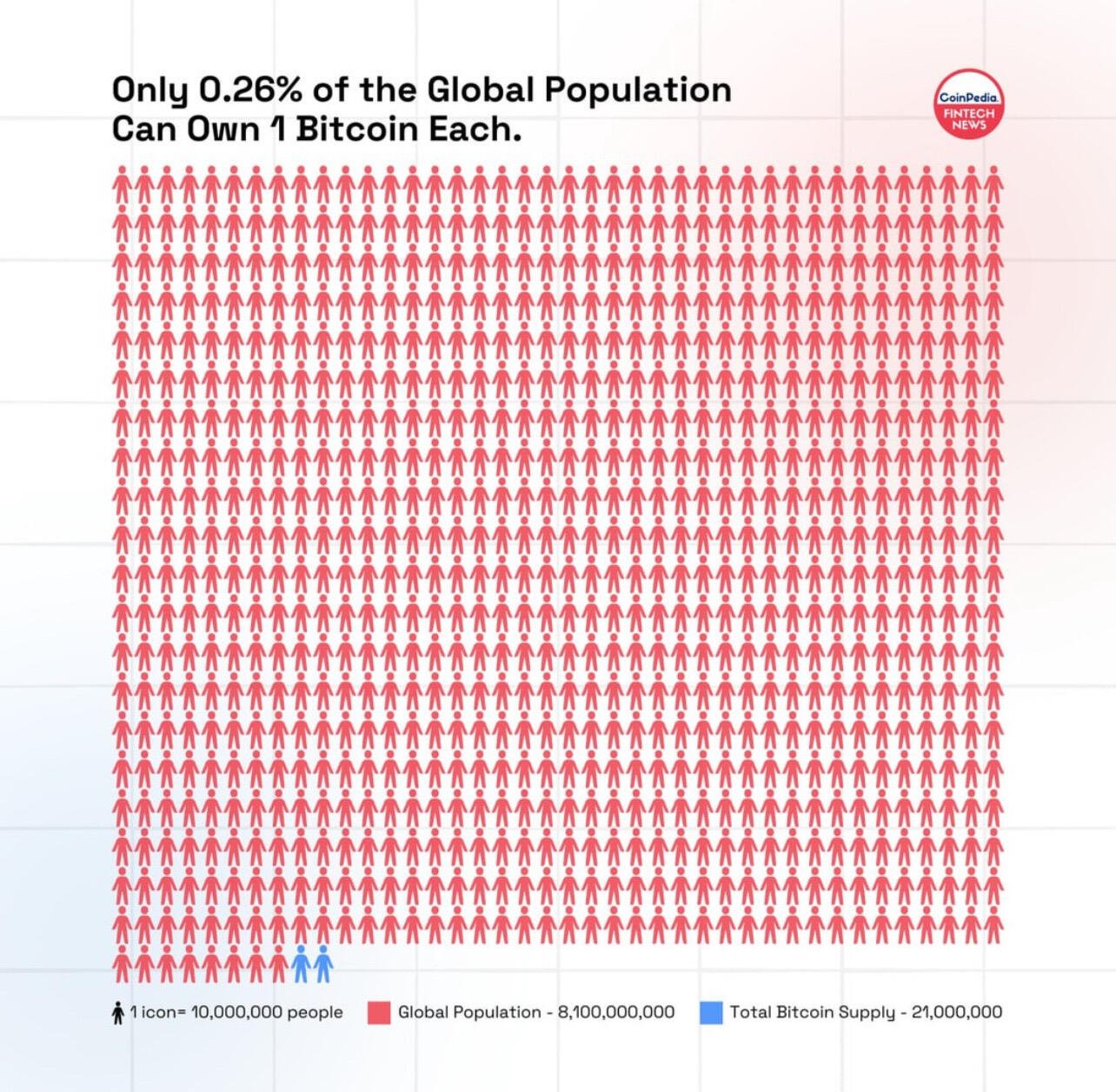

Layer 1 is for the whales. Everyone else will live on L3. It was baked into the design and the intent of the creators.

Many sats lost forever.

In a layered money system, what prevents banks and governments from eventually holding all the #bitcoin while plebes live off scraps on #L3? Wealth and power has a tendancy to concentrate over time.

The end game is for banks and governments to hold all the Bitcoin while plebes live on L3.

Is Our Money Safe? On Financial Censorship, Bank Accounts Closures & Confiscations

https://efrat.substack.com/p/is-our-money-safe-on-financial-censorship

Not "our" money. The state owns everything from cradle to grave.

Was never "our" social security to begin with. Always intended to be a wealth transfer from young to old. Democracy at it's finest. Just wait for all the tears after the government defaults on the debt. Hold my 🍺, lol.

the incentives align perfectly

Oh man, you're gonna love that one! One of my favorite audiobooks I've done. (also recommend nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a's Broken Money to follow. They are a good one-two punch for understanding money as a networking and record keeping system and how it all paints a much clearer picture of our history.

Also nostr:npub15879mltlln6k8jy32k6xvagmtqx3zhsndchcey8gjyectwldk88sq5kv0n is a really awesome dude when he's not frustrated having to explain something that he's explained a bajillion times already, lol (i get that way too). You should give him some slack (and vice versa 😘 ). None of this is really intuitively obvious without a ton of exploration and errors.

I climbed through the Keynesian Economic Mountain Range, then the swampy valley of MMT, and finally through the dark, casino scam Tunnel of Shitcoins to get to where I am... so I can't really judge anyone else.

In another context you guys might get along really well. 😁

Appreciate the references. Have already read Saifedean Ammous and Jimmy Song's work. I'm 95% on board, but still have to work out the ethos how a decentralized, hard money will will scale on BTC and still adhere to the Nakamoto vision of freedom money. Trust but verify.

Understand the ideological battle going on here. We are still in the very early days, so expect a difficult path forward. The establishment will fight tooth-and-nail against a BTC world reserve currency. Power.

In regard to winning people over, half the battle is in the approach. nostr:npub15879mltlln6k8jy32k6xvagmtqx3zhsndchcey8gjyectwldk88sq5kv0n

Thanks for the intelligent, respectful reply. My next read: https://a.co/d/0aifb9u1

nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev dig this shit. I bet you get this nonsense a LOT more than I do. 👆

hahaha. you're a bigger bitch than I thought.

Is that attitude how you win guests over on your podcast? I've never listened, but your leadership skills suck. Probably an ideological circle jerk 🤣

Who said I was losing, lol. Looks like you can't handle the difficult questions. I came here to learn. Rather than trying to dunk, maybe you could try to educate rather than score points. Triggered 🤣

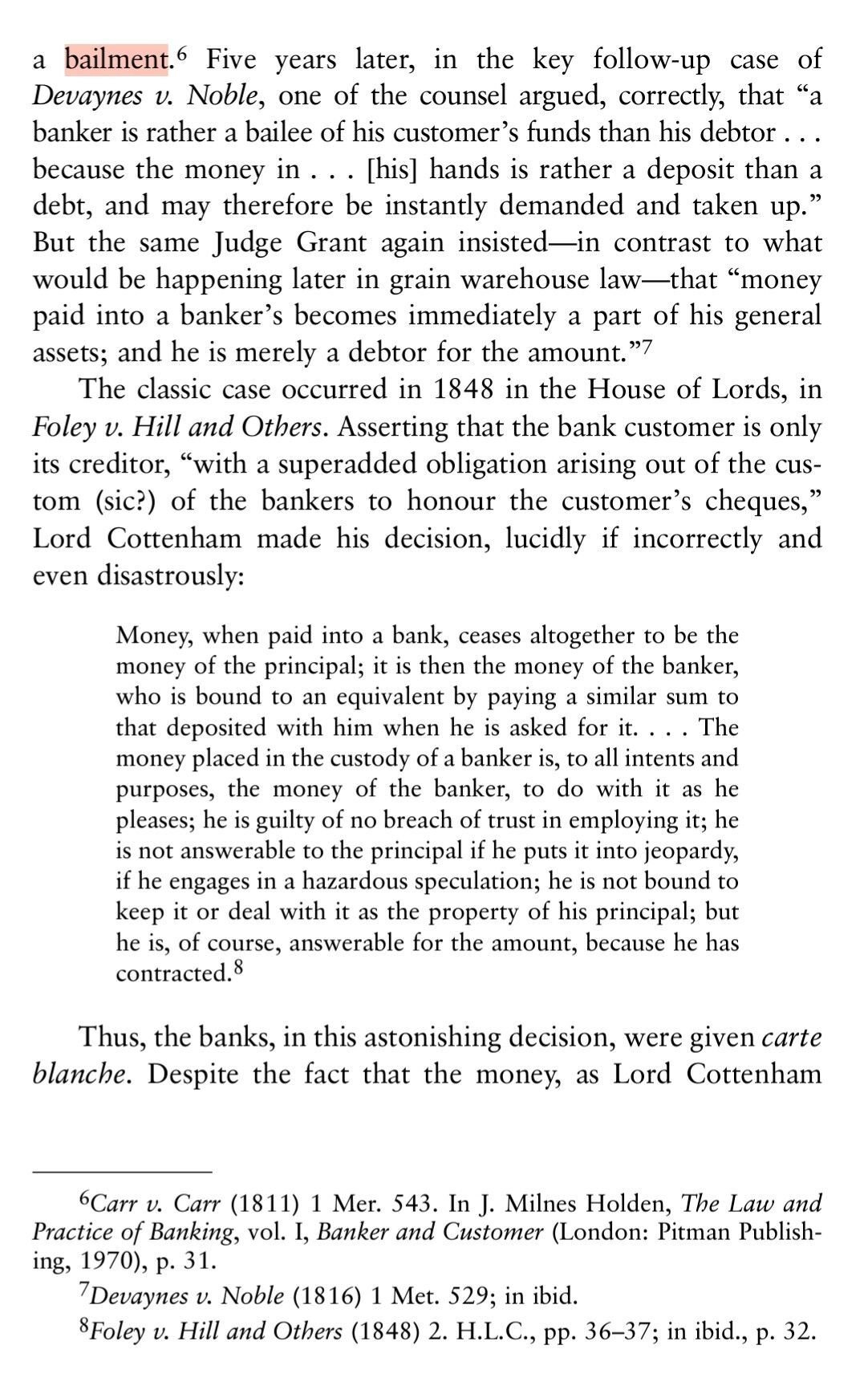

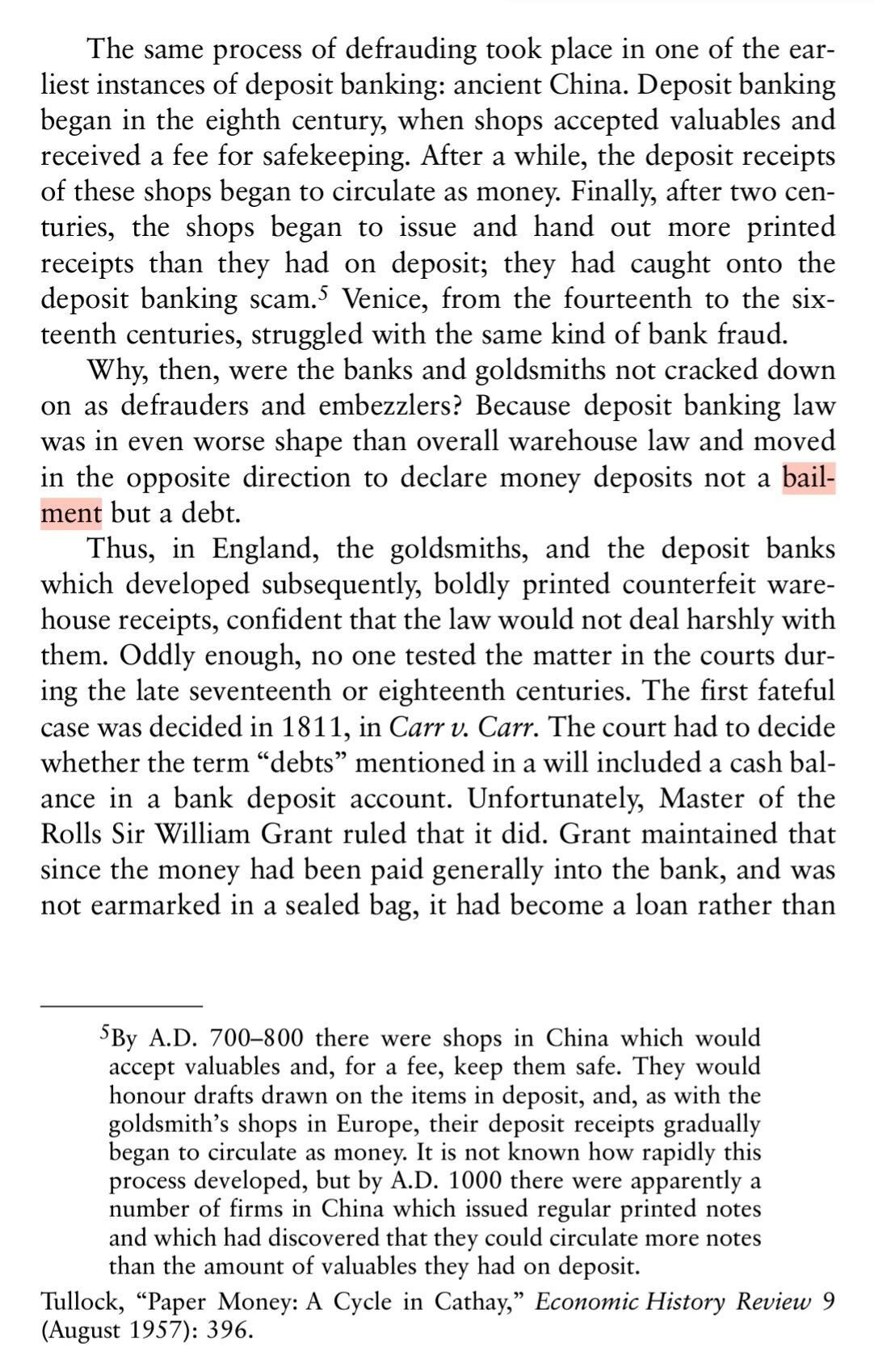

ok, considering Rothbard calls for abolishing the Fed, there's no alternative other than a free bank system, and he makes a strong case for it. His idea of hard money was gold, but that was before Satoshi. I'm sure he would support proof of work consensus if he was alive today.

fractional reserve is printing more IOUs than one has in supply. Call it theft if it's not advertised as a loan. Good luck holding international or anonymous mints accountable. Here's a good video explaining the current scaling problems with L2+. To ignore these issues is dininginuous bad faith. How likely will it be to hard fork BTC to enable rollups? BitVM currently vaporware with it's own issues. https://youtu.be/5Cq0C0SpbkY?si=uX2z1d-QaYeV-Mvs

Let's find out what Rothbard thinks about "free banking:" https://nakamotoinstitute.org/static/docs/the-mystery-of-banking.pdf

L2 will not scale to mass adoption, as the block size has a limit on the number of channels it can support. Scaling will require L3 such as ecash and the like for regular plebes. This is nothing more than a paper IOU. The game theory leads to fractional reserve minting, as custodians lower fees and offer more incentives to compete for customers. Watch what happens to the market when mint runs start snowballing.

As mints compete with lower fees and more services, the incentives lead to lending out more ecash than available in the reserve. Yes, this is theft and will be aparent when people run off the mint all at once.

A staffer mentioned volatility the other day. They couldn't grasp bitcoin so I just put this together and sent it to them. Maybe some of you will get value from this as well.

The other day we chatted about bitcoin. I just wanted to say a few things that may help you understand. First, while it's hard to grasp at first, bitcoin is actually backed by energy. Like you don't believe that gold is going to disintigrate or real estate is going to whither, if you don't believe that energy is going away, bitcoin isn't either. It's volatility is to the upside due to the upside just as gold was in its early days of adoption. This is a chart showing 50% price swings even in our lifetimes. Gold already existed though and people understood it, that's why I believe bitcoin has so much more volatility, but its to the upside.

Bitcoin is mined through stranded energy as it is the cheapest energy around. With the absolute cap on what can be mined, currently only 3.125 bitcoin every 10 minutes globally,, that drives the value of this asset up. Miners can't afford to compete for this bitcoin if they don't have the cheapest possible energy. This energy is often hydro and more recently, geothermal, and even nuclear. I really wish that Alaska's leadership would begin understanding it because it could replenish our State funds while building out our energy grids, both in serious jeopardy. Here is a short video I produced about Alaska and energy.

While others see this as an asset akin to a stock, it is not. It is an independent monetary system that is far superior in every way, free of any government. It is engineered perfect money. Beyond that, it has an absolute cap with a programmed transparent inflation rate that is cut in half every 4 years making it the only monetary system that is more akin to scarce property like real estate.

Once that you begin to understand it you start to realize that it is and will continue to suck the monetary premiums out of everything else, a monetary premium being a value placed on something above its utility value. As this happens, everything else will drop to its utility value and bitcoin will go up. This won't however happen in dollar denominated terms though as the dollar will continue to be debased.

Another way to look at this is that the BRICS Nations are looking for other settlement methods. There really are none. Gold requires trust, it requires assays, a ledger, transport, etc. That's why fiat fails as it is simply a mobile ledger representing value. Unfortunately, historically, this could never be trusted which is why all fiat eventually fails. But so do hard assets like gold because whomever holds that ledger can alter it.

Bitcoin will give other nations the ability to absolutely trust the currency as it is publically transparent. I can watch the ledger and verify every transaction globally proving that any attemp to alter the ledger fails. You can do this at bitfeed.live. This site shows the blocks being built. You can click on any of the small blocks and see the values of these transactions, their UTXO's, and dollar denominated value. Once you see this you may begin to see exactly how valuable this asset class truly is.

Another great resource is https://timechainstats.com/. It has some incredible information.

If you want info regarding how it would affect your personal portfolio I would encourage you to use the Nakamoto Portfolio put out by Swan Bitcoin. You can add a % or 2 of bitcoin to your current portfolio and see how it benefits. https://nakamotoportfolio.com/nakamoto/start

Bitcoin volatility is driven by three things, its halving cycle and dollar debasement. 1) When bitcoin halves and the supply that was mined at the old rate drops, the miners must sell at a higher rate to stay in business. 2) when the gov tightens bitcoin doesn't move down much but when it prints, it goes up drastically. This is due to the fact that many people can't get access to real estate or stocks to hold as property but they can buy bitcoin. They aren't willing to part with it as they see it as their savings. And 3) adoption. As it continues to be adopted it will simply kill all other currencies over a long enough time horizon. I can send value instantly to anywhere in the world for virtually free. No government can stop me. It takes me 2 minutes to set up a MUUN wallet that doesn't require any bs kyc/aml rules that the bank requires and I can send my money anywhere. On that note, if I decide to travel with my money, you know how you can't board a plane with more than $10k or gold bars, or cross a border in a war zone with these? I can memorize my 12 words and safely cross any border with all my value without fear of theft.

It is 100% the greatest invention since fire. It allows people the ability to save and transact without intermediaries grifting. Ledgers have been manipulated since the beginning of money. No more. That's a really really big deal. I just hope that our state catches on and starts using it to solve our fiscal/energy problems sooner than later. It is probably the most important opportunity Alaska has ever had and we're sitting on the sidelines without any desire to do anything but suffer a slow death as a state.

If you need resources I'd be happy to provide. If you'd like to speak with any educators I'd be happy to facilitate. I have access to virtually everyone in the industry one way or another.

I'm pro 100% pro BTC, but the Acquiles heel is layer 2+. The incentives lead to "free banking" and fractional reserves as people are priced out of transacting on L1.

I celebrate the founding principles that my ancestors sacrificed and died for, not for what the country has become. The cycle of history will repeat. Tyrants will get their just rewards soon enough.