nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle , his @ didn’t work in the post above.

I reposted because of that and Jack saw that one. Damus bug

Saylor posted the chart.

Later on coinbase says they’ll reimburse people who got their stack stolen via sophisticated phishing attacks.

Are they gonna get you some new children or wife when they’re covered in gasoline and set on fire in some crazy dudes trunk?

What about replace your fingers that get chopped off?

Wrench attacks incoming.

Gov IDs, account balances, addresses phone numbers all leaked…

If you got a fat stack acquired from Coinbase, it’s time to move, change your phone number, and get a gun.

And or into Rogue one is probably the absolute best Star Wars saga of all

Damn dude! Always on point! Nice work!

Yo nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle I got a friend who is a multi- whole coiner and wants to sell some bitcorn to renovate his place but is concerned if he sends it to strike ya’ll will calculate his cost basis as 0$ because he bought the corn on cash app.

Would you ask him his cost basis? Would you just him do the paperwork on his own? nostr:npub1t3ggcd843pnwcu6p4tcsesd02t5jx2aelpvusypu5hk0925nhauqjjl5g4

Yo @jack mallers I got a friend who wants to sell some bitcorn but is concerned if he sends it to strike ya’ll will calculate his cost basis as 0$ because he bought the corn on cash app.

Would you ask him his cost basis? Would you just him do the paperwork on his own? nostr:npub1t3ggcd843pnwcu6p4tcsesd02t5jx2aelpvusypu5hk0925nhauqjjl5g4

This would lead to the absolute worst flight after for sure

There is no rehypothecation with Strike Lending.

When you take a Bitcoin-collateralized loan with Strike, your #Bitcoin stays in a segregated wallet. No rehypothecation, no funny business.

We hear you loud and clear. Better rates is next. Give us until the end of the month 🫡

https://blossom.primal.net/b4d10103d60371ed362abc40a97cba6f15c03abe250d92f9d687475d1a536477.mov

When you’re lending cash for interest instead of paying yield for deposits, no funny business required.

No dude, the show he’s not running some non-economic node but rather an economic one!

Do you want your money transmission network to transmit anything other than money?

Social consensus means that even if you’re not a dev, you’re not just allowed to have an opinion, but you ought to have one.

Do you want the bitcoin network to be used for anything other than bitcoin?

Currently, it is, but do you want that to be the case?

Sounds like a market!

The bull is back!!!!

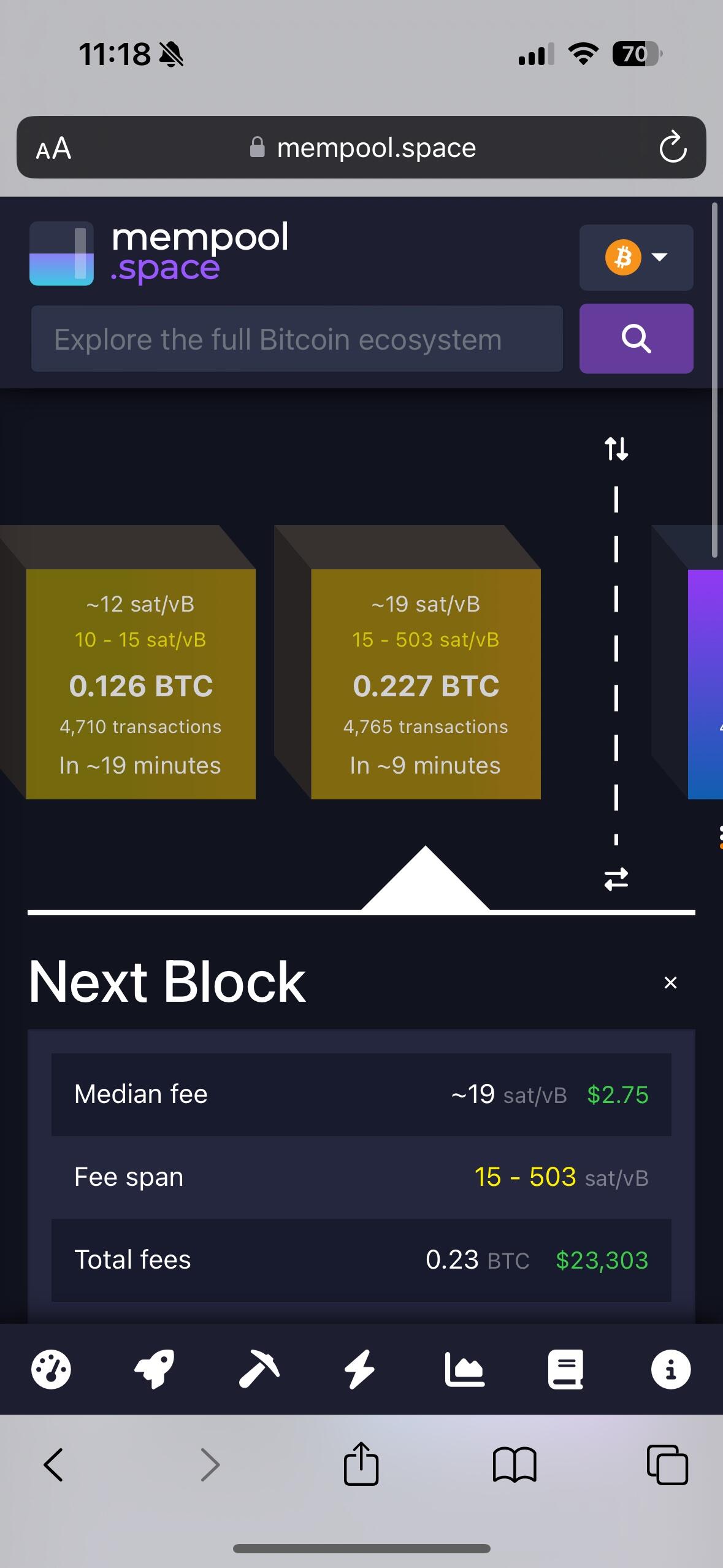

Consolidate your UTXOs, hop on the latest layer 2 dev’s dick, get ready to finally sell your ordinals and runes for a profit!

Try thinking about what zaps are for like, 2 seconds, or are you too focused on how lopp’s arm feels against your prostate?

Wonder how it feels having Lopp’s arm that far up his ass…

Wtf does that have to do with my question? I have no clue, I don’t care I don’t even run knots…

Just to clarify something here, at BTC Prague 2023- “Peter Todd introduces the concept of economic nodes, which are bitcoin nodes run by individuals or entities to validate transactions and maintain the integrity of their own bitcoin holdings.”

So what exactly is “my non-economic node” in this meme? Are you saying I don’t validate transactions and maintain integrity if my own bitcoin holdings?

This is also weird UX, where I use a partial address as an example of the format, and you try to swap it out and return an error. If you can't find an address, just leave it as-is, don't alter it, please.

https://primal.net/e/nevent1qqsftgw79d576kf8qhv8q3s25ug4ltqxmj3xczprs4z6fe9wwxzwztgfcddr0

They do all kinds of dumb shit at primal because of their stupid cached relay idea.

All in the name of PeRfOrMAncE

lol I’m not brave I just call it how I see it.

Content creators have been asking for improvements for years now and they ignore the feedback is my entire point.

Devs would rather circle jerk each others pet projects and simp for VC funds than make shit users want.

Little do you know that Cheeto is petrified.

Then over collateralize yourself? The app requires 50% loan to value but does not prevent you from allocating additional collateral, and makes it very clear where the margin call and liquidation prices sit in relation to the amount of collateral pledged.

Better selling it? So I can pay cap gains tax and then buy it back at higher prices?

Good way to stay poor.

I see transactions in the mempool with op returns that reference previous transactions with inscriptions. It may be a sliding scale when it comes to individual blocks but it is not a sliding scale when it comes to the blockchain on a whole, they can use these options in tandem to reference each other.