GM IF YOUR PRIVATE GROUP CHAT GANG ISN’T MAKING PRICE PREDICTION BETS WITH STAKES THIS HIGH ARE YOU EVEN BITCOINING

JUST THINK OF HOW NICE THE FRESHLY ADDED BUOYANCY WILL BE WHILE SWIMMING

WHEN YOU WORK IN THE BITCOIN INDUSTRY APRIL 1ST IS AN OPPORTUNITY TO GO FOR MIDWIT LULZ IN THE SLACK CHANNELS, WHILE SIMULTANEOUSLY BAITING NAIVE SHITCOINERS INTO REVEALING THEMSELVES

AFTER AN EASTER SUNDAY SPENT REFLECTING, I’VE REALIZED THE WRONGFULNESS OF MY THINKING ON SO MANY FRONTS.

I CAN NO LONGER IN GOOD CONSCIENCE PARTICIPATE IN THE ENVIRONMENTAL AND SOCIETAL CRIME OF BITCOIN MINING. AS SOON AS I’M DONE GETTING MY COVID VACCINATION + BOOSTERS, I’M SELLING MY MINERS THEN DEDICATING MY LIFE TO FIGHTING CLIMATE CHANGE, ADVANCING DEI INITIATIVES, AND MAKING SURE LGBTQIA2+TEACHINGS ARE GIVEN CENTER STAGE IN ELEMENTARY SCHOOLS. 🙏👍🏼 #COVIDISNOTOVER 😷

A MAN OF CONVICTION 👍🏼 nostr:note1ayv09jpkp6mhg3wrd45xenf56c2utc6us6rq26x78hytq98aet7sp043rr

nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx HATH DONNED THE MARK OF THE BEAST, BRINGING A POX ON ALL OUR HOUSES

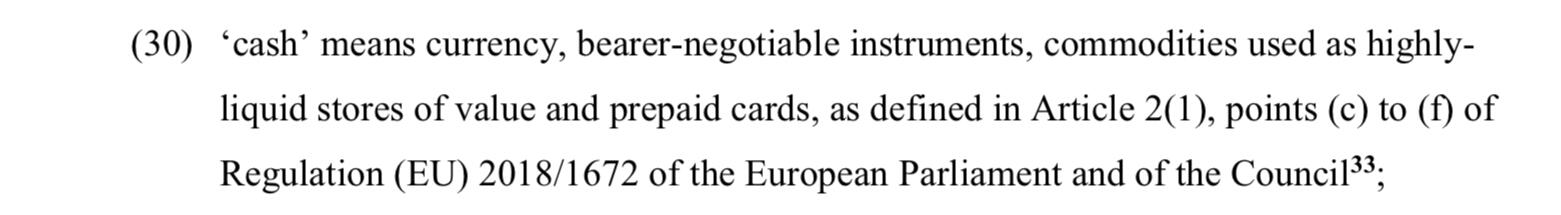

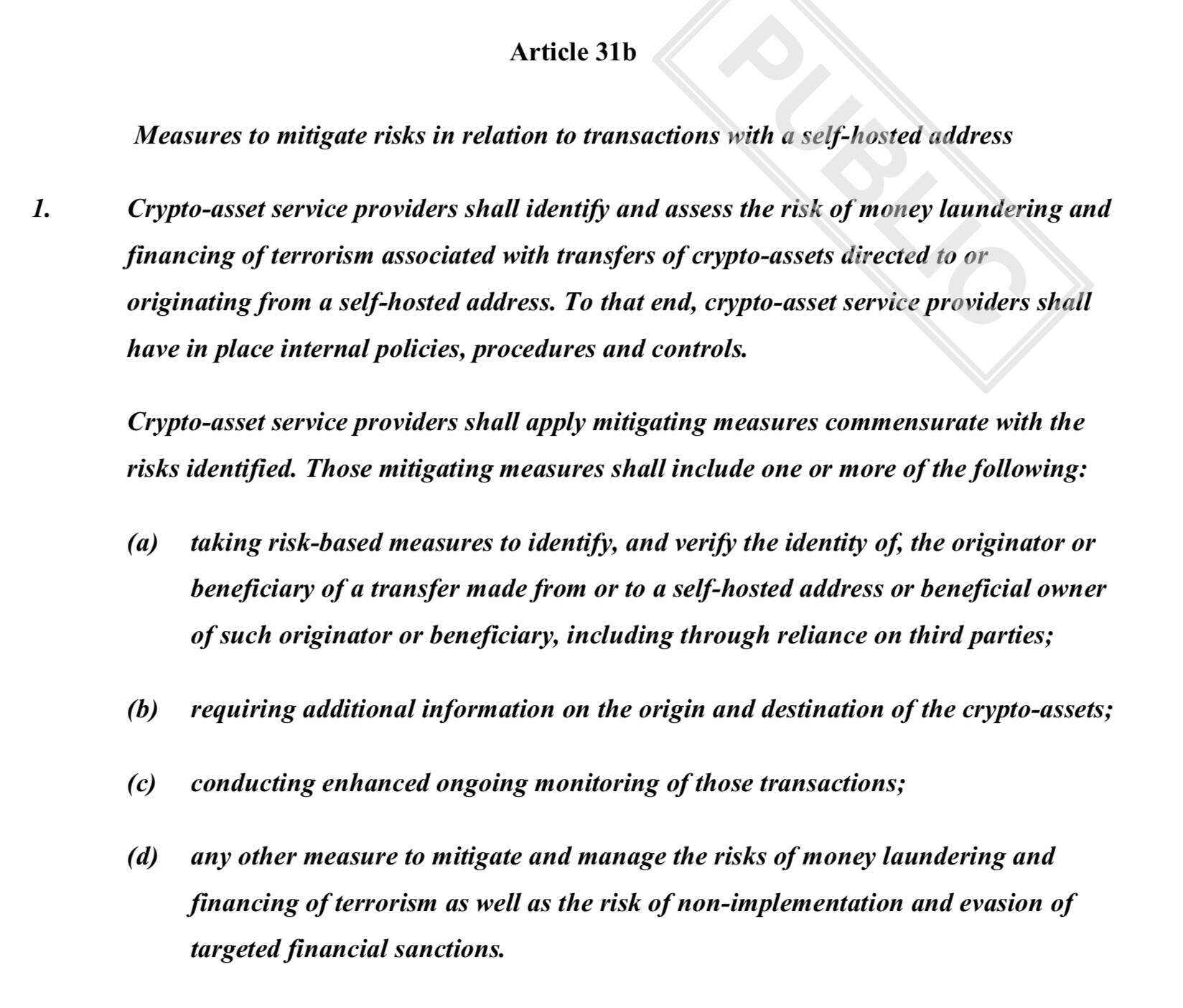

I made a quick first reading pass through the latest satanic EU thing. It's a wide ranging 324 page document, covering things like trusts, football clubs, dubious / tax optimized jurisdictions, the distinction between in house lawyers and law firms, beneficial ownership, reporting requirements, etc, etc.

https://data.consilium.europa.eu/doc/document/ST-6220-2024-REV-1/en/pdf

I tried to collect the bits that might impact Bitcoin. A minuscule fraction of the paper surface area. It's not like Bitcoin or even 'virtual assets' has its own chapter: in classic design-by-commission it just pops up in random articles.

Notably I'm ignoring cash: someone else will have to save that. But beware that 'cash' is defined much more broadly than the word suggests. It doesn't explicitly cover bitcoin, but I would expect that to happen eventually.

The first 100 pages (items numbered up to 103) seem more like an introduction than actual proposed law. Some of it seems to oversell the actual legal text.

One observation is that 'virtual asset service provider' (VASP, or what Americans would roughly call custodians and exchanges) is now considered a Financial Institution(tm).

My impression now is that only _custodians_ are not allowed to:

1. Have anonymous customers (i.e. anonymous accounts): they explicitly mandate KYC rugging existing accounts, albeit with a 3+ year heads up

2. Operating a mixer

They also need to verify ownership of destination address (wallet verification), which is bad, but far from a ban on self-custody.

The 'intro' text mentions mixers along with anonymous coins in a way that suggests banning transactions with them. But the word 'through' makes it really unclear what they mean. In the law text they define 'anonymity-enhancing coins' in a way that obviously implies Monero and Zcash in that order. Article 58 uses the vague term 'through' again. Does it mean they can't let you withdraw to it? Or just that they're not allowed to offer a pseudo-mixing service that *uses* these coins.

Anyway I'll have to re-read this a few times to grok. Keeping in mind that the politicians who wrote this don't have the brain cells to process anything more sophisticated than "monero bad, make law with fancy words!" and then the bureaucrats who write the law have no idea what anything means either. No tech literate person was involved in this process, that's very obvious from the language. But that does make it less dangerous.

The next step for me is more deeply understand what the proposal actually says, if there's any potential direct impact on myself (which might give me legal standing - now or in five years or so when stuff has really taken effect and local judges can intervene) or if it's merely bad in general (in which case perhaps all I can do is write an angry letter).

THANK YOU FOR YOUR SACRIFICE. READING THOSE KIND OF DOCUMENTS IS A MIND NUMBING TASK.

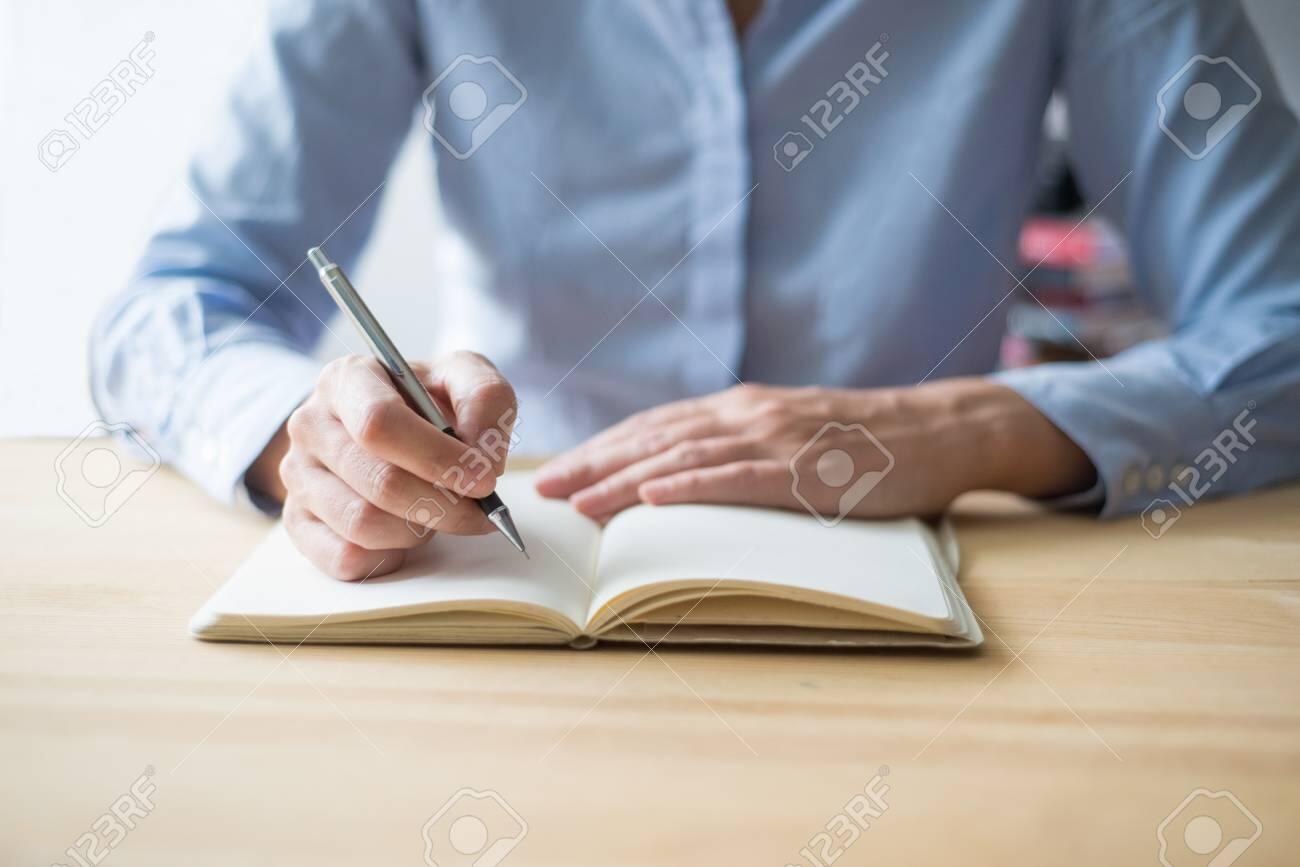

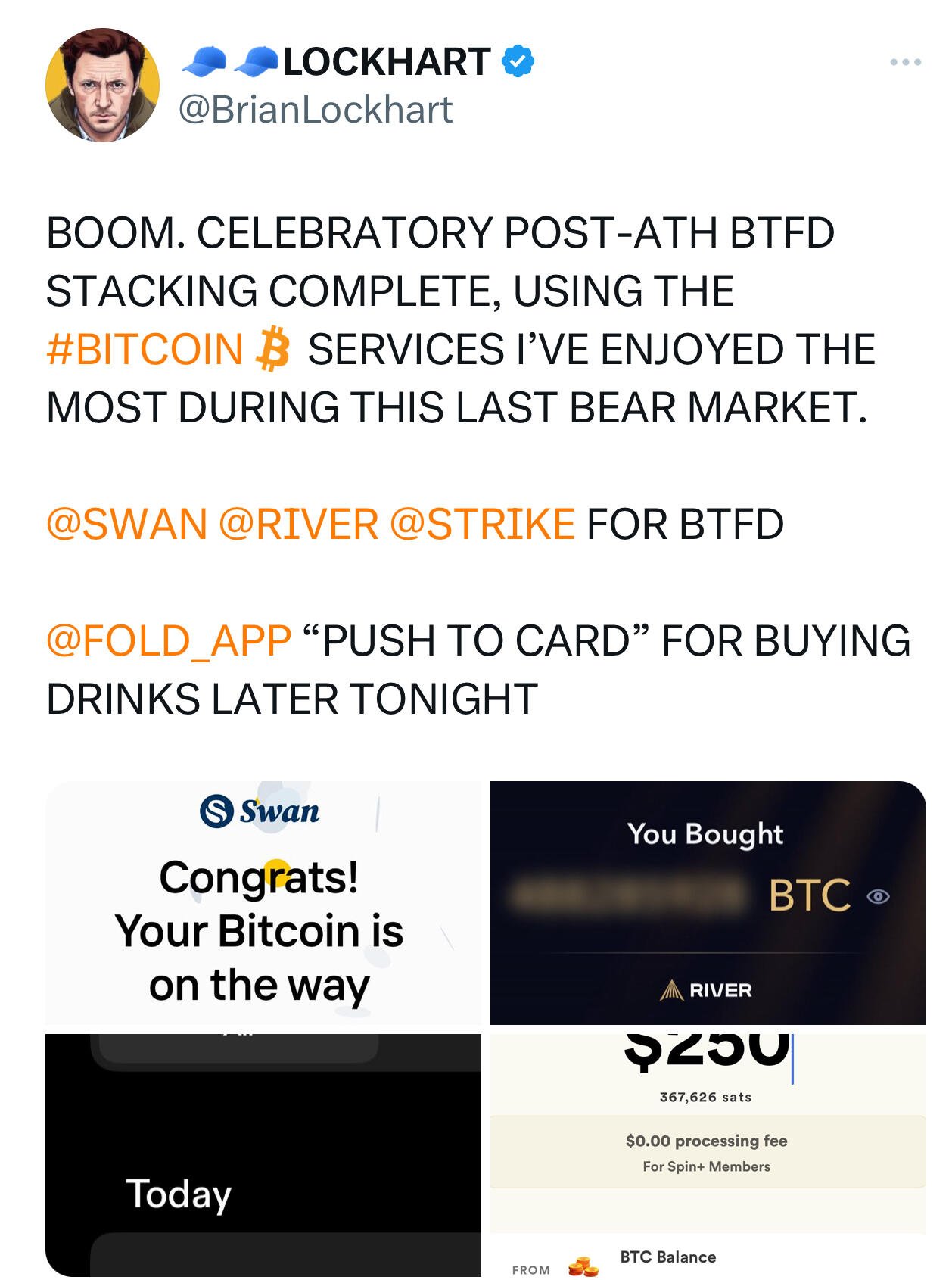

NEVER THOUGHT I’D BE JUGGLING THE MONTHLY HOUSEHOLD BUDGET SO I COULD BUY THE BITCOIN DIP AT SIXTY TWO THOUSAND DOLLARS, BUT HERE WE ARE.

QUIT WHINING AND STACK THE DIP

CHOOSE RICH

“SIR THIS MAKES NO SENSE; ACCORDING TO MY RECORDS? AS RECENTLY AS LAST MONTH YOU OWNED A HOUSE, SEVERAL CHAIRS, AND A SIZEABLE RETIREMENT ACCOUNT COMPRISED 100% OF MSTR STOCK. WHAT ON EARTH HAPPENED?”

THE PLEBS SAID I WASN’T A REAL BITCOINER SO I TOOK THE NECESSARY STEPS.

WATCHING GUYS WITH 0.008 BITCOIN MAKING PURITY TEST POSTS AGAINST MSTR

BITCOIN $73K

THE LAST THING YOU SEE BEFORE BEING ARRESTED FOR ASSAULT AND “EGREGIOUS TEABAGGING” WHILE YOUR FRIENDS CHEER HYSTERICALLY https://video.nostr.build/8cc2dd44c15577967ed347221e481dc7a8decd04b52871ccfa5644812e36c094.mp4

BITCOINERS, TRADITIONALLY, LOVE TO FIGHT. ALL REAL BITCOINERS LOVE THE STING OF BATTLE. THEY STACK SATS. BUT THEY REFUSE TO STAY HUMBLE.

HERE’S THE THING, KID:

WHEN I BUY THE TOP AND IT DIPS, I’M ONLY GOING TO FEEL PAIN FOR A FEW MONTHS, AT MOST. AFTER THAT? IT’S GRAVY FROM THEN ON, FOREVER.

BUT WHEN YOU SELL THE TOP? THAT’S THE BEST YOU’RE EVER GOING TO FEEL. AND FROM THEN ON IT’S JUST REGRET.

DEAR DIARY TODAY I MARKET SMASH BOUGHT BITCOIN 3 TIMES AT ALMOST THE EXACT ATH TOP, THEN WATCHED IT TURBONUKE $10K CHEAPER, JUST IN TIME TO SEE A POPUP ALERT ON MY PHONE SAYING MY DAILY DCA PURCHASE NEARLY BOTTOM-TICKED IT. I AM A HORRIBLE TRADER AND SHOULD ONLY DCA.

YOU KNOW IT’S BAD OUT THERE WHEN EVEN GOLD IS GOING UP A BIT. ALL THE MORE REASON TO SEEK SAFETY IN BITCOIN.

C’MON BITCOIN, WE’RE HAVING SUCH A GREAT NIGHT TOGETHER