I’m recoding the website so will release it with a bunch of others all at once

On #Bitcoin bull markets.

2012-2013 was driven by technologists and libertarians

2016-2017 was the start of retail flooding in

2020-2021 was institutional and HNW money finding a footing

2024-2025 will be driven by sovereigns in a race for defensive positioning

#Bitcoin sustainability makes another ATH. Now 54% powered by clean energy, climbing month by month.

Model by #[0]

That’s what backwardation means in trader jargon.

#Bitcoin demand from calendar futures dropped off a cliff (this tends to reflect sentiment from pro and institutional traders). Contango went into backwardation at levels akin to what we had at our $16k range.

Meanwhile the last 48hrs has seen bullish spot flows at exchanges when BTC dropped to the 19.5k-20.5k range, maybe from people fleeing USDC.

This looks responsible for causing a small short squeezed powered recovery.

Overall corn looks weak in the short term.

Do I believe BTC as drug money the reason it should not exist? No.

How about a currency for cybercrime, or to evade capital controls on enemies of the state?

How about ESG? No not at all. But it’s the current attack vector.

These are all false narratives aimed at Bitcoin, this work is about putting the record straight in order to accelerate its adoption.

Correction:

The network presently emits 0.9 grams annually of CO2e per dollar of market cap.

This is 329g of CO2e per kWh.

While I'm in NZ, #[0] dropped by. We spent today day translating some of his work into live charts so the world can keep easy tabs on #Bitcoin's progress towards being carbon negative, least of all people shaping policy where this data is critical.

This will go live soon.

Emissions are roughly the same as 3 years ago despite market cap being 3x higher and user adoption 4x higher.

In terms of CO2e intensity, the #Bitcoin network is making great strides putting out 3x less CO2e per kWh of energy use (0.09 grams per kWh presently). Daniel's best extrapolation is that is on track to go carbon negative in 4 years.

100%. If you are smart you will study the psychology of why people believe this, then exploit it to create your own cult or populist state or at the very least market your own shitcoin.

A big driver comes from the large spreads seen in crypto markets. They are now liquid enough to hold hundreds of million for a market neutral trading firm and they can get 5-15% annually on spreads instead of say 2% in traditional markets.

We’ll see these spreads close as more Wall St money enters.

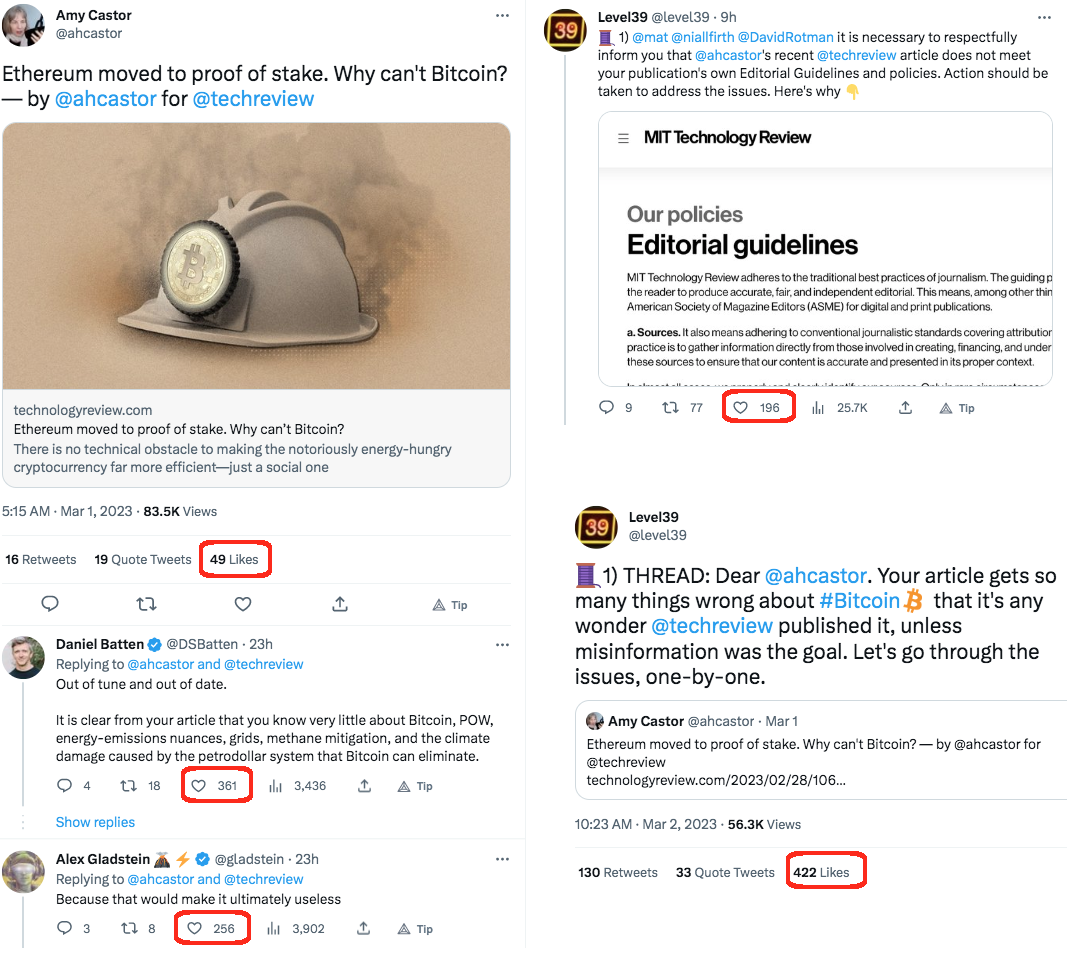

She covers “crypto and NFTs” in her profile, hardly a neutral perspective from her. She even has a Patreon account to support her work.

Bottom line looks like CVDD floor.

How about only counting zaps from high trust accounts?

Ultimately there needs to be a Sybil resistant algo in place.

- reads the history of an account for past posts and interactions (which may expand beyond just the current “Twitter” implementation but into authentication across the web etc). Then score legitimacy of an account

- extend the zap protocol to tie LN wallets to a profile.

Likes should be deprecated in favour of zaps.

We should have terminology for popular posts. Like:

> 1k⚡️ killer post

> 1m ⚡️mega post

Etc.

A zap is a Nostr note containing metadata that links to a paid lightning invoice. So yes, it’s recorded on Nostr.

tip + note = zap

A zap has an exact definition described in a NIP as part of a larger communication protocol