Neat premise. Absurdly executed. Somehow whenever a tanker ship runs aground or a plane falls out of the sky, etc it just so happens to be in life-threatening proximity to some of the few people remaining in a sparsely populated area? Come on. Once is enough... multiple times just ruins any hope of continuing to suspend disbelief.

FWIW, a simple transaction of payment for sex among consenting adults legally constitutes 'sex-trafficking'. It used to not be that way. It used to be that any form of human 'trafficking' necessarily involved involuntary participation. There may indeed be real fuckers and real victims involved in this story; but I can't help but roll my eyes at the headline and think about how the contemporary abuse of the term 'trafficking' has done such a disservice to actual victims - whether in this case or elsewhere.

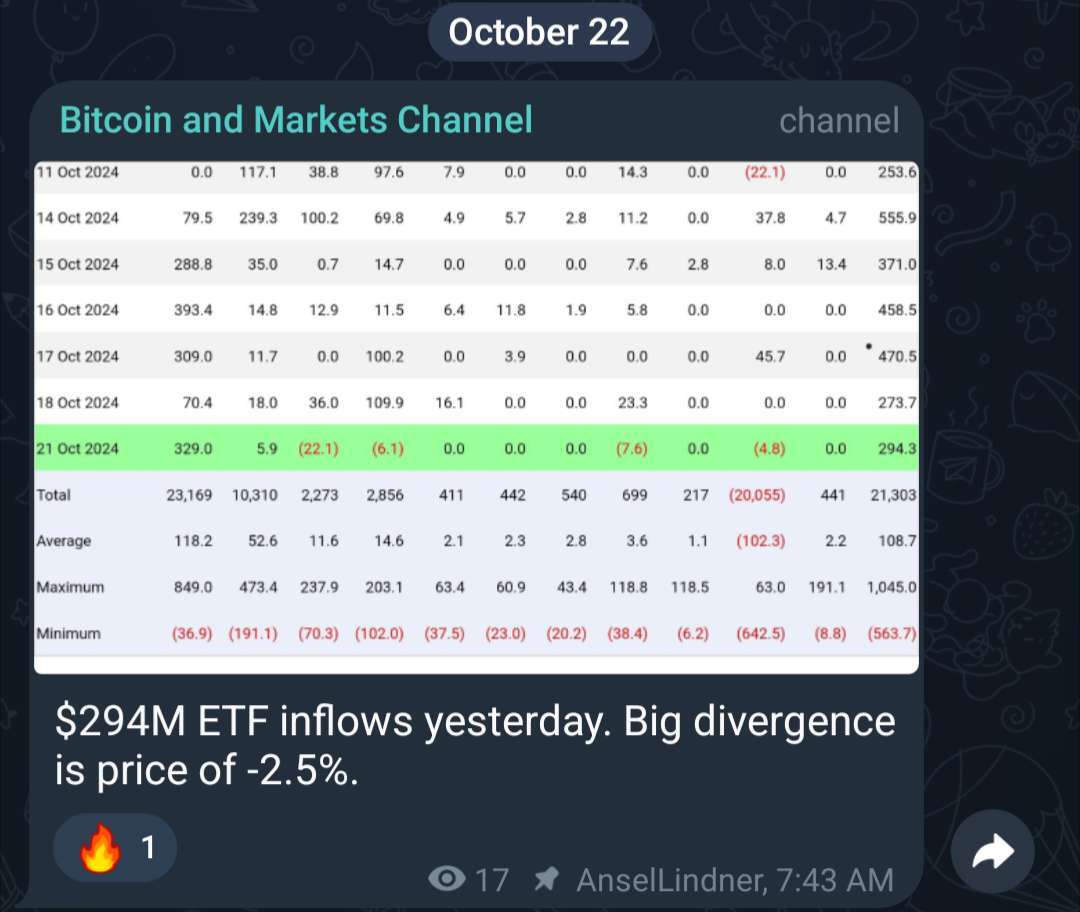

Miners? ETF front-runners? who knows?

FWIW, since just a year ago BTC is still up well more than 100%... that blows those others assets out of the water. It seems likely that ETF hype just pulled BTC's ATH forward by a few months and it's still just re-calibrating.

Yeah, I find market dynamics overall to be a big mystery myself. Clearly day traders know something that I don't (or at least they think they do).

Especially don't ask AI to open the pod bay door.

The daily volume has consistently been in the $10s of billions (well over $30B yesterday alone). It doesn't seem particularly productive to me to try to draw such conclusions regarding price coordination from < 1% of overall trading volume. Different market participants have different buy/sell pressures. ETF investors likely skew one direction. Miners skew in another. Taken together, they still only represent a mere sliver of the overall market.

Seriously, who TF is selling right now??

Also follow nostr:nprofile1qqsq52wnak9tu2uu7r0zk2xqla03zrk9ac7z4j9j4lf7zcws3s5jeygpzpmhxue69uhkummnw3ezumt0d5hsg8adhv and join his telegram group for 🔥 takes and insights on Bitcoin and macro.

My guess is miners. My sense is that the industry has been particularly cutthroat since the halving in April; but that over the preceding year+, the rapid rise in value of their BTC reserves has provided them with quite the war chest to slowly sell off in order to sustain operations during a down and/or chopping sideways market... at least for a while.

Hmmm.. I'm not sure that relying on shared custody does much to teach self custody. Using training wheels does in fact teach balance to ride a bike.

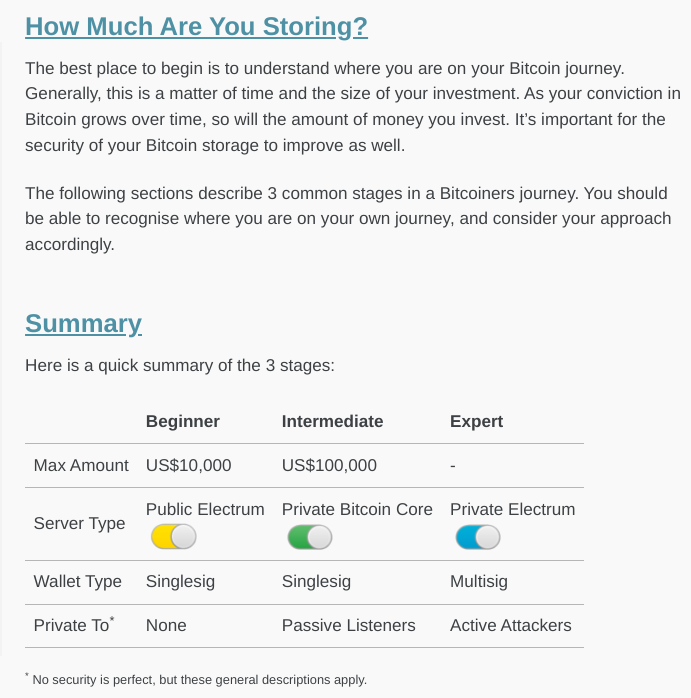

Regardless, if I don't want people too afraid to take the first step, I'm suggesting something like a singlesig wallet app on the phone they likely already own; not purchasing at least a 2nd signing device (either for themself and/or their spouse) in addition to having to sign up for some sort of assisted custody wallet service. Remember, the premise here is that we're only talking about a mere 100k sats at first. I think most newbies on the fence about dabbling in so little would be completely turned off by any relatively significant additional investment and enrollment process just to do so.

Learning can certainly be an incremental process. That process ought to be learn singlesig; then you can learn multisig, imo.

I think when someone just bought their first 100k sats is the best time to teach "ultimately, you're responsible for protecting your keys". Conversely, "Don't worry. If you screw up, your spouse might be able to bail you out." seems like the beginning of forming bad habits.

Not really; but it depends on implementation. Most I've seen suggest that you should retain possession of 2 of the 3 keys in a 2-of-3 multisig, for example... There is no counterparty risk if a) your authorization is required to move funds; and b) you don't require anyone else's authorization to move funds.

The real risk multisig introduces is complication risk: simply more keys to keep track of.

Generally, I still subscribe to the Sparrow Wallet best practices. Though, I'm not married to the amount thresholds. In short, I still think a paper seed for a singlesig wallet can be perfectly appropriate depending on the situation.

Ultimately, I think I tend to agree with your conclusion. However, i don't think gotcha videos are representative of most people. What you have seen are a subset of the most entertaining responses - curated from a total set already skewed in the direction of an intellect that would even consider participating in such videos.

meh... Saylor is clearly in a position where he benefits from others having confidence in establishment financial vehicles. He may indeed be an idiot... or he may just be spouting a self-serving narrative. The last thing he wants is for the real confirmed idiots (elected officials) to realize that Bitcoin won't be tamed.

The category of 'bitcoiner' is about as vague as 'cryptocurrency'. I'm sure there are other 'bitcoiners' that do lots of things I wouldn't necessarily approve of. To each their own, I guess.

"It is one thing to have free immigration to jobs. It is another thing to have free immigration to welfare. And, you cannot have both."

I think it's worth pointing out that this doesn't necessarily suggest blowing up the welfare state as a whole. Though, it may be worth doing so anyway.

yeah, I've been voting 3rd party (specifically libertarian) for literally decades now - purely out of hope that it sends some sort of marginal message (probably futile). Two things would have to be true for me to vote otherwise: 1) the race for the electoral votes in my state would have to be reasonably close; and 2) there would have to be a candidate from one of the major parties for whom I could respect myself voting for. So far, I'm still waiting.