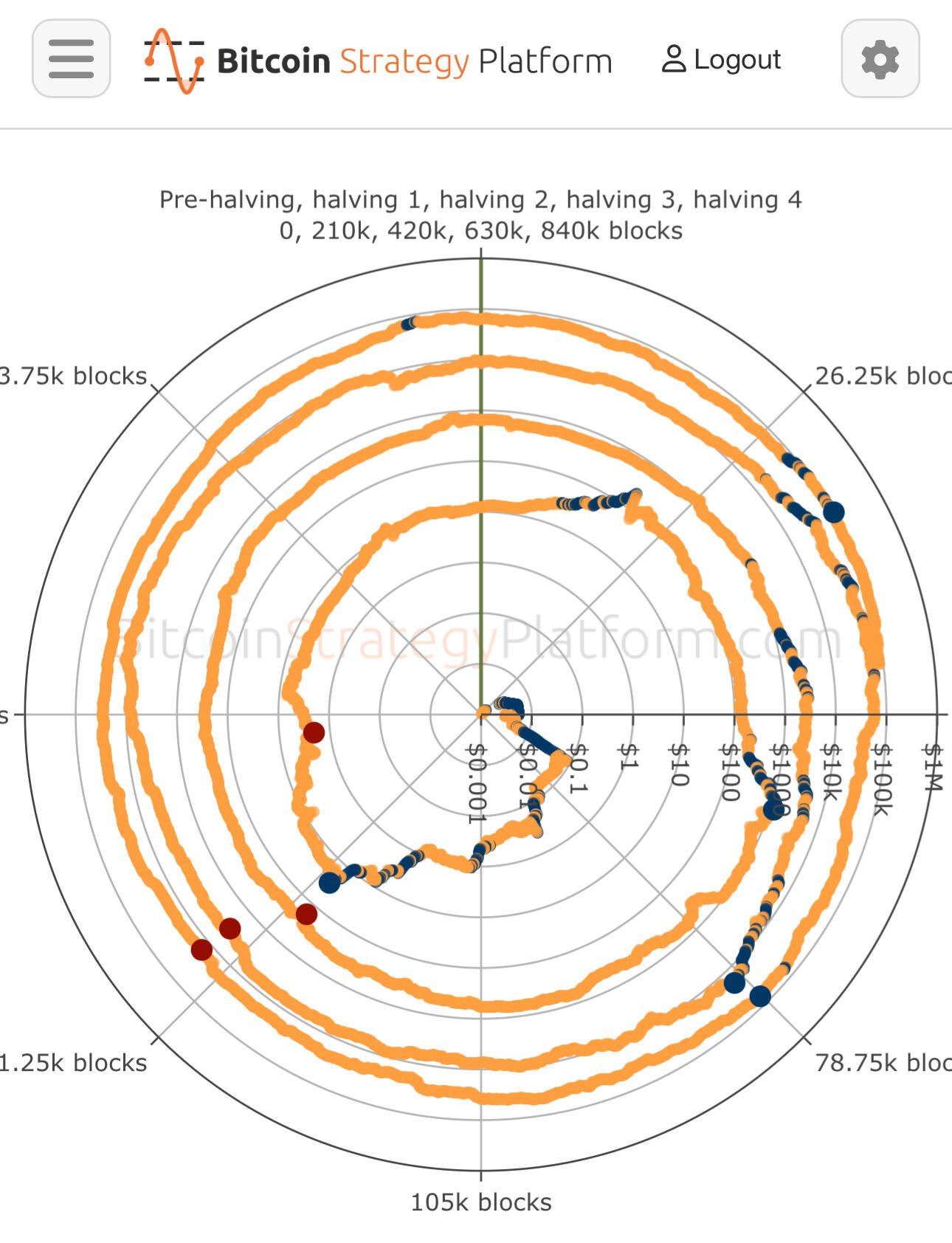

You don’t endure 80% drawdowns for 9% CAGR. Thats just bad risk management. I am expecting something much more aligned with prior cycles’ performance (which is where this tit for tat started). Somewhere around $250k/BTC, minimum.

100% conjecture at this point. But Saylor hasn’t done anything to negate the risk.

Sure. I’m changed, too. But if my purchasing power doesn’t go up and I have to keep working within and for a system designed to suck out my soul vs. be free and sovereign then the theory doesn’t matter.

And all (or at least most) these dudes posting their bitcoin-enabled, sovereign lives are class 2017 or earlier.

NGU is critically important. Congrats if you can accomplish your dreams at this point … mine needs NGU.

Adoption is driven by NGU. You won’t convince me otherwise.

People are self-interested. Self-interest drives behavior.

Congrats if you have principles that are above reproach…most others don’t.

The specific numbers are obviously unknown (which is a problem). But total global annual issuance during this epoch is ~165k bitcoin. So it is clear that 50k bitcoin here and there can really impact the expected purchasing power of bitcoin.

Show me the incentive and I’ll show you the outcome. Every power structure in the world is trying to at least SLOW DOWN bitcoin and bitcoin adoption (especially among individuals). This is an EASY way to accomplish that objective.

Coinbase has MSTR’s approval to fractional reserve the MSTR bitcoin stack. If MSTR has 250k bitcoin custodied with Coinbase, Coinbase can fractional reserve up to 150k of those coins, knowing that MSTR’s entire strategy is holding indefinitely.

Coinbase custodies most of the ETFs and MSTR … they have 2M+ bitcoins custodied. More important than 10%+ of the total supply, it is more than the TOTAL remaining issuance of the bitcoin protocol. They can 100% use a small float to manage (or create) market volatility.

Buying real world assets and doing real things serving real people the right way is the goal. Bitcoin is a tool for accomplishing that (but NGU has to happen.)

NGU is in regards to purchasing power and dollar denominated purchasing power is the simplest method for communicating Bitcoin’s purchasing power.

Really, David? This week is gonna be a big week?

1 BTC =/= 1 BTC if Coinbase, et al are creating a fluctuating paper supply.

Depends on the volume. Probably not.

2M+ bitcoin at coinbase … fluctuating their float by 100 bps to manage market volatility is very meaningful.

Then you’re familiar with diminishing returns.

Need NGU so that this next generation of bitcoiners can go build things in the real world using bitcoin as the base layer. We need to be unapologetic in our expectation for NGU and skeptical of all the avenues that might suppress NGU.

You didn’t go hard enough in 2020/2021 then. Diminishing returns bro.

Truth. Everyone else has experienced that windfall. Class of 21 over here holding an asset that’s performed like a crummy value stock.

nostr:note1eve3p8g2q4a88jyvctr7q6feqkgx4rqxnm74wvw3ykkvve6wn7tspfmd86

It’s a shame how many of the really solid bitcoin podcast influencers have been captured by MSTR and the ETFs.

The price suppression MSTR has been able to accomplish WHILE attracting the level of simp that has compromised the integrity of really good bitcoiners has been very impressive.

Demand proof of reserves from MSTR. Demand proof of reserves from the ETFs. Demand proof of reserves from Coinbase.

Whether or not MSTR has a direct claim on specific UTXOs on the Bitcoin blockchain doesn’t have anything to do with Bitcoin?

Few have been more patient than the diamond hands of 2021 … at some point that has to be rewarded. The prior classes and the lettuce hands are all “be patient, it eventually turns” but those of us who have realized 9% annual CAGR with an 75%+ drawdown are looking at the risk / reward profile of this investment and it doesn’t make much sense. We should be well into the $200k purchasing power range if it weren’t for macro manipulation.

Do those of us languishing a favor and self-custody your coins … don’t let Coinbase, etc. fractional reserve bitcoin.

When nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m ? When? You know you could do your part and show all your shareholders where on the blockchain they can find the bitcoins that are backing their investment in MSTR. That move would remove some risk from MSTR as an investment, as well as reinforce the auditablity of bitcoin and the scarcity of bitcoin, which are features to this superior asset.

The longer we go without proof of reserves, the increasingly confident I am that MSTR doesn’t have access to all their bitcoins.

MSTR acquiring bitcoin but not showing onchain addresses is another form of centralization. Saylor is pulling the ol’ “Just trust me bro” with coinbase and with 2M+ of the bitcoins in coinbase custody, that’s an unhealthy amount of centralization we’re experiencing within the bitcoin ecosystem (and people are celebrating MSTR!)