possible to use Nostr and protect your key as securely as you would your Bitcoin keys? I'm certainly not putting any Bitcoin keys that I care about into a browser extension, for example. Until there is a widely implemented standard for doing so, my working assumption is that my nsec has already been compromised, and my Nostr experience as a whole is merely experimental.

It is inevitable that relays will deem it necessary - for whatever reason - to filter much more than just spam - including for widespread viewpoint-based discrimination. But, this is the beauty of a decentralized protocol. It only takes 1 relay to circumvent system-wide censorship... even if it's to circumvent spam-blocking (for some reason). Ultimately, users will also need to filter at the client level whatever undesired content their chosen cluster of relays lets through. But, this would effectively just be a part of the individualized algorithms we've always envisioned anyway.

In short, to any relays inclined to fight spam: Go for it. Experiment. The sooner Nostr embraces this inevitable future, the better.

I think it's an issue of duration match. If a bank takes in deposits and issues loans resulting in a fraction of its liabilities left in reserve, this becomes a problem when depositors are free to withdrawal prior to a comparable repayment of the loans. As such, a responsible fractional reserve bank would put appropriate time requirements on the deposits they take in (such as with CDs). Does this prevent all banks from being irresponsible? No. But, it seems to me that problem solves itself when the irresponsible banks fail, and there is no money printer to bail them out.

Amen. I do kind of get why many people miss Saylor's point because he kept saying "risk-free" - but this was in the context of fiat for the foreseeable near future. However, Saylor also acknowledged the inherent counterparty risk involved in loaning Bitcoin.

Ultimately, there will always be people (and organizations) willing to pay a fee (i.e. interest) in order to borrow capital; and, there will always be people (and organizations) with capital willing to make loans that earn at least enough yield (i.e. interest) to account for some risk of default.

Exactly this. What I think is hanging people up is that Saylor repeatedly referred to "risk-free". In the context of the entire conversation, however, it's clear he was referring to the fiat system which he said wasn't going away in the next 10 years (this doesn't seem an unreasonable working assumption to me). What nobody bothers to mention is that Saylor also clearly acknowledged the counterparty risk inherent in lending Bitcoin for yield in Bitcoin terms; and this is correct. There is the obvious risk that the counterparty may not live up to the deal; but there's nothing about a fixed supply system that prevents a counterparty from returning more Bitcoin than what was borrowed (i.e. 'yield') any more than it prevents a renter from paying a landlord at the end of the month in Bitcoin the renter hasn't yet earned - which is a point Saylor tried to make; but by that time, Saif was a brick wall.

Owns a public company. He has to toe the fiat line.

But they’re referring to his recent appearance on nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak ‘s podcast where they disagreed about yield

Frankly, I thought each were being a little obtuse towards the others' position. Bitcoin could be exchanged for shares of equity (in a startup, for example). Bitcoin could be loaned out at a given rate of interest (to a startup, for example). Each strategy may be used to improve the original holder's overall financial situation; but they each come with their own set of risks. Both can be true. I don't really see the controversy.

"we need to develop tools that let USERS control and filter their own content"

This is where we agree. Ultimately, users ought to be able choose a stream of content to their liking (i.e. choose a set of relays) AND have the tools available to further curate that stream to suit their preferences with reasonable ease. I see no reason to assume that work isn't being done to eventually achieve this.

Don't conflate "CAN spin up their own relay" with "HAVE TO spin up your own relay". Again, only "if all relays" censored you would you be required to spin up your own. That means it would only take one like-minded individual as yourself to spin up their own censorship-free relay so that you (and all other like-minded individuals) wouldn't have to. At worst, this would-be issue presents opportunity (either to you or to anyone else) to cater to you and like-minded individuals.

It seems to me in a Nostr-inspired future, way better tools will likely exist for parents to simply have control (to the extent they choose to) of social media on the devices they provide their children.

I think Nostr was created to be censorship-resistant. That is to say, no matter how much a relay or client may choose to censor content, users are not limited by those censorship choices. Even if all relays and/or all clients chose to censor particular content, anyone is free to spin up their own relay and/or client instances to circumvent those censorship choices of others.

i.e. I think Nostr was created to render the value judgement of censorship moot.

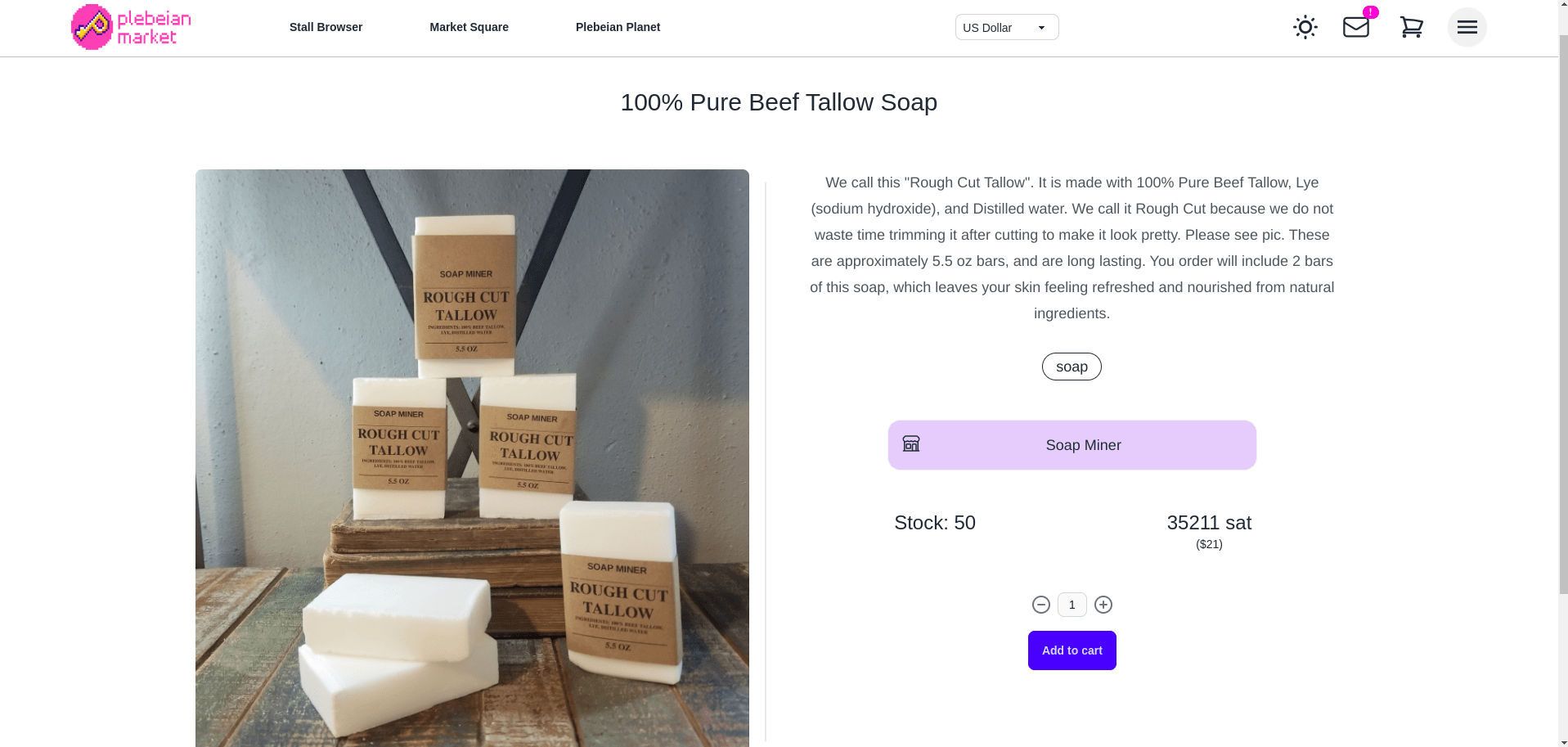

Just started a stall on Plebian Market for our amazing Rough Cut Tallow soap. Can someone please tell me whether this link is working or not. Thanks!

https://plebeian.market/product/a567d56b-4ede-41d1-901a-0f2af752940a

Looks good!

I used to have 2 or 3... the duplicates seemed to eventually go away on their own... maybe when there were finally no differences between them?... It was easier for me to get them to match at the time, though: I think I barely had double digit Follows.

It would be nice to be able to just delete one. Not sure what that would take, though. It seems each list is saved at a specific relay.