"The more apparent it is that a system is nearing an end, the more reluctant people will be to adhere to its laws. Any social organization will therefore tend to discourage or play down analyses that anticipate its demise. This alone helps ensure that history's great transitions are seldom spotted as they happen. If you know nothing else about the future, you can rest assured that dramatic changes will be neither welcomed nor advertised by conventional thinkers.

You cannot depend upon conventional information sources to give you an objective and timely warning about how the world is changing and why. If you wish to understand the great transition now under way, you have little choice but to figure it out for yourself."

- The Sovereign Individual, Chapter 2.

I like the peanut butters from trader Joe's, just peanuts and salt. Though they are in plastic jars which I don't like.

Don't forget Ghee!

Curious about Peanut oil though, I feel it's one of the better options but I'm not sure. Peanut butter is delicious and very high in peanut oil (obviously), is peanut oil really a bad one?

Agree with everything else.

Good Morning Nostr!

I have been eating too much junk and now I'm paying for it with the arrival of winter. 🤒🤧🫠

I'll feel better soon though. Thankful I'm no longer in a financial position to need to work while sick anymore.

Thank you Satoshi for freeing us from debt and wage slavery. ❤️

Hope he gets better! ❤️

Welcome to freedom tech!

GOOD MORNING NOSTR.

LIVE FREE. 🫡

https://cdn.satellite.earth/a6a657847a5be1878c7f7027851e175619f316294ddbd7e3ca5e13df0dbaf23d.mp4

Good Morning Odell 🌞.

Volatility is absolutely a part of life and the natural world and should be embraced as normal. I'm not trying to time natural market volatility though, that's a short term phenomenon and trying to time that is very high risk, I'm essentially trying to balance the actions of those who invest emotionally in something they don't understand and in turn be a custodian for the wealth they lose in the process.

The motions of the past are no guarantee that the future will repeat, yes, but if the forces behind those motions are virtually unchanged then the motions they lead to are highly likely to repeat in some form.

The halving abruptly increases the cost to mine a Bitcoin, this abrupt change leads to a wave-like cycle of value similar to how a rock dropped in a pond leads to ripples.

The halving is guaranteed through consensus, the resulting wave is a natural result of it.

That's the hard part. Deciding the safest place to store value temporarily. There's nothing anywhere near as good as Bitcoin long term, especially from a morality standpoint.

Holding dollars fuels wars and censorship thanks to the 7% a year debasement.

Holding traditional company stocks exposes funds to high counterparty risks while also fueling the growth of monopolies.

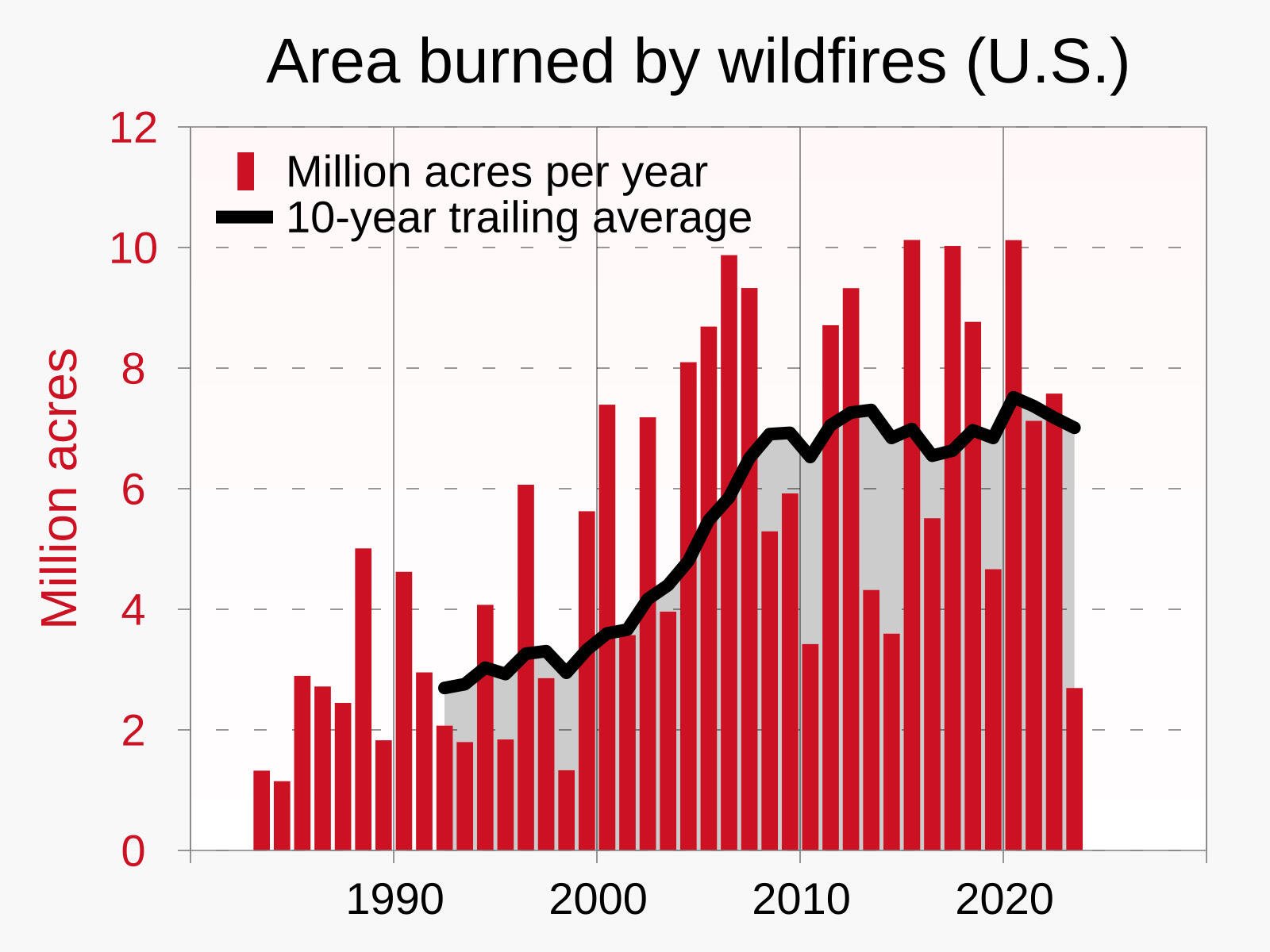

Buying property isn't really viable as you'd be gambling on your ability to resell with precision. Plus environmental risks as were reminded of with the recent destruction of properties from the California fires.

Buying Gold raises the question of how and where will you store it without significant counterparty risk, or risk of theft.

Buying Tether and USDC means their issuers allegedly use the money to buy bonds and Bitcoin and other assets.

There is no second best. Which is why only a fool would BCA their entire stack and risk losing everything, or put the value they do exchange all into a single place. Ultimately, it comes down to the morality and trust in the counterparties chosen to temporarily hold the funds when they're not in Bitcoin self custody.

Perhaps I'll just hold dollars on Bitcoin only exchanges like River or Strike for ease of re-entry into Bitcoin when the time is right.

Though I'm looking for better ideas.

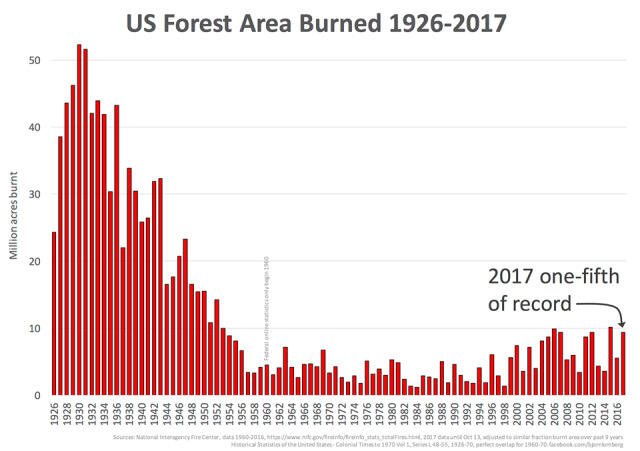

Interested to see the intensity of the fires. I'm willing to bet that while modem ones are less acres, they're also much more intense.