Bitcoin could use fewer people caring about global south and their suffering under financial fiat tyranny. It is an intellectually lazy concern to have.

Better to focus on how fiat limits the growth of the frontiers of civilization. Others will be fine without you "saving" them.

Good question

Because some people imagine they are interested in building things that matter. Studying anyone for anything is a LARP regardless.

Build your own non-KYC airplane

Be sovereign

Are you really a sovereign if you can't build aircraft?

Be honest about where you stand

But then re-raise your expectations

Airlines are now using biometric data to track who’s going inside flights, so you don’t use your passport. This is crazy.

Worldcoin was just the tip of the iceberg.

By having this we are losing our freedom, our privacy. At its most basic level, surveillance means that citizens have no privacy. Eventually, every word and action is observed.

Knowing that you’re always being watched creates an environment of perpetual fear.

Over time, the knowledge of constant surveillance can lead to self-censorship. People will no longer be able to be free. https://video.nostr.build/8b66358edd94e0b1dcb5c1d60b4d3861670a48ec5f0dceb01fbdf66ec80f5f03.mov

Cheaper airplanes fix this... gotta make it so fucking cheap to travel. Notice the regulatory attack made against JetSuiteX?

YOU WILL UNDERTAKE THE HUMILIATION RITUAL. They don't know... private jet cost keeps coming down.

What if I can get it sourced from India instead?

Can test anything that is detectable so I don't see why not.

Nostr bear market

Do you call it a "nobear" market or a "bearstr" market?

The lack of imagination is yours, and you merely affirm your failure to understand why bitcoin fixes everything, as many others surely will as well.

And only one is immortal. #AbsorbingBarrier

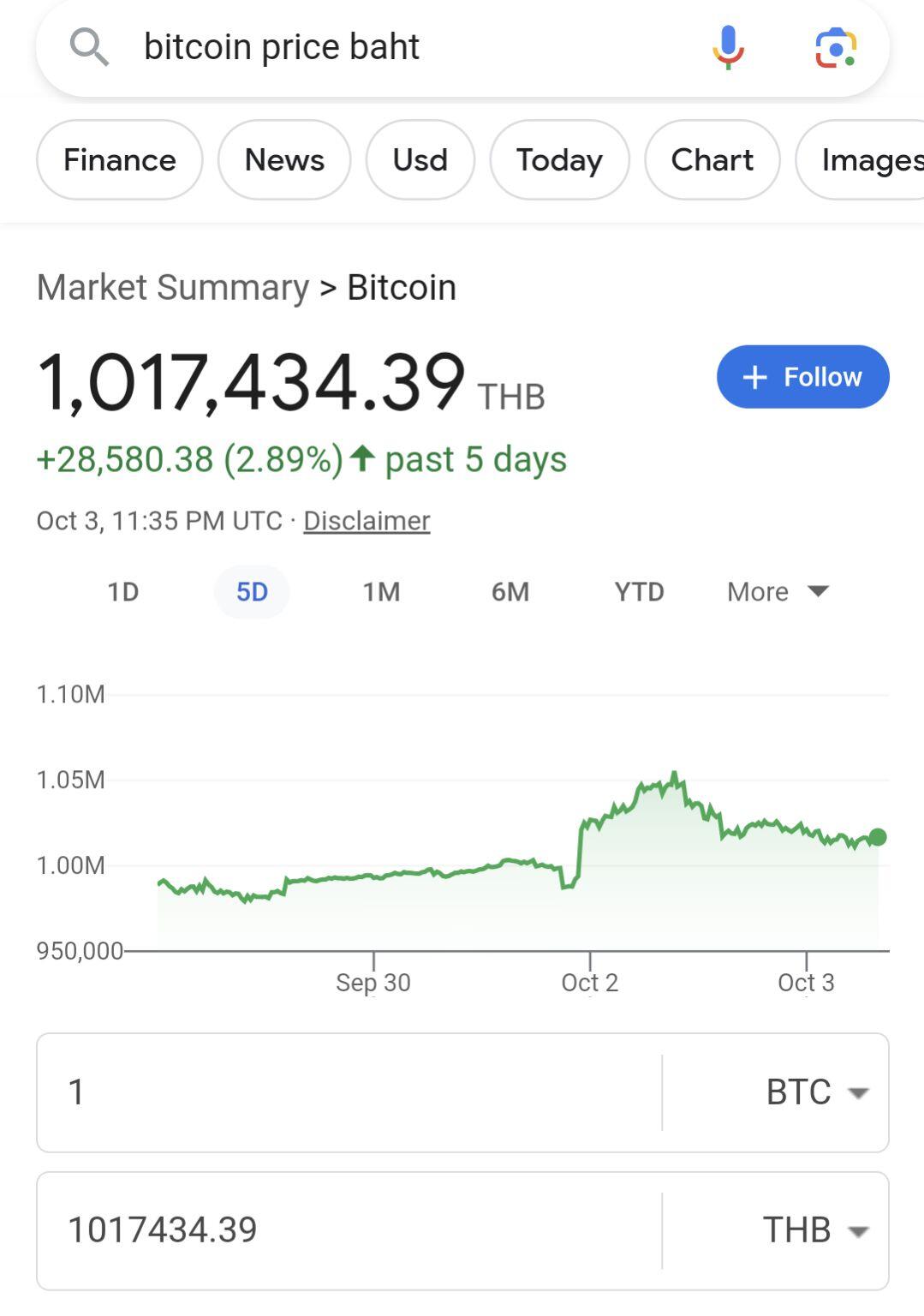

Baht-bit parity

1 baht = 1 bit

Bits the standard

What a garbage grifty post. The great thing about Nostr is there is no "free royalty" on buying and underpaying for attention. Nostr enables the first free market for attention. The attention, and capital misallocation problem are totally intertwined.

No opinion on anything bears much meaning from non-bitcoiners. In fact, opinion in general is largely a farce. Nocoiners opine; bitcoiners know.

Who else is going to be in El Salvador in November for Adopting Bitcoin?

For the same reason I haven't been on here much past few months. UI/IX not at Twitter levels yet, and only 10k people here. I look forward to Nostr growing, but feels like a "bear market" here.

Verifying my Twitter handle is @GhostOfDirac

They got bye-nanced!

What's gonna happen with Swan Bitcoin now? 😂

You should see Jeff Booth's VC profile. He literally calls himself a visionary under his bio and he named his firm "EgoDeath Capital". Can't make this shit up. Expect a lot more people trying to call themselves geniuses for being 2020s bitcoiners. 🤦♂️🤡

Breaking: fake conservative plays victim and cries about rising interest rate reducing his access to the money printer. 🤡

$boost ?

Oh you thought El Salvador was based? This is Javier Milei proclaiming "leftist sons of bitches, liberty advances, long live freedom, motherfucker". He is not a fringe candidate. He is the favorite to win Argentina's presidency this November, with >70% on Election Betting Odds.

https://video.nostr.build/37684486f59c9464d0a78a6f9548880d78e4ed050542e1e728e188bf8a668cca.mp4

If it were in a 2-of-2 multisig where you get part of it as it is paid off, there would be no problem. Try the calculator.

nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z why can't I long press to copy a short section of text in a note that I want to copy and paste?

Shortly before my Twitter account was obliterated by a fiat egomaniac, I wrote a thread laying out my predictions for how a bitcoin ETF could underpin a fiat 2.0 that purports to be atop (fractionally reserved) bitcoin. Here is the 12 part synopsis:

1. Operation Chokepoint 2.0 made Utah ILCs and other banks of the style that underpin lending startups unwilling to touch "crypto".

2. Before that, it would have been plausible to start a business that originates fiat loans for the purchase of bitcoin (sort of a layaway/mortgage style).

3. If the bitcoin were held in a 2-of-2 deadlocked arrangement between customer and lending company, it ensures company cannot rehypothecate, and ensures the loan is at least eventually paid off.

4. It is a great business, and as the calculator on https://faucet21.com shows, it allows people to end up with a lot more bitcoin.

5. As companies like Swan, Unchained, Strike, and River with mediocre business models chase greater revenue for investors, those companies and others will build lending tools like this, but for a bitcoin ETF rather than bitcoin.

6. In this way, they can gain 10x higher fees on 10x the investment capital (note, this is effectively the money printer getting connected directly into bitcoin purchasing) all the while triggering NGU. I anticipate the ETF will actually be 1:1 for a long time because there is an end game.

7. It will become the standard for noobs to get in this way and the bitcoin price will rise into the millions -- most influencers, podcasts, and conferences will dismiss the problems due to NGU.

8. Then when the bitcoin ETF rivals the pension or housing bubbles, perhaps even just low tens of trillions, the 6102 will be announced, and the ETF will turn into fiat 2.0.

9. There will be a conversion window turning all fiat 1.0 into fiat 2.0 (maybe all tied to a central federal reserve account that individuals have access to), so there is your first large chunk of devaluation.

10. There will be top down attempts to force all contracts to be denominated in fiat 2.0 -- large companies will pay salaries in it, BlackRock will rent houses in it, and fiat cash will be eliminated for total surveillance.

11. If it does not fall within days to weeks, fiat 2.0 will fail shortly thereafter as it trades at a significant discount on the international markets due to its market estimated amount of underlying bitcoin combined with huge counterparty risk and lack of auditability.

12. Nations that minimize the violence and theft they carry out in this tumultuous time may emerge as new global Schelling points and private companies will step in to further stabilize these regions by providing voluntary rule of law and insurance services.

Many will be rekt, bitcoin will be fine

Tick tock, next block

This will piss a lot of people off, but FedNow is actually a little bit like Nostr in its interoperability across "clients". 😂

All you idiots fuddding FedNow -- it will singlehandedly do more to destroy the US dollar and banks than 97% of bitcoin startups. Y'all have not thought this through, at all.

Anyone have an idea of what will bring more users to Nostr? Based on NostrBand Stats, the real users have been about 8k for past 6 months or so. Totally sideways.

Dry machining tile without a mask is a really bad idea. Imma start telling people walking around with masks outside they're killing low income workers by making masks harder to access. 😂

Running your own BTCPayServer and WooCommerce. Idk of any decent marketplaces now. ... barely even all that many bitcoiner online merchants that I have found so far. https://circularbtc.xyz

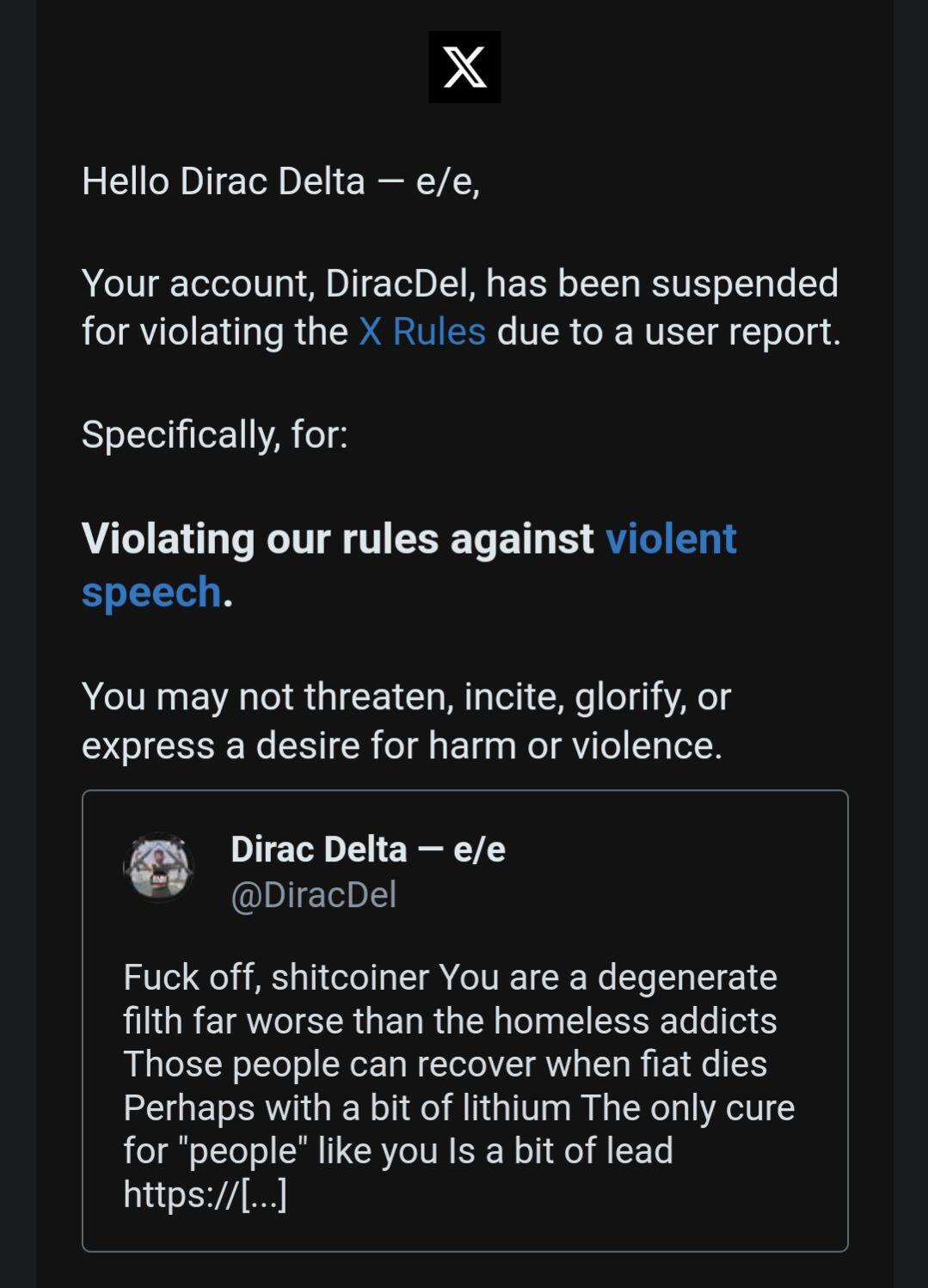

Well, it finally happened, that fiat scumbag kicked me off his grifting platform. Has Nostr improved much in past couple months? Seems it's been a bit sideways in terms of adoption.